- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

The financial report season is approaching for Microsoft: will its substantial AI investments drive

Microsoft was one of the first companies viewed as a clear “AI” success story, with the integration of “Microsoft 365” and “ChatGPT” setting a solid foundation for transforming future productivity tools. These achievements reveal Microsoft’s resilience and growth potential amid intense technological competition. Today, Microsoft’s in-depth focus on AI and cloud computing has once again caught the eye of investors.

Despite this, Microsoft faces significant challenges in 2024, particularly due to its large-scale capital investments in cloud computing and AI, which have sparked concerns about short-term profits. Microsoft’s commitment to becoming a leader in AI demands significant funding for training large models and maintaining technological leadership.

Whether these investments can deliver the expected returns has become a focal point for the market.

Microsoft’s long-term investment rationale remains robust; as one of the world’s leading cloud computing providers, its “Azure” business is viewed as a key driver of future growth. With the financial report release imminent, the market’s attention has turned once again to this giant—has it fully prepared itself for the upcoming AI wave?

AI Investment and Capital Expenditures: Is Microsoft’s Bold Bet Worth It?

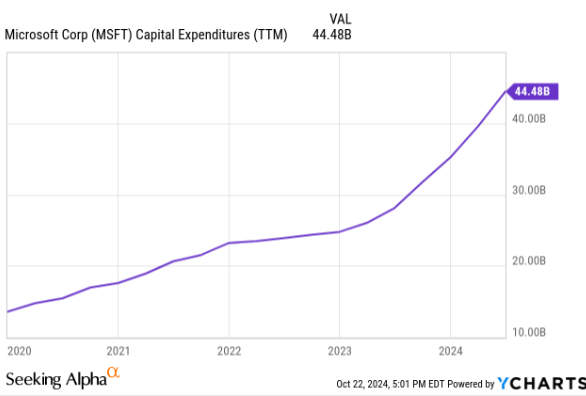

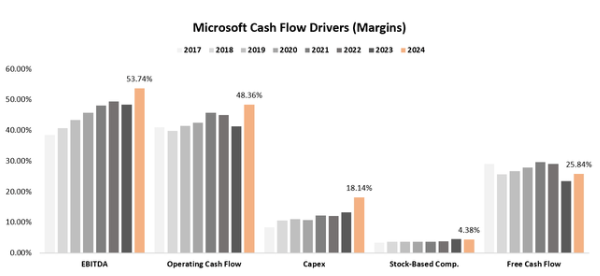

In recent years, Microsoft has made unprecedented investments in artificial intelligence and cloud computing, leading to a significant increase in capital expenditures that have drawn attention and sparked debate among investors. Since 2020, Microsoft’s capital expenditures have risen year after year, reaching $44.48 billion in 2024. This massive investment reflects Microsoft’s strong confidence in the future AI market but also brings the immediate reality of reduced free cash flow.

The Reasonableness of Large Capital Expenditures Compared with Competitors

Microsoft’s rapid growth in capital expenditures has made some investors question its future investment return, especially amid growing global economic uncertainty. Can such high capital expenditures bring reasonable returns?

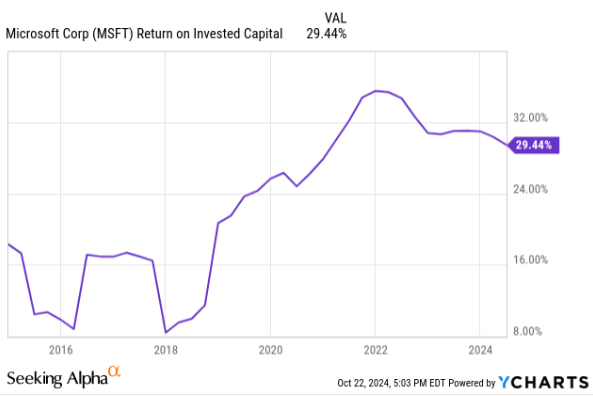

From a data perspective, Microsoft has consistently delivered strong long-term investment returns. Its return on invested capital (ROIC) in 2024 stands at 29.44%, slightly down from the high of 2022, yet still maintained at a high level of around 30%.

