- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

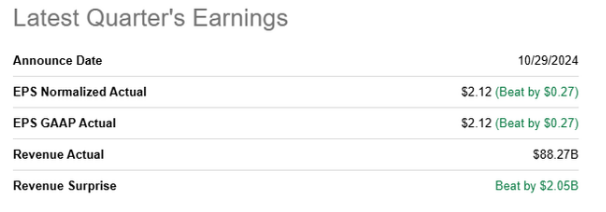

Google's new quarterly financial report is impressive, AI confidence is high, and the stock price is

After the market closed on October 29th, Google released its financial report for the third quarter. The performance not only exceeded market expectations strongly, but also achieved dual surpassing of revenue and revenue, showing remarkable business growth and continuous expansion of profit margins. With the stock price rising more than 5% after the financial report was released and rising nearly 3% at the close on October 30th, Google swept away the decline after some second-quarter performance fell short of expectations, demonstrating its indispensable role in the global economy.

Third quarter financial overview

Google has not only consolidated its leading position in the global technology industry through strong financial results, but also exceeded market expectations, demonstrating the outstanding growth and efficient operation of various Lines of Business. Here is a more detailed analysis of Google’s Q3 financial data.

Revenue growth

Google’s total revenue in the third quarter reached $88.27 billion, a year-on-year increase of 15%, which exceeded market expectations. This significant growth was mainly due to the strong performance of the digital advertising field, especially the significant increase in advertising spending driven by election-related activities. The revenue growth of the Cloud Service business was particularly outstanding, achieving a year-on-year growth of 35%, an increase from the previous quarter’s 29% growth rate, demonstrating its continued expansion and market leadership in high-growth areas.

Profit margin improvement

Google Cloud’s revenue performance is better than its profit performance. Its operating profit soared from $270 million in the same period last year to $1.95 billion, an increase of seven times, becoming the main driving force for Google’s profit growth. In the third quarter, the company’s overall operating profit increased by $7.20 billion, with a quarter of it coming from additional profits from the cloud business. The cloud business benefited significantly from operating leverage, and as revenue grew, development costs did not increase significantly, further driving profit growth. As long as Google Cloud maintains its growth rate, its profit growth is expected to continue.

Under strict cost control, Google’s other business areas have also achieved profit margin expansion. Google’s service department, including search, YouTube, and Google networks, saw a year-on-year increase in operating profit of 29%, also benefiting from operating leverage. The management effectively controlled excessive recruitment after the epidemic, promoting the continuous improvement of overall profit margin. Currently, Google’s operating profit margin has increased by 400 basis points year-on-year. Although future profit margin growth may slow down, it is expected that Google’s profit margin will further increase under the continued cost control strategy.

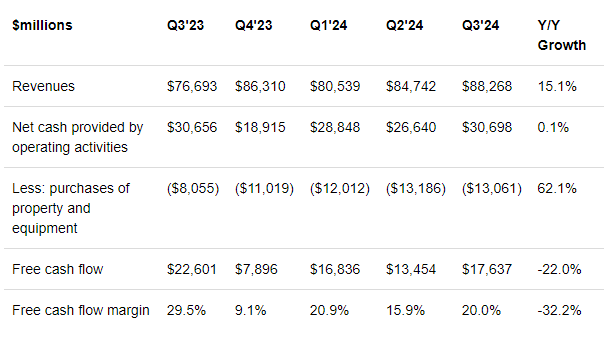

Free cash flow enhancement

Google achieved free cash flow of $17.60 billion in the third quarter, far exceeding analysts’ expectations of $140- $15 billion. This growth reflects Google’s efficient cash conversion ability in its core businesses, especially Cloud Services and Search Services. The increase in free cash flow is mainly due to the improvement of its Operational Efficiency and revenue growth in its core business areas.

Core business analysis

In the third quarter of 2024, several key business departments of Google performed well, especially in the fields of search, YouTube, and Cloud Services. The strong growth of these businesses not only drove the overall financial performance of the company, but also strengthened its competitive position in the market. The following is a detailed analysis of the performance of these departments.

Search business

Google’s search business continues to maintain its position as the main source of revenue for the company. In the third quarter, search ads revenue increased by 12% year-on-year, thanks to the surge in advertising, especially during the election season. Google continuously optimizes its advertising algorithm, improves the relevance and attractiveness of ads, and enhances the click-through rate and conversion rate of ads. In addition, Google also uses its huge Data Analysis capabilities to optimize keyword pricing and ad display strategies, thereby maximizing ad revenue. The growth of mobile search is particularly strong, thanks to the increase in global smartphone usage and the popularity of mobile internet.

YouTube

YouTube also performed well in the third quarter, with revenue growth of 12%. This growth was mainly due to the increase in advertising revenue from election-related video content. YouTube continues to expand its influence, attracting more viewers and advertisers by improving content quality and customer engagement. In addition, YouTube has enhanced its platform’s User Experience by improving recommendation algorithms to increase user viewing time and optimizing advertising delivery systems to improve advertising effectiveness. YouTube is also actively developing its subscription services, such as YouTube Premium, which not only brings additional revenue streams to the platform, but also enhances User Experience and reduces reliance on advertising.

Cloud Services

Google Cloud Service business grew 35% year-on-year in the third quarter, reflecting the increasing demand for cloud solutions among enterprises. Google Cloud provides a range of services, including data storage, Big data processing, and Machine Learning Platform, which attract a wide range of customers from small to large enterprises. Google continues to invest in cloud infrastructure, expanding its global data center network to provide faster and more secure services. In addition, Google Cloud has further consolidated its competitive advantage in the market by collaborating with industry leaders, such as conducting professional industry solutions and collaborative projects.

