- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Microsoft Makes a Massive Bet on AI, Faces Growth Challenges Amid Stock Pullback: Is Now a Good Time

Microsoft’s recent stock performance has been under pressure due to market concerns over its massive AI investment, leading to a temporary decline in stock price. The market’s increasing doubts about short-term profitability have made many investors cautious about Microsoft’s future.

However, Microsoft’s core business remains strong, particularly in the enterprise software and cloud computing sectors, which provide a solid revenue base. In the AI domain, Microsoft’s strategy goes beyond R&D, focusing on the commercialization of AI through deep collaborations with companies like OpenAI. Despite significant competitive pressure, Microsoft’s ongoing AI investment is laying a foundation for future growth.

The current price dip may be an ideal entry point for long-term investors—hidden in Microsoft’s struggles lies the potential to change the game. Buying the dip now could bring substantial returns to far-sighted investors, especially as AI commercialization starts to take shape, promising a future full of possibilities for Microsoft.

Why Has Microsoft Lagged Behind Recently?

Microsoft’s recent performance over the past few months has been disappointing for investors, particularly when compared to the S&P 500 Index, which has shown strong growth. In this environment, Microsoft’s inability to keep pace makes it appear to have fallen behind.

Microsoft’s large-scale AI investments require time to deliver results, and this delay has raised concerns among investors about short-term profit margins. This uncertainty has reflected on the stock price, causing Microsoft’s performance to fall short of market expectations.

Concerns Over AI

Despite the spotlight on Microsoft’s collaboration with OpenAI, commercializing this partnership will require significant investment and a longer timeframe. The market remains doubtful about such high spending, especially in the short term, which may not yield immediate results. In the face of rapid expansion by competitors such as Google, Amazon, and Meta, Microsoft’s competitive edge needs to be more clearly defined to reassure investors about profitability.

Other tech giants like NVIDIA and Meta have shown stellar recent stock performance, increasing pressure on Microsoft. NVIDIA’s strong market position in AI chips has driven its market value to new highs, while Meta has gained market attraction through its open-source model. Microsoft must effectively differentiate itself in the AI competition, or it will face greater uncertainty.

Wall Street’s expectations for Microsoft have gradually turned more cautious. Over the past three months, Microsoft’s growth rating has dropped from “B-” to “C”. Analysts are taking a conservative view on whether Microsoft’s AI investments can yield returns within a reasonable time frame. This re-evaluation directly impacts market sentiment, putting further pressure on its stock price. Given the macroeconomic uncertainties and Microsoft’s long-term investment strategy, some investors are taking a wait-and-see approach regarding the company’s outlook.

In summary, Microsoft’s lackluster short-term stock performance reflects market uncertainties about its AI investment returns and intense competition. The key for Microsoft is to maintain its technical and market advantages amidst competition, which will determine whether its AI investments can be successfully transformed into growth. Although these investments have tremendous long-term potential, Microsoft’s current performance may not satisfy investors looking for short-term gains.

AI Investment: A Boon for the Future or a Financial Quagmire for Microsoft?

Microsoft’s massive investment in AI has garnered widespread attention. The question remains—will these investments drive future growth, or become a short-term burden on profitability? In this section, we will explore Microsoft’s unique approach to AI investments and their potential impact on the future.

Long-Term Growth Potential of AI Investments

Microsoft’s deep collaboration with OpenAI signifies its forward-looking positioning in its AI strategy.

These investments are not only about technological leadership but also about integrating AI deeply into Microsoft’s existing businesses, particularly Azure and enterprise software products. Microsoft aims not only to develop leading AI technology but also to translate that technology into concrete commercial value—such as by offering AI services on Azure to enhance productivity and efficiency for enterprise clients.

This means that Microsoft is working towards vertical integration to expand AI applications, thereby improving overall user experience and market competitiveness. Integrating AI assistants into Office 365 and Dynamics 365 significantly boosts enterprise customers’ productivity, which differentiates Microsoft from other tech giants. By integrating AI widely across a diversified product suite, Microsoft aims to solidify its position in enterprise-level AI solutions, opening up new revenue opportunities in the future.

Profitability Challenges

While Microsoft’s AI investments carry the hope for future growth, they also present significant short-term challenges. Microsoft continues to increase capital spending on data centers and computing power, which raises concerns about its profitability. Supporting large-scale AI model training and applications requires more infrastructure globally, undoubtedly adding to costs and challenging short-term profit margins.

