- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

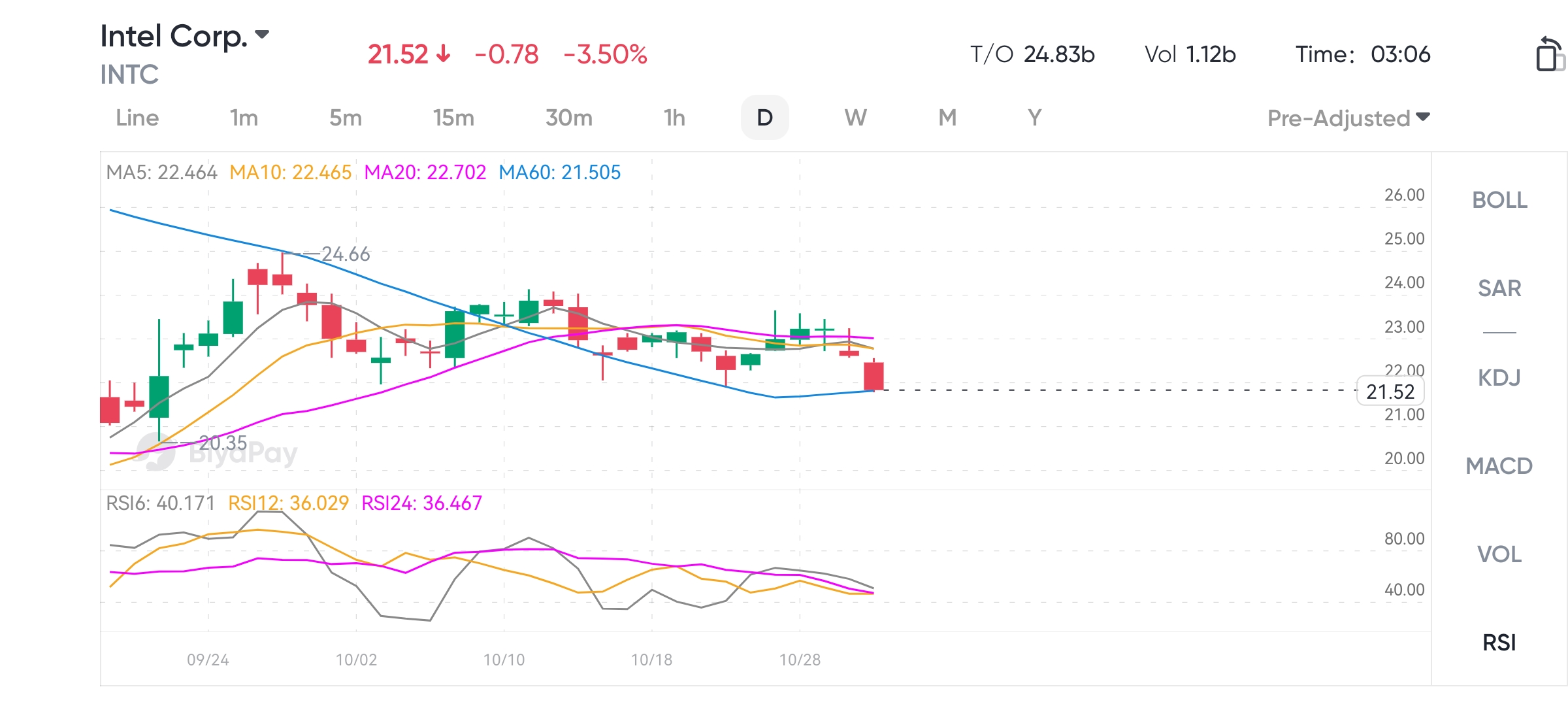

Intel's Q3 financial report hit a new high in losses, but surpassed expectations and rebounded, lead

On October 31st Eastern Time, Intel released its Q3 financial report ending on September 28th, 2024, setting a record for the highest quarterly loss of $16.60 billion! However, surprisingly, this financial report not only did not drag down Intel’s stock price after its release, but also pushed its after-hours stock price up by 15%. As of the end of after-hours trading, the increase was close to 7%.

