- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

The New York Stock Exchange extended trading hours to 22 hours. Was it because of it?

Current trading rules for US stocks

New Your Stock Exchange, one of the three major US stock exchanges, announced that it plans to extend the trading hours of its fully electronic exchange NYSE Arca to 22 hours per working day, subject to regulatory approval. According to the announcement, the extended trading hours will begin at 1:30 am Eastern Time from Monday to Friday and last until 23:30 pm (excluding holidays).

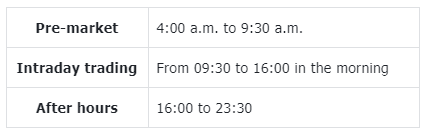

Investors who trade US stocks all year round know that the current (16-hour) trading hours for US stocks are as follows:

New York time

If the NYSE’s plan receives regulatory approval, the entire (22-hour) trading session will be changed to:

New York time

As one of the mainstream exchanges in the US stock market, the NYSE has undergone multiple rounds of reforms since its establishment in 1792: from the initial opening at 10:00 am and closing from 14:00 to 16:00 pm, to the fixed opening at 09:30 am and closing at 16:00 pm in early 1990. In 1991, the NYSE introduced an after-hours trading session, which was initially only one hour and gradually extended to four hours (i.e. the current total trading hours of the US stock market).

There are multiple exchanges in the US that compete with each other for business, competing to attract various Listed Companies to list here, or encouraging investors or traders to place orders on this exchange (increasing the depth of market orders on this exchange). As one of the three major US stock exchanges and a strong competitor to the NYSE, the Nasdaq exchange was established in 1971. By 1991, the Nasdaq exchange accounted for 46% of the total US securities trading volume. In the same year, the NYSE introduced after-hours trading.

The New York Stock Exchange’s plan to extend trading hours this time is also due to new changes in the industry: night trading, especially the surge in trading volume of users in the Asian region, has forced the exchange to start paying attention to them.

Why are there so many people trading in the night session of the US stock market?

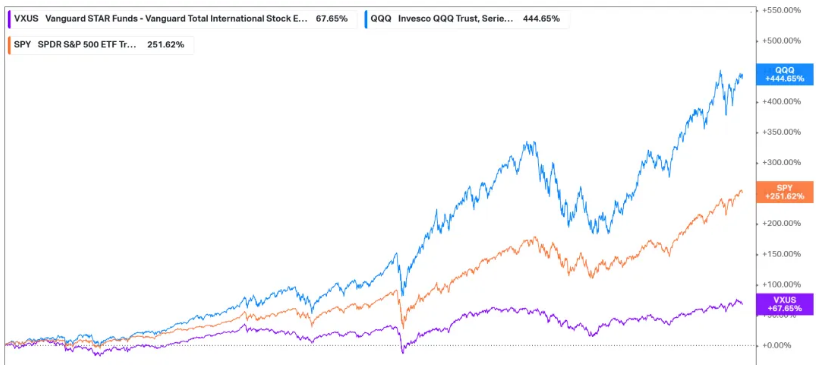

Firstly, the long bull market in the US stock market laid the foundation: since the end of the 2008 financial crisis in the 2010s, the US stock market, led by the NASDAQ index, has embarked on the longest bull market cycle in history (as shown in the figure below, VXUS represents ETFs from non-US countries and countries, and its total returns are far behind the mainstream US index). Only a long-term bull market can attract enough new entrants and inflows of funds.

Secondly, with the bull market foundation (motivation) and the customer base (Asian middle class), tools are also needed: the middle and wealthy classes in Asia are rapidly rising, while the new attractive force of the domestic (or other countries and regions except the US) stock market is relatively small compared to the US stock market. In addition, the rise of Asian fintech companies greatly facilitates retail investors to trade US stocks quickly and efficiently, resulting in a significant increase in the trading volume of US stocks in Asia.

In fact, what is more obvious and predictable than the trading volume trend of US futures during the night session (Asian session) is the surge in trading volume of US futures products during the Asian session. Around 2018-2019, the author observed that the trading volume of many US futures (such as US NYMEX’s crude oil futures and COMEX’s gold futures) began to increase, mainly because the trading volume of Asian clients gradually became active during the Asian session.

Analysis of the reasons for the surge in US stock market night trading

So why is the night trading volume of the US stock market still lukewarm? The author believes there are several reasons:

Exchanges do not attach importance: Historically, mainstream US stock exchanges have prioritized customer needs in the US (primary) and Europe and Japan (secondary), so they have set up pre-market and post-market trading sessions, considering them sufficient.

The structure of US stock investors changes slowly: The investor structure of the US stock market is also dominated by institutions and a small part by retail investors. Therefore, as long as the exchange serves institutions well (mainly concentrated in Europe and America), it is enough, while retail investors have “less money and more work”. However, with the rise of financial technology, especially internet securities firms, online securities firms in the US stock market have emerged one after another, attracting many new retail investors to enter the market, and the “power of retail investors” has begun to emerge.

