- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

The Dow and S&P 500 Halt Six-Week Gains as Tech Stocks Propel Nasdaq to Record Highs

Last week, U.S. stock markets closed with mixed results across major indexes. The Nasdaq Composite Index hit an intraday record high and marked its seventh consecutive weekly gain, while both the Dow Jones Industrial Average and the S&P 500 Index ended their six-week winning streaks, declining by 2.68% and 0.96%, respectively. The Nasdaq rose by 0.16%, largely fueled by strong performances from tech giants such as Apple, Microsoft, and Nvidia.

In detail, Apple’s share price climbed 0.36%, Microsoft gained 0.81%, Nvidia rose by 0.80%, Tesla surged by 3.34%, Meta increased by 0.96%, and Amazon grew by 0.78%. The gains of these tech companies were no coincidence, as they demonstrate competitive strength and innovation in their respective fields. For instance, Nvidia dominates the AI chip sector, and with the rapid expansion of AI applications, demand for its products has surged. Tesla, meanwhile, is renowned for its advancements and market expansion in the electric vehicle sector, while Amazon continues to excel in e-commerce and cloud computing.

The robust performance of these companies underscores the resilience and growth potential of the tech sector. They played a crucial role in boosting the broader market and highlighted the strong momentum within the technology industry.

Nvidia’s third-quarter revenue reached $18.12 billion, up 81% year-on-year, primarily driven by strong demand from AI-related sectors. The impressive results from these tech giants have drawn increasing attention from investors, making tech-focused ETFs a popular vehicle to tap into the growth opportunities in the technology sector.

Why Are Tech Stocks Becoming Investor Favorites?

In recent years, emerging technologies such as artificial intelligence, 5G, electric vehicles, and cloud computing have driven a boom in the technology sector. Especially following OpenAI’s release of ChatGPT, AI applications have seen explosive growth, significantly increasing demand for AI chips. This demand propelled Nvidia’s market capitalization beyond $1 trillion at one point in 2023.

The rise of the S&P 500 and Nasdaq Composite this year is largely attributable to the strong performance of companies like Apple, Microsoft, Tesla, and Nvidia. As of 2024, tech stocks make up over 50% of the Nasdaq Composite Index and 28% of the S&P 500, reflecting investors’ growing recognition of the importance of tech stocks and their participation in these companies’ growth via ETFs.

Despite global economic challenges such as inflation, supply chain disruptions, and rising interest rates, technology companies have demonstrated remarkable adaptability. For example, between 2022 and 2023, the U.S. Consumer Price Index (CPI) surged to a 9.1% year-on-year increase, yet in this economic environment, Microsoft’s Azure cloud services posted an annual growth rate of over 35%. Nvidia, meanwhile, reported second-quarter 2023 revenue of $13.5 billion, up 101% year-on-year.

Innovation and diversified business models have enabled tech companies to continue driving revenue growth amidst economic uncertainties, showcasing strong market resilience. This strength has turned tech stocks into a focal point for many investors.

Advantages of Tech Stock ETFs

Investing in tech stock ETFs allows investors to hold shares in multiple technology companies, reducing the risk associated with individual stocks while benefiting from the overall growth in the tech sector.

Convenience of a Basket of Stocks

By purchasing a tech stock ETF, investors can hold shares in multiple technology companies, achieving automatic diversification and saving them the hassle of selecting individual stocks.

Capturing Growth Opportunities in the Tech Sector

The technology sector is a primary engine of economic growth today, especially with ongoing advances in AI and 5G. Tech companies demonstrate robust growth potential, and by investing in tech stock ETFs, investors can capture the sector’s overall growth.

Cost-Effective and Convenient

Compared to actively managed funds, tech stock ETFs have lower management fees. For instance, the Invesco QQQ ETF has an expense ratio of just 0.20%, significantly lower than the 1-2% fees of traditional active funds. This low-cost feature is ideal for investors looking to invest in the tech sector over the long term.

Flexible Trading

ETFs can be traded on exchanges like stocks, enabling investors to react quickly to changing market conditions. This flexibility makes tech stock ETFs a valuable tool for both short-term traders and long-term strategic investors.

