- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Tesla's Q3 profit exceeded expectations, rising more than 12% at one point after the market closed.

Tesla released its Q3 2024 financial report after hours Eastern Time on Wednesday (October 23rd). Although the company’s revenue was slightly lower than market expectations, its profits exceeded Wall Street’s expectations.

On the 23rd, Tesla’s opening price was $217.07. As of the close of the US stock market, Tesla’s stock price fell by $4.32 to close at $213.65, a decrease of 1.98%. After the financial report was released, Tesla’s stock price rose more than 12% in after-hours trading.

Reasons for the sharp increase in stock prices in after-hours trading

Tesla’s stock price rose sharply in after-hours trading after the release of its third-quarter financial report, which can be attributed to several core factors. Firstly, the company’s earnings per share (EPS) and gross profit margin both exceeded analysts’ expectations, reflecting Tesla’s excellent performance in cost management and pricing strategy. These numbers are important indicators for investors to evaluate the company’s profitability, and the unexpected data naturally caused a warm response from the market.

Secondly, Tesla mentioned multiple positive business developments in its financial report, including the promotion of new products and technological breakthroughs, which injected confidence into the company’s future growth. The market responded positively to these positive news, further pushing up the stock price.

Finally, the market’s expectations for Tesla have been adjusted in the past few quarters, so when the company releases financial reports that exceed these lowered expectations, the market’s positive reaction is particularly evident. This change in sentiment is directly reflected in the rise in stock prices, demonstrating investors’ firm confidence in Tesla’s future potential.

Third quarter financial performance

As mentioned earlier, Tesla’s Q3 financial report exceeded expectations in several key financial indicators, demonstrating the company’s resilience and strategic foresight in the complex global economic environment, which also boosted the stock price. Let’s take a look at these detailed data.

Revenue and market expectations

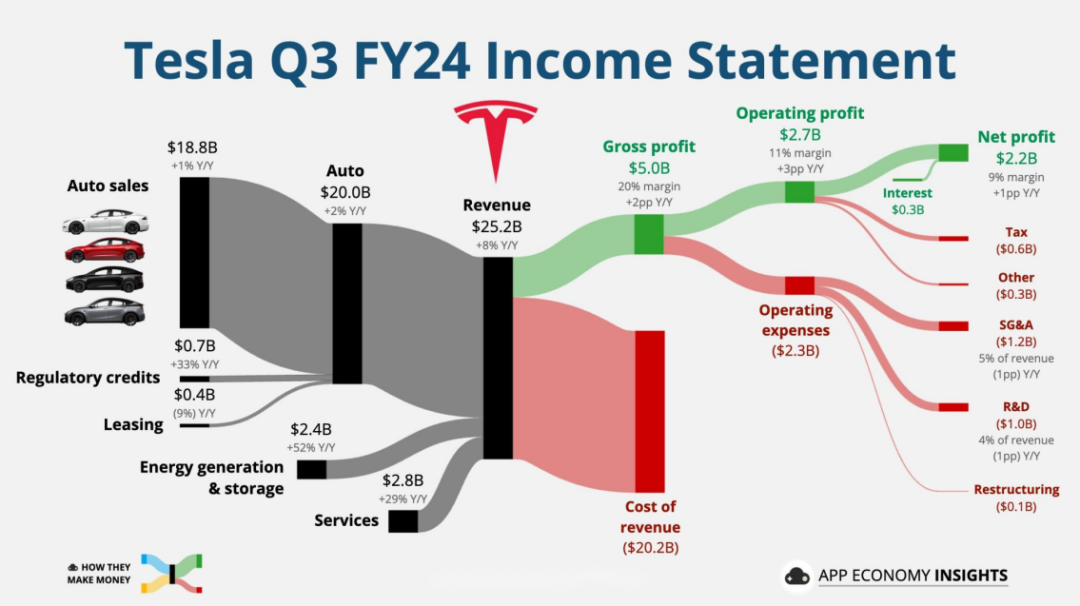

Despite the multiple challenges facing the global economy, Tesla’s revenue growth proves the stability and growth potential of its core market. In this quarter, Tesla’s total revenue reached $25.182 billion, a year-on-year increase of 8%, demonstrating strong market endurance. Although this growth did not reach the 10% expected by analysts, considering the current high interest rate environment and economic weakness, this result still demonstrates the strong appeal of Tesla products and the resilience of the brand.

Profitability and business unit performance

In the automotive business, overall sales growth is under pressure, and the decline in average selling price has been a drag on revenue. This is mainly due to intensified global market competition and price adjustments implemented in some markets to stimulate sales. However, by enhancing production efficiency and reducing unit costs, Tesla has successfully improved the gross profit margin of the automotive business, which also reflects the company’s excellent capabilities in manufacturing and operations.

