- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Low Volatility, High Yield, High Dividends? In-Depth Analysis of the So-Called Hexagonal Warrior of

Today, we are going to discuss the ever-controversial US ETF—SVOL.

On one hand, since its inception, SVOL has been lauded as a “hexagonal warrior” for its attributes of low volatility, high yield, and high dividends, garnering praise and attention from many investors. On the other hand, its complex strategy design and the difficulty of quantifying risk exposure have left many investors hesitant, maintaining a distance from it. Its complexity means that, despite its stable income aura, there are still underlying, unknown risks.

With both an aura and doubts surrounding it, can SVOL, the so-called hexagonal warrior of US stock ETFs, truly meet our investment needs? Today, we are going to lift the veil and delve into its internal workings, the ideal investor profile, and how investors should approach it.

Let me preface this by saying SVOL has always been known for its complexity, so please be patient and follow along!

In this article, I will uncover SVOL from the following perspectives:

- What is SVOL?

- How does SVOL work?

- Analysis of SVOL’s yield and risk resistance

- The risks associated with SVOL

- When and for whom is SVOL suitable? How should investors approach it?

I. What is SVOL?

SVOL, fully known as the Simplify Volatility Premium ETF, was launched by Simplify Asset Management in 2021.

Its main objective is to deliver an inverse return of 0.2 to 0.3 times the performance of the Cboe VIX Short-Term Futures Index, while also mitigating risks from extreme volatility through multiple hedging strategies.

Key Features of SVOL:

- 20%-30% of the portfolio is allocated to short VIX short-term futures.

- Positions for stable income.

- Hedging against sharp spikes in volatility using various mechanisms, such as options strategies.

II. How Does SVOL Work?

Before diving into SVOL in detail, let’s briefly review what VIX is.

VIX, formally known as the Chicago Board Options Exchange Volatility Index, measures the expected annualized volatility of the S&P 500 Index over the next 30 days. It is also known as the market “fear gauge.”

Typically, the VIX moves inversely with the overall stock market, although there are extreme exceptions.

Step 1: Shorting VIX Futures

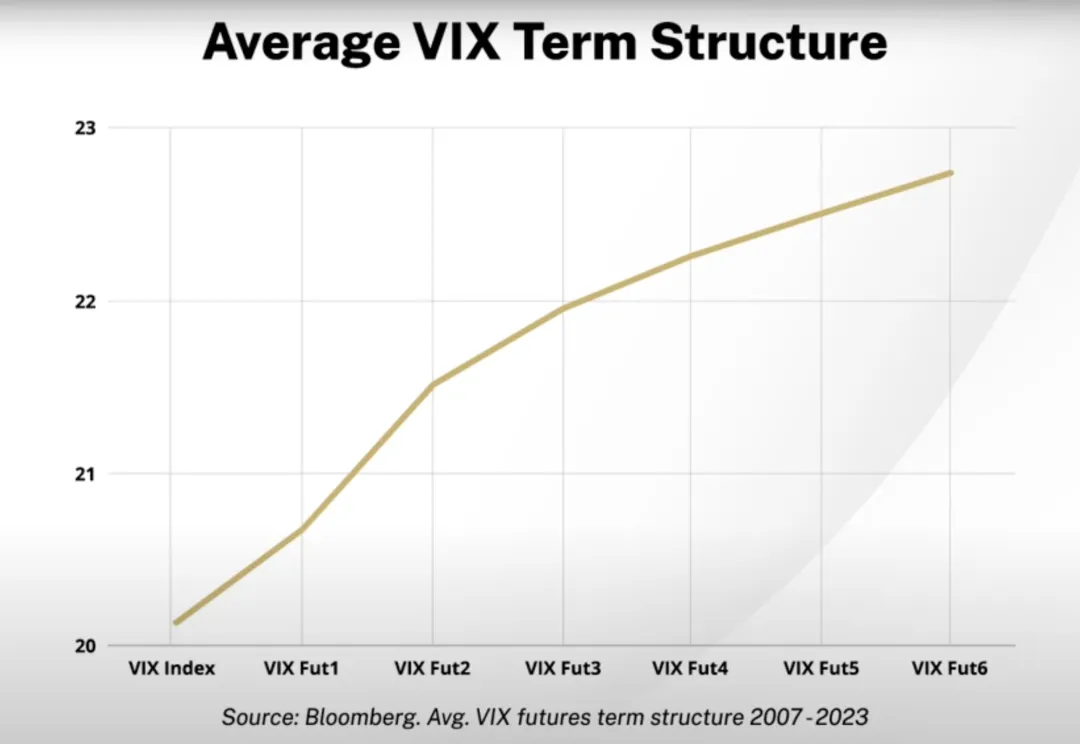

The chart above provides a simple illustration of VIX futures pricing. On the far left is the current VIX index, while further to the right are VIX futures contracts with different expiration dates. “VIX Fut1” represents contracts expiring next month, while “VIX Fut2” represents those expiring the month after, and so forth.

