- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

TSMC's financial report is positive, stock price soars, market value exceeds one trillion! How can i

In the global semiconductor industry, Taiwan Semiconductor Manufacturing Company (TSMC for short) continues to lead the global wafer foundry market with its innovative technology and strong market influence. Last week, TSMC released a highly anticipated financial report, which showed significant growth in both the company’s stock price and market value. As of the close of the day, TSMC’s stock price rose by 9.79%, and its market value exceeded one trillion US dollars, further consolidating its leading position in the global semiconductor market. Although the stock price closed down yesterday, TSMC’s investment attractiveness is still significant.

TSMC’s financial performance

TSMC’s financial performance in the third quarter of 2024 is significant, highlighting its leadership position in the global semiconductor industry. The company not only achieved significant growth in revenue and profit, but also maintained its market-leading position through strategic investments and optimized operations.

Revenue growth and profitability

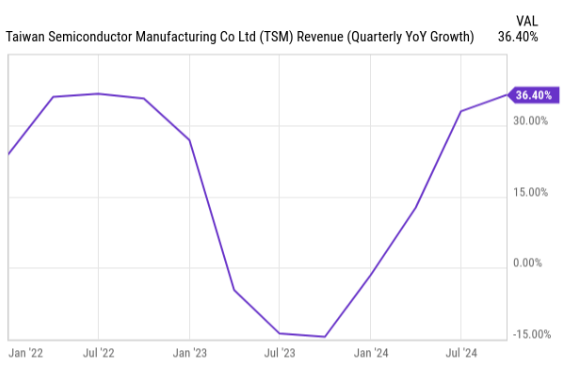

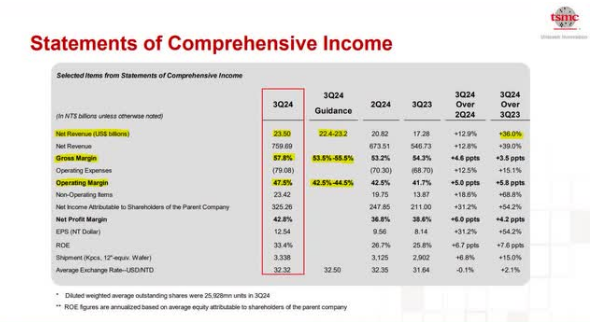

In the third quarter of 2024, TSMC reported revenue of $2.355 billion, exceeding analysts’ expectations of $338.35 million. This strong revenue growth, with an annual growth rate of 36.4%, is mainly due to its market leadership in advanced 3nm and 5nm process technologies. These technologies are mainly used in artificial intelligence (AI) servers and high-performance computing (HPC) applications, and their demand continues to increase with the continuous expansion of cloud infrastructure and enterprise-level solutions.

Gross Margin and Operating Efficiency

TSMC’s gross profit margin achieved a significant improvement in the third quarter, reaching 57.8%, a year-on-year increase of 350 basis points and a month-on-month increase of 460 basis points, far exceeding the company’s expected high-end guidance. This improvement is mainly due to the improvement of the company’s production efficiency and the success of cost control measures, especially in improving capacity utilization and cost structure. In addition, the company’s operating profit margin also significantly improved, reaching 47.5%, exceeding the upper limit of the company’s guidance of 230 basis points, reflecting its excellent financial management capabilities.

Capital expenditures and future investments

TSMC’s capital expenditure is expected to remain at a high level in 2024, with a total expected to be slightly higher than $30 billion, mainly invested in advanced process technologies, including continuous investment in 3nm and 5nm technologies. These investments are key to TSMC’s technology leadership and market competitiveness. According to the company’s forecast, with the growth of demand for the most advanced 2nm technology, capital expenditure in 2025 is expected to reach between $3.20 billion and $3.60 billion, indicating the company’s firm confidence in future technology and market development.

