- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Countdown to Google's Q3 financial report, is the stock price overvalued or has huge growth potentia

With the approach of the US stock market after-hours on October 29th, the market is looking forward to Google’s upcoming Q3 2024 financial report. Since the beginning of this year, Google (GOOG) has accumulated a 17% increase and reached a historical high in July. This quarterly report may not only further push up the stock price, but also reignite investors’ enthusiasm.

Google third quarter outlook: strong revenue growth, bullish earnings outlook

As the third quarter of 2024 approaches, investors and market analysts are focusing on Alphabet’s financial report, which is widely expected to demonstrate its continued growth and strong profitability.

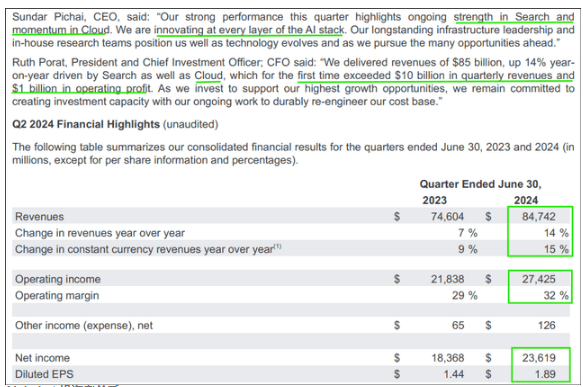

According to industry analysts’ forecasts, Google’s total revenue in the third quarter is expected to reach $86 billion, a year-on-year increase of 12%, while its operating profit is expected to reach $27.40 billion, a year-on-year increase of 14%. This expectation reflects Google’s solid leadership position in the advertising market and the continuous expansion of its Cloud Service business.

Specifically, the continued growth of Google’s advertising business is the main driving force for its revenue increase. According to market research institutions, global digital advertising spending in the third quarter of 2024 will increase by 12% -13% year-on-year, which will drive Google’s advertising revenue to $66 billion-67 billion, higher than the $64.60 billion in the second quarter.

In addition, Google’s video platform YouTube and Cloud as a Service platform Google Cloud are expected to achieve revenue growth of 20% and 25%, respectively, further consolidating its strategy of diversifying revenue sources.

In terms of cost control, Google has successfully improved its operating profit margin through continuous technological innovation and efficiency optimization. Analysts predict that Google’s operating profit margin will increase from 30% in the same period last year to 32% in the third quarter. This improvement shows that the company has successfully managed operating costs while expanding its scale.

With the approaching of the financial report release date, the market’s expectations for Google are increasing day by day. Its stock price performance will closely reflect investors’ evaluation of its financial health and business prospects. This upcoming financial report will undoubtedly provide important clues for Google’s business strategy and market performance in the next year.

Google Outlook: Innovation and strategic expansion shaping a new future for tech giants

Alphabet not only continues to grow steadily in its traditional search and advertising businesses, but also demonstrates forward-looking business initiatives in strategic innovation and market expansion. These initiatives aim to consolidate its market leadership position and explore new sources of revenue, which are expected to have a significant impact on the company’s growth trajectory in the coming years.

Continuous innovation in advertising technology

In the field of advertising, Google continues to promote technological innovation to maintain its market advantage. By using more advanced Data Analysis and Machine Learning models, Google can provide more accurate advertising targeting, thereby increasing the return on investment for advertisers. This technological advancement not only strengthens existing search ads and YouTube advertising services, but also paves the way for the upcoming Internet of Things (IoT) advertising market. Google’s innovation lies in its expanding AD Network, which covers a wide range of media from mobile devices to smart home devices, providing sustained growth momentum for the advertising business.

Google Cloud’s marketing strategy

Google Cloud, as an important driver of Google’s revenue growth, is strengthening its market share through multiple strategies. Google has successfully attracted a series of large enterprise customers by providing industry-leading cloud security, optimized data management tools, and enterprise-friendly cloud migration solutions. In addition, Google has launched customized cloud solutions for specific industries such as Financial Services, healthcare, and retail, significantly enhancing Google Cloud’s competitiveness in the fiercely competitive Cloud Service market.

