- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

US nuclear power stocks are soaring, with tech giants such as Google, Microsoft, and Amazon investin

Recently, the US nuclear power sector has performed exceptionally strong, and the stock price suddenly soared across the board! Last Friday, the nuclear power sector exploded again!

Lightbridge (LTBR), Centrus Energy (LEU), and Oklo rose by more than 57%, 21%, and 15% respectively. The cumulative increase in the past three days has reached an astonishing 95%, 60%, and 56%, respectively.

With such an increase, one cannot help but ask, will nuclear power be the major trend of US stock investment in the future? Which stocks are worth paying attention to? Next, the editor will analyze them in detail.

What is behind the rapid rise of nuclear power stocks?

In just a few days, the performance of nuclear power stocks has been remarkable. The rise in the stock prices of these companies also indicates investors’ recognition of the long-term growth potential of the nuclear power industry. Especially in the current global energy market’s urgent need for sustainable and low-carbon solutions, nuclear power, as a mature low-carbon energy technology, is gradually returning to the public and Capital Markets’ view.

The sharp rise in nuclear power stocks is closely related to the urgent demand for nuclear power from artificial intelligence and data centers. Secondly, as tech giants enter the nuclear power field, investors begin to re-evaluate the investment value of this traditional industry, which has boosted stock prices.

Nuclear power is indispensable in the future, with strong demand

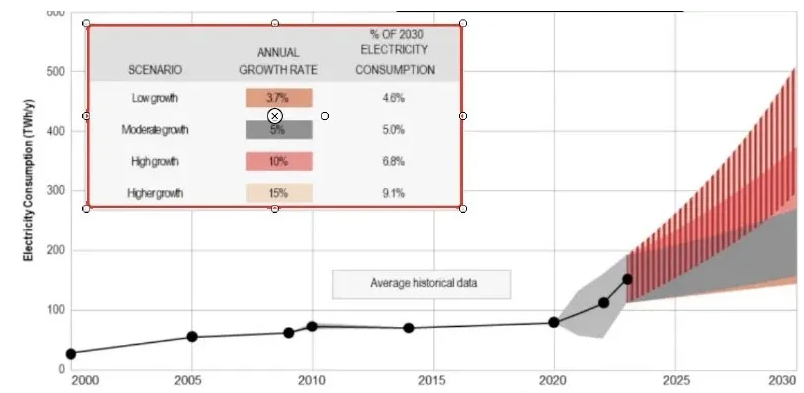

Investment Bank’s analysis and forecast reveal a striking future trend: by 2030, the electricity demand of US Data Centers will account for 9% of the country’s total electricity consumption, which is twice the current consumption. Against this backdrop, traditional energy solutions are no longer sufficient to support the growing demand. Therefore, nuclear energy is gradually becoming an option for many tech giants due to its efficient and stable power supply capabilities.

According to data from the US Energy Information Administration (EIA), nuclear power plants can stably provide 93% of the maximum annual electricity without producing carbon dioxide emissions. This ability is particularly critical in managing future electricity demand, especially for high-energy-consuming industries such as data centers. Compared to other Renewable Energy sources, the reliability of nuclear power has earned it a place in future energy strategies.

Tech giants accelerate layout and boost stock prices

In response to the growing demand for stable power in large data centers and the widespread application of artificial intelligence and Cloud Services, tech giants such as Google, Amazon, Microsoft, and Oracle are actively investing in the nuclear power field. Here are some related investment projects:

- Google has signed an agreement with nuclear power startup Kairos Power to purchase multiple small-scale modularization reactors to ensure energy supply for its large-scale data center. This action not only demonstrates Google’s trust in nuclear power as a reliable energy solution, but also demonstrates its leadership in sustainable energy strategy.

- Amazon is partnering with Virginia power company Dominion Energy to develop a small Modularization nuclear reactor near Dominion’s North Ana nuclear plant, a move aimed at reducing the carbon footprint of its data center operations while ensuring a stable and cost-effective power supply.

- Microsoft has signed a 20-year power purchase agreement with Constellation Energy to restart and upgrade the Three Mile Island nuclear power plant. This move demonstrates Microsoft’s long-term commitment to nuclear power investment and its trust in nuclear power as a sustainable energy source.

- Oracle announced in its earnings call that it is designing a data center that is expected to require more than 1 quadrillion watts of power and plans to provide the necessary power through three small nuclear reactors.

The nuclear-related investment plans announced by these tech giants have become a key catalyst for the rise in stock prices. The market’s enthusiastic response to these strategic partnerships and investors’ optimistic expectations for future profit potential have jointly driven the significant rise in the stock prices of related companies. This influence is not only reflected in stock price growth, but more importantly, these actions have injected new vitality and capital into the nuclear power industry.

The strategic investment decisions of these tech giants not only reshape the future of specific companies and stocks, but also have a profound impact on the development direction of the entire nuclear power industry. Their participation not only enhances the exposure and legitimacy of the nuclear power industry, but also lays a solid foundation for the sustainable development and maturity of the nuclear power industry by promoting technological innovation and cost efficiency improvement.

What investment potential does each nuclear power stock have?

The advance layout of these tech giants undoubtedly points out a new direction for investors, which is to invest in nuclear power companies. Next, we will introduce several stocks related to nuclear power. Let’s take a look at the performance and future development potential of these stocks in the current market.

