- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Profit Margin Recovery + Breakthrough in FSD Progress: Tesla's Stock Price Soars 22% for a Bottoming

Tesla performed outstandingly in its third-quarter earnings report, and its stock price surged nearly 22% by the close on Friday. This electric vehicle manufacturer’s strong financial performance broke market concerns about declining demand for electric vehicles and shrinking profit margins, and many bearish views were thus dispelled.

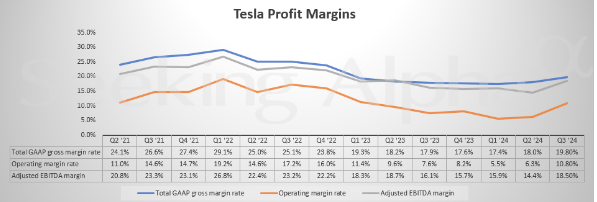

In the third quarter, Tesla’s gross margin rose to 19.8%, significantly higher than the market expectation of 16.8%. This is the second rebound after the company experienced a continuous six-quarter decline in gross margin. At the same time, the production cost per vehicle dropped to a historical low of only $35,100, helping the company improve its profit margin and showing significant improvement in Tesla’s profitability.

In terms of financial data, Tesla’s revenue in the third quarter increased by 7.8% year-on-year to reach $25.18 billion, and earnings per share was $0.72, exceeding the market expectation of $0.60.

Management also predicts that car production will increase by 20% to 30% by 2025, and by 2026, the production of Cybercab will also increase significantly.

Although the Robotaxi conference in early October failed to meet market expectations for autonomous driving, leading to a decline in investor confidence and a drop in stock price, the third-quarter earnings report changed this situation. The good results boosted market confidence, and the stock price quickly recovered lost ground.

Exceeding Expectations in Financial Performance, Tesla Returns to the Growth Track

Tesla’s financial performance in the third quarter exceeded market expectations, showing its success in reducing costs and improving profit margins. Although revenue was slightly lower than market expectations, the company performed very strongly in terms of profitability, reigniting market confidence in its growth potential.

In the third quarter, Tesla’s revenue reached $25.18 billion, an increase of 7.8% year-on-year. Although the increase is not particularly remarkable, earnings per share significantly exceeded expectations, reaching $0.72, while the market’s original expectation was $0.60. At the same time, the gross margin also increased to 19.8%, exceeding the expected 16.8%. This marks the second time Tesla has achieved a rebound after a continuous six-quarter decline in gross margin, indicating that the company has made significant progress in restoring profitability.

Tesla’s operating margin also jumped from 6.3% in the previous quarter to 10.8%, returning to double digits for the first time since 2023. This is due to the company’s successful reduction of production costs. In this quarter, the production cost per vehicle dropped to $35,100, a record low. This ability to control costs has become the key for Tesla to remain profitable in the fierce market competition.

However, it should be noted that Tesla’s quarterly earnings report was boosted by regulatory credits (carbon emission subsidies given by the government): in this quarter, regulatory credit income was the second highest in the company’s history. These subsidies are not a reflection of Tesla’s core competitiveness. However, even without this part of the impact, Tesla’s automotive business gross margin still reached 17.1%, higher than the market expectation of 16.3% and also higher than the previous quarter’s 14.7%. This means that even without additional subsidy support, Tesla’s core business is becoming stronger.

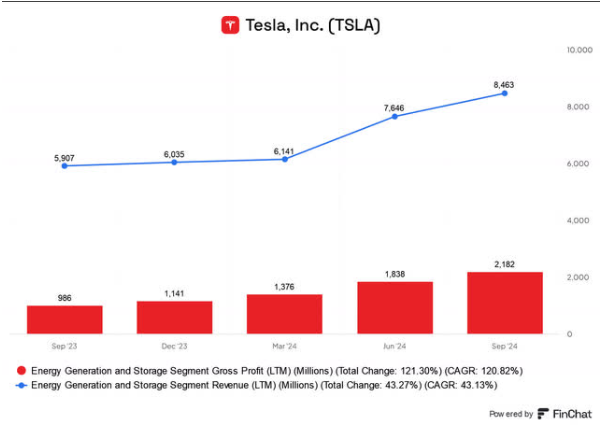

Tesla’s energy business also showed strong growth momentum. The gross margin of energy storage and solar business reached 30.5%, far higher than the market expectation of 23.9%. Although this business is still relatively small at present, its rapid growth provides more possibilities for Tesla’s future.