In addition, Microsoft’s AI investments face internal resource optimization issues. To push its AI strategy forward, Microsoft needs to effectively coordinate resources across different business lines to maximize the return on investment. Balancing resource allocation among cloud computing, enterprise services, and AI R&D is a key challenge that Microsoft must overcome to realize the value of its AI investments.

Although Microsoft has robust financial strength, whether these substantial investments can translate into steady profit growth within a reasonable timeframe remains uncertain. In particular, given the macroeconomic uncertainties, the financial pressures resulting from high capital expenditures could further amplify market hesitation.

Positioning for Future Competitive Advantage

Unlike other tech giants’ AI strategies, Microsoft’s strength lies in its deep enterprise service experience and broad customer base. Microsoft is using AI to provide more intelligent and automated solutions for enterprise customers to achieve digital transformation in business operations. In using AI for data analysis, workflow automation, and business forecasting, Microsoft’s enterprise clients have significant competitive advantages, creating relatively high barriers and moats in the enterprise-level market.

Microsoft’s partnership with OpenAI is not limited to the technical level—the company is also pushing for AI application commercialization through market products, which makes its AI strategy more pragmatic. In the future, Microsoft can provide AI as an added-value service to its existing customer base through software subscriptions and cloud services, thereby achieving steady revenue growth. This will offer solid support for Microsoft’s continued market share and technical leadership in the enterprise market.

Microsoft’s AI investments hold unique long-term strategic value but also come with challenges such as short-term profitability pressure and resource coordination difficulties. Transforming these massive investments into tangible commercial value will be one of Microsoft’s main challenges. Despite competitive pressure and uncertainties, Microsoft, backed by its enterprise service advantages and broad customer base, has the potential to succeed in AI commercialization, thereby fueling its overall business growth.

For investors with a long-term perspective, Microsoft’s deep focus on AI seems to be a promising strategic move for the future.

Technical Analysis: Has Microsoft’s Stock Bottomed Out for a Rebound?

Microsoft’s stock price has recently experienced significant volatility, prompting investors to ask: has the stock price reached a bottom, and is it poised for a rebound?

The last time Microsoft approached this moving average was in October 2022, when the stock received strong support and subsequently surged. A similar situation now could indicate that more dip-buying investors will return to the market. For these investors, choosing the right platform to seize investment opportunities swiftly is crucial. We recommend using the multi-asset wallet BiyaPay, where users can regularly monitor Microsoft’s market performance and identify trading opportunities.

If you have concerns about funding inflows and outflows, BiyaPay can also be a professional solution for managing funds seamlessly. Whether recharging cryptocurrency to convert into USD or HKD, or withdrawing to a bank account, BiyaPay offers fast, efficient, and unlimited transactions, allowing investors to capitalize on opportunities without missing market shifts.

In addition, based on historical experience, Microsoft’s long-term investors often increase their positions when the stock price approaches critical support levels, leveraging market fear to secure more attractive entry points. Therefore, with Microsoft currently approaching the 200-week moving average, more long-term funds could be drawn in, providing strong support for future price rebounds.

While a bullish reversal signal is not yet confirmed, considering Microsoft’s still-strong fundamentals, I anticipate that its long-term performance will regain momentum.

In the short term, the Relative Strength Index (RSI) indicates that Microsoft’s stock may be in oversold territory. Typically, such market sentiment helps establish a stage bottom. From a technical perspective, Microsoft’s stock shows strong support, and market sentiment suggests rebound potential, especially near the long-term technical support level. This may present an ideal buying opportunity for investors.

