- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

The US election is turbulent, how to hedge against risks in the US stock market? Follow Buffett to c

In the complex global economic landscape, the US stock market has always played a central role, especially during critical moments such as the US election, where market volatility inevitably increases. In such an environment, investors often seek guidance and wisdom, and investment giants like Warren Buffett have become their beacons. Buffett is known for his profound market insights and long-term excess returns. His investment strategy is not only a model for professional investors, but also provides a model of stable investment for ordinary investors.

Especially in the face of events such as the US election that may cause significant market fluctuations, Buffett’s Vanguard S & P 500 ETF (VOO) provides investors with an ideal choice for sailing steadily in the waves with its low-cost and high-efficiency investment method.

Warren Buffett’s investment philosophy

Warren Buffett, known as the “Stock God” and the “Prophet of Omaha”, is not only known for his wealth accumulation, but also for his seemingly simple yet extremely effective investment philosophy.

Since he started investing in the early 1950s, Buffett has shown a unique business insight. His investment method is deeply rooted in thorough fundamental analysis and a persistent pursuit of long-term value. Buffett not only invests in companies he fully understands, but also always buys stocks of these companies at reasonable prices. This method not only steadily increases his wealth in turbulent market cycles, but also reduces uncertainty and investment risk.

Buffett’s long-term investment perspective pays special attention to the intrinsic value and financial fundamentals of enterprises. His investment decisions often revolve around acquiring high-quality assets that are undervalued by the market and holding them for a long time until their value is fully recognized by the market. For example, his holdings in companies such as Apple and Coca-Cola are not only due to their brand value and market position, but also because these companies can continuously generate stable cash flow and good profit growth.

Vanguard S & P 500 ETF (VOO) - the ideal choice for ordinary investors

From the above, it can also be seen that Warren Buffett’s investment strategy emphasizes the importance of low cost and high efficiency. This is precisely why he prefers the Vanguard S & P 500 ETF (VOO) and believes it is an ideal choice for ordinary investors.

So, what is VOO?

The Vanguard S & P 500 ETF (VOO) is an exchange-traded fund launched in July 2010 by Vanguard, a prominent asset management company, with total assets of $980.30 billion.

It aims to provide investment results that are almost identical to those of the S & P 500 Index, which reflects the stock performance of the largest US 500 companies. Investing in VOO is like investing in the S & P 500 Index, indirectly holding high-quality stocks within the index and enjoying the dividends brought by US economic growth.

What are its investment advantages?

Strict standards, screening high-quality companies

The selection criteria of the S & P 500 Index provide VOO with an investment portfolio composed of financial health and market leaders. Each member company must have a market value of at least $18 billion and demonstrate stable profitability. These strict criteria ensure that only the most powerful companies can be selected. The existence of this selection process provides investors with a solid foundation composed of high-quality companies, thereby reducing investment uncertainty and latent risk.

In addition, the S & P 500 Index is managed by a special committee that reevaluates Constituent Stocks every quarter to ensure that the index reflects the latest market environment and company performance. Such dynamic adjustments further ensure that the companies held by VOO are always those that meet high standards, which is crucial for investors pursuing long-term stable growth.

Low cost rate, highly competitive

VOO’s annual expense ratio is 0.03%, making it one of the most competitive investment options in the market due to its extremely low cost efficiency. Compared to other products such as SPDR S & P 500 ETF Trust with an expense ratio of 0.09%, VOO’s low cost structure is particularly prominent, making it very suitable for novice investors because the lower the management fee, the less impact it has on investment returns.

In the world of investment, every penny of cost can cause huge differences in long-term accumulation. Choosing low-cost funds like VOO can help investors optimize returns and ensure that funds are invested as much as possible in market appreciation, rather than being eroded by various expenses.

Diversified investment, more diversified risks

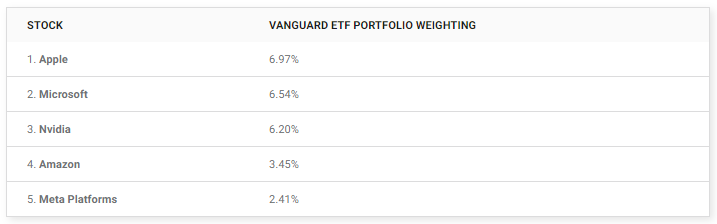

As an ETF that tracks the S & P 500 Index, VOO naturally covers the 500 largest and most influential companies in the market. This ETF consists of 11 different sectors. Technology stocks have the highest weight at 31.1%, followed by financial stocks at 13.2% and healthcare stocks at 12.2%. The total market value of the top five holdings of the ETF is $12.90 trillion, accounting for just over 25% of the total value of its entire 500-company portfolio.

This broad industry coverage provides investors with inherent risk diversification. For example, although technology stocks offer significant growth potential, they may also bring higher volatility; while financial and healthcare stocks usually provide stable cash flow and lower volatility.

In addition, the representativeness of the market ensures that investors can keep pace with the growth of the entire US economy. When the market as a whole rises, VOO investors can directly benefit from it. This synchronization with the overall market is one of the important reasons why VOO attracts investors, as it simplifies the investment process and allows individual investors to easily obtain returns similar to those of professional investors.