An important highlight of the third quarter is that Tesla’s CyberTruck finally achieved a positive gross margin. This means that Tesla has successfully reduced production costs to a profitable level on this highly anticipated new model.

Under normal circumstances, new models will be difficult to make a profit in the early stage of mass production due to various cost issues. However, the positive gross margin of CyberTruck shows that Tesla has overcome these challenges. This breakthrough not only helps improve the company’s overall profitability but also proves the market acceptance of CyberTruck and Tesla’s success in commercializing innovative models. With the expansion of future production capacity, CyberTruck is expected to become another important source of profit for the company.

Management is full of confidence in the future and expects that car production will increase by 20% to 30% by 2025. By 2026, the production of Cybercab will also increase significantly. With the sharp increase in stock price, Tesla’s market value has currently exceeded the sum of General Motors and Ford Motors and has become the 12th most valuable company in the United States. This also represents market recognition of Tesla’s profitability and growth ability.

Overall, Tesla’s financial performance in the third quarter dispelled the market’s previous pessimistic expectations. Through effective cost control and capacity expansion, the company not only improved profit margins but also laid the foundation for future growth. Although the competition in the electric vehicle market is still fierce, Tesla’s performance proves that it is still in a very favorable position and can continue to maintain its leading position.

Towards Driverless: Key Progress of Tesla’s Autopilot and Robotaxi

The earnings conference in the third quarter filled in many questions left by the previous Robotaxi conference, giving investors a clearer understanding of Tesla’s autonomous driving prospects.

Progress in Full Self-Driving (FSD) Technology

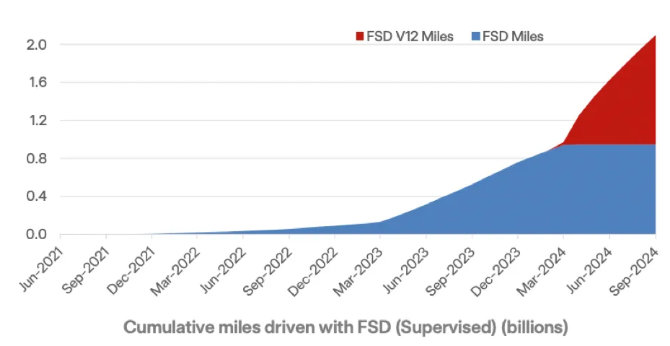

Musk revealed in the earnings conference that currently FSD has accumulated more than 2 billion miles of data, and version V12 contributed 50%. Tesla is constantly upgrading its autonomous driving algorithm. Currently, the parameter quantity of version V12.5 is five times that of the previous version. Musk expects that FSD V13 will be launched soon, and compared with V12.5, the distance between interventions is expected to increase by 5 to 6 times.

This means that the vehicle can travel a longer distance without human intervention and is closer to true full self-driving.

Musk said that Tesla internally expects that by the second quarter of next year, the distance between interventions will be close to the human driving level. The realization of this goal will be a key step in the commercialization of autonomous driving business. Tesla is also increasing hardware investment. In the third quarter, nearly 30,000 Nvidia H100 chip clusters were deployed, and it is expected to increase to 50,000 by the end of October. These high-performance computing powers will help Tesla complete the training and optimization of autonomous driving technology faster.

Prospects and Enhanced Certainty of Robotaxi Business

The Robotaxi business has always been an important part of Tesla’s future planning. At the Robotaxi conference in early October, the market had high expectations for Tesla because this may fundamentally change Tesla’s business model - after all, the value of a car seller and an AI technology company is completely different.