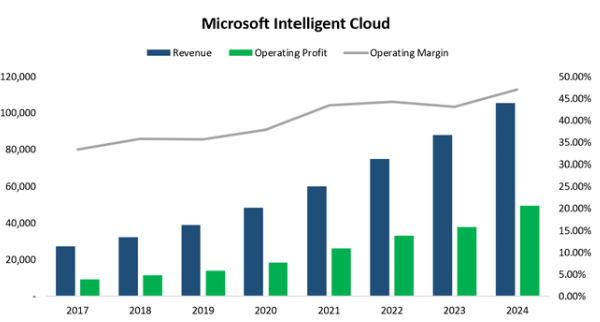

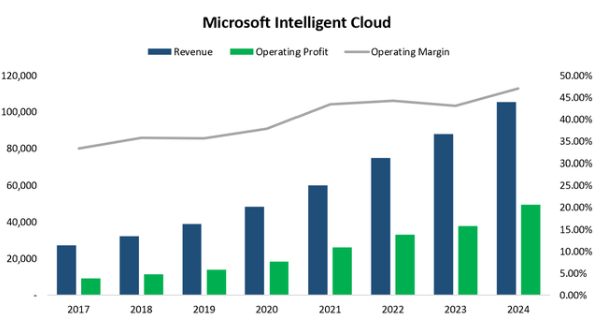

This strong ROIC is closely related to Microsoft’s expansion across multiple fields, especially its investment in the intelligent cloud business, which has established a favorable position in the global cloud computing market. Since 2017, the “Microsoft Intelligent Cloud” has shown steady growth in both revenue and operating profit.

In 2024, the operating profit margin of this sector is close to 50%, making it a crucial pillar of Microsoft’s profitability. This also shows that while capital expenditures have significantly increased, Microsoft’s effective capital allocation ensures stable returns on investment.

In AI and cloud computing, Microsoft’s main competitors are “Alphabet” and “Amazon.” From 2024 stock performance data, “Amazon” leads with a 21.57% stock growth rate, followed by “Alphabet” at 16.71%, while “Microsoft” has a relatively modest growth of 12.91%. This may reflect the market’s more cautious stance on Microsoft’s capital spending, as investors need to see substantial returns from its high investment.

What Has Microsoft Built with All This Investment?

Microsoft’s ambitions in the AI field are evident, as it integrates “Microsoft 365” with “ChatGPT,” aiming not only to enhance product functionality but also to establish an unshakable foundation in productivity tools.

This strategy has clearly shown results in the company’s business performance, particularly in driving the growth of its intelligent cloud business and stock price.

Through the integration of “Microsoft 365” and “ChatGPT,” Microsoft has infused AI into traditional office tools such as “Word,” “Excel,” and “PowerPoint.” For instance, “Copilot” is already applied in “Excel,” allowing users to leverage “Python” for advanced data analysis, eliminating the complexities of coding. Similarly, “PowerPoint” users can quickly generate design templates with simple prompts.

In the highly competitive productivity tools market, Microsoft has gained an advantage over its competitors with these AI-driven functionalities. While “Google Workspace” continues to introduce AI features, Microsoft’s collaboration with “OpenAI” and the deep integration of “Copilot” have helped it maintain a leading market share.

This is also reflected in the latest financial report: subscriptions to Microsoft’s “Office” suite have continued to grow steadily, showing the appeal of its AI functionalities to users.

Microsoft Copilot Studio and AI Agents: Empowering Every User, Enhancing Business Performance

“Microsoft Copilot Studio” is a significant part of Microsoft’s AI strategy, allowing users to create their own “AI agents” to automate specific tasks. For users without programming experience, this is a revolutionary productivity tool. At a competitive level, even “Salesforce” CEO Marc Benioff publicly expressed concerns about Microsoft’s AI products, indicating the strong advantage Microsoft holds in the integration of productivity tools and AI. In comparison, “Google” and “Salesforce” have also introduced similar intelligent assistants and automation tools, but their market acceptance and impact are not yet on par with Microsoft.

These AI agents and automation tools not only enhance user productivity but also generate new revenue streams for Microsoft—these add-on features drive up the company’s “ARPU” (average revenue per user).

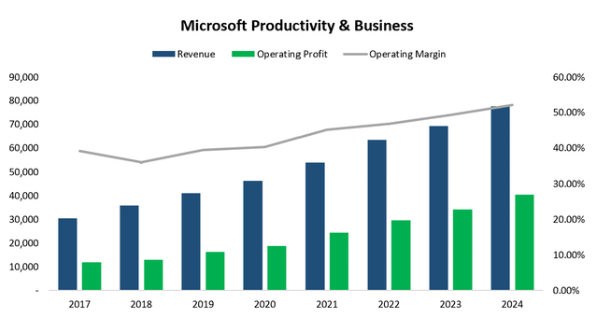

Thus, Microsoft’s productivity and business division has shown impressive performance, with a compound annual growth rate (CAGR) of 14% since 2017. With more companies gradually adopting AI functionalities, this growth is expected to continue in the coming years.

How is Azure Performing as Microsoft’s Leading Business Segment?