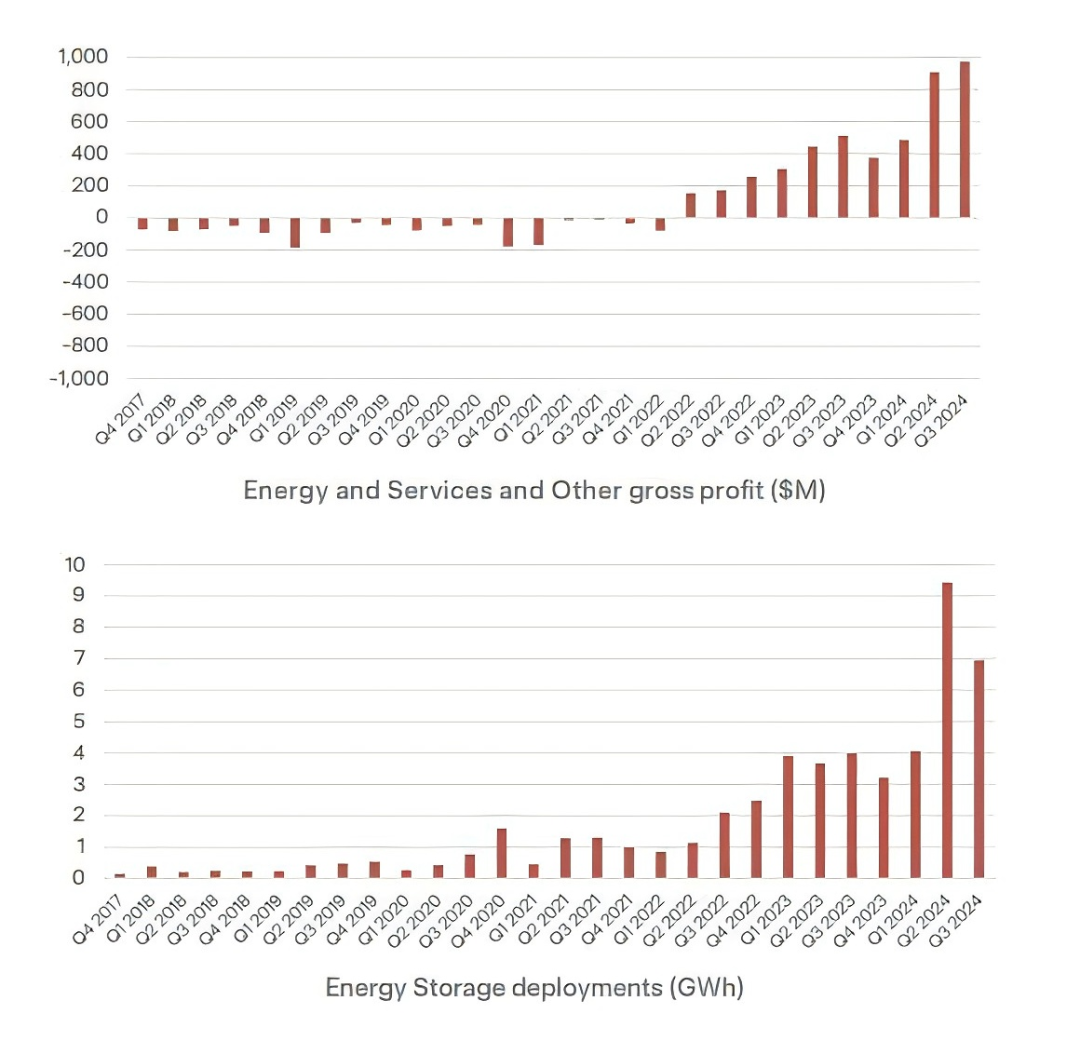

The energy business was a bright spot this quarter, with its gross profit margin increasing to 30.5%. The success of this part is attributed to the continuous growth in global demand for Renewable Energy solutions, especially the strong demand for Tesla’s energy storage products in the commercial and residential markets. Tesla’s energy storage solutions such as Powerwall and Megapack have shown excellent market acceptance and financial performance, which not only improves the profits of the energy department, but also enhances the overall profitability potential of the company.

Profitability and technological innovation

In the third quarter, Tesla’s earnings per share (EPS) turned from negative to positive, reaching $0.72. Previously, the market generally believed that Tesla’s profits might decline due to rising production costs and expenses to stimulate demand. Analysts even predicted that EPS would decrease by nearly 9.1% year-on-year. However, the financial report shows that Tesla’s EPS not only did not decrease, but also increased by more than 9% year-on-year. This reflects Tesla’s continued efforts to improve Operational Efficiency and reduce costs.

At the same time, the company’s new products such as Cybertruck and the progress of autonomous driving technology have provided new growth momentum for the market. Tesla not only increased the production of the car, but also successfully turned the gross profit margin into positive, breaking the previous concerns about its high cost. This undoubtedly enhances the market’s confidence in the future, especially in the new product line, where Tesla has demonstrated the ability to steadily expand.

Future growth potential

As Tesla continues to advance its business strategy and technological innovation, the company’s future outlook stands out in multiple ways. Here is a forward-looking analysis of Tesla’s delivery growth, artificial intelligence transformation, and management guidance.

