- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

ASML's Stock Plunges 40%, Rebound Imminent: A Buying Opportunity or a Bubble Bursting? How Should In

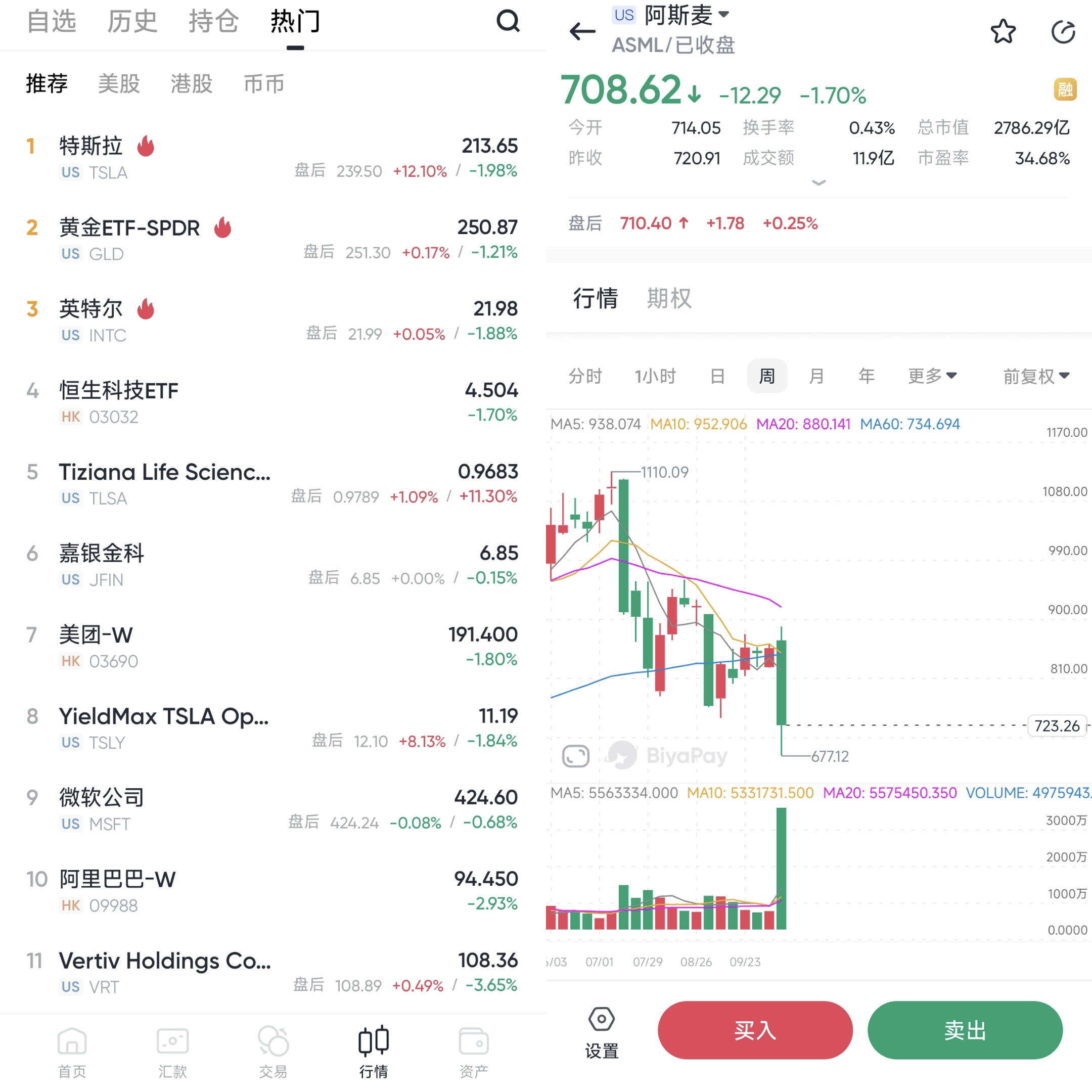

In its recently released Q3 2024 earnings report, ASML unexpectedly cut its revenue forecast for 2025, leading to a sharp market sentiment reversal and causing the stock to plummet nearly 40% from its July peak this year.

ASML’s performance decline was not only affected by the cyclical fluctuations of the memory and logic markets but also impacted by changes in the external environment. However, does this “pain” genuinely reflect the company’s intrinsic value? After all, ASML, with its exclusive technology in the extreme ultraviolet (EUV) lithography equipment sector, still controls a crucial link in the world’s most advanced semiconductor production chain, maintaining a significant market advantage.