Microsoft’s business segments span cloud computing, productivity tools, and personal computing, each playing a critical role in the company’s overall growth. Among them, the intelligent cloud business stands out as a key driver, fueling Microsoft’s performance as a whole.

The Intelligent Cloud Business

The intelligent cloud business is crucial for Microsoft’s future growth. “Azure,” the core of Microsoft’s intelligent cloud, has shown sustained strong growth since 2017, with an operating profit margin close to 50% in 2024.

As more enterprises shift workloads to the cloud, Azure’s market share continues to expand, especially with AI technology support. Microsoft’s intelligent cloud platform combines AI and data analytics to help clients make smarter business decisions.

Microsoft’s investments in AI and cloud computing have enabled its intelligent cloud division to consistently expand its market share, further consolidating Microsoft’s position in the global cloud computing market. Compared with “Amazon’s” “AWS” and “Google’s” “Google Cloud,” “Azure” has shown significant growth in 2024, partly driven by AI’s impact on the intelligent cloud business.

Productivity and Business Division

Microsoft’s productivity and business division primarily comprises revenue from the “Office” suite, “Dynamics,” and parts of “LinkedIn.” The high user stickiness of these products makes this division an essential component of Microsoft’s revenue structure. Since 2017, the productivity and business division has achieved a CAGR of 14%, with an operating profit margin of 52% in 2024.

With continuous updates to the “Microsoft 365” product line and the integration of AI features, the appeal of these products has further increased. For example, the “Copilot” feature in “Excel” enables advanced data analysis without programming knowledge, while natural language generation in “PowerPoint” facilitates quicker presentation design. These innovations have helped Microsoft’s productivity tools stay ahead of competitors like “Google Workspace.”

Even in the context of “AI” transforming the way we work, products like “Word,” “PowerPoint,” and “Excel” still demonstrate high market stickiness. It is expected that these tools will maintain high usage rates and profitability over the next decade without significant disruptions.

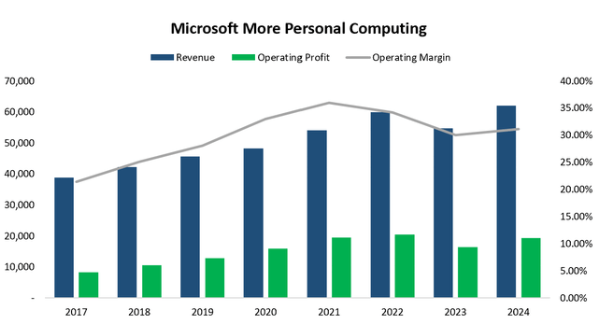

More Personal Computing: Challenges and Breakthroughs in Transition

Microsoft’s More Personal Computing division primarily includes “Windows OEM,” “Surface” hardware, gaming, and “Bing” search and advertising. Although overall growth has been moderate, some sub-segments show promising results. In particular, search and advertising have achieved mid-to-high double-digit growth, with “Bing” gradually gaining market share and driving growth in this segment.

In 2024, the More Personal Computing segment generated approximately $600 billion in revenue, with a steady operating margin of around 30%.

However, the gaming business faces challenges amid a slowing market, as the strategies around “Xbox” and “Game Pass” appear not to fully meet market expectations. Consequently, Microsoft needs to find a clearer direction in this area to ensure the competitiveness of its overall business.

Despite the challenges in the personal computing business, breakthroughs in advertising and search, as well as efforts to integrate AI into personal computing, still provide growth opportunities for this segment. As AI adoption in personal devices grows, Microsoft has ample potential for expansion in this area.

Current Valuation and Future Investment Opportunities: Is Microsoft Still Worth the Premium?

Microsoft’s capital investments and AI initiatives undoubtedly bring enormous growth potential for the future. However, the market holds mixed views on its current valuation. For investors, the central question remains: does Microsoft’s current valuation still hold appeal?

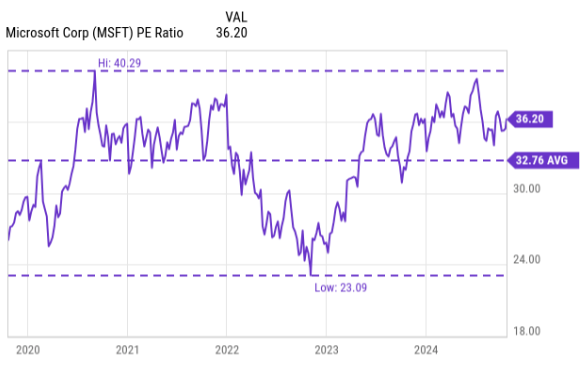

In terms of valuation, Microsoft’s current price-to-earnings ratio is higher than its five-year average but lower than the peak of the past five years.