Free cash flow and financial condition

TSMC’s unleveraged free cash flow increased significantly from $296 million in 2023 to $1.931 billion in 2024. As of the end of Q3 2024, the company held $6.8215 billion in cash and marketable securities, as well as $2.8628 billion in long-term debt. Its debt-to-equity ratio is 0.23, indicating that the company operates primarily with equity rather than debt funds. Its debt-to-EBITDA ratio is 0.65, indicating that the company’s core operating profit can effectively cover its debt.

From the above, it can be seen that TSMC has successfully transformed capital expenditures into profitable growth through continuous technological innovation and market expansion, while maintaining a good financial condition. With continuous investment in advanced technology, TSMC is preparing for future market demand and technological challenges. Despite facing risks such as costs, the company’s forward-looking market strategy and financial strength indicate that it will continue to maintain leadership in the global semiconductor industry.

Technical advantages and market position

After understanding TSMC’s financial performance, we now look at its technological advantages and market position, which are key factors for the company to maintain its industry-leading position. TSMC continues to consolidate its position as a global leader in the semiconductor industry with its innovation in advanced process technology. Especially in the development of 3nm and 5nm technologies, TSMC not only meets current market demand, but also lays the foundation for future technological progress.

Leading position in advanced process technology

TSMC’s 3nm and 5nm process technologies are currently leading the global semiconductor industry. These technologies have significantly improved the performance and energy efficiency of chips, meeting the needs of high-performance computing (HPC) and artificial intelligence (AI) applications. TSMC’s advanced processes not only support more complex computing tasks, but also help customers reduce operating costs by improving energy efficiency. The promotion of 3nm technology, especially breakthroughs in processing speed and power optimization, enables TSMC to support the next generation of AI algorithms and models, which is crucial for the development of applications such as autonomous cars, smart cities, and advanced data analysis.

Technological innovation supports high-growth areas

TSMC’s technological innovation is not limited to process miniaturization, but also includes the research and development of new materials and the application of advanced packaging technology. These innovations enable TSMC to take the lead in high-growth areas such as AI, the Internet of Things (IoT), and 5G. For example, TSMC’s development of RF and micro-electromechanical systems (MEMS) chips has greatly improved the performance and interoperability of smart devices and communication devices. In addition, TSMC has integrated more security features into its chip design, which is crucial for meeting the growing demand for cyber security and protecting consumer data.

The impact of technological advantages on market share and competitive position

TSMC’s technological leadership not only enhances the market appeal of its products, but also enhances its strategic position in the global supply chain. Through continuous technological innovation and expanding capacity, TSMC can attract and maintain a series of high-end customers, including industry giants such as Apple and Nvidia, who rely on TSMC to provide the most advanced chips to support their products. As a result, TSMC’s market share has expanded globally, especially in direct competition with competitors such as Intel and Samsung. TSMC’s technological advantages have won it more orders and cooperation opportunities.

Strategic expansion and market opportunities

After TSMC’s technological advantages brought it a solid market position, the company’s strategic expansion became another key driving force for its continued growth. By implementing the “Foundry 2.0” strategy, TSMC not only expanded the boundaries of its traditional chip manufacturing, but also added comprehensive services such as packaging, testing, and mask manufacturing, further expanding its business scope and market opportunities.

Composition and Impact of “OEM 2.0” Strategy

The “Foundry 2.0” strategy is a major expansion of TSMC’s traditional foundry business model. CEO Wei detailed this strategy during the Q2 2024 earnings conference call, emphasizing that in addition to chip manufacturing, it also includes services such as packaging, testing, and mask manufacturing. These added services not only enhance TSMC’s product added value, but also enable the company to provide customers with one-stop solutions from design to final product, which is highly attractive in the market, especially for customers seeking to shorten product development cycles and reduce operational complexity.

In addition, by expanding its service scope to every aspect of semiconductor manufacturing, TSMC’s position in the global supply chain has been strengthened, which is of great significance for the company to cope with industry fluctuations and market uncertainties. For example, by controlling more production steps internally, TSMC can more effectively manage costs, improve production efficiency, and thus be more competitive in the global market.