Historical data shows that VIX futures are in “contango” (upward-sloping) about 85% of the time, meaning that longer-dated futures are priced higher than near-term futures. This suggests that longer-dated futures are more expensive, while near-term futures are cheaper.

Thus, SVOL’s strategy is to sell longer-dated futures at a higher price and buy them back at a lower price when approaching maturity, thereby earning the spread.

Example: SVOL sells a futures contract expiring in two months. One month later, that same contract has only one month left to maturity, and it is generally priced lower than when it was initially sold. SVOL then buys the contract back, closing the position and realizing a profit.

This process is continuous, with SVOL effectively “rolling” futures contracts.

Step 2: Fixed Income-Like Investments

This portion makes up the majority of SVOL’s allocation, primarily focused on bond-like assets such as U.S. Treasury Bills (T-Bills, Notes) and Treasury Inflation-Protected Securities (TIPS). Additionally, SVOL invests in some fixed income-like ETFs, including those issued by Simplify, to enhance portfolio stability.

Step 3: Risk Hedging Strategy

Deep Out-of-the-Money Option Hedging: SVOL buys deep out-of-the-money VIX call options to hedge against the risk of a sharp increase in VIX futures prices. This strategy provides extra protection during extreme volatility spikes.

Adjusting Futures Strategies: SVOL adjusts its futures strategy based on VIX levels. For example, when VIX is high, SVOL sells more short-term contracts to earn higher premiums. When VIX is low, SVOL sells longer-term contracts to avoid the risk of mean reversion that could push VIX higher.

In summary, SVOL’s portfolio combines shorting VIX futures, buying VIX call options as a hedge, and incorporating fixed income-like assets, resulting in a strategy that benefits from decreasing volatility while offering hedging against sudden increases.

III. SVOL Yield and Risk Resistance Analysis

1. Dividend Yield A significant reason investors buy SVOL is for its dividend yield. The rolling annual dividend yield over the past year reached 16.58%, with yields of 7.30%, 24.38%, and 18.43% for 2021-2023 respectively. Except for its inaugural year in 2021, the dividend yield has remained consistently high.

However, it’s important to note that SVOL’s monthly dividends are planned ahead and are not always directly tied to that month’s actual fund performance. The dividend rates in recent years have generally exceeded the actual yield, meaning some dividends may be drawn from investors’ capital.

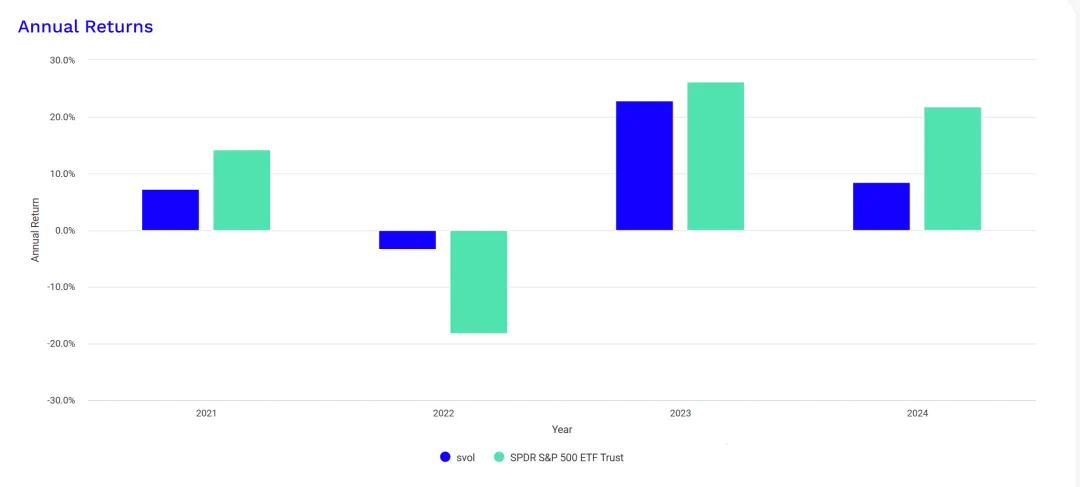

2. Yield Analysis By comparing the growth curves, annual returns, and annualized returns of SVOL and SPY, we can observe that SVOL’s annualized returns are slightly lower than those of SPY, although its overall performance is relatively strong.

