- Remittance

- Exchange Rate

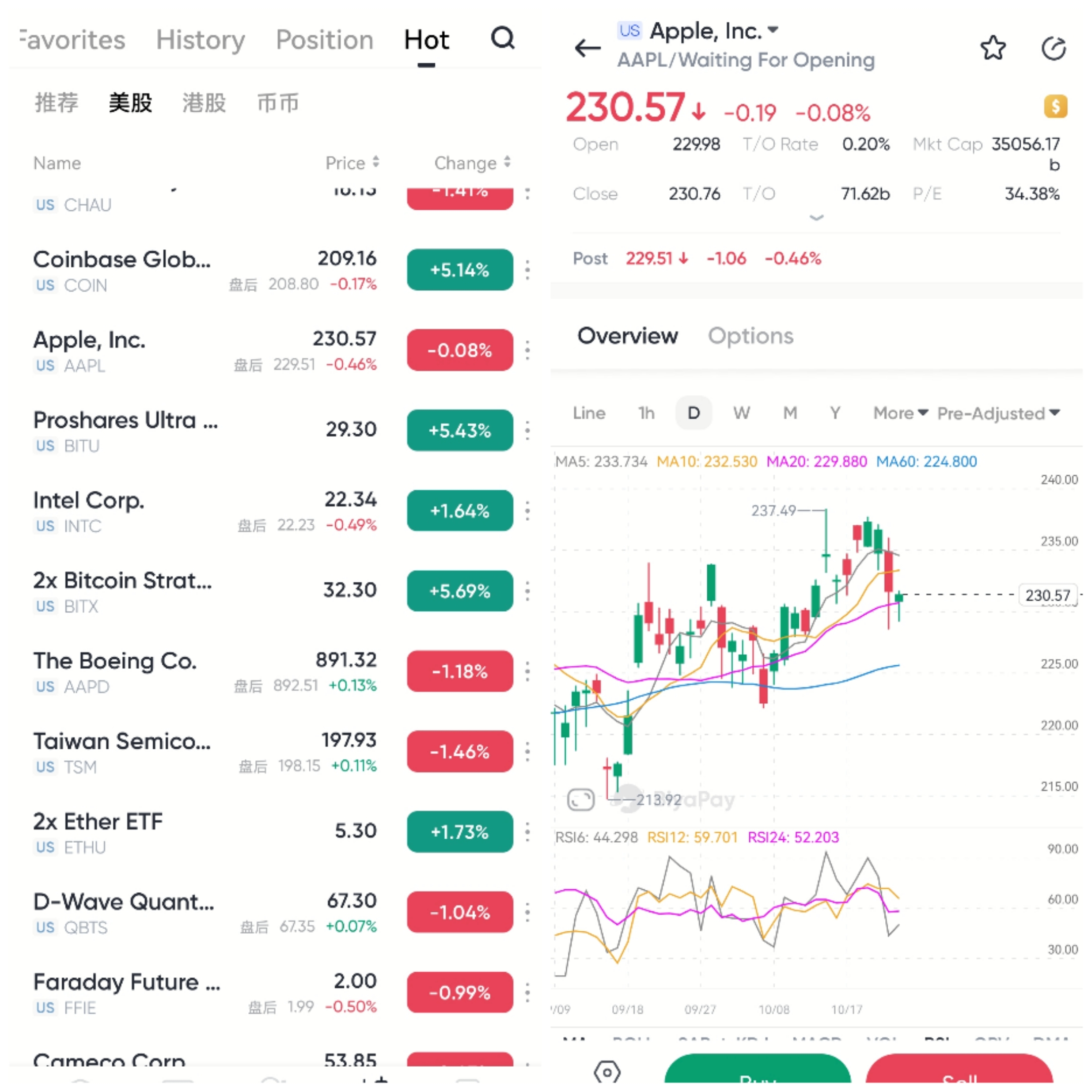

- Stock

- Events

- EasyCard

- More

- Download

Q4 earnings are approaching, iPhone 16 and AI double blessing, can Apple exceed expectations and bri

In the wave of continuous change in the technology industry, Apple (NASDAQ: AAPL) has always stood firm, leading the global market with its revolutionary products and innovative technologies. As the Q4 2024 financial report is about to be released, investors and market analysts are closely watching whether this tech giant with a market value of nearly $3.50 trillion can continue to maintain its performance growth momentum.

