- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Buffett's "mysterious holding" is a "Dividend Aristocrat" with 31 consecutive years of dividend grow

In recent years, as the global economic environment continues to change, investors’ demand for stable returns and risk control has increased significantly. Against this backdrop, the Dividend Low Volatility Index has gained widespread recognition. When “dividend” meets “low volatility,” what kind of chemical reaction will these two elements create?

Since last year, dividend stocks have been performing well globally, as evidenced by the recent popularity of Hong Kong dividend ETFs. Behind this trend lies the pursuit of stable cash flows by investors in a high-interest-rate environment. To cater to this demand, Meta, which had never paid a dividend before, announced its first-ever dividend last year, followed by Amazon and Google.

Dividend Low Volatility

The Dividend Low Volatility Index, as its name implies, combines the features of “dividends” and “low volatility.” In simple terms, it selects a group of high-quality companies that consistently distribute dividends and maintain relatively low market volatility. The design of this index aims to provide investors with an investment tool that offers relatively stable returns while effectively managing risk. Put simply, dividend low volatility is like the quiet top student in the class, achieving high and consistent performance.

The Dividend Low Volatility Index has several key features:

Smart Beta Strategy

As a Smart Beta strategy, the Dividend Low Volatility Index captures factor exposure in a systematic way to achieve risk-adjusted returns, making it suitable for investors seeking long-term stable returns.

High Dividend Yield

The stocks selected for the Dividend Low Volatility Index have high dividend yields, usually indicating strong profitability and a willingness to distribute profits to shareholders in the form of dividends.

Low Volatility

In addition to dividend yields, the Dividend Low Volatility Index also considers stock volatility, favoring stocks with relatively low volatility, which helps reduce portfolio drawdowns during market fluctuations.

The construction logic of the Dividend Low Volatility Index involves first screening companies with a consistent dividend payment history, followed by a comprehensive assessment of metrics such as dividend yield, payout ratio, dividend growth rate, and price volatility. Ultimately, it selects constituent stocks that meet the criteria. These constituent stocks not only have high dividend yields but also exhibit low price volatility, embodying the “offense and defense” investment philosophy.

Buffett’s “Mysterious Holding” Finally Revealed

The latest regulatory filings show that since the second half of last year, Berkshire Hathaway has been building and increasing its position in Chubb Limited (ticker symbol CB). As of the end of March 2024, Berkshire had accumulated nearly 26 million shares, with a total holding value of approximately $6.7 billion, making Chubb the ninth-largest holding in Berkshire’s portfolio.

Chubb Limited is one of the world’s largest property and casualty insurance companies. It recently gained attention as the insurer of the Baltimore bridge collapse incident in the United States.

Chubb also holds the title of being one of the rare “Dividend Aristocrats” in the U.S. stock market.

The “Dividend Aristocrats” refers to companies in the S&P 500 that have achieved at least 25 consecutive years of dividend growth. Currently, only 68 companies meet this criterion, and Chubb is one of them, having achieved 31 consecutive years of dividend growth.

U.S. Dividend ETFs

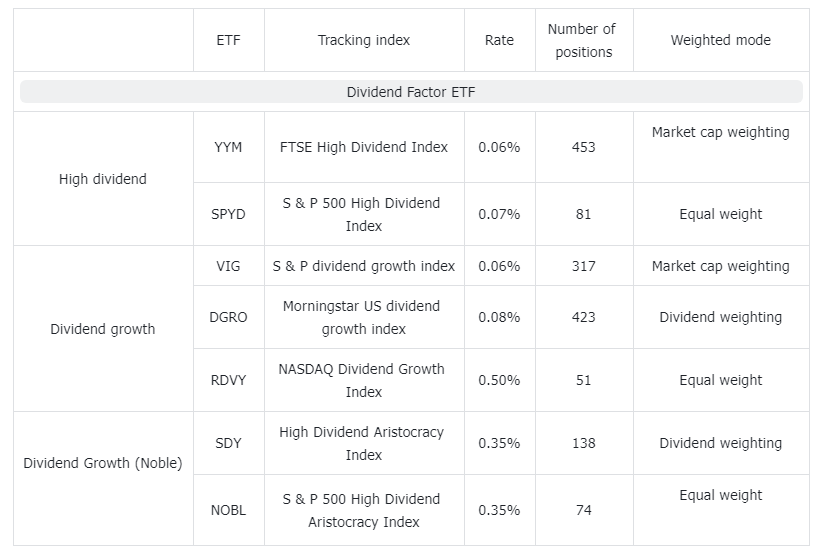

Here are some of the major dividend ETFs in the U.S. market. U.S. dividend ETFs can generally be divided into three categories based on strategy characteristics:

- High Dividend Yield: Selects companies with relatively high dividends.