The Clearing System: The current stock clearing system in the US stock market is not yet real-time clearing. The 16-hour trading time in the US stock market has been running smoothly for many years. If the trading time is changed to 22 hours, there will only be 2 hours left for clearing on the same trading day, which is much shorter than before. It is expected that many problems will arise. Once there is a problem in the financial industry, it may mean huge compensation. Clearing companies/institutions would rather stabilize inefficiently than take responsibility for accidents themselves.

Intermediate participating institutions: A very important feature of the US stock market is the market maker system. If only the two parties are matched, the market liquidity may not be as good as it is now.

Cryptocurrency 24-hour trading: Cryptocurrency allows 24-hour trading (technically allowed), and many individual investors want stocks to be traded 24 hours as well.

Then why did the NYSE request an extension to 22 hours this time?

The answer is that potential competitors are gaining momentum.

If you trade the US stock market for a long time, you will find that starting from 2022 and 2023, many US stock brokers have successively announced their support for night trading of the US stock market. At first, the author traded a few times, but the order price (spread) and trading volume were not ideal, so they did not continue or pay attention to it. Until August of this year (2024), the reversal of the yen carry trade caused the Japanese stock market to plummet.

At that time, the US stock market had not yet opened, and many investors went to the night session of the US stock market to trade, only to find that the night session had also been closed.

Afterwards, a news rushed to the hot search: Blue Ocean, a US overnight trading platform, has completed its expansion. According to coverage, as an overnight trading service provider for 20 brokers worldwide, the company has completed the technical migration supported by Members Exchange (MEMX) with a background in US Wall Street. Within 8 hours, the night trading capacity has expanded from 50 million to 35 billion messages.

Who is Blue Ocean Company? How dare they “cut the network cable” to prevent investors from trading? Who gave them the courage? After searching for some information, the author found that the background of this company is really extraordinary.

According to the information on the company’s official website, the company was established in 2016 and began to cooperate with TD Ameritrade (formerly TD Ameritrade) in 2018 to provide night trading services (initially only supporting 24 stocks or ETFs). In 2019, a dedicated subsidiary, Blue Ocean ATS, LLC, was established to focus on providing alternative trading systems (ATS), which is the night trading function we currently use. In 2020, it became a member unit and broker of US FINRA (US Financial Industry Regulatory Authority). In 2021, it received investment from Urbana Corporation, a listed investment company in Canada (holding 30% of the shares), and reached a strategic partnership with the Canadian Stock Exchange. In June 2021, Blue Ocean’s ATS (Alternative Trading System) was launched, providing underlying US stock night trading services for partner institutions.

So which clients does it have? According to coverage, currently about 19 brokers registered in the US are its clients, including: Robinhood (HOOD), Interactive Brokers (IBKR), Samsung Securities, Futu (FUTU), Tiger Securities (TIGR), etc. In addition, according to company news materials, we also found that its clients include: Virtu Financial, Jane Street, LEK, Score Priority Corp.

The first few are familiar to those who believe in trading US stocks. What are the last few? The author also checked the information and found that they are: proprietary trading groups, market makers, trading system providers, etc. Oh, it turns out to be this trick: the orders placed by night trading investors are directly sent to night trading market makers for transactions (of course, market makers are generally positive and can activate trading liquidity), and the exchange’s customers are away.

Why does the NYSE attach so much importance to it? A private company established in 2016 and only launched a night trading system in 2019, still wants to shake up the century-old NYSE? However, it has indeed developed very rapidly…

In February 2022, it signed an agreement with Samsung Securities in South Korea, allowing Korean investors to access night trading in the US stock market. According to Samsung Securities, 50% of US stock trading takes place between 23:00 and 01:00 local time. Oh, it turns out to be Korean individual investors. Those who hyped up Bitcoin during the epidemic, bought Tesla, and followed US retail investors to “lead the way” in the “GME” battle, making Korean investors famous outside of Korea?

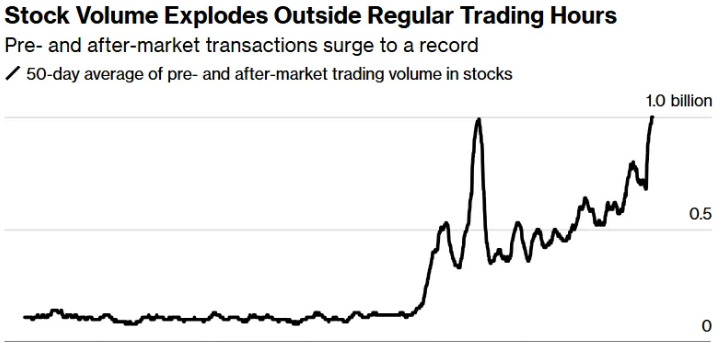

Fortunately, Blue Ocean has found the right customer: according to the company’s shareowner letter in 2022, the monthly trading volume increased by 37% compared to the previous month, and the company’s goal is to continue expanding its Asia-Pacific customer base. According to news reports, in the fourth quarter of 2022, the company’s trading volume per night session was about 900,000 shares.