Global expansion plans and their potential contributions

TSMC’s global expansion strategy is also part of its “Foundry 2.0” plan, especially the company’s investment activities in the US and Europe in recent years. By establishing production facilities in these key markets, TSMC can not only be closer to its customers and provide faster services, but also directly participate in the local technology development and innovation process, which helps the company seize specific needs and opportunities in the local market.

For example, TSMC’s expansion plan in the US not only responds to the US government’s call to enhance domestic semiconductor production capacity, but also enables the company to better serve large customers such as Apple and Google, who rely on reliable supply chains to support their rapidly growing product demand. At the same time, these investments are expected to enhance TSMC’s competitiveness in the global semiconductor market and bring long-term growth momentum to the company.

Through these strategic expansions, TSMC has not only consolidated its position as a global leader in the semiconductor industry, but also opened up new paths for the company’s future growth. These strategic initiatives demonstrate how TSMC maintains its market leadership and seeks new growth opportunities through continuous innovation and adaptation to market changes.

Valuation analysis

After understanding TSMC’s growth potential, understanding its valuation is particularly crucial for guiding our investment. By carefully examining Price-To-Earnings Ratio, Price-To-Sales Ratio, and Price-Earnings Growth Ratio (PEG), we can comprehensively evaluate its current and future market performance.

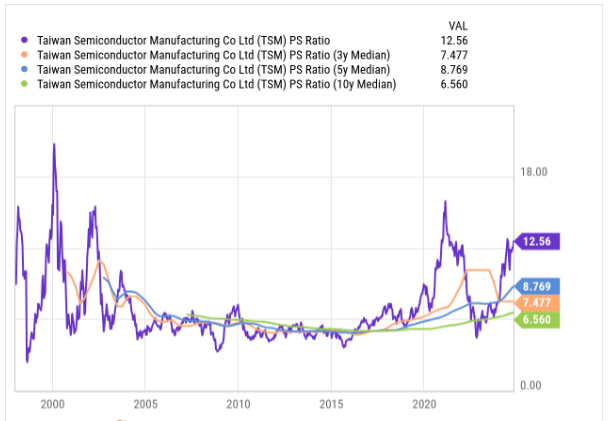

Price-To-Sales Ratio (P/S) and Market Evaluation

TSMC’s rolling 12-month Price-To-Sales Ratio (P/S) is 12.56, much higher than its three-year, five-year, and ten-year median. This high Price-To-Sales Ratio may lead some market analysts to believe that TSMC’s stock is overvalued. However, the stock price does not need to fall to return to its historical median; if the company’s sales growth rate exceeds the market capitalization growth rate, its Price-To-Sales Ratio will naturally return to a more reasonable level.

Price Profit Growth Ratio (PEG)

TSMC’s one-year forward-looking PEG ratio is 0.95. The calculation method is to divide the one-year forward-looking Price-To-Earnings Ratio 23 by the analyst’s predicted 2025 earnings growth rate of 24.13% per share. Generally, the market does not consider high-quality growth stocks to be overvalued until their PEG ratio reaches 2.0. Assuming TSMC’s PEG ratio reaches 2.0, its stock price will reach $421.30, which is 109% higher than the Closing Price of $200.78 on October 18, 2024. Therefore, from this perspective, TSMC’s stock has the potential to double in the next year.

Price Free Cash Flow Ratio (P/FCF)

The current free cash flow yield is 2.15%. Based on the trading range of the past five years, when the free cash flow yield is higher than 3%, the stock is considered undervalued; when it is lower than 1.5%, it is considered overvalued. Therefore, based on the free cash flow yield, TSMC’s stock may be within a reasonable valuation range.

Therefore, considering the company’s growing potential in AI chip manufacturing and its profitability, as well as the recovery of the smartphone and IoT markets, 2025 is expected to be another outstanding year for TSMC.

