- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

NVIDIA hits new high after four months! Blackwell reignites investment enthusiasm, can it ignite the

With the arrival of October, NVIDIA’s stock price has seen a significant increase. Especially on Monday, the company’s stock price hit a new high in nearly four months. This growth trend not only reflects the strong demand for its latest Blackwell GPU in the market, but also shows investors’ optimistic expectations for its future prospects. On that day, NVIDIA’s stock closed up by 2.43% to $138.07, breaking through the historical high of $135.58 on June 18, making its market value reach $3.39 trillion, second only to Apple, and becoming the second highest-valued company in the US stock market.

Driven by the continuous demand in the fields of artificial intelligence and advanced semiconductors, NVIDIA’s stock price has risen by more than 18% in the past two weeks since early October, with a nearly 180% increase this year. Since the beginning of 2023, its stock price has increased by more than nine times. All of this points to NVIDIA’s core position and technological advantages in the AI field, as well as the market’s high recognition of its sustained growth ability.

Why have stock prices risen recently?

The significant increase in NVIDIA’s stock price is mainly attributed to the following core factors, which comprehensively reflect the company’s market dynamics and outlook expectations.

Blackwell chip optimistic expectations boost stock price

NVIDIA CEO Huang Renxun recently announced that the Blackwell chip designed for the next generation of artificial intelligence applications has started full production, and the market has shown exceptionally strong demand for this new GPU. It is expected that this chip will bring billions of dollars in revenue to NVIDIA in this fiscal quarter, reflecting its technological leadership in the high-end GPU market.

In addition, Morgan Stanley’s latest market report also shows that the pre-orders for this chip have been fully loaded for the next 12 months. This sustained strong demand not only proves the high recognition of the market for NVIDIA’s innovation ability, but also is a key factor driving the recent stock price rise. Companies including Microsoft , Meta, Google and Amazon are buying NVIDIA’s GPUs in large quantities to build larger and larger computer clusters for their advanced artificial intelligence work.

Analysts at Mizuho said that Nvidia accounts for a large part of the billions or even billions of dollars that top technology companies spend on artificial intelligence construction each year, and the company controls about 95% of the artificial intelligence training and inference chip market.

It is worth mentioning that Nvidia’s revenue has more than doubled in each of the past five quarters, with at least three quarters of growth.

In addition , analysts expect NVIDIA’s revenue to more than double this fiscal year and grow another 44% next fiscal year, and Wall Street continues to raise its earnings and profit expectations for NVIDIA.

Strong growth prospects have sparked market enthusiasm

In addition to the optimism about the future of Blackwell chips, the recent sales performance of TSMC , a key foundry partner of NVIDIA chips, also reflects the strong demand for AI in the market. TSMC’s recent data shows that its revenue in September reached a record NT $2518.7 billion, a year-on-year increase of 39.6%. This significant growth not only reflects the surge in demand for NVIDIA chips, but also reflects the booming development of the entire AI market.

In addition, some media pointed out that the current round of NVIDIA’s stock price rise began on October 2nd. On that day, OpenAI announced the completion of a new round of huge financing of $6.60 billion, with a valuation of $157 billion. It is said that NVIDIA also participated in the investment. Among the financing obtained by OpenAI, a large number of them are expected to “flow back” to NVIDIA, because OpenAI’s energy demand continues to grow and the number of AI chips that need to be configured also increases.

At the same time, with the release of the OpenAI o1 model, the growth in demand for inference computing power has brought new growth space to NVIDIA. The above report by Morgan Stanley believes that inference computing will boost long-term demand for AI chips. It is expected that NVIDIA will have strong performance in 2025 and sees 2026 as the early stage of the long-term investment cycle.

In addition, analysts also predict that NVIDIA’s revenue may more than double this fiscal year and grow by 44% in the next fiscal year. These factors together have stimulated the market’s enthusiasm for NVIDIA’s future growth potential, further driving up its stock price.

What are the potential increases in stock prices in the future?

NVIDIA’s advantage in the AI hardware market is obvious, with a market share of up to 90% in the global data center GPU market. This dominant position is due to its continuous innovation and optimization in graphics processing unit (GPU) technology. With the rapid penetration of AI and Machine Learning applications in various industries, the demand for high-performance computing solutions is also growing. NVIDIA has consolidated its market leader position by continuously launching innovative products to meet these demands.

