- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

TSMC soared nearly 90% this year, hitting the trillion-dollar market cap! Can Q3 financial report br

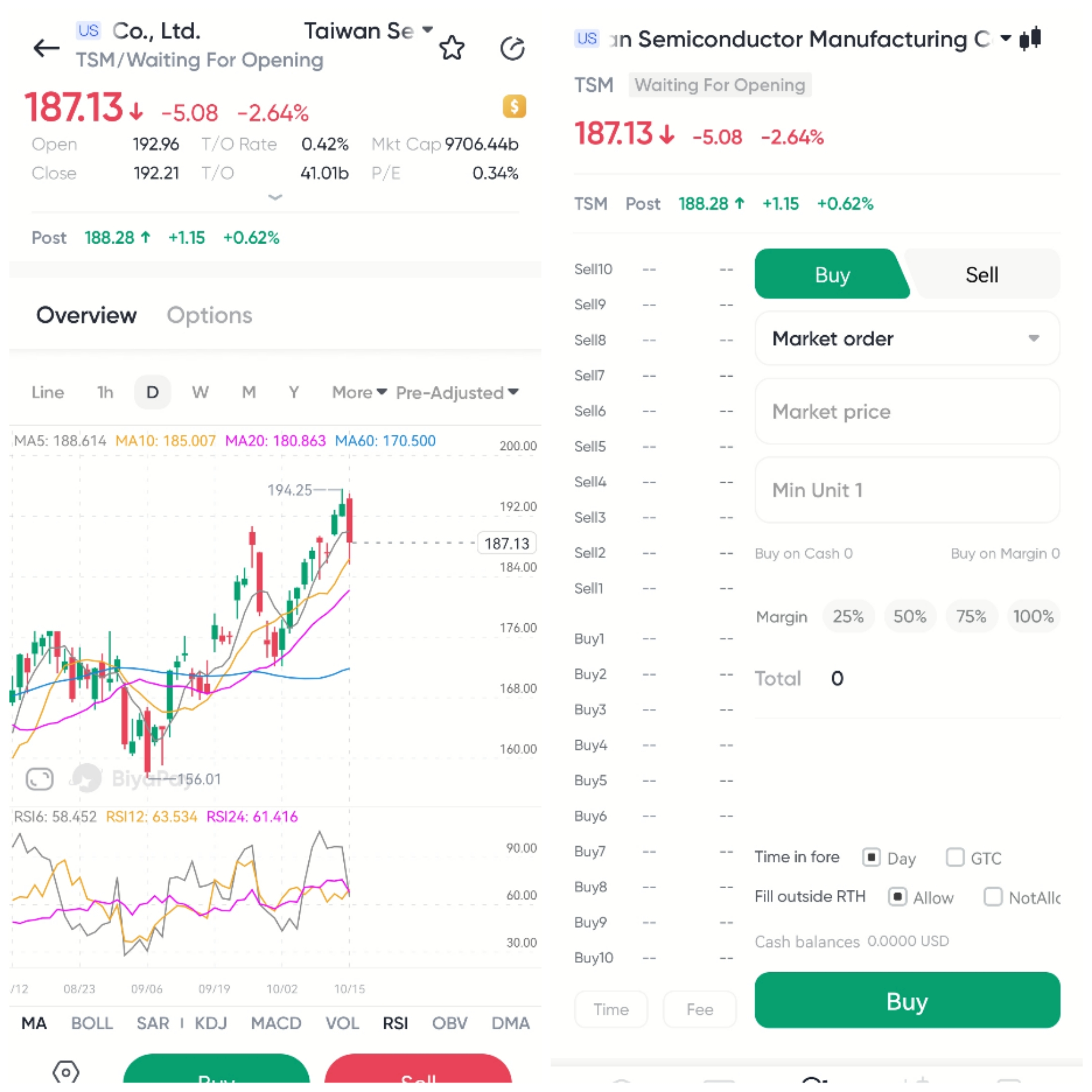

As a leader in the global semiconductor industry, TSMC’s stock price has been the focus of the market in recent years. On October 14th local time, TSMC’s stock price rose to a high of $194.25 after the opening of the US stock market, reaching a new high. The intraday market value once touched the eye-catching trillion-dollar mark, but as of the close of the 15th, the stock price has fallen slightly. It is worth noting that within 2024, TSMC’s stock price has risen by nearly 90%. This growth rate not only demonstrates TSMC’s strong competitiveness in the global semiconductor market, but also reflects investors’ optimistic expectations for its future prospects.

This Thursday (October 17th), TSMC will release its latest Q3 results. As TSMC is about to release its Q3 financial report, investors are focusing on a key question: Can TSMC’s stock price continue to break records after the performance is released, supported by strong demand in the AI chip market? The answer to this question will directly affect investors’ confidence and provide important market signals for the semiconductor industry.