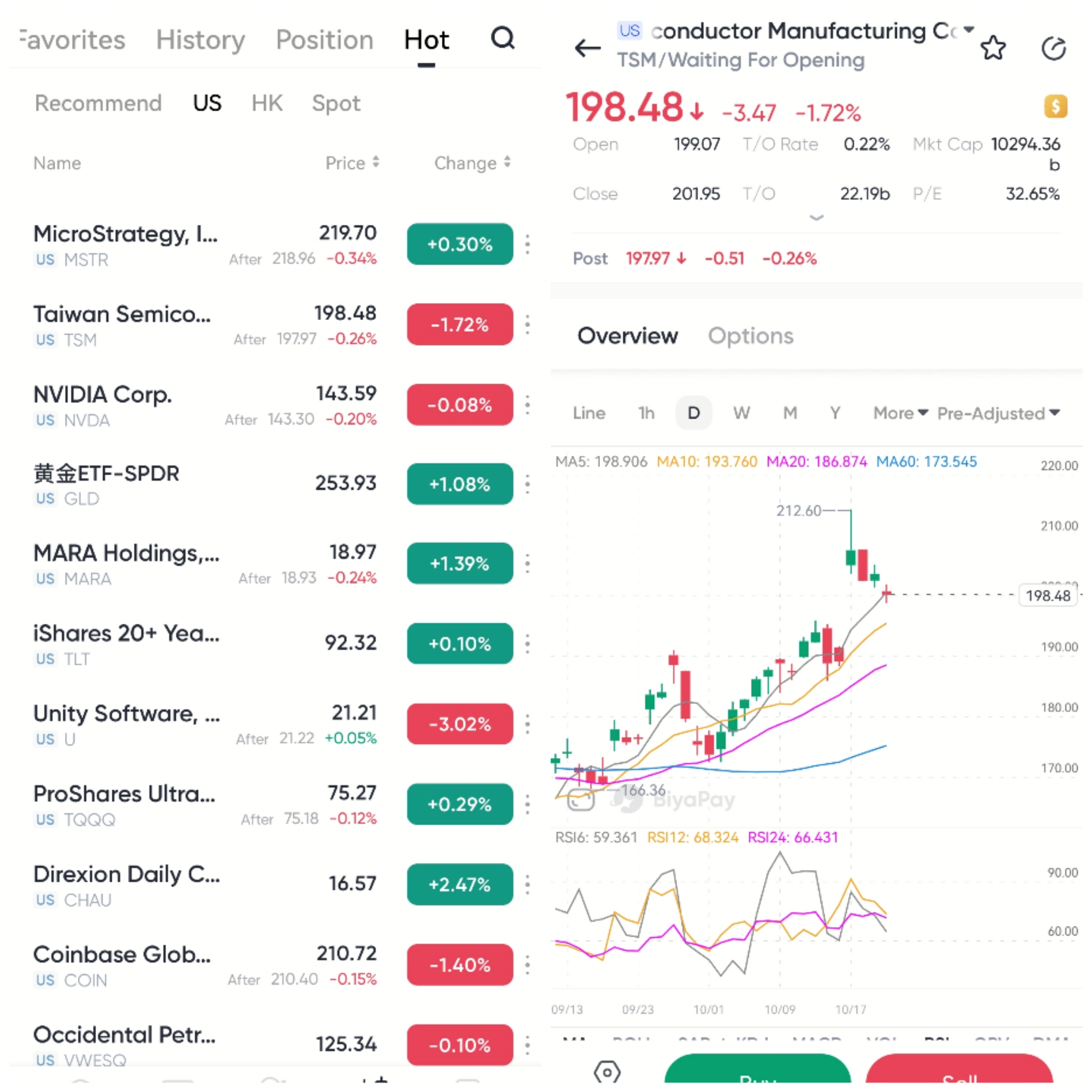

Given these factors, TSMC’s stock still has investment value and has significant market potential in the next two to three years. For investors who are willing to hold, they can go to BiyaPay to buy TSM. Of course, they can also monitor the stock trend on the platform and find a more suitable time to get on board.