But the conference didn’t give the answer the market wanted. Musk did not clearly show the route of FSD’s technological advancement, nor did he give a specific timeline for Robotaxi, which makes the market full of uncertainty about the landing of this business. In particular, the Cybercab’s design eliminates the steering wheel and pedals, making regulatory approvals more difficult and the market’s timeline expectations for the Robotaxi business more pessimistic.

But this earnings conference gave a clearer path and goal. Musk said that Tesla plans to take the lead in launching driverless taxi services in Texas and California. Existing models already have relevant technologies and can be tested and served under the conditions permitted by regulations, which means that there is no need to wait for the mass production of Cybercab. In addition, Tesla is also testing driverless ride-hailing services for employees in the Bay Area. Employees can call these vehicles through mobile phone applications. Although there is still a safety driver in the vehicle at present, this is a transitional stage before realizing full driverlessness.

Another executive also mentioned that Tesla has actually started promoting this service long ago, and some functions have been pushed to users, which will make seamless connection in the future more feasible. This is also a blockbuster news. It also increases the certainty of the implementation of driverless business next year.

In terms of regulation, Tesla has obtained approval at the federal level, and approval at the state level is also in progress. Musk said that California has allowed driverless vehicles of other companies to be on the road, which provides a good precedent for Tesla to conduct business in California. In addition, the US Congress began discussing the nationwide implementation of driverless approval in 2017. If this measure is implemented, it will greatly accelerate the promotion of Tesla’s Robotaxi business.

The Significance of Robotaxi for Tesla’s Future Growth

The implementation of the Robotaxi business will bring a new source of income for Tesla. Different from the traditional profit model of selling cars, the autonomous driving taxi business has long-term and stable income potential. In the future, when this service is commercialized in more regions, Tesla’s business model will be further expanded, including both the sales of electric vehicles and the income from autonomous driving mobility services.

In this way, Tesla is expected to open up a new market space while maintaining its leadership position in the electric vehicle market.

Market Sentiment Recovery and Changes in Valuation

Tesla’s non-GAAP forward price-to-earnings ratio is currently 92.75, far higher than the industry median of 17.19, 439.52% higher. From the perspective of the industry median, such a valuation is obviously very high, but I think the key is that compared with other companies, Tesla still provides investors with a more attractive business prospect.

In a previous article, through rough calculations, it was concluded that the valuation of Tesla’s automotive department is about $455 billion. Based on a 6% year-on-year growth, I adjusted the valuation of the automotive department to $477.75 billion. At the same time, adding my valuation of the rest of the company at about $425 billion, this makes Tesla’s overall valuation about $902.75 billion, which represents about a 13% upside at that time. Since then, Tesla’s stock price has risen by about half.

But after the third quarter, I think Tesla’s potential upside has further increased. As Musk mentioned in the earnings conference call, the company expects car sales to increase by 20% - 30% in 2025. If a 25% increase is taken as the average, then the valuation of the automotive department will need to be further increased.

If Tesla can indeed achieve a 25% increase in car revenue in 2025, I expect the valuation of its automotive department to increase to nearly $600 billion (about $597.188 billion). Coupled with the valuation of the rest of the company at about $425 billion (including Tesla Energy and Optimus robots), the overall company valuation I derive will be slightly higher than $1.022 trillion.

It should be noted that although Tesla’s energy department performed strongly this quarter, for conservative reasons, the valuation of this department has not been increased for the time being.

Dividing this new estimated valuation ($1.022 trillion) by the current market value ($682.53 billion), it can be calculated that Tesla’s potential upside is about 49.8%, provided that stock dilution is minimal.

Although such a valuation seems very high, we need to see the opportunities Tesla faces. This quarter is one of the best in years in my opinion, not only because of record revenue, but more importantly, the clear outlook for 2025, which has laid confidence and foundation for Tesla to achieve more growth and made this quarter particularly optimistic. For investors who want to seize this growth opportunity, the multi-asset wallet BiyaPay is an ideal choice.