The shortcut to a million dollars: by 2030, the increase could reach 163%.

Investing in the Vanguard S & P 500 ETF (VOO) provides an attractive path for investors seeking significant financial growth over the next decade. By understanding the historical performance of VOO and predicting future gains, we can better grasp the potential of this investment tool.

Excellent historical performance

Since the S & P 500 Index adopted its current form in 1957, its average annual return has been about 10.26%. This return is based on a broad index that includes some of the largest and most successful companies in the market. Through ETFs like VOO, investors can directly invest in these top companies at extremely low cost ratios to obtain similar returns.

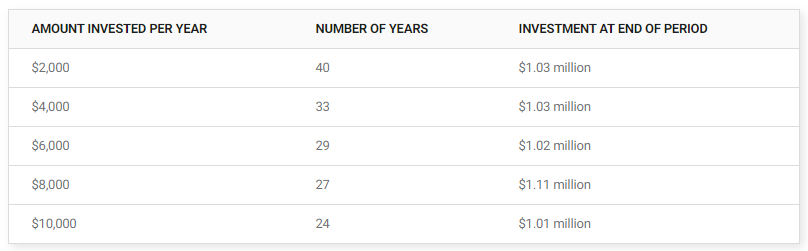

The following table shows its cost for different investment amounts and investment periods (adjusted for Vanguard ETF’s annual fee percentage):

Assuming a person invests $2,000 in VOO every year during their career, based on past average returns, such a strategy is enough to accumulate over a million dollars over several decades.

Strong future trend

Although specific market performance is difficult to predict accurately, many analysts are optimistic about the future performance of VOO and its benchmark index. Market analyst Tom Lee has made some very accurate predictions about the S & P 500 Index in the past few years.

Earlier this year, he released a long-term prediction that the index could exceed 15,000 points by 2030. This means that if he is correct, the S & P 500 Index could achieve a growth of up to 163% by then. This prediction takes into account the driving force of technological advances such as artificial intelligence, which will greatly increase global productivity and economic growth. In addition, as millennials and Generation Z enter their high-income age group, their investment activities are expected to bring new vitality to the market.

As an ETF that tracks this index, VOO’s performance is expected to be consistent with the S & P 500 Index, so investors holding VOO are expected to receive similar gains and amazing returns.

How to use the Vanguard S & P 500 ETF (VOO) to achieve long-term financial goals?

By combining Buffett’s investment philosophy with specific investment strategies, investors can use VOO to achieve their long-term financial growth goals. Next, let’s take a look at how to use these advantages through investment strategies to achieve long-term financial growth.

Set long-term investment goals

Successful investment begins with clear goal setting. For many investors who invest in VOO, goals usually include establishing retirement savings, increasing capital, or accumulating capital for their children’s education. As an ETF that tracks the S & P 500 Index, VOO provides a way to gain broad market exposure through an investment tool, which is highly attractive for investors seeking long-term stable growth.

Regular investment and dividend reinvestment

By regularly purchasing VOO shares regardless of market conditions through a regular investment plan, this strategy can help avoid the difficulty of trying to predict the best market entry time, while achieving capital appreciation through long-term market participation. In addition, the dividends distributed by VOO can be automatically reinvested, which allows investors to compound their personal investments and accumulate more ETF shares over time. Reinvesting dividends is an effective way to increase investment returns and accelerate capital accumulation.

Combining the convenience of the BiyaPay platform

To simplify the investment process, using service platforms such as BiyaPay can provide investors with real-time data on market dynamics and strategy adjustments. Investors can either directly conduct VOO transactions on BiyaPay or use it as a professional tool for depositing and depositing US and Hong Kong stocks, recharging digital currency to exchange for US dollars or Hong Kong dollars, and then withdrawing it to a bank account and transferring it to a brokerage account for investment. This method can prevent you from missing market opportunities due to funding issues and help you efficiently allocate assets.

Balance the risks

Although VOO’s market coverage and diversified investments provide a certain margin of safety, no stock market investment can completely avoid short-term fluctuations. Market fluctuations may cause the originally set Asset Allocation to deviate from the target. Investors should regularly monitor the performance of their investment portfolios and adjust investment strategies based on their personal financial situation, market conditions, and life stage.

At the same time, investors should maintain a long-term perspective and focus on the potential for capital growth rather than short-term fluctuations. During market downturns, adhere to investment strategies or increase investment in VOO to bring additional returns when the market recovers.

Finally, while VOO is a diversified investment vehicle in its own right, investors should also consider further diversification across asset classes to help offset the impact of fluctuations in a single market on the entire investment portfolio.

Overall, the Vanguard S & P 500 ETF (VOO) is a low-cost and efficient investment option that provides the opportunity to directly invest in well-known US companies. Through its passive management strategy and extremely low fees, VOO can maximize investors’ long-term returns, providing an ideal choice for seeking stable growth and financial security. However, you should also balance risks when making investments.