In addition, BiyaPay can also be used as a professional tool for depositing and depositing US and Hong Kong stocks. You can exchange digital currency for US dollars or Hong Kong dollars by recharging, quickly withdraw to your bank account, and then transfer the funds to other brokerage accounts to buy stocks. The platform has a fast and unlimited deposit speed, so you won’t miss investment opportunities.

Risk factor assessment

While focusing on the investment value of TSMC, we also need to do a good job in threat and risk assessment, which may have a significant impact on the company’s long-term stability and stock price performance.

The challenges of the global supply chain

TSMC relies on its fine and complex global supply chain to maintain its manufacturing operations. The stability of the supply chain is crucial to maintaining production efficiency and meeting the needs of global customers. Recent global events, including epidemics and international trade frictions, have demonstrated the potential impact of supply chain disruptions on production and delivery. These disruptions can lead to shortages of key materials, production delays, and ultimately affect the company’s revenue and profits. In addition, supply chain instability can also lead to rising costs, thereby compressing profit margins.

Rising costs and energy demand

With the increasing global demand for energy, especially in the high-energy semiconductor manufacturing process, the rise in energy costs has become an important issue facing TSMC. The company’s main production facilities consume a large amount of electricity, especially on production lines that use high-energy technologies such as extreme ultraviolet (EUV) etching technology. The increase in electricity and other energy costs may directly affect manufacturing costs, thereby compressing profit margins. In addition, fluctuations in global raw material prices may also affect TSMC’s operating costs, especially for rare metals and special chemicals, which are indispensable materials in semiconductor manufacturing.

Raw material price fluctuations

TSMC’s demand for specific raw materials makes it particularly sensitive to price fluctuations. These materials include silicon wafers, special gases, and chemicals, whose prices are significantly affected by global supply and demand conditions and local policies. The increase in raw material costs not only affects production costs, but may also affect TSMC’s overall financial performance. To address this risk, TSMC has adopted various strategies, including long-term procurement agreements and diversified supplier strategies, to stabilize costs and ensure the sustainability of the supply chain.

Investment advice

When evaluating TSMC’s future investment potential, it is necessary to focus on its outstanding performance in technological innovation, market expansion, and financial performance. The following are detailed investment recommendations for different types of investors.

Growth investors can find significant growth opportunities in TSMC’s technological innovation. The company’s continued investment in artificial intelligence (AI), high-performance computing (HPC), and 5G, especially its leading advantage in 3nm and 5nm process technologies, enables it to meet the urgent demand for high-performance, low-power chips in the global market. With the rapid expansion of industries such as AI, autonomous driving, and the Internet of Things, TSMC will continue to drive performance growth in the coming years, providing considerable capital appreciation space for growth investors.

Long-term investors can benefit from TSMC’s solid financial performance and global strategic expansion. The company not only expands production facilities globally, enhances the risk resistance of the supply chain, but also supports future capital expenditures through stable free cash flow. These investments ensure that TSMC can maintain competitiveness in the constantly changing market, while bringing long-term dividend returns and stock price growth expectations to investors. TSMC’s strong financial foundation provides predictable and stable returns for long-term investors.

Value investors can also profit from TSMC’s relatively reasonable valuation. Although its Price-To-Earnings Ratio is high, its low PEG ratio means that the market’s expectations for its future profit growth potential remain optimistic. With the growth of market demand and the company’s continuous technological innovation, TSMC’s long-term profit prospects are broad. For investors who focus on long-term value, TSMC provides a stable and growth-potential investment opportunity.

Overall, TSMC is quite attractive to growth investors who pursue high growth, long-term investors seeking stable returns, and even value investors based on valuation. TSMC not only has a leading advantage in technological innovation, but also its global strategic expansion and financial stability ensure long-term development opportunities in the semiconductor market.