Furthermore, ASML is set to release its latest long-term forecast during its Investor Day in November 2024. This highly anticipated event is crucial for supporting a stronger consolidation range above its $700 support level. I believe that this price level is key to further triggering dip-buying sentiment, especially as the stock has almost given back all of its gains from earlier this year.

Faced with these changes, investors are bound to wonder: Is this merely a short-term pain or a potential opportunity for long-term gains? With the continued growth in demand for AI, 5G, and high-performance computing (HPC), does ASML’s weak stock price signal an ideal buying opportunity?

Q3 Earnings Market Reaction

ASML’s Q3 2024 earnings report surprised many investors. In Q2 2024, the company had maintained relatively optimistic revenue expectations, but the latest report saw a significant downward revision of its 2025 revenue outlook, indicating high uncertainty in the short-term market recovery. Management pointed to the semiconductor industry’s cyclical fluctuations, along with postponed purchasing by some clients, as the primary reasons for this revision.

In Q3, ASML’s performance decline was mainly evident in significant decreases in both orders and sales. Particularly, demand fluctuations in the memory and logic markets put considerable pressure on the company. Data shows that although memory market orders saw some recovery in Q3, concerns about potential oversupply remain. Meanwhile, demand from key customers such as Intel and Samsung was weaker than expected, impacting ASML’s logic market orders. TSMC, on the other hand, adopted a strategy of “repurposing” existing equipment to extend their lifespan, further reducing the demand for new ASML equipment.

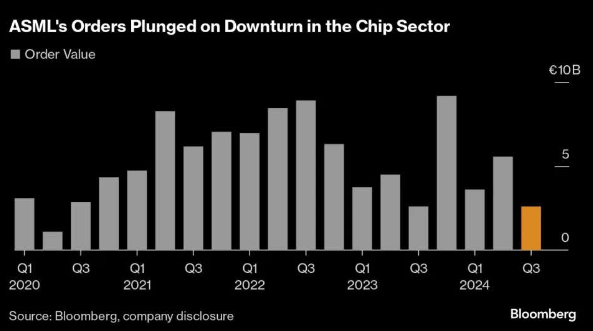

As shown in the chart above, ASML’s orders saw a significant decline in Q3 2024, with order value plunging sharply from the highs of recent years. This illustrates the notable negative impact of market conditions on ASML’s order volume, particularly amid a weak chip industry, as the company faces challenges due to fewer customer orders.

Moreover, changes in the external environment have also impacted the company’s business. ASML expects its sales contribution in the Chinese market to gradually “return to relatively normal levels,” falling to around 20%. This suggests that the previous peaks in Chinese market orders over the last few quarters were likely short-term concentrated demand releases rather than sustainable growth. Additionally, considering adjustments in global tech supply chain policies, the company remains cautious about the future demand in certain markets.

Due to these factors, ASML’s stock saw a significant drop after the earnings release. From its July peak to its October low, the stock has cumulatively fallen by about 40%.

Nevertheless, despite these challenges, ASML still achieved a total return of 23% over the past year, demonstrating overall stable performance, though investor confidence has taken a hit in the short term.

Order Decline or Poised for Growth? ASML’s Shifting Demand and Challenges

The recent decline in ASML’s orders has undoubtedly raised doubts about its future growth potential. In particular, the drop in orders highlighted in the Q3 2024 earnings report became a focal point of discussion among the market and analysts. This decline is driven by multiple factors, including the cyclical changes in the semiconductor industry and adjustments in client purchasing decisions, which collectively impacted ASML’s short-term performance.

From a customer dynamics perspective, the performance of Intel and Samsung fell short of market expectations, directly leading to a decline in ASML’s logic market orders. Meanwhile, TSMC has adopted proactive measures to cope with market changes, such as extending the lifespan of existing lithography equipment, which indirectly reduces the demand for new ASML equipment. Although these strategies help customers lower costs, from a supply chain standpoint, they also mean fewer sales opportunities for ASML.

These changes illustrate the current market environment and evolving customer demand dynamics.

In the memory market, although there was a slight recovery in Q3 2024 orders, concerns about future imbalances between supply and demand remain. The highly cyclical nature of the memory market often leads to fluctuations in prices and orders during periods of weak demand. Current positive signals have not yet restored overall orders to previous peak levels, suggesting that the market’s recovery path remains challenging.

Furthermore, changes in the external environment have also affected ASML’s regional market layout. Sales contributions from the Chinese market are expected to decline to around 20%, indicating that the strong demand seen in recent quarters may have been a phase of concentrated release rather than sustainable growth. In response to these uncertainties, ASML is taking a more cautious approach by reevaluating its global market strategy.

