- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

The U.S. election is approaching! Will Trump win? What impact would a Trump victory have on the U.S.

The dynamics of the 2024 U.S. election have captured global attention. For much of the year, stock market investors appeared relatively unconcerned, but as Election Day draws closer—with less than two weeks to go—the tension is finally beginning to permeate the market.

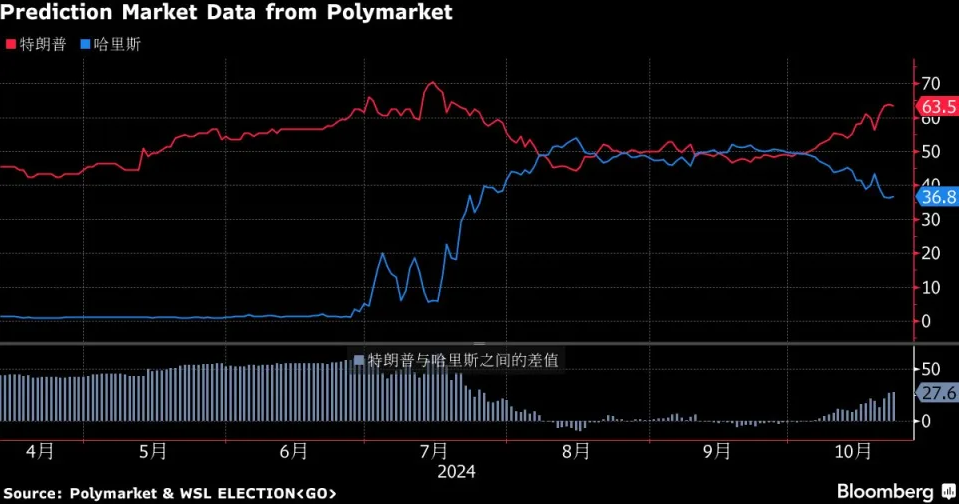

Currently, the competition between the two presidential candidates has entered a heated sprint phase. According to recent data, former President Donald Trump’s chances of winning are on the rise. The forecasting model from The Hill’s Decision Desk HQ now shows Trump with a 52% probability of winning, surpassing Vice President Kamala Harris, who stands at 42% as of the latest update.

Bank of America strategist Michael Hartnett points out that with increasing odds of a Trump victory and Republican control of Congress, investors have started accumulating assets that performed well following Trump’s 2016 victory, such as bank stocks, small caps, and the U.S. dollar. Additionally, recent polling data indicates that Trump and Harris are neck and neck, though on Polymarket, Trump’s odds stand at 61%, significantly higher than Harris’s 39%.

Moreover, Tesla CEO Elon Musk has announced plans to distribute substantial funds to randomly selected registered voters in Pennsylvania on Election Day, adding further intrigue and attention to the race.

With Trump’s odds rising, many are speculating on how his potential victory might affect the U.S. stock market. Let’s take a closer look.

Potential Policy Moves if Trump Wins

(1) Economic Policy

Expansionary Fiscal Policy

If Trump wins, he is expected to continue pursuing expansionary fiscal policies, including increased government spending and advocating for lower personal and corporate tax rates, with the aim of bolstering the domestic economy. Tax cuts could reduce the burden on businesses, increasing their available capital and enabling them to allocate more resources toward production, research, and expansion, thereby enhancing competitiveness and profitability—a favorable environment for U.S. companies in the stock market.

Trade Policy

Trump has consistently emphasized “America First” and may maintain his stance on imposing comprehensive tariffs on imports, including a proposed 10% tariff on all imports and a 60% tariff on Chinese goods. While such measures could theoretically hinder global economic growth and elevate inflation in the U.S. in the short term, Trump’s actual policy implementations remain highly uncertain and may be limited by various factors. For example, during the 2018–2019 period when Trump imposed heavy tariffs on China, U.S. import prices remained stable due to factors like a strong dollar and falling raw material prices. However, trade policy uncertainties could still impact market sentiment and investor confidence in the short term.