How to Choose a Tech-Focused ETF?

Beyond the well-known QQQ, there are many types of tech ETFs available. Here, we categorize tech-focused ETFs into three main types for your consideration.

Large-Cap Tech ETFs

Characteristics of Large-Cap Tech ETFs: Large-cap ETFs are generally known for their stability and lower volatility, as they cover high market-cap companies and diversify investment risk. They are suitable for investors seeking steady growth with minimal risk exposure.

These ETFs often provide consistent dividends and track closely with broad market indexes, making them ideal for beginner and conservative investors.

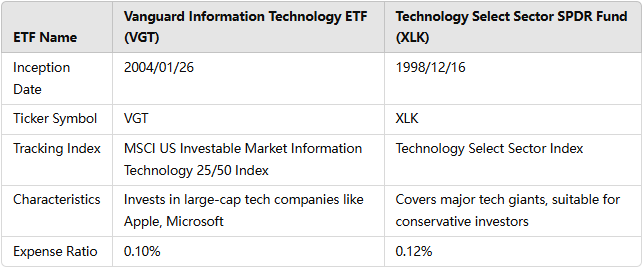

Vanguard Information Technology ETF (VGT): VGT holds a wide range of large-cap tech companies, including Apple, Microsoft, and Nvidia. Its holdings span leading companies in the information technology field. VGT aims to track the MSCI US Investable Market Information Technology 25/50 Index, offering robust risk resistance, making it suitable for long-term holding.

Suitable for: Stable growth investors, especially those looking for long-term capital appreciation by investing in top tech companies.

Technology Select Sector SPDR Fund (XLK): XLK tracks major companies in the tech sector, holding shares in leading tech stocks such as Apple, Microsoft, and Google, providing investors with broad exposure across the tech industry. It also has low management fees and excellent liquidity.

Suitable for: Investors looking for overall growth in the tech sector and those who want stable returns from high market-cap tech companies.

Semiconductor ETFs

Importance of the Semiconductor Industry: The semiconductor sector underpins the entire tech industry, supporting applications from smartphones and computers to autonomous driving and AI. Semiconductor ETFs are ideal for those interested in chip manufacturing and tech infrastructure, willing to accept higher volatility.

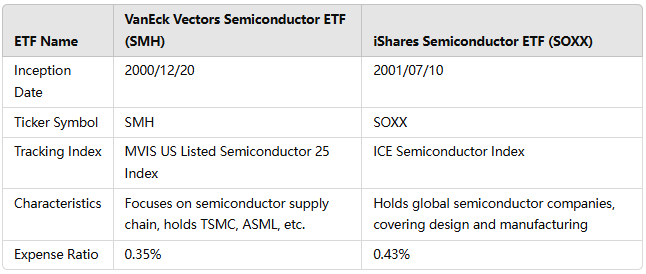

VanEck Vectors Semiconductor ETF (SMH): SMH tracks the MVIS US Listed Semiconductor 25 Index, holding stocks in leading semiconductor companies such as TSMC, Nvidia, and ASML. This ETF covers the entire supply chain, from chip design to production, offering broad industry exposure. TSMC and Nvidia hold significant weight in the fund, driving technological advancements in the industry.

Suitable for: Investors highly interested in the semiconductor supply chain and those looking to capture industry growth opportunities through leading semiconductor firms.

iShares Semiconductor ETF (SOXX): SOXX tracks the ICE Semiconductor Index, mainly holding leading semiconductor companies worldwide, including Intel, Broadcom, and Qualcomm. Its holdings span design, production, and sales, reflecting comprehensive industry performance.

Thematic Tech ETFs

Characteristics of Thematic ETFs: Thematic tech ETFs focus on specific emerging tech trends such as AI, electric vehicles, cloud computing, and clean energy. With the rapid development of these new technologies, these ETFs allow investors to capture growth opportunities in certain areas.