OKLO: Innovative Pioneer of Small Modularization Nuclear Reactors

OKLO is a company that focuses on developing small Modularization nuclear reactors. Its products have attracted market attention due to their small footprint and low construction costs. OKLO’s technology allows for more flexible and economical deployment of nuclear power solutions, especially in remote and resource-constrained areas. The company has received support from top investors including OpenAI founder Sam Altman, which has increased market confidence in its technical feasibility and commercial potential.

LEU (Centrus Energy): Key supplier of fuel for nuclear power plants

Centrus Energy is a company that mainly provides nuclear fuel and services, occupying a key position in the nuclear power plant fuel supply chain. With the growth of global nuclear power demand, LEU’s market position makes it a stable investment in nuclear power stocks. The company’s technological capabilities and long-term supply contracts provide predictability for its revenue and profits, especially suitable for investors seeking stable returns.

NNE (NuScale Power): Pioneer of Micro Nuclear Reactor Technology

NuScale Power is committed to the development of miniature nuclear reactor technology. Its design of small and scalable nuclear reactors aims to provide safer and more economical nuclear power options. NNE’s technology has passed the review of the US Nuclear Regulatory Commission, which is an important milestone on its monetization path. The company’s innovative solutions are expected to open up new market opportunities, especially in areas where traditional large nuclear reactors are impractical, and its future development opportunities are worth looking forward to.

SMR (Small Modular Reactor Technology): Leader in Small Modularization Nuclear Reactors

SMR focuses on the design and production of small Modularization nuclear reactors, and its products are favored for their higher safety and lower environmental impact. SMR’s technical solutions can support various scales of power demand, provide flexibility and economy, and are particularly suitable for markets that require rapid deployment. The market prospects for SMR are very optimistic, especially against the backdrop of rising demand for clean energy.

CCJ (Cameco Corporation): Leading company in the global uranium market

As one of the world’s largest uranium producers, Cameco Corporation plays a crucial role in the nuclear power industry. CCJ has some of the world’s highest quality uranium mines, and its stable uranium supply is crucial to global nuclear power plant operations. With the growth of nuclear energy demand, its market share will further expand. CCJ’s financial health is good, with excellent market value and earnings performance, making it a high-quality choice for investors.

How to invest more safely and efficiently?

After a brief analysis of the investment potential of the above stocks, the next step for investors is to think about how to invest in order to make their funds safer and more secure, and to obtain asset appreciation. This requires mainly considering the following aspects:

Choosing the right platform is very important

Choosing the right investment platform can not only avoid risks, but also bring you many conveniences and improve investment efficiency.

When exploring investment opportunities in nuclear power stocks, BiyaPay provides a convenient channel for quick asset allocation. For investors who are optimistic about the above nuclear power stocks, BiyaPay can not only directly purchase these stocks, but also help you capture the best buying opportunity through its efficient market monitoring tool. If you are worried about the current high stock price, you can also track and analyze the stock price dynamics in real time to find opportunities.

In addition, BiyaPay also plays the role of a deposit and withdrawal tool for US and Hong Kong stocks. You can recharge digital currency and exchange it for US dollars or Hong Kong dollars, and then quickly withdraw it to your bank account or transfer it to another brokerage account for stock purchases. The fast arrival and unlimited characteristics of this platform can ensure that you will not miss any investment opportunities in the dynamic and changing market.

Evaluate risk and return

Understanding the latent risks and returns of the aforementioned nuclear power stocks is crucial for investors. Each company has its unique market position and technological potential, so making wise investment decisions is crucial and requires full consideration of industry dynamics, Company Finance health, and market volatility.

- Although OKLO has a promising technology future, as a startup, its financial stability and project execution capabilities are subject to certain uncertainties. Investors should consider the risks associated with the monetization process, especially the potential challenges of technology implementation and regulatory approval.

- LEU (Centrus Energy) offers a relatively stable investment option due to its solid position in the nuclear fuel supply market, but investors should pay attention to the impact of global nuclear power policy changes on the company.

- NNE (NuScale Power) 's miniature nuclear reactor technology offers significant market expansion potential, but like all new technologies, monetization success will take time to prove and initial capital and operating costs may be high, but it has great potential in the long run.

- SMR (Small Modular Reactor Technology) has obvious advantages in terms of safety and cost-effectiveness, but it should be noted that the wide acceptance of its technology needs to be further validated by the market, and the expansion of its technical applicability is the key to its future success.

- CCJ (Cameco Corporation) has low market volatility and a strong financial position, but fluctuations in global uranium demand and prices may affect its performance, although CCJ’s stable supply chain remains its main advantage.

For long-term investors, it is crucial to choose companies with stable financial performance and sustained growth potential. At the same time, for investors seeking high-risk, high-return investments, they can consider companies that are leading in nuclear power technology innovation. It is recommended that investors allocate their investment portfolios based on their own risk tolerance and investment objectives.

- Invest a portion of the funds in technically mature and market-proven enterprises, such as CCJ and LEU, to ensure stable returns on the investment portfolio.

- Another part of the funds can be considered for allocation to innovative companies with high growth potential, such as OKLO and NNE. Although these investments are riskier, they may also bring higher returns.

With the global pursuit of carbon reduction targets intensifying, the market demand for nuclear power as a clean energy solution is expected to continue to grow. Policy support, technological progress, and changes in market demand will be key factors driving the future development of the nuclear power industry. Investors should closely monitor these dynamics in order to adjust their investment strategies in a timely manner.