Commercial applications of artificial intelligence

In the field of artificial intelligence, Google continues to expand the application scope of its products and services, from consumer-level Google Assistant to enterprise-level automated Data Analysis tools. Google is transforming the potential of AI technology into actual business results. In addition, Google’s investments in autonomous cars and medical AI applications are beginning to bear fruit. The progress in these areas not only opens up new revenue channels for Google, but also deepens its influence in global technological innovation.

Through the implementation of these strategies, Google has not only maintained its leading position in advertising and search, but also made significant progress in Cloud Services and artificial intelligence. Growth and innovation in these areas are the core of Google’s future growth strategy.

Latent risks and regulatory challenges: Google needs to respond to changing market conditions

As its global business continues to expand, Google also faces a range of potential risks and regulatory challenges that could affect its business operations and market reputation.

Uncertainty of Anti-Trust investigation

Google has long been the focus of global Anti-Trust regulators. Despite successfully resolving some legal disputes in multiple countries and regions, the company still faces a new round of Anti-Trust scrutiny from the US, Europe, and other markets. These investigations focus on Google’s market dominance in search, advertising, and mobile operating systems. For example, the US Department of Justice recently filed an Anti-Trust lawsuit against Google, accusing it of maintaining its market position in online advertising by excluding competitors. Such legal challenges not only consume a lot of resources, but may also force Google to adjust its core business strategy.

Data privacy and security regulations

With the increasing global attention to data privacy and security, Google must comply with increasingly strict regulations, such as the European Union’s General Data Protection Regulation (GDPR) and California’s Consumer Privacy Act (CCPA). These regulations require companies to take additional protective measures when processing user data and give users more control. For Google, this not only increases compliance costs but also increases the risk of violations, which may lead to high fines and reputation damage.

The double-edged sword of technological innovation

Although Google’s innovation in fields such as artificial intelligence and Cloud Services has brought it market advantages, it has also brought new challenges. The rapid development of AI technology requires Google to continuously invest heavily at the forefront of technology, while also dealing with ethical and social issues such as bias and privacy issues in artificial intelligence. In addition, as competitors such as Amazon and Microsoft increase investment in these areas, Google must continue to innovate to maintain its technological leadership.

By effectively managing these risks and challenges, Google can maintain the sustained growth of its business and protect its brand reputation. In future financial reports, investors and analysts will pay special attention to how the company can respond to these potential uncertainties through strategic adjustments.

Stock price valuation and investment opportunities

As Google’s Q3 2024 financial report is about to be released, the market is paying significant attention to its stock price valuation. By analyzing Google’s financial strategy and market performance in depth, we can gain more insights into its fair value and investment opportunities.

DCF model valuation

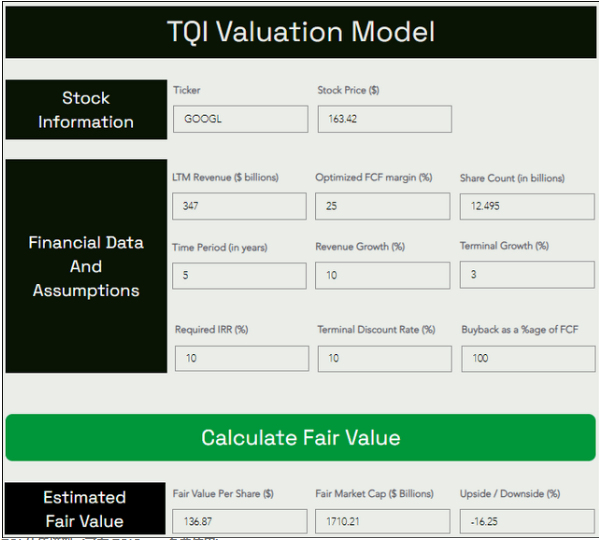

We use the Discounted Cash Flow (DCF) model to evaluate Google’s fair market value, based on Google’s expected revenue of $347 billion in 2024, a projected sales growth rate (CAGR) of 10%, and an assumed free cash flow (FCF) margin of 25%. Given Alphabet’s ability to generate stable cash flow, this analysis uses a lower 10% Universal Discount Rates.

