- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Amazon Earnings Preview: The Rise of the Next Dividend Giant? Driven by AWS and Advertising, Will St

Amazon (NASDAQ: AMZN) is set to release its September quarterly earnings on October 31 after market close. According to data compiled by Refinitiv, analysts (based on median estimates) expect the company’s revenue to be approximately $157.2 billion, with operating profit around $15.3 billion, representing year-over-year growth of 11% and 42%, respectively. Given that the broader macro environment continues to favor e-commerce and cloud computing growth, these estimates seem reasonable, with Amazon likely to meet or even exceed expectations.

However, investors are divided on the company’s future: On one hand, many are optimistic about Amazon’s long-term growth potential, particularly driven by AWS (Amazon Web Services) and its advertising business, which are poised to become major revenue sources for the company due to their high profitability. The upcoming earnings report will provide new insights into the growth prospects of these businesses. On the other hand, some investors remain cautious about Amazon’s currently high valuation, believing that rising retail costs and macroeconomic challenges could dampen the company’s short-term performance.

The high-profit growth of AWS and advertising underscores Amazon’s undeniable long-term potential, yet the retail business faces rising costs and macroeconomic uncertainties. Can Amazon continue its growth trajectory, or will it be hindered by these factors? Below, we delve into Amazon’s major business segments, uncovering its growth drivers and potential challenges, while assessing whether the company can deliver more returns to shareholders.

AWS and Advertising: Amazon’s Super Growth Engines, Future “Cash Cows”

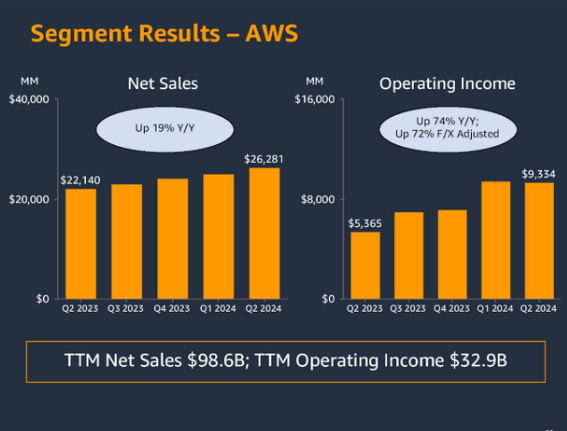

AWS is Amazon’s cloud computing business and one of the company’s most profitable segments. In recent years, AWS has maintained its leading position in the global cloud services market, currently holding a market share of about 32%, ahead of major competitors like Microsoft Azure and Google Cloud.

The growth of AWS is primarily driven by enterprise digital transformation and the development of artificial intelligence, particularly in applications involving large models and machine learning, which have fueled strong demand for AWS.

However, AWS faces significant competitive pressure. Microsoft’s Azure, through its deep partnership with OpenAI, has gained a notable advantage in the enterprise AI applications market, while Google Cloud has earned strong feedback from specific customer segments with its data analytics and machine learning tool, BigQuery. Additionally, more companies are adopting multi-cloud strategies to reduce reliance on a single cloud service provider, which poses a challenge to AWS’s market share.

Even so, AWS retains a powerful market leadership position, with advantages in infrastructure, product functionality, and a robust partner ecosystem, allowing it to remain competitive while continuing to attract new customers and workloads.

Furthermore, AWS’s product innovation continues to advance. Amazon has developed custom machine learning chips, such as Trainium and Inferentia, to improve training and inference efficiency. According to Amazon, Inferentia offers a 30-40% cost reduction compared to EC2 instances using NVIDIA GPUs.

The combination of hardware and services aims to provide more cost-effective AI solutions to customers. For instance, AWS introduced the “Bedrock” platform, which integrates its own and partners’ large language models (LLMs), enabling customers to start using generative AI applications without training models from scratch.

Advertising Business: From Nothing to Prime Video’s Boost, Propelling Amazon into an Advertising Giant

Amazon’s advertising business is one of the company’s fastest-growing segments, with advertising revenue reaching $12.8 billion in the second quarter of 2024, accounting for about 9% of the company’s total revenue, with a growth rate of 20%. The rapid rise of Amazon’s advertising business can be attributed to its integration of consumer purchasing data, which helps advertisers precisely target their audience, thus enhancing the return on ad spend.