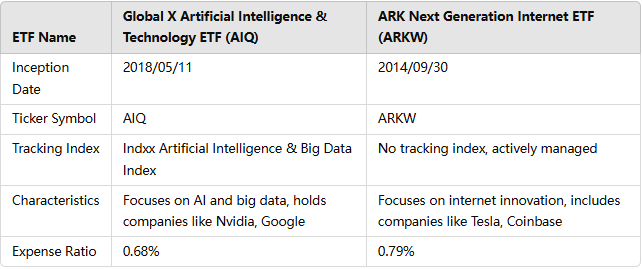

Global X Artificial Intelligence & Technology ETF (AIQ): AIQ focuses on AI and big data, primarily holding shares in tech giants like Nvidia, Google, and Amazon, as well as some small and medium-sized companies specializing in AI technology, providing broad exposure to AI applications.

Suitable for: Investors optimistic about the widespread application of AI in future society and looking to profit from AI-related companies’ growth.

ARK Next Generation Internet ETF (ARKW): ARKW specializes in next-generation internet technologies, including cloud computing, e-commerce, AI, and blockchain. It primarily holds companies such as Tesla, Nvidia, and Coinbase, benefiting from the broad adoption of emerging technologies in daily life and work.

Suitable for: Investors interested in internet technology and its applications, especially those who are enthusiastic about frontier technologies like blockchain, e-commerce, and artificial intelligence.

Choosing Different Thematic ETFs: Thematic ETFs are suitable for investors who are bullish on specific tech trends and have a high-risk tolerance, such as those optimistic about emerging fields like AI, autonomous driving, and cloud computing.

How to Buy Tech Stock ETFs

Multi-Asset Wallet BiyaPay

When investing in tech stock ETFs, managing fund deposits and withdrawals can be a concern for many investors. BiyaPay, a professional multi-asset trading platform, not only provides convenient fund management services but also allows users to seamlessly transfer funds to U.S. stock accounts for ETF transactions.

With BiyaPay, investors can exchange digital currency into USD or HKD, transfer directly to bank accounts for same-day clearing with no transaction limit, and then deposit into their investment accounts for ETF purchases, helping them avoid missed market opportunities.

Through Fund Company Websites:

Investors can buy tech stock ETFs directly from fund management companies’ websites, such as Vanguard and BlackRock. These companies’ websites provide detailed ETF product information and enable online transactions. Purchasing ETFs via official websites allows investors to access extensive investment materials and support services.

Banks and Financial Platforms:

Some banks and investment platforms also offer the option to purchase tech stock ETFs, which can be convenient for those accustomed to investing through banks. Additionally, financial advisors at banks typically provide personalized advice to help investors select suitable ETF products.

Factors to Consider When Choosing Tech Stock ETFs

Risk Tolerance: Different types of tech stock ETFs have varying levels of volatility.

For example, large-cap tech ETFs (such as Vanguard Information Technology ETF (VGT)) primarily invest in high market-cap tech companies, making them less volatile and more suitable for conservative investors.

On the other hand, semiconductor ETFs (like VanEck Vectors Semiconductor ETF (SMH)) and thematic tech ETFs (such as Global X Artificial Intelligence & Technology ETF (AIQ)) are more volatile, suitable for those willing to take on higher risks for potentially greater returns.

Investment Goals: Investors should choose a tech stock ETF based on their investment goals.

For those seeking stable long-term growth, large-cap tech ETFs might be more appropriate, as these ETFs generally consist of mature, high market-cap companies, aligning with a stable, long-term investment strategy. Conversely, investors interested in emerging tech trends (like AI, 5G, and semiconductors) and willing to bear some risk may prefer semiconductor or thematic ETFs, which are more suited for those pursuing high-growth potential in the short term.

Expense Ratio and Dividends: Management fees (expense ratio) and dividend policies are also important factors when choosing tech stock ETFs. For instance, the Invesco QQQ ETF has an expense ratio of 0.20%, significantly lower than the 1-2% fees of actively managed funds, which can substantially lower investment costs over time.

Furthermore, some tech stock ETFs offer regular dividends, so investors can choose ETFs according to their cash flow needs. Low-fee ETFs are generally more attractive for those focused on long-term returns, while investors with cash flow requirements may prefer ETFs with stable dividends.