Analysis shows that Alphabet’s fair value has been adjusted from $129.49 per share to $136.87, and its market value has increased from $1.62 trillion to $1.70 trillion. Although the current market price is about $163.40 per share, which shows some overvaluation, considering that Alphabet has a cash reserve of over $100 billion, its premium is actually less than 15%, indicating that the market is optimistic about its long-term growth potential.

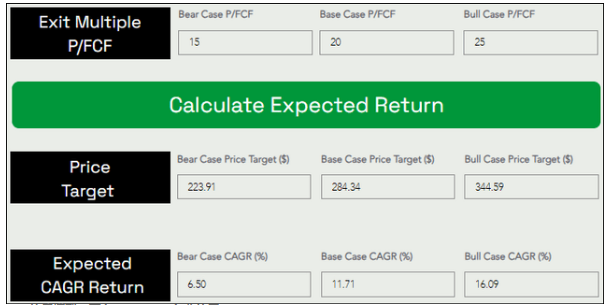

Technical analysis shows that Alphabet’s stock price remains above the key 10- and 20-week Moving Average lines, indicating market confidence. According to model predictions, based on a valuation of 20 times P/FCF, Alphabet’s stock price is expected to increase from $163 per share to $284 per share in the next five years, with a compound annual growth rate of about 12%. The long-term potential for investment return is still considerable.

Excess premium or discount purchase?

Against the backdrop of a constantly changing market, investors often face the question of how to interpret Google’s stock price. Currently, Google’s market valuation may be slightly higher than the intrinsic value derived from its DCF model, but this premium largely reflects the market’s optimistic expectations for its future growth potential. Google’s leadership in advertising and Cloud Services, as well as its investment in artificial intelligence technology, are all rationalizing factors for its valuation premium. Investors need to evaluate whether this premium is reasonable and whether it provides sufficient buffer for future potential growth.

Long-term investment strategy: buy, hold, or wait and see?