However, despite short-term pressures, ASML’s long-term growth opportunities remain significant.

With the expanding applications of AI, 5G, and HPC, demand for advanced semiconductor equipment continues to rise, particularly in high-end computing and autonomous driving. With its unique EUV lithography technology, ASML remains at the forefront of these cutting-edge markets, driving technological progress across the industry.

The upcoming weeks are crucial for ASML. The company will announce a new long-term strategic plan at its Investor Day in November 2024, a key opportunity to rebuild market confidence and stabilize its stock price.

The market focus will be whether ASML can effectively hold the key $700 support level, thus reinvigorating dip-buying sentiment. The current stock price has nearly erased all gains for the year, which also means that for long-term investors who are bullish on ASML, the current price might present an opportunity too good to miss.

Overall, while ASML is facing market volatility and external challenges in the short term, its strong position in advanced technologies continues to provide a solid foundation for long-term growth. For investors looking at the company’s long-term potential, BiyaPay can conveniently help track the market trends in U.S. and Hong Kong stocks, enabling you to make timely entries, especially during periods of market volatility when such convenience becomes even more crucial. The current market turbulence could indeed be a potential entry opportunity.

Furthermore, if you find the fund inflow and outflow processes in U.S. and Hong Kong stocks cumbersome, BiyaPay can also facilitate quick fund transfers into securities or bank accounts by converting digital currencies into USD or HKD, ensuring you don’t miss out on any investment opportunities.

Dominating the Market! How ASML Uses Its Technological Moat to Weather the Storm

ASML, with its monopoly on extreme ultraviolet (EUV) lithography equipment, holds an unassailable position in the semiconductor industry. EUV lithography systems are essential for manufacturing advanced chips, and ASML is currently the only company globally capable of producing this equipment.

Although recently affected by short-term demand fluctuations, ASML has relied on its robust technological moat to maintain its core competitiveness, allowing it to continue leading in a volatile market.

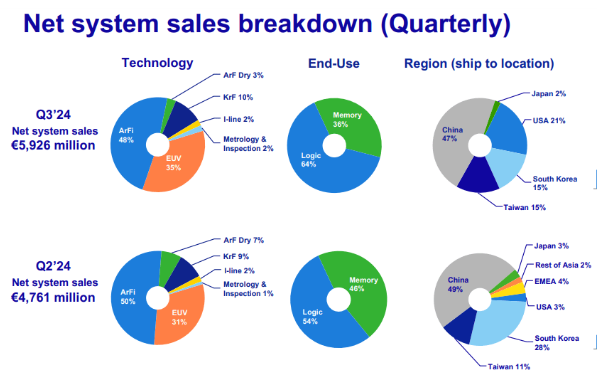

In Q3 2024, sales from EUV systems accounted for 35% of the company’s net system sales, up from 31% in Q2. This increase reflects the rising demand for advanced process equipment, particularly in AI and HPC sectors.

ASML’s technological advantage is not only limited to EUV systems but also includes deep ultraviolet (DUV) lithography equipment, which remains widely used in mature processes. In Q3, DUV systems still accounted for approximately 48% of total sales, demonstrating stable demand in mature processes, especially in memory chip manufacturing where DUV equipment continues to be the preferred choice for clients.

Beyond hardware sales, ASML has also generated stable revenue through equipment maintenance and upgrade services. In Q3, revenue from installed base management reached €1.5 billion, surpassing market expectations. This continuous income from services and upgrades has helped the company withstand the short-term impact of fluctuations in equipment sales.

According to the company’s disclosed long-term plan, ASML aims to achieve an annual production of 20 high-NA systems by 2027-2028. These new systems will further strengthen the company’s position in high-end chip manufacturing, providing robust support for future growth.

Overall, ASML has successfully weathered the current market storm thanks to its unparalleled technological moat. Despite facing order fluctuations and market challenges, the company’s ongoing investment in technological innovation and customer service has allowed it to maintain its strong market-leading position.

Low Valuation: A Trap or a Golden Buying Opportunity?

Since hitting a peak in July 2024, ASML’s stock has fallen approximately 40%, attracting widespread attention. Investors are asking: Is the current low valuation merely the result of short-term sentiment swings, or is it indicative of irreversible changes in the company’s fundamentals? For long-term investors who believe in ASML, is this valuation a golden buying opportunity?