Valuation Adjustment

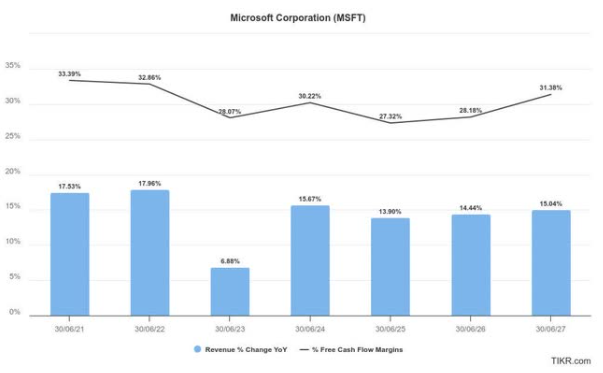

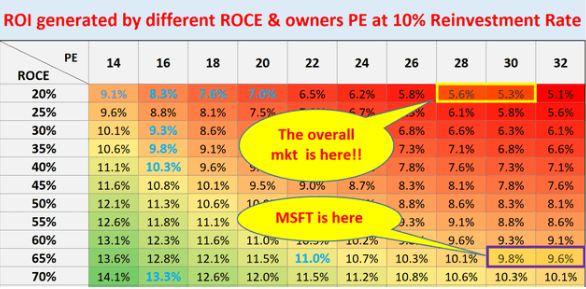

In terms of valuation, Microsoft’s forward P/E ratio is around 31x, and its Owner’s Earnings Yield (OEY) is approximately 3.2%. With an average Return on Capital Employed (ROCE) of 64.4% and assuming a reinvestment rate of 10%, its long-term growth rate is expected to reach 6.4%. This brings Microsoft’s total investment return to around 9%-10%, far surpassing the S&P 500 Index’s expected return (about 5%-6%). Despite the high valuation, Microsoft’s underlying growth potential is evident, providing investors with a stable growth outlook.

The valuation adjustment for Microsoft is directly related to market concerns about its AI investment returns. Given the high infrastructure costs and delayed profitability, the market has revised down its growth expectations for Microsoft. However, Microsoft’s diverse business structure, particularly its Azure cloud computing and AI solutions, still supports its notable valuation premium.

From an overall economic perspective, Microsoft’s Marginal Return on Capital Employed (MROCE) reaches 63.8%, significantly higher than most competitors. This figure highlights the scalability of its SaaS model and annuity-style income streams.

Furthermore, Microsoft’s PEG ratio is approximately 1.92, and the combination of AI commercialization, cloud expansion, and enterprise service deepening makes it relatively attractive.

Thus, the high valuation does not represent a bubble but rather recognition of Microsoft’s future technological leadership and growth potential. The recent price dip offers an attractive entry point for investors willing to accept short-term volatility, with the prospect of significant long-term returns.

Is Now the Best Time to Increase Holdings in Microsoft?

Is the current dip and technical support a good opportunity for investors to buy more Microsoft shares? Despite profitability pressures and competition, Microsoft’s long-term strategy and robust fundamentals suggest immense growth potential.

Microsoft’s current stock price is near its 200-week moving average support level—a historical entry point for long-term investors. Whenever prices approach this support, Microsoft often sees a strong rebound, especially when fundamentals are solid. The recent price correction hasn’t changed its leadership in cloud computing, enterprise software, and AI. The market’s concerns over AI’s investment cycle, resulting in short-term volatility, provide an attractive buying opportunity for long-term investors.

Technically, Microsoft’s Relative Strength Index (RSI) indicates the stock is in oversold territory, often a signal for a phase bottom. Therefore, for long-term investors, the current market conditions and technical signals may offer a good chance to increase holdings.

Microsoft’s Long-Term Prospects Remain Strong

Microsoft’s strategic initiatives in AI, cloud computing, and enterprise services continue to drive long-term growth potential. Through its deep partnership with OpenAI, Microsoft is working on commercializing AI technologies and integrating them into its core products such as Azure and Office 365. The popularization of AI is set to significantly enhance enterprise productivity and drive sustained revenue growth for Microsoft in the future.

Furthermore, Azure’s ongoing expansion has turned into a strong growth engine for Microsoft, especially as more companies accelerate their digital transformation. Microsoft’s enterprise software services also generate a steady income stream, providing robust support for the company’s overall financial performance.

In terms of Return on Capital Employed (ROCE) and reinvestment, Microsoft’s financial performance is impressive, signifying sufficient resources to continue innovation and business expansion, further solidifying its market position. Over the coming years, growth in multiple business segments is expected to drive overall profitability steadily upward.

In conclusion, the current price correction and technical support make this a compelling time for investors to consider increasing their Microsoft holdings. AI commercialization, Azure expansion, and ongoing enterprise services growth will all support Microsoft’s market-leading position. At the same time, stable shareholder return policies offer additional gains for long-term investors. Given short-term uncertainty, those who believe in the company’s long-term value may find now an opportune time to add to their positions.