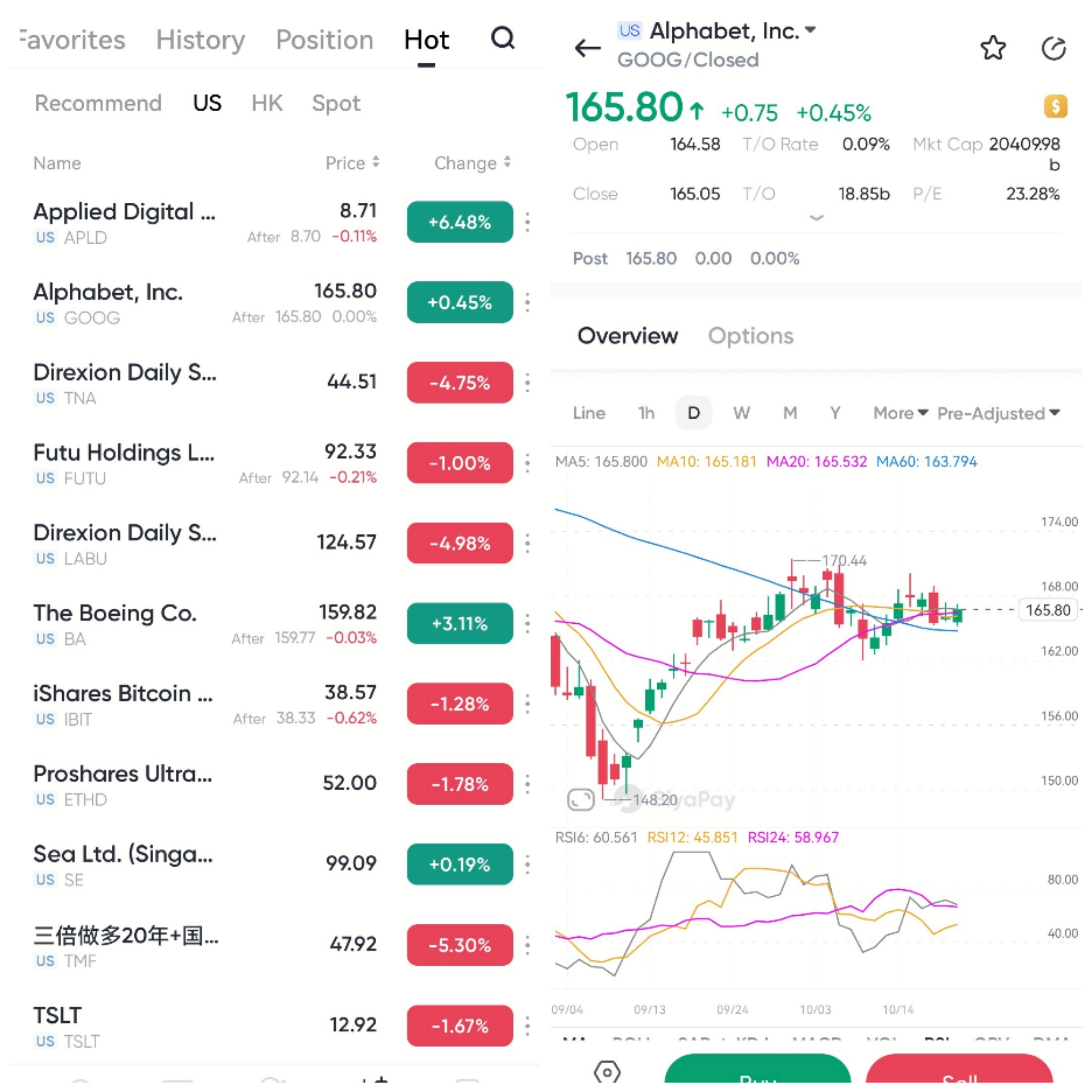

For long-term investors, decisions should not be based solely on current stock price valuations, but should also consider the company’s future growth potential and industry position. Google’s core business - search and advertising services - provides stable cash flow, and its continued investment in Cloud Services and artificial intelligence indicates broad growth prospects. Therefore, even if the current stock price has a premium, holding it for the long term may still be a wise choice, especially for investors seeking to keep pace with the growth of the technology industry. For investors who have a long-term holding intention, they can go to BiyaPay to buy Google. Of course, if they feel that the current stock price is in short-term fluctuations, they can also monitor the trend of the stock on the platform and find a more suitable time to get on board.

In addition, BiyaPay can also be used as a professional tool for depositing and depositing US and Hong Kong stocks. You can exchange digital currency for US dollars or Hong Kong dollars by recharging, quickly withdraw to your bank account, and then transfer the funds to other brokerage accounts to buy stocks. The platform has a fast and unlimited deposit speed, so you won’t miss investment opportunities.

How to make a reasonable layout before the release of the financial report?

As the financial report release date approaches, investors and market analysts need to develop wise strategies to deal with possible market fluctuations.

Investors should pay attention to analysts’ latest predictions about Google’s financial performance and changes in market sentiment. It is crucial to maintain strategic flexibility and prepare for possible stock price fluctuations before the financial report is released. Understanding the difference between market expectations and company performance can help investors seize trading opportunities that may arise after the financial report is released.

Due to the release of financial reports often accompanied by information updates, the volatility of stock prices usually increases. Investors should evaluate various factors that affect Google’s stock price, such as earnings performance, future revenue guidance, and macroeconomic conditions. These factors may have a significant impact on the stock price in a short period of time.

Understanding Google’s competitive position and financial health in the industry is crucial for analysts and investors. Detailed market analysis and a deep understanding of Google’s strategy will be key to navigating future investment decisions.

Considering Google’s market performance, financial strategy, and upcoming financial report, although there may be short-term market fluctuations, in the long run, Google is still a worthwhile investment target due to its innovative ability and market leadership in the industry. For investors seeking long-term growth, Google provides an opportunity to participate in the future development of the digital economy.