- Dividend Growth: Focuses on companies with continuous dividend growth, often excluding the top 10-25% highest-yielding companies. The “Dividend Aristocrats” ETF is a representative of this type.

- High Dividend + Strong Fundamentals: Combines high dividend criteria with certain fundamental screening factors, such as profitability, valuation, or low volatility.

Some ETFs adopt one of these strategies, while others employ multiple strategies.

The ETFs mentioned in this article are as follows:

High Dividend Yield ETFs

VYM: Tracks the FTSE High Dividend Yield Index, typically holding stocks of companies that pay above-average dividends. The fund is market-cap weighted, with stable dividends 80% of the time over the past five years.

SPYD: One of the highest-yielding dividend ETFs, tracking the S&P 500 index’s top 80 dividend-yielding companies. The fund is equally weighted, meaning each company has an equal impact on the fund’s performance, with real estate and financial sectors having the highest weightings.

Dividend Growth ETFs

VIG: The largest dividend ETF. It tracks the S&P U.S. Dividend Growers Index and holds U.S. companies with at least 10 years of consecutive dividend growth. It excludes the top 25% highest-yielding companies and does not hold REITs. Notably, Microsoft and Apple account for 10% of the total holdings in this ETF.

DGRO: Tracks the Morningstar U.S. Dividend Growth Index, requiring at least five years of uninterrupted annual dividend growth while excluding the top 10% highest-yielding companies. The ETF is dollar-weighted, with a single stock weight cap of approximately 3.5%.

RDVY: Tracks the Nasdaq Dividend Achievers Index, consisting of companies in the Nasdaq U.S. Benchmark Index, excluding REITs. It is equally weighted and requires the trailing 12-month dividend to be higher than the dividends of the last three and five years.

Dividend Growth (Aristocrats) ETFs

SDY: Tracks the S&P High Yield Dividend Aristocrats Index, targeting S&P 1500 Composite Index constituents that have increased their dividends for at least 20 consecutive years. It is dividend-weighted, giving higher weight to energy companies like ExxonMobil and Chevron.

NOBL: Tracks the S&P 500 High Yield Dividend Aristocrats Index, focusing on large-cap stocks with at least 25 years of consecutive dividend growth. The portfolio is equally weighted and rebalanced quarterly.

Both ETFs include Chubb, the “new favorite” mentioned earlier.

High Dividend + Strong Fundamentals ETFs

SCHD: A multi-strategy dividend ETF that tracks the Dow Jones U.S. Dividend 100 Index, screening for companies with strong fundamentals, 10 years of continuous dividends, and robust five-year dividend growth. It does not include REITs, with a maximum single stock weight of 4% and sector weight capped at 25% during rebalancing.

DVY: Tracks the Dow Jones Select Dividend Index, which consists of the top 100 dividend-yielding U.S. listed stocks, covering more mid-cap stocks. It is dividend-weighted, with the current per-share dividend required to be higher than the five-year average, and the dividend coverage ratio (defined as annual earnings per share divided by annual dividends per share) must be at least 167%. Dividends must have been paid for the past five years, and earnings per share over the past 12 months must be positive.

HDV: Tracks the Morningstar Dividend Focus Index, comprising large, mid, and small-cap stocks, weighted by dividends, focusing on energy, consumer staples, and telecommunications sectors.

FVD: Tracks the Value Line Dividend Index, which uses a unique “safety” metric for stock selection and sets equal weighting for those exceeding the average dividend yield.

The U.S. market offers a wide range of dividend ETF products, each catering to different investor groups, with their respective advantages and disadvantages. High-dividend yields may not always be stable, dividend growth ETFs provide stability but with lower yields, and Dividend Aristocrats offer even lower yields with limited growth. Therefore, combining multiple strategies is often a more suitable approach for investors.

How to Invest in These High-Quality Dividend ETFs?

Ordinary investors can determine the legitimacy of a platform based on factors like licensing and compliance. Examples of multi-national compliant trading platforms include Interactive Brokers, Tiger Brokers, and BiyaPay, which offer a one-stop service for trading. Wishing you all successful and rewarding investments!