Performance exceeded market expectations, but losses reached a historic high

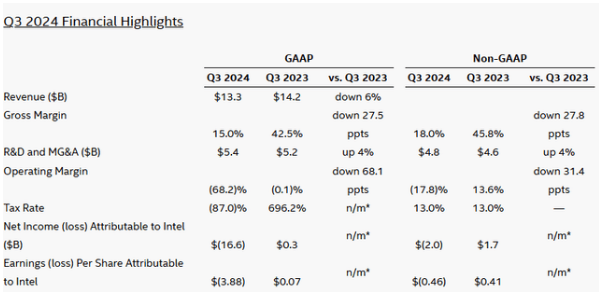

Intel’s third-quarter revenue reached $13.30 billion, a decrease of 6% year-on-year, but exceeded the market average expectation of $13.02 billion. Despite the higher-than-expected revenue, Intel still recorded a record quarterly loss, with a net loss of $16.639 billion calculated according to GAAP (US Generally Accepted Accounting Principles). Compared with the same period last year’s $297 million Net Profit, there was a significant profit-to-loss, with a loss of $3.88 per share, compared to $0.07 per share in the same period last year.

Adjusted data (non-GAAP) shows that Intel’s adjusted net loss for the third quarter was $1.976 billion, with a loss of $0.46 per share, higher than the analyst’s expected loss of $0.02 per share. In addition, Intel’s operating loss expanded from $8 million in the same period last year to $9.086 billion, with an adjusted operating loss of $2.369 billion. The adjusted operating profit margin fell to -17.8%, a decrease of 31.4 percentage points from 13.6% in the same period last year.

In terms of profit margin, Intel’s gross profit in the third quarter was $1.997 billion, and the gross margin decreased to 15.0%. On a non-GAAP basis, it was 18.0%, a decrease of 27.8 percentage points from the gross margin of 45.8% in the same period last year. In terms of operating expenses, total operating expenses in the third quarter rose to $11.054 billion, with R & D expenses rising to $4.049 billion, and restructuring and other expenses also increased significantly.

Nevertheless, Intel CFO David Zinsner stated that the company has made “progress” in profitability, but achieving full profitability still requires continuous efforts and adjustments. In the third quarter, the company’s cash flow from operating activities was $4.10 billion and a $500 million dividend was distributed to shareholders. The market has shown some confidence in these financial data, especially in terms of cost optimization and revenue growth expectations in the coming quarters.

The underlying reason behind the highest loss in history

Intel recorded a $16.60 billion loss in its Q3 earnings report, setting a new quarterly record, but this figure is not entirely due to the decline in Main Business. In fact, the main reason is that Intel has undergone a large-scale asset restructuring and impairment liquidation, totaling more than $18 billion in related expenses. The inclusion of these expenses reflects the challenges facing Intel’s current operations, and also shows that the company is actively adjusting its strategy to optimize its future cost structure and business layout.

Asset Impairment and Accelerated Depreciation

During the quarter, Intel confirmed a non-cash impairment charge of $3.10 billion, mainly for scrapping some chip manufacturing equipment. As the company advanced to the 18A node, Intel gradually phased out equipment used for Intel 7-node production, resulting in expenses for equipment impairment and Accelerated Depreciation. This strategy indicates that Intel is committed to improving the advanced manufacturing process, but in the short term, these improvements have shown significant losses in the financial report.

Impairment of Mobileye goodwill

Intel’s autonomous driving unit, Mobileye, also experienced goodwill impairment in the third quarter, totaling $2.90 billion. This impairment reflects Intel’s re-evaluation of the value of its acquired assets, especially adjustments for future market demand. Mobileye has faced fierce competition and changes in business environment in recent years. This impairment also indicates that Intel has taken a more cautious attitude towards restructuring resources and streamlining investment portfolios to concentrate advantageous resources on core businesses.