During bullish periods, SVOL tends to underperform SPY, especially in the current year where it has lagged significantly. However, during bearish periods like in 2022, SVOL significantly outperformed SPY.

SVOL vs. SPY Growth Curve Comparison

SVOL vs. SPY Annual Returns Comparison

SVOL vs. SPY Annualized Returns

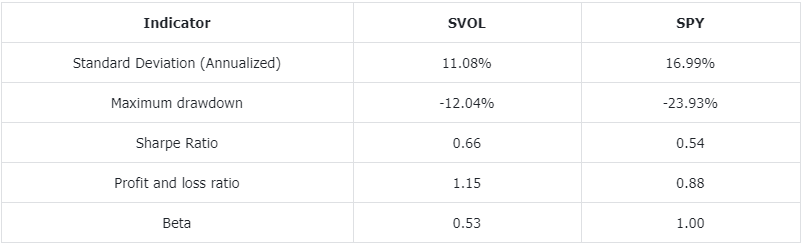

3. Risk Resistance By comparing SVOL and SPY on metrics such as drawdown curves, standard deviation, maximum drawdown, Sharpe ratio, profit and loss ratio, downside standard deviation, and Beta, SVOL has shown smaller fluctuations and drawdowns compared to SPY. It provides higher investment value and has stronger defensive capabilities during market downturns.

SVOL vs. SPY Drawdown Curve

SVOL vs. SPY Key Risk-Return Metrics

4. Scale, Expense Ratio, and Dividend Frequency

SVOL’s current size is approximately $1.25 billion, which is moderate and has good liquidity—nothing to worry about here. The total expense ratio is 1.16%, including a 0.50% management fee and 0.66% in other costs (mainly financing expenses), which is relatively high. Dividends are paid monthly, which is particularly friendly for those who value the frequency of dividend distributions.

IV. Key Risks of SVOL

1. Risk of Extreme VIX Volatility

SVOL’s primary strategy is to earn returns by shorting VIX futures. Although VIX futures generally trend back to lower levels most of the time, providing stable returns for short positions, in times of sudden market volatility, this strategy may face significant losses.

For example, take XIV, another product that also shorted VIX. It managed to deliver 15-fold returns in 7 years, but was wiped out overnight in an extreme volatility spike. Although XIV was a 1x VIX short strategy, while SVOL is only 0.2-0.3x, and thus has a much lower risk, it still cannot completely avoid losses.

For instance, on August 5, 2024, the VIX soared from the previous day’s close of 23.39 to 38.57, an increase of 64.89%, with an intraday high of 65.73, marking the third-highest point in history, with an intraday surge of 181%.

On the same day, SVOL fell from $21.32 to $20.05, a drop of only 6%, with the intraday low reaching $19.41 for a maximum decline of 9%. This example shows that SVOL performed relatively steadily under extreme volatility, demonstrating its defensive capability. However, it is impossible to predict if future extreme market conditions will exceed everyone’s expectations.

2. Limited Hedging Effectiveness of Long-Dated Options in Extreme Conditions

Although purchasing long-dated VIX call options can partially hedge the risk associated with shorting VIX futures, during periods of extreme market volatility, the hedging effect of options may not be sufficient to completely protect the fund from significant losses. For instance, if SVOL holds call options with strike prices of 50 expiring from December 2024 to May 2025, and VIX futures are not covered within these dates or strike prices, SVOL could still incur considerable losses.

3. Complexity of Product Design

VIX itself is a complex volatility index with significant swings. SVOL aims to capture core returns and manage risks through VIX futures and options derivatives, resulting in a risk exposure that is challenging to quantify. Under extreme market conditions, SVOL’s strategy and risk control outcomes are difficult to predict, making it challenging for the average investor to fully understand this product’s design.

4. High Management Fees and Multiple Product Layers

SVOL has relatively high management fees, and its investment portfolio also includes several ETFs issued by Simplify itself. This results in reduced overall returns due to fee layering. While these ETFs provide diversification and hedging benefits, their impact on returns cannot be ignored. Over the long term, the effect of these management fees on total investment returns needs to be considered.

