- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Seven Reasons Why Amazon's Low Valuation May Be a Golden Opportunity for a Comeback

Amazon (NASDAQ: AMZN) has long been a top pick among long-term investors. Over the past decade, its total stock return has reached 1,110%, far outpacing the S&P 500’s 263%. However, despite its stock once approaching historical highs, its recent performance has failed to continuously impress, leading to a certain degree of diminished investment appeal.

In the past three years, AMZN’s total return was only 16%, while the S&P 500 delivered nearly 40% over the same period. Behind this gap, even though the company has made significant breakthroughs in artificial intelligence and achieved remarkable growth in its advertising business, the market’s reaction to these positives has remained relatively muted. Multiple contractions have depressed its valuation, and the current stock price is below historical levels, indicating a certain discount.

Does the current decline in valuation suggest a rare opportunity to invest at a low point? With core growth engines like artificial intelligence and cloud computing continuing to drive forward, perhaps Amazon’s real story is just beginning—is this a prime opportunity for a comeback to its peak?

Amazon’s Unique Advantages: Economies of Scale and Market Leadership

Amazon’s success primarily stems from its powerful economies of scale and early market positioning. These factors have established Amazon’s unshakable leadership in e-commerce, cloud computing, and advertising.

In the e-commerce sector, Amazon leads competitors by a wide margin with a 38% market share. Such a vast share has helped Amazon establish a solid leadership position in the global retail market. By optimizing supply chains and logistics efficiency, Amazon continues to reduce costs, offering consumers lower prices and faster delivery services.

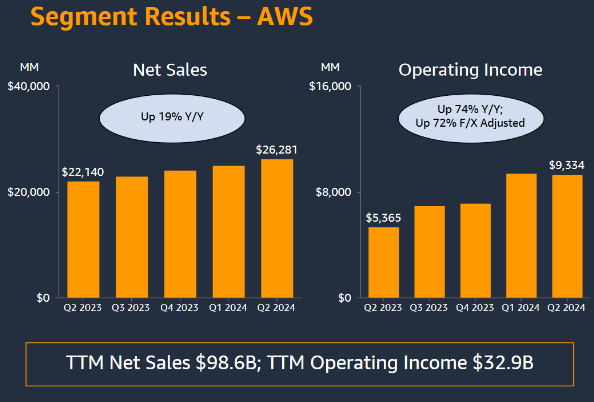

Amazon Web Services (AWS), its cloud computing business, also maintains a global leadership position with a 31% market share. AWS’s success is not only due to its technological edge but also its continuous infrastructure investments and extensive customer base. This makes AWS an industry benchmark in digital transformation and cloud services, with immense long-term growth potential.

Advertising is another key pillar of Amazon’s growth, with market share increasing from 10% in 2018 to 22% in 2024. Leveraging rich consumer data and precise user behavior analysis, Amazon provides advertisers with efficient channels, enhancing ad conversion rates and significantly optimizing the company’s overall profit structure.

Moreover, Amazon’s Prime Video service boasts over 200 million users, making it the world’s second-largest streaming platform after Netflix. With diverse content and deep integration with e-commerce services, Prime Video increases user engagement and loyalty, further consolidating Amazon’s brand influence.

Seven Reasons Supporting Long-Term Investment Opportunities

Amazon has achieved significant advantages in e-commerce, cloud computing, and advertising markets. With a 38% share in e-commerce and AWS holding 31% of the cloud computing market, such scale not only gives Amazon an edge in cost control but also creates high entry barriers, allowing it to remain competitive across various sectors.

Amazon’s accomplishments in its core businesses are primarily due to its early mover advantage. As an industry pioneer, Amazon rapidly expanded its business scale, making it difficult for smaller companies to catch up. In its core online retail business, this scale advantage is especially evident, helping Amazon establish extensive infrastructure to deliver products to consumers faster and more reliably.

By combining its retail business with Prime Video streaming services, Amazon possesses a unique advantage in the advertising market. Compared to other advertising and streaming platforms, Amazon can offer more targeted and differentiated advertising services. These economies of scale and unique advantages ensure that Amazon can maintain its market leadership in key business areas for many years to come, making it difficult for competitors to replicate.