Immigration Policy

Trump’s hardline stance on immigration is likely to continue, with stricter immigration controls that could reduce the labor supply and dampen consumer demand—factors that could slow U.S. economic growth in the medium term. However, in the short term, this policy might appeal to certain segments of the domestic population, potentially creating mixed effects on specific industries or companies.

(2) Other Policies

Regulatory Policy

In terms of regulation, Trump may ease restrictions in the financial and environmental sectors. For the financial industry, regulatory easing could create more room for innovation and expansion, boosting profitability and market dynamism—a potentially positive development for financial stocks. In the environmental sector, reduced regulatory requirements might lower operational costs for some companies, though it could also spark controversy over environmental and social responsibility. Additionally, Trump may impose stricter controls on social media, including investigating censorship policies—a move that could impact operational strategies for related tech companies.

Monetary Policy Influence

Trump may put pressure on the Federal Reserve to maintain low interest rates. During his previous term, Trump was known to intervene in Fed policies. If he is re-elected, the Federal Reserve could face greater political pressure, potentially challenging its independence. While Fed Chair Jerome Powell has so far resisted such pressures, his term ends in 2026, and Trump could appoint individuals who align with his economic views to key positions in federal agencies, thereby influencing future economic policies. This interference could have profound effects on the cost of capital, corporate financing conditions, and investor expectations in the U.S. stock market.

Review of Trump’s First Term Impact on the Stock Market

After Trump’s victory in the 2016 U.S. election, the stock market surged by 24% within a year (see chart below). Investors anticipated pro-growth policies from Trump, which drove optimism about U.S. economic prospects.

Sectors like technology and financials performed particularly well, as investors expected these industries to benefit from a more favorable regulatory environment. Trump’s overseas profit tax reduction plan also boosted the tech sector, including some major tech companies later reclassified as part of the communications services sector.

The industrial and materials sectors thrived due to expectations of increased infrastructure and defense spending, while defensive sectors like utilities and consumer staples lagged during the market rally. Energy stocks underperformed unusually, affected by supply factors and strong gains before Trump’s election.

There’s little doubt that expectations of pro-growth measures from the Trump administration significantly impacted U.S. stock valuations at the time.

During his first term, Trump signed the 2017 Tax Cuts and Jobs Act, which included personal income tax cuts, substantial increases in deductions, a corporate tax rate reduction to 21%, elimination of the corporate alternative minimum tax, tax relief for new corporate investments, territorial taxation for multinational companies, and a one-time tax reduction on repatriated overseas profits.

So what about this time? What might happen if Trump is re-elected?

Potential Impact of Trump’s Re-election on the Stock Market

If re-elected, Trump is unlikely to pursue sweeping tax reforms like he did in his first term. Instead, he may focus on extending the individual income tax cuts set to expire after 2025 and reducing corporate tax rates further.

Trump’s re-election would likely have significant implications for the global economy and international trade, given his signature “protectionist” stance.

During Trump’s previous term, the average U.S. tariff rate doubled to around 3%. In a second term, he is expected to continue emphasizing “protectionism,” expanding trade conflicts and imposing high tariffs on various countries to boost domestic manufacturing and reduce trade deficits. He has proposed a 10% tariff on all imports, which he may negotiate down to secure concessions from certain countries.

This protectionist approach would add uncertainty to trade and immigration policies, with Mexico likely to become a key focus. Such factors could drive global market volatility.

Trump’s “isolationist” policies could also reduce U.S. support for Ukraine, introducing new uncertainties to European geopolitics.

If re-elected, Trump may pressure the Federal Reserve to keep interest rates low. With shifting political dynamics, the Fed could once again find itself in the political spotlight, as seen in 2018–2019. Trump’s second term could subject the Fed to more political pressure. While Fed Chair Powell has withstood such pressure so far, his term ends in 2026, allowing Trump the opportunity to appoint like-minded individuals to influence future economic policy.