From an investment perspective, Google’s investment potential

Among the giants in the global technology industry, Google continues to lead the trend with its innovative ability and strong market influence. When investors evaluate Google’s attractiveness as a long-term investment, they need to have a deep understanding of its market valuation, capital return, and growth drivers.

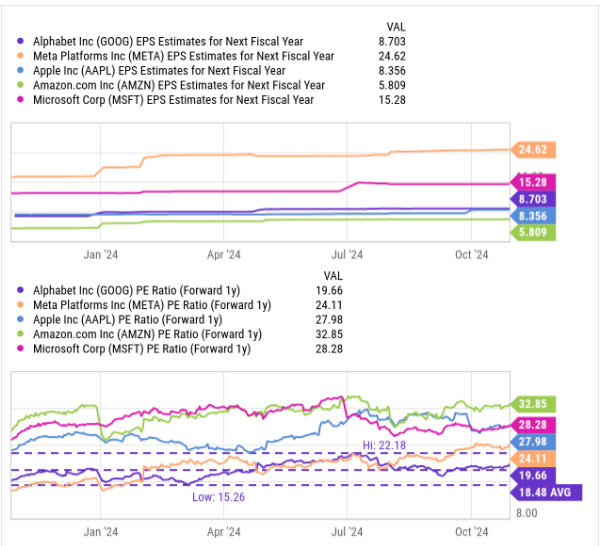

Market valuation analysis

Among large technology companies, Google provides the best investment value in the field of artificial intelligence. Compared to other tech giants, including Apple (AAPL), Meta Platforms (META), Amazon (AMZN), Microsoft (MSFT) and other high-growth, high-free cash flow companies, Google’s valuation has a significant advantage. Despite the significant growth in operating income from Google’s Cloud Service-related business and continued double-digit top-line growth, its expected Price-To-Earnings Ratio for fiscal year 2025 is still 19.7 times, lower than the industry average of 26.6 times.

If Google’s Price-To-Earnings Ratio can rebound to 26.6 times the industry average, the fair value of its stock may approach $231 per share. This value is dynamic and changes with the growth rate of Google’s operating income and free cash flow. I believe that Google should not be underestimated to below the industry group average Price-To-Earnings Ratio, as the company has proven that it can achieve growth in various business areas and generate a large amount of sustained free cash flow from it. In addition, the proportion of free cash flow returned by Google to shareholders is very high, which further enhances its attractiveness as a capital return investment.

Return on capital

In the third quarter of 2024, Google’s free cash flow continued to demonstrate its financial strength, reaching $17.60 billion, a significant increase compared to the previous quarter. This growth reflects Google’s ability to optimize its financial structure through efficient operations and savvy capital management. During this period, Google vigorously returned approximately $15.30 billion to shareholders through stock repurchases and dividends, accounting for 87% of its free cash flow. This generous capital return strategy not only enhances investor confidence, but also demonstrates Google’s firm belief in its own business prospects. In this way, Google strengthens its image as a responsible and visionary company, which also attracts more investors seeking stable returns and growth potential.

If you are optimistic about Google’s future development and considering investing in its stocks, you can use the BiyaPay platform for operation. BiyaPay not only supports trading of US and Hong Kong stocks, but also serves as a professional deposit and withdrawal tool to help you manage your funds efficiently and securely. With BiyaPay, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, easily withdraw to your personal bank account, and then invest in other securities firms. BiyaPay has a fast arrival speed and no transfer limit, allowing you to not miss any investment opportunities.

Driving factors

In terms of driving factors for business growth, Google has made significant achievements, especially in the fields of Cloud Services and artificial intelligence. The performance of Google Cloud Computing Platform (GCP) is particularly outstanding, with a growth rate exceeding the market average, thanks to the company’s core competitiveness in providing enterprise-level services and Data solutions. At the same time, Google’s deep investment in the field of artificial intelligence has supported the development of multiple innovative projects, including autonomous driving technology Waymo, medical and health technology, etc. The development of these cutting-edge technologies not only brings new sources of revenue to Google, but also establishes its leadership position in the global technology industry. Google’s investments demonstrate the company’s strategic vision and execution in pursuing long-term growth and maintaining its leading position in the industry.

Latent risks and market challenges

As is usually considered in investment decisions, high returns often come with high risks. Although Google has strong market advantages and technological leadership, it also faces various complex challenges and uncertainties in its operations and strategic execution process.

Macroeconomic and market changes

The fluctuations in the global economy may have a significant impact on Google’s main sources of revenue - advertising and Cloud as a Service. Economic recession may lead to a reduction in advertising budget, directly affecting Google’s advertising revenue. At the same time, although Cloud as a Service continues to grow, in an unstable economic environment, enterprise customers may postpone large-scale technology expenditures, affecting the revenue growth of Cloud Service services.

Technology Investment and Return

Google’s massive investment in artificial intelligence and other high-tech fields has brought huge market potential, but it also comes with risks. Rapid technological iteration may cause early investment to depreciate rapidly, and the return cycle of high-tech projects is long and uncertain, which requires Google to continuously optimize its R & D investment portfolio to ensure investment efficiency and effectiveness.

Legal and regulatory implications

The uncertainty of Anti-Trust investigation and data privacy regulations is the main legal challenge facing Google. The tightening of regulatory environments may limit Google’s business operations, especially in key markets such as Europe and the US. The increase in legal risks may lead to increased operating costs and even affect Google’s market strategy and revenue model.

Google’s third-quarter achievements demonstrate that despite macroeconomic uncertainty and regulatory challenges, the stability of its core business and the forward-looking nature of Technology Investment still support its market position. Investing in Google stock not only provides considerable returns, but also requires investors to pay attention to the risks it faces. It is recommended that investors allocate Google stock reasonably in a broad investment portfolio to balance potential returns and risks.