Valuation provision for deferred tax assets

In the third quarter, Intel also recorded a non-cash charge of $9.90 billion to adjust the valuation of US deferred tax assets. This valuation provision demonstrates Intel’s cautious attitude towards future tax policies and the company’s profitability prospects. The impairment of deferred tax assets will affect Net Profit in the short term, but this accounting treatment provides assurance for future financial soundness.

Large-scale layoffs and optimization of operating expenses

In order to achieve cost reduction goals, Intel carried out the largest layoff since its establishment this quarter, with a total of about 15,000 employees. This decision is expected to save Intel a large amount of operating costs each year. However, in the short term, Intel needs to pay $2.20 billion in severance pay, early retirement benefits, and other expenses. In addition, non-cash restructuring costs of $528 million further amplified the loss data for this quarter on the books. These restructuring measures are intended to help Intel optimize operating expenses, enhance financial flexibility, and support future profit growth.

Intel CFO David Zinsner pointed out that although these restructuring costs have put pressure on Q3 profits, the company has seen positive trends in profitability and liquidity. Intel CEO Pat Gelsinger added that this restructuring is one of the most groundbreaking adjustments in Intel’s history, and the company is settling historical burdens in a “kitchen sink” style to create a more resilient profit foundation for the future.

Core business performance: Dual pressure of revenue and profit

Despite being dragged down by large-scale restructuring and impairment charges, Intel’s core business still showed some resilience in the third quarter, especially in key areas such as Data Center and AI business. The revenue of some businesses even exceeded market expectations, further stimulating market confidence in its future business recovery.

Customer Computing Business (CCG)

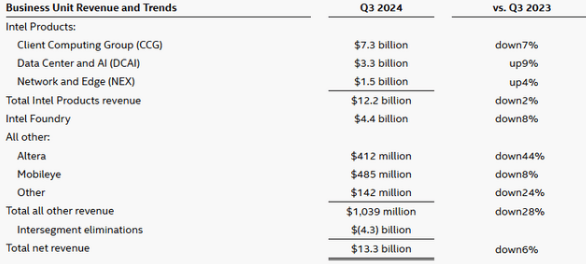

Revenue from customer computing, Intel’s traditional core business, was $7.33 billion in the quarter, down 7% year-over-year and slightly below analysts’ expectations of $7.38 billion. This segment mainly covers desktop and laptop chip businesses. Desktop revenue fell to $2.07 billion from $2.753 billion in the same period last year, but notebook revenue grew from $4.503 billion in the same period last year to $4.888 billion. The shrinking desktop market remains a challenge for Intel, but the growth of notebook business has to some extent balanced the decline in customer computing revenue.

Data center and AI business (DCAI)

Data center and AI businesses have become the highlights of Intel’s revenue, with revenue of $3.349 billion in the third quarter, a year-on-year increase of 9%, higher than the analyst’s expected $3.16 billion. The growth of the data center business is particularly critical in the current AI wave, and Intel is actively improving the performance of its Xeon processors to meet higher demand. The newly launched Intel Xeon series processors have improved in memory bandwidth and embedded AI acceleration, enhancing their competitiveness in the market. In addition, Intel has launched a new AI accelerator Gaudi 3, which has doubled internet bandwidth and 1.5 times memory bandwidth compared to the previous generation. These product upgrades undoubtedly strengthen Intel’s layout in the AI and Data center fields, providing support for the company to occupy more market share in the fiercely competitive market.

Network and EdgeComputing Business (NEX)

Intel’s Networking and EdgeComputing business revenue reached $1.511 billion, a year-on-year increase of 4%. The stable growth of the Networking business reflects the expanding market demand for EdgeComputing, especially driven by emerging technologies such as 5G. Intel’s cooperation with global telecommunications companies (such as KDDI) has further strengthened its position in the field of network infrastructure. This cooperation marks Intel’s continuous innovation in telecommunications solutions and brings more stable revenue growth points for the future.

