- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

AMD's Q3 financial report is about to be released. Can AI-driven performance growth meet market expe

In the fierce competition of the global semiconductor industry, AMD firmly occupies the forefront of the artificial intelligence and high-performance computing markets through its cutting-edge technology and strategic layout. Since August, AMD’s stock price has achieved a significant growth of 11%, reflecting the market’s recognition of its innovation ability and the upcoming Q3 financial report. As the financial report is about to be released, investors and analysts are closely watching whether AMD can continue its growth trend and seize more market opportunities.

AMD Q3 earnings preview

After the market closes on October 29th, AMD will release its Q3 financial report. AMD’s market performance and business growth are the focus of investors’ attention. According to market analysis, AMD’s Q3 revenue is expected to reach $6.71 billion, a year-on-year increase of 15.77%, and earnings per share (EPS) are expected to be $0.92, a year-on-year increase of 30.83%. This expectation reflects AMD’s continued product momentum and market demand in the high-performance computing and AI chip fields.

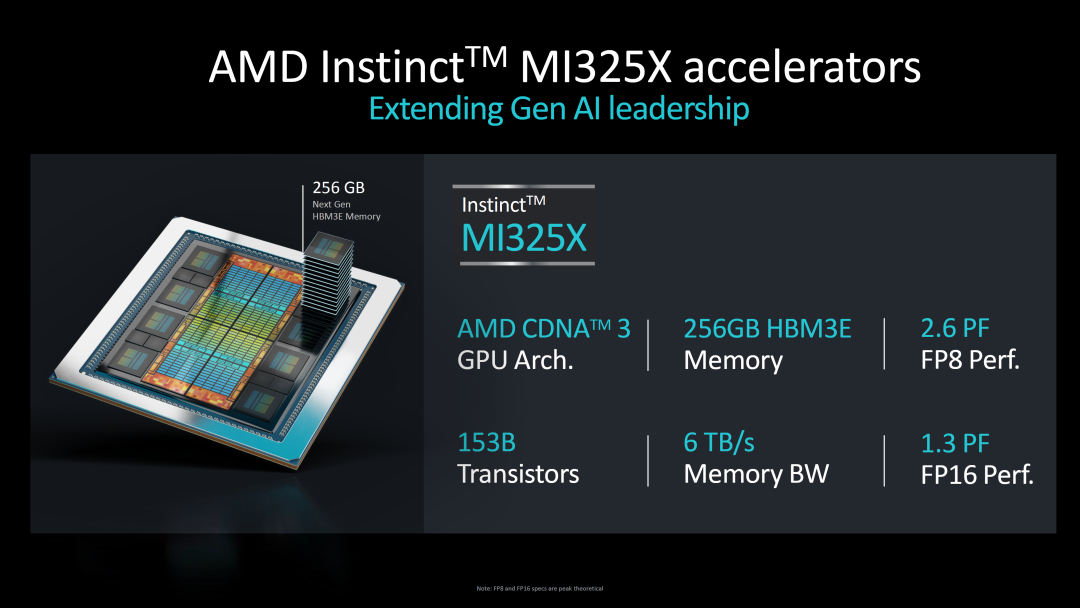

It is particularly noteworthy that AMD’s newly launched MI325X AI chip is expected to significantly drive revenue growth. This chip is well-designed with advanced memory architecture and 2.5D chip technology, specifically developed to improve AI inference performance, and directly competes with NVIDIA’s Blackwell GPU series. According to reports, MI325X has a 40% higher inference performance than competitors’ products in specific AI models, demonstrating AMD’s competitive advantage in technological innovation.

In addition, it is expected that AMD’s Data Center business will also show strong growth momentum. Analysts predict that the quarterly revenue of this department will achieve significant year-on-year growth, with a growth rate of up to 114%, indicating strong demand for its products and services in the Cloud Service and Big Data Analysis markets.

Through these specific data and market analysis, we can see that AMD’s business strategy and market positioning are gradually being validated, and its competitiveness in the AI chip market has significantly increased. It is expected that in the upcoming financial report, AMD will further demonstrate its strong business growth and market leadership.