Additionally, Trump may relax regulations in finance and environmental sectors while tightening controls on social media companies, including investigating their censorship policies.

Overall, Trump’s re-election could have a multi-faceted impact on the market. Among all factors, the Fed’s monetary policy remains the most relevant for investors. The Fed’s typical focus on averting a recession is generally favorable for the stock market. Trump’s inclination toward “isolationism,” tax incentives, and deregulation could also benefit equities.

Thus, a potential “Trump shock” could still have a positive impact on market trends.

How Should Investors Respond?

(1) Closely Monitor Policy Developments

Investors should keep a close watch on Trump’s policy developments, including fiscal, trade, regulatory, and monetary policies. For industries that might benefit from Trump’s policies, such as finance, industrials, and certain tech sectors, it’s important to analyze how policy changes could create opportunities, while also being mindful of potential risks due to policy uncertainties. For example, stay informed on adjustments to tariffs, tax policies, and industry-specific regulations to timely adapt your portfolio.

(2) Diversify Your Portfolio

In an uncertain market environment, diversification is key to risk reduction. Investors shouldn’t limit themselves to the U.S. stock market but consider allocating assets across other regions and asset classes, such as bonds, gold, and real estate. Within the U.S. market, diversify across sectors to avoid over-concentration. While cyclical sectors may benefit from Trump’s policies, defensive sectors shouldn’t be overlooked for risk balancing. For instance, gold can serve as a hedge against market volatility, while bonds offer steady cash flows.

(3) Focus on Fundamentals for Long-term Investment

While short-term policy shifts can cause market fluctuations, a company’s fundamentals remain central to its investment value in the long run. Investors should thoroughly evaluate companies’ financial health, profitability, industry position, and innovation capabilities, focusing on those with strong growth prospects and stable earnings. Companies that stand to benefit from Trump’s policies with solid fundamentals deserve attention, but avoid blindly following market hype. Maintain a rational, patient approach for steady asset growth.

(4) Choose the Right Investment Platform

Besides understanding the potential market impact of a Trump re-election, choosing a reliable brokerage platform is essential. For instance, Charles Schwab is a globally recognized investment broker. Opening a Schwab account provides a corresponding bank account, allowing investments in U.S. stocks via fiat currency transfers from BiyaPay’s multi-asset wallet. Alternatively, users can directly search for U.S. stock codes on BiyaPay for stock purchases. Investors can then monitor stock prices periodically and buy or sell at opportune times based on their strategy.

(5) Risk Management and Flexible Adjustment

Lastly, given the market uncertainty and volatility that

Trump’s policies may bring, investors must strengthen risk management. Set reasonable stop-loss and take-profit levels; exit positions to control potential losses and lock in profits when prices reach desired targets. Consider using derivatives, such as options and futures, to hedge risks and reduce overall portfolio risk. Additionally, adapt your portfolio based on market changes and policy adjustments, ensuring your investment strategy remains flexible and responsive. For instance, if shifts in trade policy place pressure on certain industries, promptly assess the risks associated with relevant companies in your portfolio and consider making appropriate adjustments.

Conclusion

As a major political event, the U.S. election has profound implications for the stock market. If Trump wins, his policy moves could have complex effects on U.S. equities. Historical experience and policy expectations suggest potential positives for the stock market, such as boosting corporate profits and favoring specific industries. However, uncertainties and risks are also significant, including potential global market volatility from trade policies, the impact of fiscal deficits on stock valuations, and policy uncertainties affecting investor sentiment.

Overall, a Trump victory would likely have a generally positive impact on the market.

In response, investors should develop a comprehensive and adaptable investment strategy, closely monitor policy developments, diversify portfolios, focus on fundamentals for long-term growth, and employ effective risk management to seek opportunities amid uncertainty. Regardless of the election outcome, investors should remain calm and rational, prepared to navigate the evolving financial landscape with resilience in pursuit of steady progress.