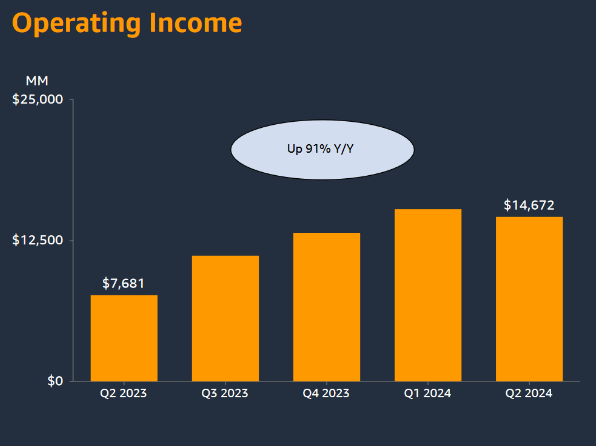

Amazon is excellently positioned within the growth trends of cloud computing, e-commerce, and advertising markets. AWS is one of the company’s most promising businesses for future growth; although it accounts for only 18% of total revenue, it contributes over 60% of operating profit.

As global IT spending gradually migrates to the cloud, AWS will continue to benefit from this long-term trend. Additionally, the ongoing expansion of online retail and digital advertising markets brings significant growth opportunities for Amazon.

One of the most underrated aspects of Amazon’s bullish narrative may be its continually growing advertising business. By 2024, Amazon is expected to capture 22% of the entire U.S. search advertising market, a significant increase from 10% in 2018. This growth has directly eroded the market leader Google’s share, whose U.S. search ad market share has declined from 60% to 48%.

Amazon’s share in the overall online advertising business has also risen from 10.7% in 2021 to 13.9% in 2024, in comparison with competitors like TikTok and Meta. The reason behind this is that many consumers begin their purchase searches on Amazon, and Amazon possesses a vast amount of customer purchasing data, unmatched by Google and Meta.

In the second quarter of 2024, Amazon’s advertising revenue grew by 20% year-over-year, and this growth trend is expected to continue.

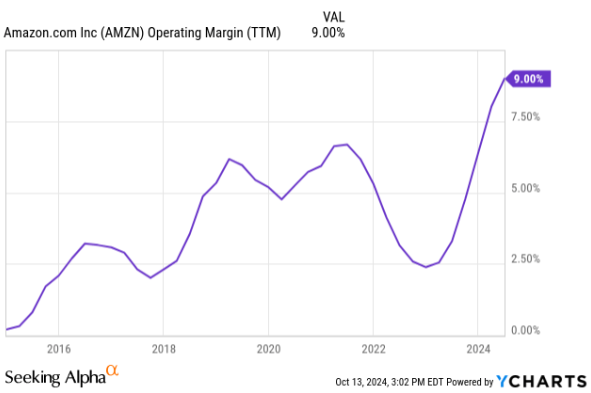

Although Amazon’s overall profit margin is relatively low, AWS boasts a profit margin of up to 35%, and the advertising business also has high margins compared to peers. As the revenue proportion from high-margin businesses increases, Amazon’s overall profit margin is expected to expand further in the future.

Moreover, as international retail businesses gradually achieve economies of scale, the allocation of fixed costs will also enhance profit margins.

Although Amazon faces antitrust lawsuits from regulatory agencies, compared to other tech giants, its lower profit margins and diversified businesses help it cope with regulatory challenges, as its market share is not large enough to be typically considered monopolistic.

Furthermore, Amazon’s relatively low profit margins, especially in its retail business, may make it difficult for the government to prove that its actions harm consumer interests. In contrast, other tech companies facing regulatory challenges, such as Apple, Alphabet, Meta, and Microsoft, have much higher profit margins, making it easier for the government to argue that consumers are being harmed.

If remedial measures are ultimately required, the business most likely to be affected is online retail, which contributes less to the company’s overall profitability compared to the advertising and cloud computing businesses.