Delivery volume will continue to grow

Tesla has set clear growth targets and plans to significantly increase the delivery of its electric vehicles in the coming quarters and years. This growth is expected to be driven by multiple factors, including global market expansion, capacity enhancement, and the launch of new models. Tesla is expanding its production facilities in the US, China, and Germany, which will help meet the growing global demand for electric vehicles. In addition, as the company continues to launch innovative models such as Cybertruck and upcoming more economical electric vehicles, it is expected to attract a wider consumer base and further increase delivery volume.

Accelerate the transition to AI

Tesla is not only a manufacturer of electric vehicles, but also at the forefront of technology in the fields of autonomous driving and artificial intelligence. The company’s fully autonomous driving (FSD) software has shown significant progress in ongoing testing and is expected to achieve monetization in the near future. Tesla is integrating AI and Machine Learning technologies into its vehicle and energy solutions to optimize performance and User Experience. In addition, Tesla is developing new AI projects, such as the Optimus robot, which is expected to further expand its business scope and market influence in the field of artificial intelligence.

Management’s guidance on future performance and market forecasts

Tesla’s management continues to provide guidance and forecasts for the company’s future development, which is crucial for investors and market analysts to evaluate the company’s long-term value. Despite challenges such as supply chain issues and global economic uncertainties, Tesla’s management remains optimistic about the company’s growth prospects. They emphasize that through continuous technological innovation and market expansion, the company is expected to achieve its financial and operational goals, thereby maintaining its leadership position in the electric vehicle and energy fields.

Given Tesla’s continued growth potential in electric vehicles and AI technology, investors can invest in various ways. If you are optimistic about Tesla’s future development, you can buy TSLA stocks on the BiyaPay platform. Of course, if you want to avoid short-term volatility risks, you can also monitor Tesla’s stock price trend on the platform and find a more suitable entry time.

In addition, BiyaPay can also serve as a professional tool for depositing and withdrawing funds from US and Hong Kong stocks, helping you to quickly and safely operate your funds. You can recharge digital currency, quickly exchange it for US dollars or Hong Kong dollars, easily withdraw it to your bank account, and then transfer the funds to other brokerage accounts for investment. The platform has a fast arrival speed and no limit, so you won’t miss any investment opportunities.

Valuation analysis

Tesla’s market value and stock price have always been a hot topic in the investment community. According to analysis, Tesla’s stock price was worth more than five times its expected revenue in 2026 at the end of trading on Wednesday, which is much higher than other electric vehicle manufacturers. For example, the average market value of competitors such as Lucid, VinFast, Rivian, XPeng, BYD, NIO, and Polestar is only slightly higher than twice their expected sales. Compared with traditional US automakers, the stock prices of these companies usually only reach 0.3 times their expected revenue in 2026.

Tesla’s valuation reflects the market’s high expectations for its future growth and profitability, especially in the autonomous car field. From a financial perspective, although the car revenue is slightly disappointing, other indicators are generally positive, and the company’s performance in profit margins compensates for this. Tesla’s balance sheet is still solid, and the financial guidance for 2024 is maintained. We are still expected to see whether Tesla can achieve record deliveries in the fourth quarter.

Risk and competition

Although Tesla has shown strong market potential and technological innovation capabilities, the company’s future development still faces a series of risk factors. These risks may not only affect Tesla’s business execution and financial performance, but also have an impact on its stock price.

Macroeconomics and market environment

Tesla’s sales are largely affected by the key market economic environment. In the US, the sustained high interest rate environment may suppress consumers’ willingness to purchase high-value goods, affecting the sales of Tesla models. At the same time, in the Chinese market, the slowdown in economic growth has begun to affect consumer spending, which may hinder sales growth. Tesla needs to develop flexible market strategies in response to these changes to maintain its sales momentum and adapt to changes in different economic environments.

Fierce competition

Tesla is facing challenges from multiple competitors around the world in the electric vehicle market. In addition to traditional automakers accelerating their transition to electric vehicles, emerging technology companies such as Waymo’s development in autonomous driving technology have also brought direct competitive pressure to Tesla. These companies not only invest heavily in technological innovation, but also actively expand in the global market, challenging Tesla’s market share. Tesla needs to continue to innovate and optimize its product line to maintain its market leadership position.

Valuation risk

Tesla’s high valuation reflects the market’s high expectations for its future growth and profitability potential. However, such a high valuation also brings its own problems and risks. The market has certain doubts about whether it can maintain such a high growth rate, especially in the current global economic challenges and uncertainties. When evaluating Tesla’s stock, investors need to carefully weigh the company’s market position, technological innovation capabilities, and the impact of the global economic environment to make judgments.

Overall, Tesla, as a pioneer in the global electric vehicle and Renewable Energy fields, has demonstrated strong growth potential and technological advantages. Despite facing many challenges such as macroeconomic fluctuations, intensified market competition, and technological and regulatory risks, Tesla still has long-term market prospects with its innovative ability and global brand influence. When evaluating Tesla, investors should fully understand the risks behind its high valuation and focus on the company’s long-term growth opportunities, especially in autonomous driving, energy solutions, and global market expansion. By prudently laying out and paying attention to market dynamics, you are expected to obtain stable returns in Tesla’s continued development.