- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

The US general election is about to begin. Do you still not know what to buy? How can ordinary retai

The US general election not only has a profound impact on the direction of national policies but also directly affects the trends of financial markets. From tax reform, environmental protection plans to infrastructure construction, every change in policy will be reflected in the stock market, triggering fluctuations in stock prices. For investors, the general election is not just a political event; it is also an important opportunity to capture investment opportunities.

Just as the classic strategy that circulates in the market says, “Buy on rumors and sell on facts.” Investors can make layouts by understanding the policy directions of candidates in advance and grasp the pulse of the market. If ordinary investors can understand the policy directions of candidates in advance, they will have the opportunity to grasp the hot spots in the market and profit from them. Correct strategies and forward-looking judgments can help investors benefit from policy changes and seize potential market growth points.

Next, we will analyze the policies of Harris and Trump to help investors better understand the impact of various policies on related industries and identify stocks that may benefit during this special period.

How to understand the impact of the general election on the investment market

The US general election will have a great impact on the financial market, not only because national policies may change but also because of investors’ reactions and emotional fluctuations. Before and after each general election, new policies will be proposed. For example, some people support increasing taxes, and some people support environmental protection energy. These will directly affect related industries and companies and then affect stock price performance.

For example, if a candidate proposes to strongly support renewable energy, then solar and wind energy companies may benefit, and stock prices may rise. If a candidate wants to relax supervision over banks, then the profits of financial companies may increase, and the stock performance of these companies will also be better. Therefore, although market fluctuations after the general election are uncertain, they often come with some potential investment opportunities.

In addition to the stock market, some betting platforms also provide opportunities to bet on election results, such as Kalshi and ForecastEx under Interactive Brokers.

On these platforms, you can bet on who will win and even buy winning contracts like buying and selling stocks. If you bet on the right result, you can win a bonus. For example, in the recent prediction market, the contract price for betting on Trump’s victory is 60 cents, while the contract price for betting on Harris’s victory is 40 cents. These betting markets also provide a window for investors to understand the expected election results because people inside are betting on the election results with real money. These data also reflect the public’s judgment on the trend of the general election.

By understanding the policies of candidates and changes in market sentiment, investors can better grasp investment opportunities, find industries and companies that may benefit, and thus obtain potential returns during the general election. Each candidate has different policy focuses. Next, we will further reveal how these policies will affect various industries and find investment opportunities therein.

The competitive fields of Harris and Trump

Kamala Harris has replaced Joe Biden as the Democratic presidential candidate. Analysts are speculating whether she will continue to implement Biden’s policies. Harris also brings the possibility of a “Silicon Valley commander-in-chief” with more progressive tendencies towards green energy and technology. In 2024, Trump’s proposals and focuses are calling for the modernization of the military and increasing domestic manufacturing, and he has overturned restrictions on big banks.

Based on Harris’s past governance records, regional connections, and campaign platforms, we can see that her policies may bring obvious benefits to the following industries:

- Information technology Harris has long had close ties with the technology industry. Especially during her tenure as California’s attorney general and senator, her relationship with Silicon Valley is particularly deep. She has received extensive support from technology industry leaders and advocates focusing on industry supervision while promoting technological innovation to maintain the healthy development of the technology industry. Therefore, technology companies, especially those focusing on artificial intelligence, cloud computing, and digital infrastructure, are expected to benefit under her leadership.

- Renewable energy The Inflation Reduction Act (IRA) proposed by the Biden administration has invested heavily in promoting clean energy. If Harris is elected president, she will continue to promote this plan. She is committed to increasing investment in renewable energy and encouraging the development of green energy such as solar and wind energy. Therefore, companies in the alternative energy field, such as solar and wind power generation enterprises, will expect better development opportunities under the impetus of her policies.

- Industry Harris supports the Bipartisan Infrastructure Law and the Inflation Reduction Act. Both contain a large amount of investment in fields such as grid infrastructure and transportation, totaling $830 billion. She also emphasizes the development of domestic manufacturing and hopes to support manufacturing through modern infrastructure construction. Therefore, industrial enterprises related to infrastructure construction and manufacturing will have great potential.

According to Trump’s “Agenda 47” and his policy records during his previous tenure, the following industries may benefit from Trump’s policies:

- Finance During Trump’s first term, he cut many regulatory requirements in the Dodd-Frank Act, greatly reducing the burden on financial institutions. If he is re-elected, Trump may continue this policy to help financial companies reduce costs and increase profits. Therefore, banks and other financial enterprises will likely be the direct beneficiaries of this policy.

- Architecture and engineering Trump’s “Agenda 47” includes a plan to build 10 new cities on undeveloped federal land and simplify the approval process to accelerate the implementation of infrastructure projects. This means that architecture and engineering companies will face more project opportunities, especially in infrastructure construction and real estate development.