Q4 2024 financial report preview

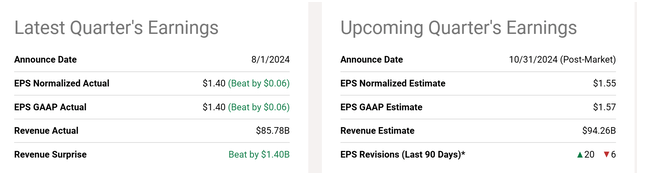

Apple released its Q3 financial report on August 1, 2024, and its profit exceeded market expectations. The company reported earnings per share (EPS) of $1.40, which was $0.06 higher than expected, and revenue reached $85.78 billion, exceeding expectations by $140 million. Looking ahead to the upcoming Q4 financial report on October 31, analysts expect Apple to continue to grow. The market consensus expects Apple’s EPS in Q4 to reach $1.55, an increase of 10.7% from the previous quarter. In terms of revenue, it is expected to reach $94.26 billion, an increase of about 10% quarter-on-quarter.

The main driving force behind this growth is the increase in Apple’s subscription users and the expansion of its service revenue. The performance of the iPhone 16 series in the global market has been the focus of market attention since its release. According to the latest data from Counterpoint, the early sales of the iPhone 16 Pro and Pro Max high-end models in the Chinese market showed strong growth, but overall, the global sales growth rate of the iPhone 16 series did not meet expectations. Apple expects its global sales revenue to focus on this series of products, and the 20% sales growth rate widely expected by analysts may have a direct impact on the company’s stock price and investor confidence.

The core driving force behind strong performance

Apple’s growth strategy has always focused on the innovation of its core product line and the expansion of its service business, and continuously explores the application of new technologies in the global market. In addition, Apple has demonstrated its ability to adapt to global market changes through its response strategies to key regional market challenges. This section will delve deeper into these strategies and their impact on Apple’s overall performance.

Strong expansion of service business

The service business has become Apple’s second largest source of revenue and is expected to continue to maintain strong growth momentum in the coming years. Apple’s service revenue includes digital services such as the App Store, Apple Music, Apple Pay, and iCloud, especially the subscription business, which has huge growth potential. These service businesses have high profitability, with gross profit margins far higher than hardware sales, becoming an important pillar for Apple to maintain high profitability.

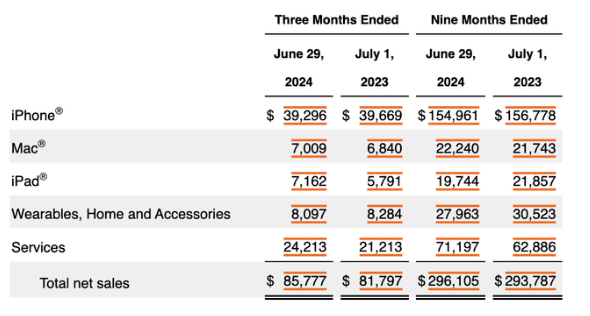

In the third quarter of 2024, Apple’s service revenue was $24.21 billion, a year-on-year increase of 14.1%. This growth is mainly due to the widespread use of Apple devices worldwide and the enhanced stickiness of the ecosystem. In particular, the expansion of payment services such as Apple Pay and Apple Card has made users more dependent on Apple’s fintech services. In addition, the number of subscribers to entertainment services such as Apple Music and Apple TV + is steadily increasing, providing stable cash flow for the company. It is expected that these service revenues will continue to drive Apple’s overall revenue growth in the fourth quarter.

With the continuous development of artificial intelligence technology, Apple is enhancing the competitiveness of its service business through more AI applications. For example, combined with OpenAI technology, Apple is continuously improving the intelligent assistant function in its operating system, making the User Experience smoother and more intelligent. This not only improves user Retention Rate, but also brings higher profit margins to Apple.

Technological innovation drives business development

Apple continues to lead in technological innovation, especially in the application of artificial intelligence, Machine Learning, and augmented reality technology. Apple uses these technologies to optimize its product performance and User Experience, such as improving camera functionality through Machine Learning algorithms and enhancing Siri’s interaction capabilities through AI. In addition, Apple is actively exploring the application of these technologies in new product development, such as launching innovative products in the health technology and smart home fields. The application of these technologies not only enhances the market competitiveness of Apple products, but also opens up new growth channels for the company.

Financial analysis and valuation models

As the Q4 2024 financial report approaches, investors not only focus on Apple’s revenue and profit performance, but also need to have a deep understanding of its financial structure and valuation model.