Q3 financial report is approaching, AI demand is expected to drive performance beyond expectations

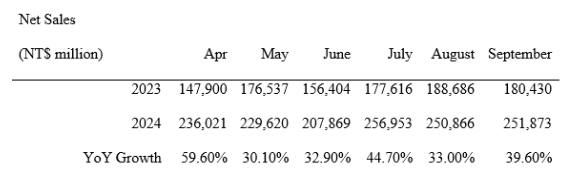

With the end of the third quarter of 2024, TSMC is about to release its financial report, and the market is full of expectations for its financial performance. According to the consensus expectation of the market, TSMC’s revenue in the third quarter is expected to reach NT $750.211 billion, a year-on-year increase of 37.22%, and earnings per share are expected to be NT $56.8, a year-on-year increase of 36.4%.

Behind this expected data is the continuous outbreak of demand for AI chips, especially the surge in orders from major customers such as Nvidia and Apple. This impressive financial data not only demonstrates TSMC’s huge benefit ability in the AI wave, but also provides solid support for its stock price to soar nearly 90% this year.

By comparing historical performance, we can see that TSMC’s growth momentum is particularly strong this year. In September, TSMC’s monthly revenue reached NT $2518.73 billion, an increase of 39.6% compared to the same period last year, setting a new high for monthly growth in recent years. This indicates that TSMC can still maintain strong growth momentum by relying on the demand for AI and high-performance computing chips while coping with the global decline in chip demand.

In contrast, other semiconductor companies such as Intel and Samsung have performed relatively weakly in the face of a surge in AI chip orders, unable to match TSMC’s growth rate. This situation further highlights TSMC’s dominant position in the high-end chip manufacturing field, and the third-quarter performance expectations further consolidate the market’s optimistic attitude towards TSMC’s long-term growth prospects.

Before the release of the results, the market sentiment was obviously positive, but one question investors need to consider is whether these positive news have been fully reflected in the current stock price, or whether TSMC still has room to continue to rise. The answer may be revealed after the financial report is released.

How did TSMC win high expectations?

The rapid growth in demand for AI chips is undoubtedly the main driving force behind TSMC’s significant performance growth this year. Especially, the strong demand for Nvidia’s Blackwell AI chips and Apple’s high-performance computing chips has directly driven TSMC’s order volume to continue to rise. In the AI field, the computing needs of tech giants such as Nvidia are becoming increasingly complex, requiring more efficient chips to process large amounts of data and AI workloads. With its advanced process technology, TSMC has become the preferred supplier for these companies.

The hot sales of Nvidia’s Blackwell chips in the AI market indicate the key role of AI in global technology companies. This not only helps TSMC steadily increase its market share in 2024, but also further consolidates its leading position in high-end chip manufacturing. In addition, Apple’s demand for high-performance computing chips is also steadily increasing, especially in its smart devices and future AI applications, which provides greater impetus for TSMC’s future growth.

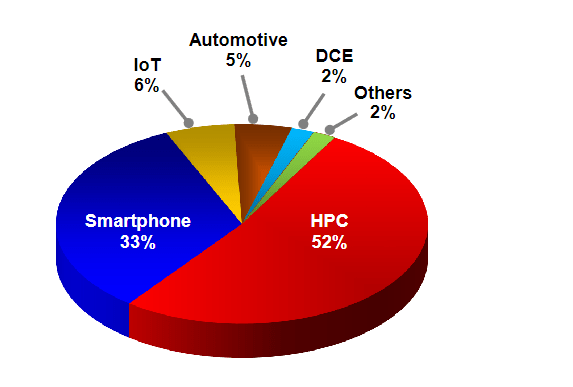

The demand for AI chips has not only helped TSMC increase its overall revenue, but also driven the rapid growth of high-performance computing (HPC) revenue. It is expected that by the end of 2024, HPC products will account for about 55% of TSMC’s total revenue, and may further increase by 2025. This structural change not only reflects the expansion trend of the AI market, but also shows that TSMC will continue to benefit from the continuous growth of the AI market in the coming years.

By continuously expanding production lines and upgrading technology, TSMC has met the demands of major customers for advanced processes, while ensuring its competitive advantage in the global semiconductor market. TSMC’s expansion capabilities are not only reflected in its advanced manufacturing processes, but also in the further deepening of cooperation with major customers, which has enabled it to maintain its leading market position when facing competitors.

These competitive advantages and growth potential have also made the market look forward to its new quarterly financial report, with a focus on the investment value before and after its financial report.

Can the current valuation reasonably reflect its growth potential?

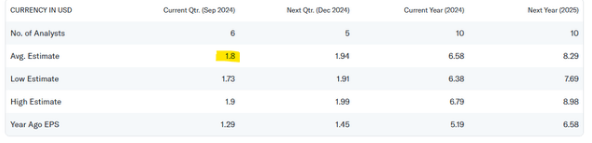

When analyzing TSMC’s current financial performance, we must focus on the robustness of its profit margin and the health of its cash flow. The market expects TSMC’s profit per share in the previous quarter to be $1.80, a year-on-year increase of 40%. In addition, the market also expects TSMC’s total profit per share in this fiscal year to reach $6.58, a year-on-year increase of 27%. This significant profit growth mainly reflects TSMC’s profit from strong demand for AI chips, especially new AI semiconductors that can handle exponentially growing artificial intelligence workloads.