5. Treasury Yield Dependency on Interest Rate Environment

SVOL’s holdings include a significant amount of short-term Treasuries as underlying assets. Currently, these short-term Treasuries have high yields, reflecting the interest income in a high-rate environment over the past few years. However, if the market enters a rate-cutting cycle, the yield on these short-term Treasuries will fall significantly, reducing SVOL’s overall risk-free return component and diminishing its total return potential.

6. Mismatch Between Long-Term Returns and Dividends

As mentioned earlier, SVOL employs a dividend smoothing strategy, and in recent years its dividend payout ratio has exceeded its actual earnings rate. If the fund continues to distribute dividends above the actual earnings rate, it may erode its capital base, thereby affecting long-term growth potential.

7. Impact of Dividend Taxes on Returns

For Chinese investors, while the U.S. dividend tax rate is only 10%, which is lower than the 15%-30% rate in many other countries, it still results in an annual loss of 1.5% of returns based on SVOL’s average annual dividend yield of over 15%.

The risks and drawbacks outlined above highlight the complexity and potential risk exposure of SVOL. Despite the fact that it uses multiple strategies to reduce volatility, investors should be cautious about its complexity and the potential mismatch between risk and returns when considering this product.

V. Who Should Buy SVOL, When Is It Suitable, and How Should Investors Invest?

1. Investors Seeking Short-Term High-Level VIX Short Exposure

Suitable Timing: When VIX is at a high level, those who wish to short VIX in the short term but are wary of high risk may consider SVOL, which uses the lowest leverage (0.2-0.3x) among VIX shorting products, making it less risky compared to directly shorting VIX or using leveraged products.

Suitable Investor Profile: Ideal for investors looking to capitalize on short-term opportunities but with a low risk tolerance.

2. Investors Looking for Enhanced Returns in a Low-Volatility Market

Suitable Timing: In a low-volatility market, SVOL’s short volatility strategy can enhance returns. This is particularly beneficial in the early to mid stages of a bull market, when market volatility is declining.

Suitable Investor Profile: Investors who wish to earn extra returns during a low-volatility environment. Such investors typically have a cautious approach to risk but desire higher returns than traditional bonds.

3. Investors Seeking Stable Cash Flow—Retirees or Low-Risk Tolerance Investors

Suitable Timing: In a high-interest-rate environment, SVOL generates stable interest income through short-term Treasuries and earns extra yield via volatility strategies. During periods of stable market sentiment with high rates, SVOL can be a reliable source of stable cash flow.

Suitable Investor Profile: Investors who want consistent dividends, particularly retirees or income-focused conservative investors, can benefit from SVOL’s ability to provide higher-than-average dividends from low-volatility assets.

4. Investors Who Do Not Want Direct Exposure to Stock Market Volatility

Suitable Timing: In stable markets with low volatility, SVOL provides a tool for hedging against market swings using VIX futures and options. Compared to directly holding stocks or high-volatility assets, SVOL is a better performer when volatility is low, making it suitable for those wishing to reduce direct exposure to equities during bull or fluctuating markets.

Suitable Investor Profile: Investors looking to diversify risk while avoiding overexposure to stock market fluctuations may find SVOL appealing, particularly those who wish to incorporate hedging strategies in a portfolio of volatile assets.

In summary, SVOL is ideal for those looking for stable cash flow or enhanced returns during low-volatility markets, especially during periods with high interest rates. It can also be used as an allocation tool to construct a lower-volatility portfolio during times of market turbulence. In my view, now is a good time to consider it. Investors can choose a multi-asset trading wallet like BiyaPay to keep real-time track of it and choose the right time to trade online. Additionally, BiyaPay allows investors to recharge digital currencies (such as USDT) and withdraw USD/HKD to a bank account, making it a professional cash-in and cash-out tool. Through this multi-asset trading wallet, investors not only gain convenience but can also invest in U.S. stocks and diversify asset classes to handle future market fluctuations, driving up U.S. stock valuations.

Conclusion

In summary, SVOL indeed delivers on its promises of low volatility, high yield, and high dividends, with clear advantages that appeal to many. However, its complexity and uncertain risks also make it intimidating for others.

At the core of investing lies understanding the strategy logic and risk; knowing how to navigate in times of high market volatility is crucial. If managed correctly, SVOL can be a valuable alternative investment tool in your portfolio. If managed poorly, however, high market volatility could lead to substantial losses.

That’s all for today’s discussion on SVOL. It is indeed complex, requiring extensive research. I hope the above content helps. If there are any inaccuracies, I welcome your feedback and discussion.