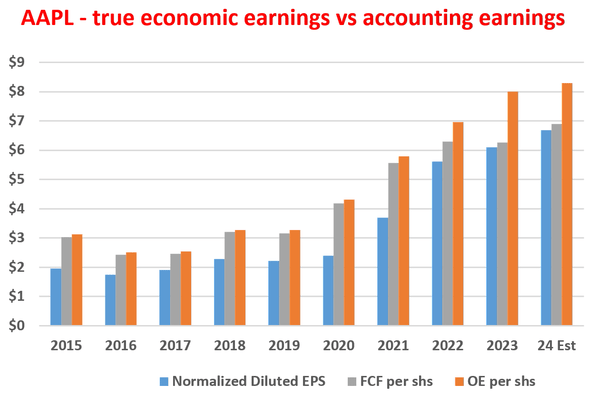

The difference between accounting EPS and economic income

When evaluating Apple’s financial health, the commonly used indicator is accounting earnings per share (EPS), but this indicator alone may not fully reflect Apple’s actual profitability. Apple’s business model highly relies on its capital-light operating strategy, which underestimates its true economic benefits to some extent. According to market analysis, Apple’s economic benefits are usually about 24% higher than accounting EPS, which means that the company can have more profit potential than traditional valuation models through efficient capital allocation.

Economic benefits take into account the capital investment efficiency and actual cash flow generated by the enterprise, so they can better reflect the true operating situation of the company than simple accounting benefits. Most of Apple’s capital expenditures are used for growth investments rather than maintenance investments, which means that if the company chooses to reduce investment in the future, more funds can be directly returned to shareholders. Therefore, Apple’s capital-light model has brought sustained high returns, making economic benefits more representative of the company’s long-term profit creation ability than accounting EPS.

Advantages of the capital-light model

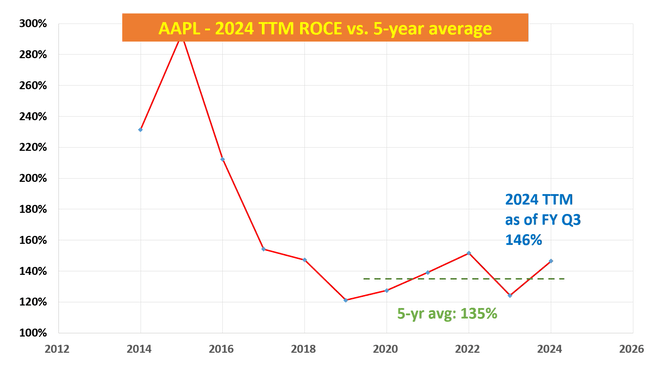

Apple’s capital-light model is one of its core competitive advantages. Compared to other tech giants, Apple spends less capital on infrastructure and equipment, and more resources are invested in research and branding. This strategy enables Apple to maintain a high return on capital (ROCE). In the third quarter of 2024, Apple’s ROCE reached about 146%, far higher than the average level of the technology industry. This efficient capital allocation method not only improves Apple’s profit margin, but also enables the company to flexibly respond to various changes and challenges in the global market.

In addition, Apple’s business relies on its large device user base and service business, which have lower capital expenditure requirements but can bring sustained cash flow. This model ensures that the company can maintain a stable financial position even in the face of short-term market fluctuations and create long-term value for shareholders.

Valuation adjustments and future prospects

According to the traditional accounting EPS valuation model, Apple’s current Price-To-Earnings Ratio (P/E) is 34.7 times, which appears relatively high. However, if its economic benefits are taken into account, Apple’s actual valuation level has significantly decreased. Based on estimates of economic benefits, Apple’s P/E ratio is close to 28 times, indicating that its valuation is not as high as the current market data suggests. Through this reassessment, Apple’s valuation not only becomes more reasonable, but also shows greater growth potential.

Against the backdrop of valuation adjustments, Apple’s future prospects appear brighter. With the expansion of its service business and continuous innovation of its product line, the company is expected to maintain stable revenue growth and profit improvement in the coming years. In addition, Apple’s shareowner return policy, including large-scale stock buybacks and dividend payments, further enhances investor confidence. Since 2021, Apple has reduced its outstanding shares by about 9% through stock buybacks, which has brought additional value enhancement to the remaining shareowners.

If you are optimistic about the future development of Apple, you can go to the BiyaPay platform to buy Apple stocks. Of course, if you want to avoid the current short-term volatility risk, you can also monitor the trend of Tesla’s stock price on the platform and find a more suitable entry time.

In addition, BiyaPay can also serve as a professional tool for depositing and withdrawing funds from US and Hong Kong stocks, helping you to quickly and safely operate your funds. You can recharge digital currency, quickly exchange it for US dollars or Hong Kong dollars, easily withdraw it to your bank account, and then transfer the funds to other brokerage accounts for investment. The platform has a fast arrival speed and no limit, so you won’t miss any investment opportunities.