This suggests that while Microsoft’s expansions in AI and cloud computing have heightened market expectations for future growth, this potential is not fully reflected in its stock price yet. Microsoft’s current price-to-earnings ratio stands at 31.0, slightly above its five-year average of 32 times earnings.

To some investors, this valuation level may appear somewhat elevated, especially in light of surging capital expenditures. However, with Microsoft’s leadership in AI and cloud computing, the company has the capacity to realize higher growth rates in the future. Given that Microsoft has frequently exceeded market expectations in revenue and profit over the past decade, its current valuation retains a certain margin of safety, leaving room for further growth.

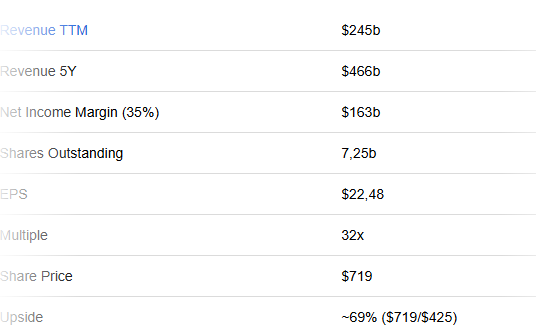

It is estimated that by 2029, Microsoft’s revenue could reach $466 billion, with a net profit margin of around 35%, and the number of outstanding shares is projected to further decrease to approximately 7.25 billion shares.

Under these conservative estimates, Microsoft’s stock price could see an increase of 69% to 90% over the next five years, with an expected annual compound growth rate of around 11%. If the market maintains Microsoft’s current valuation, overall returns could improve further. Thus, Microsoft remains a compelling choice for long-term investors.

Comparing Microsoft’s Valuation with Competitors

Among similar companies, Microsoft’s valuation appears more reasonable relative to other tech giants such as “Apple,” “Salesforce,” and “Adobe.”

Particularly in the AI sector, Microsoft’s collaboration with “OpenAI” has given it a clear advantage, and the market seems not to have fully priced this leadership into its stock yet. Although facing the pressures of high capital expenditures, Microsoft’s investments in intelligent cloud and AI ensure it will experience sustained growth over the coming years. For long-term investors, Microsoft’s valuation remains worthy of consideration.

In comparison with the stock prices of “Alphabet” and “Amazon,” Microsoft has shown relative stability. While Microsoft’s stock gain in 2024 (12.91%) has lagged behind its competitors, the stability of its business and its AI leadership make it attractive for long-term investors. For those who believe in the long-term potential of AI and cloud computing, Microsoft offers a strong risk-reward profile.

Investment Strategy Recommendations

Long-term Investors: AI Initiatives Offer Significant Potential

For investors who favor the long-term development of AI and cloud computing, Microsoft’s current performance and valuation are appealing.

While Microsoft’s stock performance in 2024 has been somewhat conservative due to increased capital spending, these investments will gradually yield returns over the next few years. Microsoft’s deep partnership with “OpenAI” grants it a strong advantage in implementing AI technology and commercial applications, particularly within intelligent cloud and productivity tools, which show solid growth potential.

Considering Microsoft’s effectiveness in capital allocation over the past five years and its consistently high return on invested capital (ROIC), the company’s future growth prospects will likely deliver considerable returns for long-term investors. Therefore, for long-term investors, Microsoft remains a significant option worth considering.

Short-term Considerations: Navigating the Earnings Release and Market Volatility

While Microsoft’s long-term outlook is promising, short-term investors should remain cautious as high capital expenditures and concerns about short-term performance may lead to stock volatility.

Uncertainties around earnings reports often trigger sharp market reactions. Therefore, short-term investors should closely monitor the upcoming earnings release, particularly capital expenditure and earnings forecasts. If the report exceeds expectations for investment returns, Microsoft’s stock price may see a strong rebound.

Furthermore, the commercialization of AI technology remains uncertain, potentially leading to short-term stock fluctuations. Investors with lower risk tolerance might consider waiting until the market fully absorbs the impact of high capital spending before entering the market.

Considering Microsoft’s business stability, continued innovation, and leading position in AI, the company provides a relatively strong margin of safety, making it an ideal choice for long-term investors. As AI technology matures and its applications deepen, Microsoft is likely to transform its capital expenditures into substantial shareholder returns, establishing itself as a hallmark enterprise leading the next wave of technological advancement.

Thus, whether for investors optimistic about long-term growth or those seeking steady returns in the tech sector, Microsoft is a key stock to watch. As the earnings release approaches, there is keen anticipation about whether Microsoft will surprise investors once again.