- Aerospace and defense Trump’s strong support for defense modernization means an increase in defense spending, especially support for the military and aerospace industries. These policies are aimed at ensuring that the United States continues to maintain a world-leading position in defense technology. Therefore, aerospace enterprises and military companies are expected to directly benefit from the increase in defense budgets.

Industries benefiting from both policies

There are some industries that may be promoted by policy benefits regardless of who is elected:

Housing construction Both Harris and Trump have active policy plans in housing construction. Harris supports building three million new houses and providing down payment assistance to solve the housing shortage problem. Trump has proposed reducing zoning and permit restrictions faced by developers and speeding up the approval of housing construction projects. Therefore, real estate development companies and building material enterprises may both benefit from it.

Different policy directions may drive the growth of some industries. For investors, this is a good opportunity. However, ordinary investors often encounter a problem: it is really not easy to pick out the most potential ones from so many companies. There are many companies in each industry, and the impact of policy benefits on them varies, which makes stock selection very complicated.

To make stock selection easier, everyone can refer to the analysis and recommendations of professional institutions. For example, SA Quant can screen out companies that are most likely to benefit through quantitative analysis combined with policies and market sentiment, helping everyone better seize opportunities. In addition, you can also choose to invest in ETFs (exchange-traded funds). This can not only diversify the risks of individual stocks but also easily participate in the growth of the entire industry.

Next, we will introduce seven stocks recommended by SA Quant. These stocks cover multiple industries benefiting from policies and are expected to experience significant growth in the post-election policy environment.

Seven stocks recommended by SA Quant

SA Quant combines policy trends and quantitative analysis to screen out seven stocks that may significantly benefit in the post-election policy environment. These stocks cover multiple industries such as information technology, alternative energy, industry, finance, defense, and housing construction. They have good investment fundamentals and growth potential and are quantitatively rated as “buy” or “strong buy.”

- Zeta Global Holdings Corp. (ZETA)

Industry: Information technology

Company overview: Zeta is a cloud platform company that uses artificial intelligence to help customers optimize marketing strategies in 15 different industries such as retail, financial services, and telecommunications. Zeta’s market performance is better than that of the overall technology industry. In the second quarter of 2024, it achieved a 25% year-on-year increase in revenue, and its long-term growth expectation has a compound annual growth rate of 34%. With Harris’s policy support, Zeta is expected to benefit from technological innovation and the development of alternative energy.

Investment highlights: Zeta’s profit margin performance is better than the industry average, and it has strong cash flow. Against the background of market sentiment favoring technology stocks, Zeta is quantitatively rated as a “strong buy.”

- NextEra Energy, Inc. (NEE)

Industry: Renewable energy

Company overview: NextEra Energy is one of the largest renewable energy companies in the world, mainly dedicated to power generation from wind and solar energy and has extensive power generation facilities in the United States. With Harris’s government’s strong support for alternative energy, NextEra Energy is expected to continue to benefit from it, especially by obtaining more policy support and subsidy projects to promote its development.

Investment highlights: NextEra Energy has a good market position in the clean energy field and continuous expansion of power generation capacity. The company has a solid financial position and strong profitability. Industry growth driven by policies will help the company continue to maintain a leading position in the alternative energy field.