The new product is expected to become a strong competitor to NVIDIA Blackwell

AMD’s success lies not only in its technological innovation, but also in how to effectively compete with competitors through market strategies, especially in the competition with NVIDIA’s Blackwell GPU. AMD’s latest AI chip MI325X represents an important breakthrough in the company’s high-performance computing and AI fields. The chip aims to provide better inference performance and cost efficiency than NVIDIA Blackwell, directly affecting the competition landscape of the AI market.

The launch of the MI325X chip is a strategic move by AMD to respond to the market’s demand for higher performance and more economical chips. By utilizing advanced memory architecture and 2.5D chip technology, MI325X outperforms or equals Blackwell in multiple key performance indicators, especially in specific AI model inference tasks, with a performance improvement of up to 40%. This technological advantage has won AMD new market share in competition with NVIDIA, and also strengthened its position in high-performance AI applications.

In addition, AMD plans to make the MI325X more attractive to customers by reducing the total cost of ownership. The planned pricing strategy aims to be lower than NVIDIA’s price. NVIDIA’s Blackwell GPU is priced between $30,000 and $40,000 per GPU, while AMD’s current MI300X costs between $10,000 and $20,000. The new MI325X is expected to remain in a similar price range. Such pricing strategies not only improve the market competitiveness of AMD products, but also provide developers with more cost-effective options.

AMD has further lowered the technical threshold through continuous improvement of its ROCm open source software platform, making it easier for developers to migrate from NVIDIA’s CUDA platform to the AMD platform. This strategic move not only strengthens the market appeal of AMD chips, but also helps the company expand its influence in the rapidly growing AI and high-performance computing markets. Through these innovations and strategic deployments, AMD has demonstrated its determination and ability as a strong competitor to NVIDIA Blackwell.

AMD chips are cyclical: expected to shift from contraction to expansion

With the fluctuation of the global semiconductor market, AMD’s business cycle has also shown obvious ups and downs. According to recent industry data, especially TSMC’s report, it can be seen that the semiconductor industry is entering a new expansion period from the previous contraction phase. This change is a positive signal for AMD, as historical data shows that whenever the industry enters an expansion period, AMD’s business performance often improves significantly.

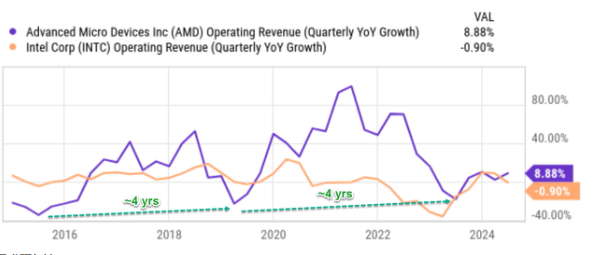

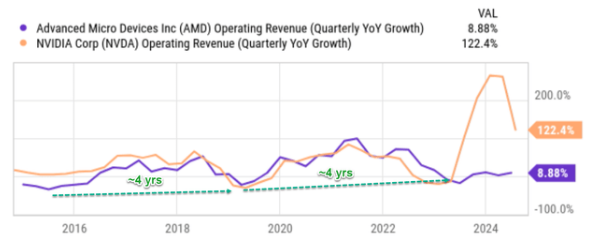

Over the past decade, the quarterly revenue data of AMD and Intel (INTC) have shown cyclical fluctuations similar to sine waves. AMD’s cyclical fluctuations are more severe than Intel’s, with the latest low point appearing in 2023, about four years after the previous low point in 2019. This regular cyclical fluctuation reflects the sensitivity and responsiveness of AMD’s business to external market conditions.

Although AMD’s revenue growth rate in the latest quarter was only 8.8%, which is at a historical low, combined with TSMC’s rapid growth and market demand recovery, it indicates that AMD is about to enter a new stage of business expansion. This expected change is based on the continuous growth of global demand for high-performance computing and AI chips, especially after AMD launched the competitive MI325X AI chip, the market demand for its products is expected to further increase.

In the future, AMD will have several key factors in responding to global market challenges and seizing industry expansion opportunities. Firstly, AMD will continue to rely on its technological innovation, especially in the AI chip field, to maintain its leading position with competitors. Secondly, the company will use its improved ROCm open source software platform to lower the technical threshold and attract more developers to turn to its platform. Finally, AMD’s global supply chain optimization strategy will be the key to its successful response to market fluctuations.