Foundry business (Intel Foundry)

Intel’s foundry department performed slightly weakly in this quarter, with revenue of $4.352 billion, a year-on-year decrease of 8%. However, analysts believe that the long-term potential of this business is still huge. The development of the 18A node is progressing well, and the cooperation with AWS brings long-term growth potential to Intel’s foundry department. AWS has promised to deepen cooperation with Intel in the foundry business, which undoubtedly injects momentum into the development of Intel’s foundry business in 2025 and beyond. In addition, the early layout of 18A node technology will help Intel gain a greater leading position in the foundry market and lay the foundation for future revenue growth.

Other business performance

In the third quarter, Intel’s FPGA (Altera) business revenue was $412 million, a decrease of 44% year-on-year; the revenue of Mobileye’s autonomous driving department was $485 million, a decrease of 8% year-on-year. Although the performance of these two businesses has declined, Intel is confident in their future potential. As a representative of the autonomous driving business, Mobileye is facing challenges while optimizing quotas. The company is adjusting Mobileye’s investment structure and focusing resources on core businesses to improve future business performance.

Technological innovation: the future potential of 18A nodes and AI PCs

Intel has shown a long-term strategic vision in cutting-edge technology layout, especially in the investment of 18A nodes and AI PCs, which strengthens its potential for future growth.

The advancement of the 18A node is the key to Intel’s restoration of its technological leadership, and it is expected to enter the full mass production stage in 2025. The company’s Client product Panther Lake and server product Clearwater Forest have made early progress on the 18A node, and the cooperation with AWS is further deepening. Intel will provide customized Xeon chips and new AI architecture chips on the 18A node for AWS. The years of cooperation promised by AWS not only bring demand to Intel’s foundry business, but also enhance the attractiveness of the 18A node in the foundry market. The market is therefore confident in Intel’s future competitiveness.

In addition, Intel’s expansion in the AI PC market has attracted much attention. The company expects to ship more than 100 million AI PCs by 2025, and has launched the Core ™ Ultra 200V series processors codenamed Lunar Lake in September, which not only improves the battery life and AI computing capabilities of PCs, but also accelerates the popularity of PCs in AI applications. The Arrow Lake series processors released in October expand AI PC functions to the desktop, further meeting the needs of the consumer and high-end desktop product markets. Through the x86 ecosystem advisory group established with tech giants such as AMD, Broadcom, and Microsoft, Intel is simplifying software development standards and promoting the ecological expansion of AI PC products.

Intel has also made gains in the fields of EdgeComputing and autonomous driving. The company has collaborated with Japanese telecommunications giant KDDI to launch the vRAN 3.0 solution based on the fourth-generation Xeon processor, demonstrating its technological innovation in the fields of networking and EdgeComputing. Although the autonomous driving department Mobileye performed poorly this quarter, Intel is confident in its future potential and plans to continue investing to consolidate its competitive position in the fields of intelligent transportation and autonomous driving. These technological layouts not only boost market confidence in the short term, but also lay the foundation for Intel to dominate the future innovation market.

With the recovery of market confidence, can Intel usher in a recovery turning point?

Although Intel’s third-quarter financial report showed a record loss, this huge loss has instead sparked a rebound in market confidence in its future development. Through a “drastic” restructuring, Intel focused on dealing with a large number of asset impairments, layoffs, and operational cost optimization issues, aiming to clear obstacles for future profit growth. The market believes that this “kitchen sink” cleaning method will help Intel go into battle lightly.

Analysts pointed out that the resurgence of optimism is not only a response to Intel’s low expectations in the market, but also stems from the company’s positive outlook for Q4 2024. Intel expects revenue to be between $13.30 billion and $14.30 billion in the quarter, with adjusted earnings per share of $0.12, higher than analysts’ conservative expectations. In addition, the company expects its Q4 gross profit margin to recover to 36.5%, with adjusted gross profit margin reaching 39.5%, indicating the potential for a rebound in profitability. This series of positive outlooks has injected confidence into investors.