Prime Video has provided new momentum for the growth of Amazon’s advertising business. Prime Video not only serves as a platform for users to watch content but also as a channel for advertisers to showcase their products. In 2024, Amazon began introducing ads on Prime Video, covering approximately 180 million users in the United States. According to Nielsen, it currently holds a 3.1% share of total TV viewing time in the U.S.

This move allows Amazon to directly compete with other advertising platforms, such as Google’s YouTube and Meta’s Instagram.

Amazon’s management believes that the video advertising business is still in its early stages of development and is expected to capture a larger share of the advertising market in the future, leveraging its advantage in user data and its closed-loop system.

Retail Business: Under the Giant’s Halo, How to Cope with the “Consumer Chill”?

Amazon’s retail business has long been the core pillar of the company’s revenue, accounting for approximately 65% of total revenue. However, unlike the high-profit AWS and advertising businesses, the retail business’s profitability faces various challenges, especially in the current macroeconomic environment.

In recent years, Amazon has implemented various measures to improve the efficiency of its retail business, such as expanding automation and robotics technology to reduce fulfillment and logistics costs. Since 2022, the operating profit margin of Amazon’s North American retail business has grown from -2.3% to 5.6%, showing significant efficiency improvements.

Despite these efforts, Amazon’s retail business still faces multiple challenges, particularly due to rising labor costs and macroeconomic uncertainties. According to recent data, Amazon employs more than 1.5 million people worldwide, with most concentrated in logistics and warehousing. In September 2024, Amazon announced a $1.5-per-hour wage increase for approximately 800,000 U.S. employees, raising the average hourly wage to $22. As labor costs rise, especially under the pressure of regulatory scrutiny—such as increased union activity and efforts to reclassify third-party delivery drivers—these factors put pressure on the company’s operating profits.

At the same time, Amazon’s retail business faces uncertainty in consumer demand. The unstable macroeconomic environment has constrained consumer spending, especially as high inflation and rising interest rates impact consumer confidence, leading to a decline in Amazon’s average selling price (ASP). Management mentioned during the latest earnings call that weak consumer spending has become apparent in some key markets and is expected to continue to slow down in the third quarter.

Despite these challenges, Amazon remains committed to strengthening the core competitiveness of its retail business. The company is focused on expanding product variety, maintaining low prices, and improving delivery speeds to enhance the customer experience. In 2024, Amazon set a new record for Prime customer delivery speeds, with over 5 billion items delivered same-day or next-day, which not only improved the shopping experience but also increased order frequency and average order value.

However, the outlook for Amazon’s retail business remains uncertain, particularly with the Federal Reserve’s monetary policy still unclear. If the labor market deteriorates further, consumer spending could be impacted even more. As the largest portion of Amazon’s revenue, the performance of the retail business is critical to the company’s overall profitability. Therefore, how Amazon balances cost control with maintaining sales growth is a key challenge for the company moving forward.

Valuation Strategy: High Valuation Risk or a Future Growth Stock?

As of now, Amazon’s valuation multiple is close to 33x EV/EBIT, which is notably higher compared to other “Magnificent 7” tech giants like Google and Meta. According to Refinitiv data, Amazon’s non-GAAP earnings per share for 2025 are expected to be $7.3, with its growth rate projected to be twice that of overall revenue growth. This is largely driven by the higher profit margins of AWS and the advertising business, which are expected to account for a larger share of company revenue over the coming years, thereby improving overall profitability.

However, such growth expectations also bring valuation pressure. The market’s tolerance for Amazon’s high valuation hinges on future earnings realization. If the company fails to deliver strong earnings reports in the coming quarters, it could lead to significant stock price volatility. Moreover, compared to its peers, Amazon’s EV/EBIT valuation is not cheap at this stage, indicating that short-term investments may face the risk of valuation compression.

For long-term investors, the current valuation level may still be attractive, as advertising and AWS will gradually account for a larger portion of revenue, boosting the company’s overall profit margin. Especially with AWS’s innovations in generative AI and the expansion of the advertising business through Prime Video, Amazon has new growth drivers.

For conservative investors, short-term valuation pressure may pose certain risks. Therefore, finding a balance between high valuation and market volatility is crucial. Investors may choose to position themselves during price corrections or periods of heightened market volatility to lower entry costs and capture long-term gains.

Overall, Amazon’s valuation and growth potential present a duality. The high valuation reflects market expectations for growth but also signals risk. For investors, understanding and evaluating these two aspects is key to making successful investment decisions.