Through BiyaPay, you can conveniently check stock prices regularly and trade at the right time. BiyaPay can directly trade US stocks and Hong Kong stocks, and can also recharge USDT and withdraw it as US dollars or Hong Kong dollars to a bank account, and then further use it for investment in other securities. The whole process is efficient and fast, without quota restrictions, completely solving the trouble of depositing and withdrawing funds, allowing you to easily grasp market dynamics and seize every investment opportunity.

Risks and Challenges

Risk of Delay in Autonomous Driving Technology

Tesla has invested a lot of resources in autonomous driving technology and has made significant progress, but its commercialization still faces many challenges.

Musk’s timetable has always been aggressive. Although the research and development speed of FSD (full self-driving) technology has accelerated, there are still many uncertainties in achieving full driverlessness. Tesla has failed to achieve the promised technological progress on schedule many times, which may lead to delays in the commercialization process of autonomous driving and Robotaxi, thus affecting the company’s leading position in this field and having a negative impact on investor confidence.

Market Pressure from High Valuation

Tesla’s current valuation is still at a relatively high level, which shows the market’s high expectations for its future growth, but it also increases the short-term market risk. If the future financial performance fails to meet market expectations or the technological progress is not as expected, Tesla’s stock price may face significant downward pressure. In addition, Tesla’s high valuation exposes short-term investors to greater risks when the stock price fluctuates.

For those investors who hope to profit from short-term trading, changes in market sentiment and high stock price volatility are challenges that cannot be ignored.

Although the expected interest rate cut is expected to boost consumer willingness to buy cars in the future and thus support Tesla’s valuation, macroeconomic uncertainties may still affect Tesla’s market performance. Therefore, investors need to have a certain degree of prudence towards Tesla’s high valuation and the progress of technology implementation, especially in the case of possible market fluctuations in the short term.

Summary and Investment Recommendations

Long-Term Investment Opportunities

Tesla has a wide range of layouts in electric vehicles, autonomous driving, and new energy storage, which makes it occupy a leading position in these emerging industries. Through the third-quarter earnings report, we have seen Tesla achieve significant progress in multiple fields. For example, the production cost of cars has hit a new low, and the gross margin has also started to rebound, showing Tesla’s improvement in cost control and operating efficiency. In addition, the development of FSD (full self-driving) technology also makes the market see the possibility of commercialization of autonomous driving. Tesla’s optimistic outlook for version FSD V13 lays the foundation for the future commercialization of Robotaxi.

Tesla’s strong performance in the new energy storage and solar business also proves the effectiveness of its business diversification strategy. The gross margin of energy storage and solar business reached 30.5%, far exceeding market expectations, showing the growth potential of this business.

These all provide strong support for Tesla’s long-term development and give it long-term growth potential in the global trend of transitioning to clean energy.

For investors with a long-term perspective, Tesla’s technological breakthroughs and continuous innovation mean that the company has the opportunity to further expand its market share in the automotive and energy markets. Therefore, Tesla is suitable for long-term investors who are patient and willing to bear certain short-term volatility risks. Although the valuation is relatively high, In the long run, Tesla’s innovation ability and market leadership are expected to bring substantial returns to investors.

Short-Term Investment Recommendations

Although Tesla’s long-term growth prospects are exciting, its valuation is still at a high level, reflecting the market’s high expectations for its future growth. Tesla’s non-GAAP forward price-to-earnings ratio is 92.75, far higher than the industry average, which means that the stock price is more sensitive to short-term performance. If Tesla fails to achieve the expected growth target or the technological progress is not as expected, the stock price may fluctuate significantly.

Tesla’s stock price rose nearly 22% after the third-quarter earnings report, showing market confidence in its financial performance and future development direction. However, part of the increase was triggered by short sellers covering their positions, and there is certain short-term volatility. At the same time, the expected interest rate cut may have a positive impact on car sales in the future and further support Tesla’s valuation. But short-term market sentiment and macroeconomic changes may still have a significant impact on its stock price.

Therefore, short-term investors should be cautious when considering investing in Tesla, especially when the valuation is at a high level. It is recommended to wait for clearer growth signals or entry opportunities after a stock price correction.