The capital expenditure plan for the next few years lays the foundation for Intel’s long-term development. The company expects to invest $12 billion to $14 billion in 2025, especially in the technology research and development of 18A nodes to support the expansion of foundry orders. As one of its main partners, AWS has committed to a multi-year cooperation contract, which will further deepen the cooperation between the two parties in the foundry business and provide strong support for Intel’s future growth.

In addition, Intel’s decision to establish its foundry business as an independent department indicates that the company may plan to introduce external capital in the future, and may even split it. The independent foundry department allows Intel to be more flexible in Capital Markets, providing more possibilities for future fundraising and shareholder returns. Analysts generally believe that this measure can not only alleviate Intel’s financial pressure, but also improve the profitability of the foundry business through independent operations, helping the company inject new vitality into the fiercely competitive chip market.

Currently, Intel is at a critical juncture of recovery. The recovery of market confidence also indicates that Intel may have passed the most difficult stage and is gradually moving towards stable growth. For investors, Intel’s undervaluation and future layout provide long-term growth opportunities. However, in the context of the global chip market being full of variables, it is still necessary to closely monitor the company’s technological advancement and market performance to seize this recovery opportunity.

If you are optimistic about Intel’s future development and considering investing in its stocks, you can operate through the BiyaPay platform. BiyaPay not only supports trading in US and Hong Kong stocks, but also serves as a professional deposit and withdrawal tool, bringing you an efficient and secure fund management experience. With BiyaPay, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With advantages such as fast arrival speed and unlimited transfer amount, BiyaPay will help you seize every investment opportunity.

The road ahead is bumpy, and there are uncertainties on the road to recovery

Although Intel is paving the way for future recovery through restructuring and technological innovation, it still faces many risks and challenges. The uncertainty of the global semiconductor market, fierce technological competition, and the impact of business adjustments may all become obstacles to its performance rebound.

Firstly, the fluctuation in demand in the semiconductor market has put pressure on Intel, especially in the layout of Emerging Markets such as AI, Data center, and EdgeComputing. At the same time, macroeconomic changes may lead to a decrease in corporate spending, thereby affecting product demand. At the same time, the popularity of mobile devices and new architectures has slowed down the growth of PCs and servers, affecting Intel’s core computing business revenue.

Secondly, the intensification of technological competition has posed challenges for Intel. The technological breakthroughs of TSMC and Samsung in advanced nodes have made it more difficult for Intel to catch up. Although progress has been made in the 18A node, it will take time and money to achieve technological transcendence. The market’s expectations for this transcendence have also increased Intel’s pressure. Whether it can continue to optimize in controlling costs and accelerating research and development will determine its future market share.

In addition, the risk of restructuring should not be underestimated. Intel has improved profitability through layoffs and cost optimization, but it is unclear whether short-term measures can bring lasting effects. Especially during the layoff process, the stability of the technical team and business continuity are crucial to the company’s execution and innovation, and the impact of restructuring may take several quarters to fully manifest.

Finally, Intel’s positioning transformation in the foundry market will also take time. As a traditional chip giant, its foundry business customers and demands are different from the original model. If Intel cannot quickly expand its share in the foundry market, it may affect its return on investment and increase its financial burden.

Therefore, although the recovery prospects are promising, the future road is still full of uncertainty, and investors need to be vigilant about related risks.

Overall, Intel is in a critical period of transformation. Despite a record loss in the third quarter, market confidence has partially recovered and the stock price rebound reflects investors’ expectations. The company’s layout in areas such as Data Center, AI PC, and 18A nodes has laid the foundation for future growth, but the competitiveness, technological progress, and restructuring effectiveness of the foundry business still need time to be verified. In the long run, if Intel can effectively balance innovation and market expansion, it may gradually recover its performance and re-establish its market position, but investors still need to be vigilant about potential uncertainties and market fluctuations.