If these strategies can be successfully implemented, AMD will not only overcome current challenges, but also achieve greater market share and business growth in the new expansion cycle.

Investment prospects from a valuation perspective

When evaluating AMD’s future prospects, its valuation is particularly critical. Currently, AMD’s non-GAAP forward Price-to-Earnings Ratio is 45.27, far higher than the industry median of 24.19, reflecting investors’ high expectations for AMD’s future performance. Although AMD’s stock price seems expensive on the surface, a deeper analysis of its expected price-to-earnings growth ratio (PEG) of 1.12 shows that the stock may be undervalued by the market.

The relatively low PEG ratio of this valuation takes into account the expected profit growth in the next 12 months. Compared with the industry’s expected median PEG ratio of 1.86, the current valuation indicates that the market may hold a conservative attitude towards AMD’s profit growth. However, if AMD can achieve or exceed the current growth expectations, based on the industry’s average expected PEG ratio of 1.86, its stock price may rise by as much as 66.07%. This analysis provides a perspective, indicating that although AMD’s valuation appears high in absolute terms, its stock price may still have room to rise in terms of growth potential.

When evaluating AMD’s attractiveness as a long-term investment, investors should consider this potential valuation adjustment and the company’s continued investment in the AI and high-performance computing markets. AMD’s strategic focus and market performance may drive further stock price growth in the coming fiscal years, especially as the company continues to drive technological innovation and market expansion.

If you are optimistic about AMD’s future development, you can go to the BiyaPay platform to buy the stock. Of course, if you want to avoid the short-term volatility risk brought by the current financial report, you can also monitor AMD’s stock price trend on the platform and find a more suitable entry time.

In addition, BiyaPay can also serve as a professional tool for depositing and withdrawing funds from US and Hong Kong stocks, helping you to quickly and safely operate your funds. You can recharge digital currency, quickly exchange it for US dollars or Hong Kong dollars, easily withdraw it to your bank account, and then transfer the funds to other brokerage accounts for investment. The platform has a fast arrival speed and no limit, so you won’t miss any investment opportunities.

The risks faced cannot be underestimated

Although AMD has shown strong business growth potential, the company still faces several important challenges that could affect its business performance and market position.

Firstly, fierce market competition is one of the main risks that AMD must continue to address. Especially the competition from Intel (INTC) and NVIDIA (NVDA), the strong competition between these two companies in the AI and high-performance computing markets poses a direct threat to AMD. As these competitors introduce more advanced technologies and cost-effective products in the market, AMD needs to continuously innovate and improve the performance and value of its products to maintain its market competitiveness.

Secondly, the speed of technological iteration is another major challenge for the semiconductor industry, requiring AMD to continuously invest in research and development to keep up with the rapid development of the industry. AMD’s future success largely depends on its ability to continuously launch innovative products, such as the MI325X AI chip, which can meet the growing market demand and surpass competitors. However, rapid technological updates and shortened product lifecycles may lead to increased research and development costs, while also bringing additional pressure to the company’s operations.

In terms of valuation, AMD’s current Price-To-Earnings Ratio is significantly higher than the industry median, reflecting the market’s high expectations for its future earnings growth. However, the high valuation also brings significant market expectation risks. AMD’s forward Price-To-Earnings Ratio is much higher than the industry average, which to some extent increases the volatility and downside risk of its stock price. Especially in the current financial forecast, if AMD fails to meet or exceed these growth expectations, its stock price may face significant adjustments.

In addition, AMD also faces challenges in global supply chain management. The complexity and uncertainty of the global semiconductor supply chain may affect AMD’s production efficiency and cost control. Supply chain interruptions or fluctuations in raw material prices may have a negative impact on the company’s profit margin and business performance.

With the upcoming release of the third quarter financial report, investors’ focus should mainly be on its AI and high-performance computing product lines, especially the performance of the MI325X AI chip. Faced with the current high Price-To-Earnings Ratio, it is necessary to closely monitor whether the company can continue to meet or exceed market expectations and pay attention to management’s guidance on future business prospects. These factors will have a significant impact on the short-term and long-term performance of AMD’s stock, and investors should adjust their investment strategies accordingly to adapt to possible market changes.