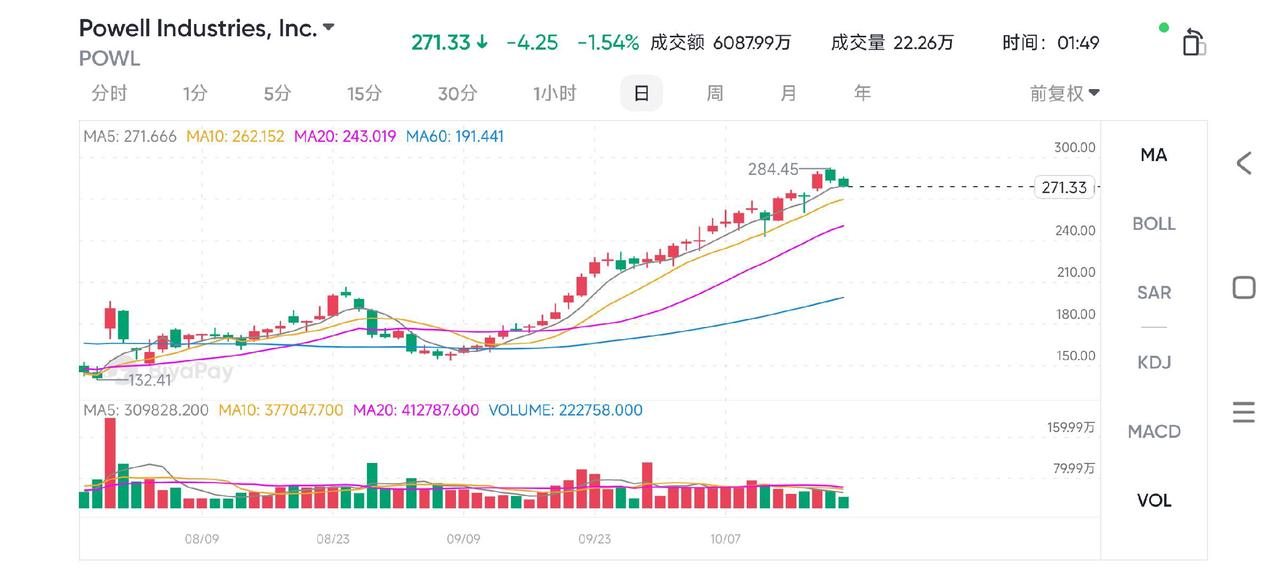

- Powell Industries, Inc. (POWL)

Industry: Industry

Company overview: Powell focuses on providing complex electrical solutions for the energy and industrial fields, serving utilities, transportation, oil, and liquefied natural gas markets. The company’s revenue in the third quarter of fiscal year 2024 increased by 50% year-on-year, showing strong demand in the oil and power fields. Investment highlights: Powell’s profitability in the industrial field far exceeds the industry average, with a net profit margin of 14%. Driven by infrastructure modernization and grid construction, Powell continues to maintain excellent market performance.

- Northrop Grumman Corporation (NOC)

Industry: Aerospace and defense

Company overview: Northrop Grumman is one of the major defense contractors in the United States, focusing on producing military equipment, drones, missile defense systems, etc., and also involved in satellite and civil aviation fields. Trump supports increasing the defense budget, which will enable the company to continue to benefit from the growth in military spending.

Investment highlights: The company currently has an order reserve of $83 billion, and its profitability is excellent. It is a leader in the defense industry and is quantitatively rated as a “strong buy.” The company’s strong market position, innovative products spanning civil and military fields, and excellent fundamentals make NOC the top choice if Trump wins.

- First Citizens BancShares, Inc. (FCNCA)

Industry: Finance

Company overview: First Citizens is one of the major banks in the southeastern United States, the mid-Atlantic, the Midwest, and the western United States. In 2023, it successfully acquired Silicon Valley Bank (SVB). Quantitative industry ranking (as of October 16, 2024): ranked 27th among 682 industries. This acquisition has strengthened its lending business and achieved a 29% revenue growth in the second quarter of 2024. FCNCA’s second-quarter revenue exceeded expectations by $44.2 million, and earnings per share exceeded expectations by $6.12, resulting in 10 upward revisions and no downward revisions to its first fiscal year’s performance in the past 90 days.

Investment highlights: The company’s net income margin reaches 29%, significantly exceeding the industry average, and its future valuation is relatively cheap. These performances have helped the company obtain an “A-” momentum rating. Although it has risen, the company’s valuation is still attractive. Its forward price-earnings ratio is 10.5 times, while the industry’s price-earnings ratio is 12.7 times. FCNCA scores much higher than average in all factor ratings and is an excellent choice in the financial industry if Trump may win.