Dividend and Buyback Potential: $500 Billion Cash Reserve, Is Amazon’s “Cash Bomb” About to Explode?

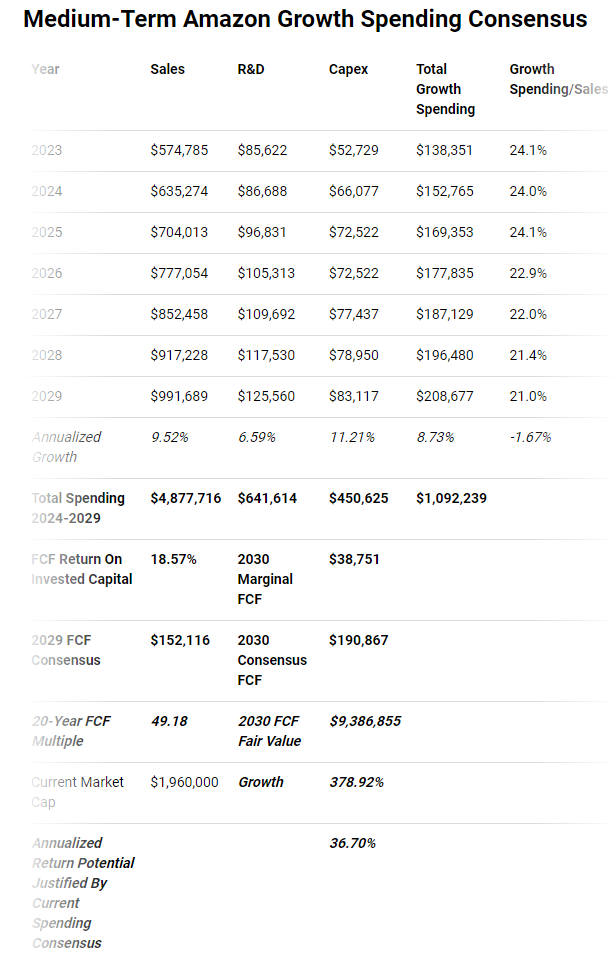

According to market analysis, Amazon is expected to accumulate over $500 billion in net cash reserves by 2029. This level of cash reserves far exceeds the company’s operational needs and has even been deemed “financially irresponsible.”

In fact, a similar situation occurred with Apple, which launched the largest shareholder cash return program in history in 2012, distributing $250 billion in dividends and conducting massive stock buybacks since then. Amazon’s cash flow trend indicates that the company has a similar capability, especially as capital expenditures stabilize.

Amazon’s growth efficiency and sustained free cash flow growth make dividend payments and stock buybacks feasible future options. From 2024 to 2029, Amazon’s free cash flow is expected to grow at an annualized rate of 26.8%, approaching $200 billion by 2030.

This means that the company could potentially return significant amounts of cash to shareholders through dividends and buybacks in the future, enhancing shareholder returns and stabilizing the stock price.

Prospects for Future Shareholder Returns

For income-oriented investors, the implementation of dividend and buyback plans would be highly appealing. Although Amazon is not currently a traditional dividend stock, once the company reaches a mature stage and begins returning cash, its dividend yield could rise rapidly, especially against the backdrop of its growing high-margin businesses. This potential could make Amazon a tech giant with strong dividend returns in the future.

Additionally, a stock buyback program could effectively boost earnings per share (EPS), driving stock prices higher. In the current high-valuation environment, stock buybacks could not only stabilize the stock price but also strengthen investor confidence in the company’s long-term growth.

By 2030, Amazon’s market size is expected to expand significantly, and its accumulated free cash flow will provide ample funds for shareholder returns. As cash reserves grow and the company enters a mature phase, there is widespread market expectation that a shareholder return plan will soon be implemented. For investors looking to hold long-term and enjoy steady returns, this is undoubtedly a very attractive prospect.

In conclusion, Amazon is a strong candidate for long-term investment. The steady growth of AWS and the advertising business will drive future profitability, while the massive cash reserves pave the way for potential dividends and stock buyback plans, all of which enhance shareholder returns. Therefore, for long-term investors who can tolerate market volatility, the current stock price remains an attractive buying opportunity. Conversely, more conservative investors may want to wait for an appropriate market correction to reduce risk and secure a better entry point.