Challenges

Although Apple has performed well in the global market and has a solid financial foundation and efficient capital allocation strategy, it still faces multiple risks and challenges.

Artificial intelligence and innovation challenges

As a leading global technology company, Apple has always led the market through innovation. However, with the rapid development of artificial intelligence (AI) technology, Apple’s pace in the AI field has been relatively slow. According to some analysis, Apple is at least two and a half years behind the market leader in generative artificial intelligence (Generative AI). This lag may cause Apple to lose its technological advantage in certain key areas, especially in technology areas such as intelligent assistants and automatic speech recognition that interact closely with users.

Although Apple has made some efforts to improve User Experience and integrate AI functions, compared with companies such as Google and Amazon, Apple’s pace in AI innovation is not fast. The future of AI will have a profound impact on the global technology industry. Therefore, if Apple cannot accelerate the integration and research and development of its AI technology, it may be at a disadvantage in future technological competition. Therefore, Apple’s investment and innovation speed in the AI field is a key risk for the future growth of the company.

Global supply chain risk

Apple’s global supply chain is complex and extensive, covering multiple countries and regions. Although this supply chain provides flexibility and scale advantages for the company, it also brings potential risks to Apple. Recently, a fire broke out at Apple’s factory in the Tata Group in India, causing production interruptions. This event highlights the negative impact that global supply chain disruptions can have on Apple’s business, especially when global capacity is highly dependent on specific regions.

India is an important production base and future growth market for Apple. Any interruption related to local production may have a negative impact on the company’s product supply in this market. This not only affects the production progress of products such as iPhone, but also may cause a chain reaction to the overall supply chain of Apple’s global sales. Therefore, Apple needs to further optimize its supply chain management to improve its resilience in the face of emergencies while reducing its dependence on a single region.

The impact of macroeconomic factors

The fluctuations in the macroeconomic environment have a direct impact on the business performance of global companies like Apple. In particular, inflation and rising interest rates around the world may weaken consumers’ purchasing power, thereby affecting the demand for Apple products. Apple’s products, especially the iPhone and Mac series, are mainly positioned in the high-end market. When the economy slows down or consumer spending decreases, Apple’s high-end product sales may be affected.

In addition, exchange rate fluctuations can also affect Apple’s international revenue. As a global enterprise, Apple has a large sales revenue in multiple countries, especially in the Chinese and European markets. Exchange rate fluctuations may cause fluctuations in Apple’s overseas revenue when converted into US dollars, which in turn affects the company’s overall financial performance. Therefore, Apple’s agility and ability to respond in the macroeconomic environment will be the key to the company’s future competitiveness.

How investors layout

Apple is still a favored target for investors due to its strong product ecosystem and continuous innovation ability. Whether it is in the innovation of hardware product lines or the expansion of service business, Apple has shown strong growth potential. In the third quarter of 2024, Apple’s service business revenue increased by 14.1% year-on-year, reaching $24.21 billion, becoming an important engine driving the company’s revenue growth. The high profit margin and recurring revenue of the service business enable Apple to maintain stable profitability despite the slowdown in hardware sales growth.

On the other hand, Apple’s expansion in Emerging Markets, especially in the Indian market, has brought new growth momentum. The increasing demand for high-end smartphones in the Indian market has enabled Apple to further expand its market share. In addition, Apple’s leading position in the high-end market, especially in the US and European markets, will continue to bring strong revenue to the company.

Although the current Price-To-Earnings Ratio is high, about 34.7 times, if Apple’s true economic returns are taken into account, its valuation level may be close to 28 times, which is not as high as it appears on the surface. Apple’s future stock price growth potential will also be driven by its investment in emerging technologies such as AI and augmented reality (AR). These technologies will not only drive product innovation, but also may open up new business areas for the company.

For existing investors, continuing to hold Apple stocks is a stable strategy. Apple’s financial stability and innovation capabilities provide long-term investment guarantees. For new investors, considering Apple’s current high valuation, they can choose to buy on dips during market fluctuations and gradually establish positioning. Investors should closely monitor Apple’s future progress in technological innovation and service expansion to seize future growth opportunities.

Overall, Apple remains one of the top choices for investors due to its innovative ability, strong financial performance, and global market layout. The upcoming financial report may exceed expectations again, driving up the stock price. Apple’s capital-light model and Technology Investment also give it long-term growth potential. For existing investors, holding Apple is a stable choice, while new investors can consider gradually building positions during market fluctuations to seize long-term investment opportunities.