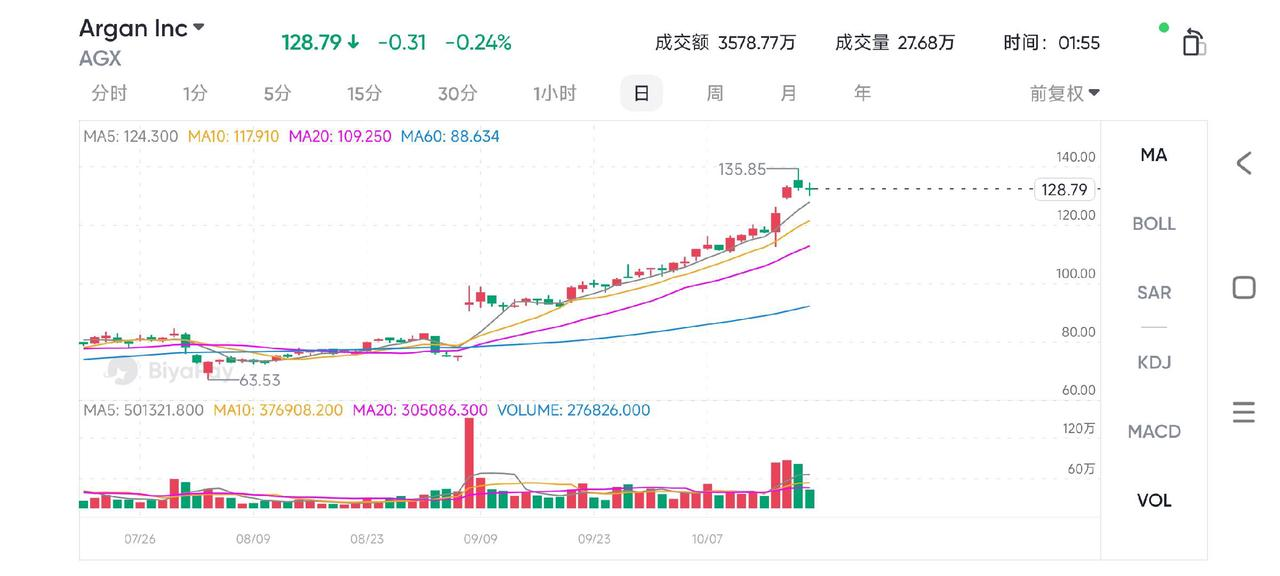

- Argan, Inc. (AGX)

Industry: Industry

Company overview: Argan is an engineering and construction company that mainly provides services for the power and industrial construction fields. With Harris’s government’s investment in infrastructure construction, Argan may become a beneficiary under the impetus of this policy.

Investment highlights: Argan achieved a 61% year-on-year increase in revenue in the second quarter of 2024 and showed good cash flow performance. The company is expected to obtain growth opportunities in traditional and renewable energy projects in the future.

- Green Brick Partners, Inc. (GRBK)

Industry: Housing construction

Company overview: Green Brick Partners is a diversified housing construction and land development company, mainly covering Texas, Georgia, and Florida. Whether it is Harris’s housing assistance policy or Trump’s housing construction simplification policy, the company may benefit from it.

Investment highlights: The company set a record high in home deliveries in the second quarter of 2024, with a year-on-year increase of 26%, and has high profit margins. It is quantitatively rated as a “strong buy.” GRBK is the highest-rated residential construction stock by quantitative analysis and may benefit regardless of who wins in November.

How to buy these stocks

To effectively invest in these potential profit opportunities brought by the general election, ordinary investors can choose various ways to purchase stocks. Here are some main suggestions to help investors better participate in the investment of these selected stocks.

1.Use a securities account for trading Investors can purchase these stocks through traditional securities accounts. Most online brokers, such as Interactive Brokers and Charles Schwab, provide convenient stock trading services. These brokers usually have low handling fees and convenient trading systems, suitable for individual investors to conduct self-service trading. The specific steps are as follows:

- Open a securities account: Choose a suitable broker and register an account. Submit relevant personal information for identity verification.

- Deposit funds: Inject funds into the account through methods such as bank transfer to ensure there is enough capital for purchasing stocks.

- Select stocks and place orders: Enter the stock code (such as ZETA, NEE, etc.) on the trading platform and perform a buy operation according to the real-time price of the target stock.

2.Use ETFs for diversified investment For investors, if they want to better diversify risks, they can choose exchange-traded funds (ETFs). ETFs usually contain stocks of multiple companies and can help investors obtain extensive market exposure in specific industries. For example: If you are optimistic about the growth of alternative energy, you can consider investing in the iShares Global Clean Energy ETF (ICLN). This fund holds stocks of many alternative energy companies, including leading enterprises like NextEra Energy. For companies in the industrial and infrastructure fields, the Vanguard Industrials ETF (VIS) provides overall investment exposure to the industrial industry. By investing in ETFs, investors can reduce the risks that individual companies may face and enjoy the growth dividends of the entire industry.

3.Use online platforms and tools to simplify trading Today, more and more investment platforms provide convenient services to help investors easily purchase and manage these stocks. Platforms such as Robinhood and BiyaPay provide mobile applications. Users can view market dynamics at any time and make quick trading decisions. For investors, choosing the right platform to seize investment opportunities is crucial. Multi-asset wallet BiyaPay is such a platform that supports investors to trade in the US and Hong Kong stock markets and digital currencies. It is convenient for users to regularly check market conditions and look for suitable trading opportunities. If there are problems with the inflow and outflow of funds, BiyaPay also provides an efficient, safe, and non-freezing solution. Whether it is recharging digital currency and converting it into US dollars or Hong Kong dollars or withdrawing to a bank account, BiyaPay can quickly and flexibly meet capital needs to ensure that investors do not miss any market opportunities.

The US general election is not only a major political event but also has an important impact on the investment market. By analyzing the policies of Harris and Trump, we can see that different policy directions will bring benefits to some industries, which provides good opportunities for investors. And recommendations provided by professional institutions like SA Quant can help everyone find these opportunities more easily. Investors can participate in the investment of these stocks through securities accounts, ETFs, or using online tools like BiyaPay.

Whether it is buying individual stocks directly or diversifying risks through ETFs, investors have the opportunity to obtain good returns in the post-election policy environment. Of course, investment always has risks, and the market is full of various uncertainties. Therefore, when investing, one must do sufficient homework and maintain a calm mindset. Only by reasonably controlling risks can one find a balance between opportunities and challenges and achieve stable investment returns.