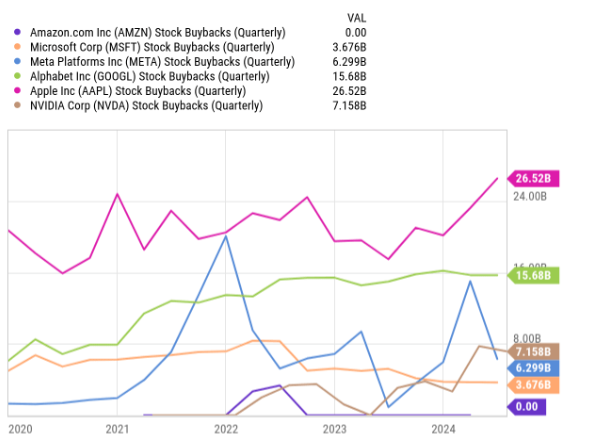

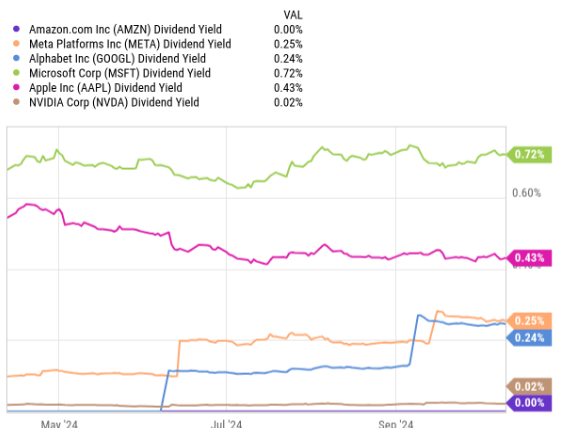

One significant difference between Amazon and other large companies is that it does not distribute dividends nor conduct large-scale stock buybacks.

Typically, dividends and aggressive stock buybacks are considered positive factors when evaluating stocks, but when considering high-growth companies, this may reflect that the company lacks sufficient good investment opportunities. Therefore, this instead shows that Amazon still has plenty of investment growth potential.

As shown in the figures, most mega-cap tech companies have begun distributing dividends and actively buying back stocks in recent years, while Amazon has not taken similar actions. Although the company has some stock repurchase plans, currently with $6.1 billion in repurchase authorization, the overall scale is not large.

Amazon chooses to reinvest capital into its core businesses rather than directly returning it to shareholders. Data shows that in recent years, Amazon’s capital expenditures have been much higher than those of its peers. In my view, this approach is correct because each of Amazon’s core businesses has long-term growth potential. This capital allocation strategy also reflects management’s confidence in the company’s future development.

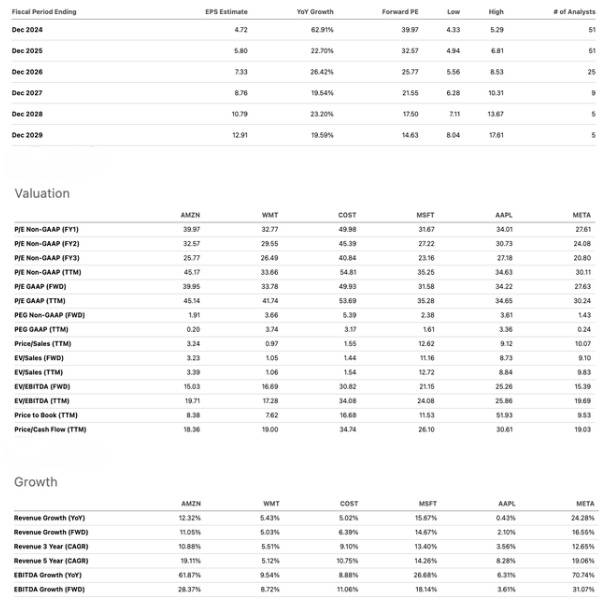

Traditionally, because Amazon reinvests a large amount of capital, its valuation is often based on per-share cash flow and other metrics, making indicators like the P/E ratio less applicable. However, with recent margin improvements and further expected expansions, the P/E ratio has now become more meaningful. Currently, Amazon’s stock price corresponds to 32.5 times the expected earnings per share for fiscal year 2025. While this is significantly higher than the S&P 500’s 23.7 times, Amazon’s growth prospects are far better than the overall market.