Strong performance in profit margins

TSMC’s high profit margin comes from its advanced 5nm and 3nm processes. These process technologies enable TSMC to produce powerful chips with high efficiency, meeting the growing demand for AI and high-performance computing chips in the market. Based on the third quarter performance, TSMC’s operating profit margin is expected to increase by about two percentage points from 42.5% in the previous quarter. This steadily rising profit margin reflects TSMC’s continuous revenue growth while improving process technology and relying on high-profit AI chip orders.

Attractive valuation

From the perspective of valuation, TSMC’s current Price-To-Earnings Ratio is 28.2 times. Although this number is relatively low compared to Nvidia’s 33.5 times Price-To-Earnings Ratio, considering TSMC’s dominant position in the AI chip field and the expansion potential of future high-performance computing and AI markets, its valuation still has some appeal.

In the future, TSMC’s expected profit per share in 2025 is $8.29, which means its Price-To-Earnings Ratio will drop to 22.4 times. This shows a significant valuation advantage compared to Nvidia, whose Price-To-Earnings Ratio is expected to be 33.5 times. Although Nvidia’s profit growth is expected to reach 42%, TSMC’s relatively low valuation provides investors with an ideal entry opportunity.

For investors who want to seize the current entry opportunity, they can go to BiyaPay to buy TSM. Of course, considering the short-term volatility that the upcoming financial report may bring, investors can also monitor the real-time trend of the stock on the platform, effectively avoid risks, and find a more suitable time to get on board.

In addition, BiyaPay can also be used as a professional tool for depositing and depositing US and Hong Kong stocks. You can exchange digital currency for US dollars or Hong Kong dollars by recharging, quickly withdraw to your bank account, and then transfer the funds to other brokerage accounts to buy stocks. The platform has a fast and unlimited deposit speed, so you won’t miss investment opportunities.

The relevant risks are still worth paying close attention to

Despite TSMC’s significant growth in the market with AI chip demand, future risks cannot be ignored. Among them, the potential slowdown in AI investment and global supply chain issues are key factors affecting TSMC’s future performance.

The continued expansion of the AI market is crucial for TSMC, but it also comes with potential volatility risks. If capital expenditures in the AI field fail to meet expected growth, especially if companies find that short-term investment returns are not as expected, the demand for AI chips may decrease, leading to a decrease in TSMC’s orders. The rapid growth rate of the AI market may bring the risk of excessive investment. Once investment slows down or market demand decreases, TSMC’s performance may face downward pressure.

However, it is worth noting that the application scenarios of AI are constantly expanding, especially in fields such as autonomous driving, Cloud Services, and smart cities, which will provide a solid foundation for the long-term demand for AI chips. Therefore, even if there are fluctuations in the short term, TSMC still has the ability to maintain a relatively stable order volume with its technological advantages.

TSMC, as an important player in global semiconductor manufacturing, is deeply affected by the complexity of the global supply chain. In recent years, geopolitical tensions, especially the technological competition between China and the United States, have brought unprecedented challenges to the semiconductor industry. Supply chain disruptions, chip material shortages, and other issues may increase TSMC’s production costs and weaken its profitability.

TSMC’s global expansion plan, such as building new factories in the US and Europe, aims to reduce its dependence on a single market through diversification. These measures not only help mitigate risks, but also enhance its competitiveness in the international market. However, the high capital expenditures and operating costs of building new factories will also put pressure on Company Finance’s performance in the short term. Overall, TSMC is gradually alleviating these external challenges by optimizing its supply chain and expanding its global market presence.

Although facing risks, long-term investment value remains strong

Although TSMC faces potential market risks and challenges, its long-term growth potential remains strong. Especially driven by strong demand for AI chips and high-performance computing chips, TSMC has the ability to continue to dominate the global semiconductor market. Its global expansion plan will not only help alleviate supply chain pressure, but also bring new market opportunities to the company.

Although TSMC’s capital expenditures may affect cash flow in the short term, these investments will bring substantial returns to the company in the long run. Investors can consider TSMC as an important part of their long-term investment portfolio in the current market environment, especially in the context of the broad prospects of the AI and high-performance computing markets. TSMC’s technological advantages will continue to drive its performance growth.

TSMC’s valuation is currently at the low end of the technology industry, considering its future growth potential has not been fully reflected. In the future, with the expansion of the global market and the investment of new production capacity, TSMC is expected to achieve higher returns in the long term.

TSMC investors should closely monitor key data in its Q3 financial report, especially capital expenditures and future growth prospects. If the company can continue to maintain high gross profit margins and revenue growth, its stock price is expected to continue to rise after the financial report is released.

As a leading global semiconductor manufacturer, TSMC’s leading position in the AI chip and high-performance computing chip markets has been fully recognized by the market. Despite facing challenges such as slowing AI investment, global supply chain issues, and high capital expenditures, TSMC still has strong competitiveness and long-term growth potential with its technological innovation and global expansion strategy. After evaluating its Q3 financial report, investors need to closely monitor its expansion performance in the global market and look for investment opportunities.