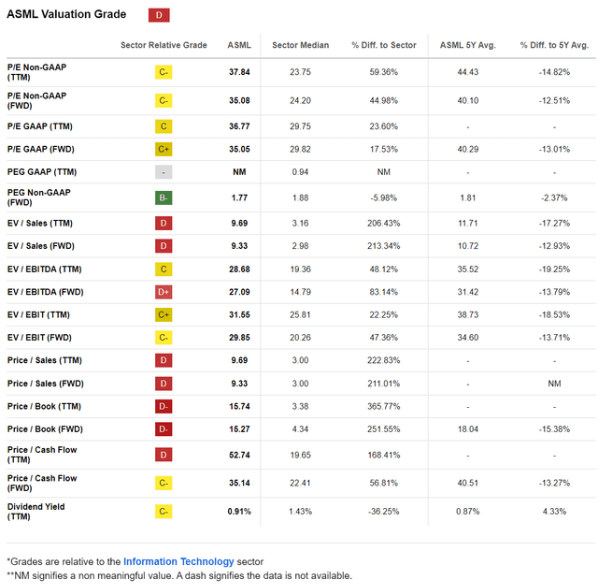

From a valuation perspective, ASML’s forward PEG ratio is currently 1.77, below the tech industry’s median, indicating that market expectations for its future growth are relatively conservative. However, given ASML’s monopoly in the EUV lithography technology field and its growth prospects in HPC and AI, this valuation may not fully reflect its long-term potential. Particularly as chip manufacturing continues advancing towards more sophisticated processes, ASML’s technological leadership positions it well to benefit from ongoing industry developments.

As the above chart shows, ASML’s performance in multiple valuation metrics varies compared to the tech industry’s median and historical averages. For example, its forward PEG ratio stands at 1.77, slightly below the industry median of 1.88, while its non-GAAP P/E ratio is 35.08, significantly higher than the industry median of 24.20. This suggests that while market sentiment on growth remains cautious, the valuation premium partially reflects ASML’s unique technological advantages.

Despite recent order reductions, ASML’s profitability remains solid. The company’s adjusted operating margin continued to rise in Q3, demonstrating its strengths in cost control and operational efficiency. According to market forecasts, 2024 is expected to be an “adjustment year,” while 2025 may mark a turning point for growth, especially as global semiconductor industry investment gradually recovers, potentially benefiting ASML. The current P/E ratio is below historical averages, providing potential for valuation recovery.

Furthermore, from a technical analysis perspective, ASML’s stock price is currently holding steady around the $700 support level, showing no signs of further decline after multiple tests. This has bolstered market confidence in a rebound. Historical data indicates that buying interest often emerges when the stock price nears long-term support lines, suggesting that the current price might provide a good opportunity for buying on the dip.

Although geopolitical and macroeconomic uncertainties persist, ASML’s importance in the global semiconductor supply chain gives it strong resilience against risks. Particularly in the context of growing demand for advanced chips driven by AI and 5G, ASML is well-positioned to continue benefiting. Thus, for long-term investors with high conviction, the current low valuation may represent a rare opportunity rather than a trap.

Investor Strategy: Sell, Hold, or Buy?

Faced with ASML’s sharp stock pullback, investors are caught in a dilemma: Should they buy the dip or wait for clearer signals? This section aims to help investors assess different strategy options to make more informed decisions based on their risk tolerance and investment goals.

For long-term and value investors, ASML’s current stock decline may present a rare entry opportunity. The company’s monopoly in lithography equipment and its irreplaceable role in the global semiconductor supply chain ensure that its long-term growth prospects remain favorable. With the expected steady rise in demand for advanced lithography equipment in fields like AI, 5G, and HPC over the coming years, investors focused on long-term growth potential could consider buying incrementally at the current valuation level to share in the company’s future growth dividends.

Short-term investors need to be more cautious. ASML faces geopolitical uncertainties and cyclical fluctuations in the semiconductor industry, which could continue to weigh on its stock price in the near term. Especially considering 2024 as an adjustment year, market sentiment may remain cautious due to reduced orders and external factors. For investors aiming for short-term gains, it is advisable to monitor whether the stock price can stabilize above the $700 support level and keep an eye on upcoming earnings reports and Investor Day events over the next few months before taking action.

In summary, ASML’s long-term growth potential and current valuation provide an opportunity for high-conviction investors to take positions. However, given the complexity of the external environment and cyclical risks in the industry, investors need to choose suitable strategies based on their investment goals and risk tolerance. For those who are bullish on the semiconductor industry’s growth and willing to bear short-term volatility, now could be a good time to incrementally enter the market.