The focus is on 2023. Blue Ocean has partnered with internet brokers such as Robinhood, Futu, and Interactive Brokers to provide them with night trading services for the US stock market. (The author says it’s no wonder that IB also launched night trading services last year, which was indeed a bit later than Futu. In addition, IB Interactive Brokers does have its own matching trading system, but it should only be used by LITE customers - US/Indian residents.) In 2024, several new partner companies were added, including Tiger Securities. The performance of this year began to soar like a rocket: in January 2023, it was 1.50 million shares, in February it was 4.50 million shares, and by March, the average monthly trading volume was 11 million shares, with the highest record being 14 million shares. By May 2024, the average volume per night session will climb to 40 million shares.

But this is not enough. CEO Hyndman expects this number to reach 1 billion shares in the future. What does this mean? The daytime trading volume of the US stock market is about 12 billion shares. In other words, the night trading volume of Blue Ocean alone is expected to reach 10% of the total trading volume of the US market.

50-Day average volume of pre- and after-hours trading since 2020 (in 1 billion)

However, it should be noted that considering the possibility of extreme events in night trading, Blue Ocean only accepts limit orders for night trading, and the price does not exceed plus or minus 20%.

What is Blue Ocean?

The author is curious about why a company developed a night trading system in 2019, which started to explode in 2022 and now has alarmed the exchange. What is the origin of this company? The author checked the company’s website and relevant information, and analyzed as follows:

Company President (Chariman): Ralph Layman

Capital Markets veteran, served as a global investment portfolio fund manager at Franklin Templeton in 1987, and published the first Emerging Markets equity fund in the US, Templeton Emerging Markets Fund. Later, joined GE Asset Management (GEAM) in 1991, was acquired by State Street Bank, and became the executive vice president of State Street Bank and vice chairperson of State Street Global Investment Management (SSGA), where he stayed until his retirement in 2018. After 2019, he should have been “old and strong” and founded Blue Ocean, specializing in night trading systems.

Board Director: Thomas Caldwell

President of Listed Company Urbana Corporation in Canada (which invested over $10 million in Blue Ocean and acquired 37% of its stock), former director of the Toronto Stock Exchange in Canada, and one of the world’s leading stock exchange investors. Prior to the privatization of the New York Stock Exchange (NYSE), Urbana Corporation and its subsidiaries under his control were the second largest shareholders of the NYSE.

Board Director: Richard Carleton

In 2011, he was appointed CEO of the Canadian Stock Exchange.

Chief Executive Officer (CEO): Brian Hyndman

Former Vice President of Global Senior Information Services at NASDAQ OMX Group, responsible for creating and distributing data and trading on NASDAQ OMX’s system. Prior to this, responsible for handling the operation of the NASDAQ Stock Market.

After this analysis, the following conclusion can be drawn: the veteran of US Capital Markets is “still strong”. He brought in the second largest shareholder of the New York Stock Exchange, the Canadian Stock Exchange, and the operational executives of the US NASDAQ exchange to start a business…

No wonder the Japanese exchange also invested 5% of Blue Ocean’s stock: In August 2023, Blue Ocean announced its first entry into the Japanese market and established a partnership with the Tokyo Stock Exchange (TSE). The exchange opened trading channels to Blue Ocean, and the company attracted more overseas investors to invest in Japanese stocks for the Tokyo Stock Exchange. As support, the Tokyo Stock Exchange invested 5% of Blue Ocean’s stock.

So why did the NYSE have such a big reaction? Because they really understand the industry. Although Blue Ocean is a private company, the situation of mainstream exchanges in the US is not optimistic: Internet securities firms and high-frequency market makers are “shoulder to shoulder”, securities firms hold customer orders, and high-frequency market makers provide trading feedback, without the need for exchange intervention. If these people are allowed to continue to develop, it won’t be long before all trader orders are intercepted, and the exchange can disappear directly… (Of course, regulatory and clearing institutions are still needed).

What else does Blue Ocean want to do?

Step 1: If the trading volume increases, they also want to introduce institutions. Currently, night trading is mainly participated by retail investors, and institutional participation is still very small. However, as the trading volume increases, the bid-ask price difference narrows, and liquidity deepens, some institutions may place orders in night trading if they encounter unexpected events and want to trade.

Step 2: After the current night trading US stock order is completed, Blue Ocean needs to send the trading report to the NYSE Trade Reporting Facility before 08:15 the next morning. Regarding stock clearing, Blue Ocean will send it in bulk to clearing partners, who will then send it to the National Securities Clearing Corporation (NSCC) for clearing. If it is changed to 22-hour trading, the working time limit of the clearing company will be shortened to 2 hours. In addition, because the clearing company does not work on Saturdays and Sundays, no one clears overnight trading on Friday and Saturday nights the next day, and the clearing can only be completed next Monday.

So how can Asian users participate in night trading of US stocks? You can take a look at several large compliance exchanges, such as Interactive Brokers, Jiaxin Wealth Management, Tiger Securities, BiyaPay multi-asset trading wallet, etc. Not only can you monitor prices in real time, but you can also achieve real-time deposits and withdrawals. I wish everyone a smooth investment and be aware of risks.