Considering Amazon’s diversified business portfolio, it’s meaningful to compare it with other companies, including retailers like Walmart and Costco, as well as tech companies like Microsoft, Apple, and Meta. Notably, Amazon’s valuation is currently much lower than Costco’s and only slightly higher than Walmart’s. Yet, the earnings growth of these companies is far less than Amazon’s, indicating that Amazon is severely undervalued relative to these companies.

In the cloud business, Amazon’s biggest competitor is Microsoft. Based on earnings forecasts for fiscal year 2025, Microsoft’s stock price is relatively slightly lower than Amazon’s. However, Amazon’s valuation should arguably be higher because its growth drivers are more diversified (cloud computing, advertising, and online retail), while Microsoft’s growth relies more on the cloud business.

Another comparison worth noting is Apple, whose expected P/E ratio is 31 times, compared to Amazon’s 32.5 times. Over the next two years, Amazon’s earnings are expected to grow by more than 20%, while Apple’s earnings are projected to grow only at a low double-digit rate.

The most attractive part of Amazon’s valuation may be the change in its current valuation relative to historical levels. Before the COVID-19 pandemic outbreak in 2020, Amazon’s P/E ratio was about 25 times, but now it’s only 18.6 times based on the same metric. This valuation decline has occurred after the booming development of the online retail market, enhancing Amazon’s core business, along with advancements in AI technology and growth in advertising market share. In terms of expected P/E ratio, the current stock price is also below recent historical standards.

A Golden Opportunity Amid Short-Term Volatility

Investment Recommendations and Valuation Analysis

The recent pullback in Amazon’s stock price offers investors a potential low-entry buying opportunity, especially given the continued robust growth of the company’s core businesses. Although Amazon’s P/E multiple is slightly higher than the S&P 500, considering its diversified business layout and significant growth potential, this valuation remains attractive—particularly as cloud computing and advertising businesses continue to drive profitability improvements.

In the short term, Amazon’s stock price fluctuations are mainly influenced by market sentiment, earnings expectations, and the macroeconomic environment. However, Amazon’s diversified business portfolio and strong market position give it good risk resistance when facing these fluctuations. The continued growth of AWS and the advertising business indicates that the company’s future profitability remains promising, providing strong support for its future stock performance.

Therefore, we recommend that investors focus on Amazon’s long-term growth potential and consider gradually increasing their positions amid market fluctuations to share in the company’s future growth returns. Especially in a situation where the valuation is relatively discounted, such market volatility may be an ideal timing for long-term investors to position themselves.

Risk Assessment

Internal Impact of Return-to-Office Plan

Amazon’s recent return-to-office plan may cause employee dissatisfaction, leading to the departure of some key employees and affecting overall morale. Although Amazon has competitive advantages in company culture and attracting tech talent, the risk of large-scale talent loss cannot be underestimated in the current tight job market.

Competitive Pressure from Microsoft’s Collaboration with OpenAI

Microsoft’s collaboration with OpenAI and the integration of the Azure cloud platform may bring competitive pressure to AWS. Azure has become a significant choice for many enterprise customers, posing a risk to AWS’s market share. Additionally, the FTC is investigating the business relationship between Microsoft and OpenAI, which may provide better collaboration opportunities for AWS, helping Amazon maintain market competitiveness.

Potential Impact of Macroeconomic Slowdown

An economic slowdown may also pose challenges to Amazon, as its business is highly dependent on consumer and corporate spending. If the economy declines, the company’s overall performance may be affected. However, from a long-term investment perspective, stock price drops caused by macroeconomic factors may also provide investors with good entry opportunities.

In summary, Amazon continues to exhibit significant investment appeal with its diversified businesses and strong market leadership. Despite current market volatility, Amazon’s core businesses—including cloud computing, advertising, and e-commerce—still possess strong growth momentum, sufficient to withstand short-term challenges. The current market fluctuations may be an ideal entry point for long-term investors. Those willing to seek opportunities amid market uncertainties may find that this is an excellent time to position themselves in this tech giant; the future growth prospects remain promising.