The release of Blackwell GPU marks a new milestone for NVIDIA in the high-performance AI processor market. This GPU has attracted widespread attention in the industry for its excellent computing power and energy efficiency ratio, and is considered the next generation benchmark product for data centers. Blackwell’s design focuses on optimizing the processing efficiency of large-scale AI models, making them more efficient in complex computing tasks. With the acceleration of AI computing demand from enterprises and Cloud as a Service providers, Blackwell GPU is expected to drive further expansion of NVIDIA in the data center market.

Considering the expanding influence of AI technology in the global economy, NVIDIA has great potential to achieve new stock price highs in the future with its leading position in the AI hardware field. The demand for AI chips in the market is growing exponentially, especially in areas such as autonomous driving, Cloud Services, and big data analysis. In addition, with the market acceptance and application scope of innovative products such as Blackwell GPU expanding, NVIDIA’s revenue and profits are expected to continue to grow. These factors, together with NVIDIA’s deepening Competitive Edge in the AI market, provide a solid foundation for its long-term stock price rise.

Valuation and investment advice

Understanding NVIDIA’s financial expectations and potential valuation is crucial when evaluating its investment value. NVIDIA’s current valuation reflects the market’s high recognition of its technological innovation and market leadership. Analyzing the current stock price and future earnings potential can guide investment.

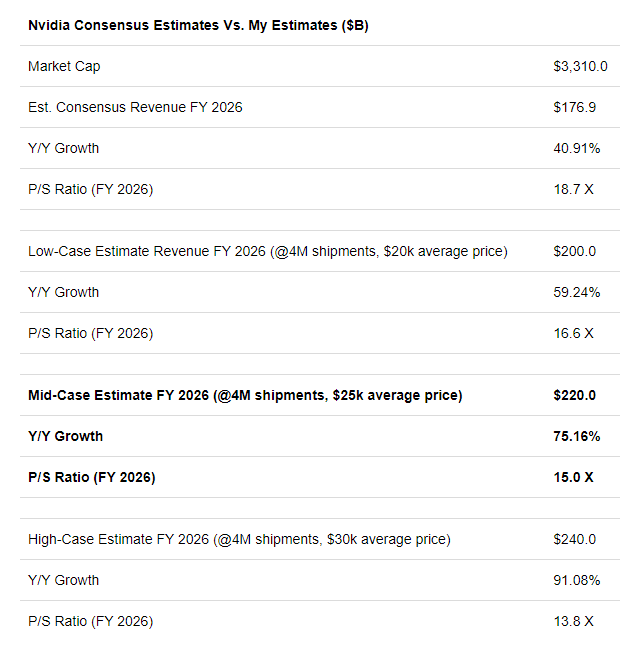

Analysis shows that NVIDIA is expected to achieve $176.92 billion in revenue in fiscal year 2026, but this may underestimate the incremental revenue contribution related to Blackwell GPUs. If Blackwell’s revenue increases by $80 billion next year, NVIDIA’s total revenue in fiscal year 2026 is expected to exceed $200 billion, far exceeding market expectations. In the scenario of incremental revenue reaching $100 billion (assuming Blackwell’s average selling price is $25,000), NVIDIA’s revenue may reach $220 billion, about $43 billion higher than current expectations. In the most optimistic forecast, total revenue may reach $240 billion, about $63 billion higher than expected.

The positive estimate of NVIDIA’s Blackwell shipment growth will significantly affect its valuation. If NVIDIA can achieve much higher revenue than generally expected, its expected Price-To-Sales Ratio will also significantly decrease. Currently, NVIDIA’s stock trading price is 18.7 times the expected Price-To-Sales Ratio (based on general expectations). The intermediate estimate means that the revised Price-To-Sales Ratio is 15.0 times, which is lower than the current market expectation of about 20%.

Due to the expected growth rate of sales far exceeding expectations, the market may experience a situation similar to the beginning of 2023, when NVIDIA’s data center GPU-driven revenue acceleration was not fully understood by the market. In recent research, it was predicted that NVIDIA’s fair value had been raised to $148 per share, which has almost been achieved. After reviewing the forecast again, it can be seen that NVIDIA’s revenue growth will also significantly exceed market expectations. According to the forecast of a 75% year-on-year revenue growth for the 2026 fiscal year, the growth of earnings per share may be between 40-50%, far exceeding the current market consensus. Using the 35 times Price-To-Earnings Ratio, the median estimated earnings per share for fiscal year 2026 is $5.80 (compared to the consensus expectation of $4 per share), which translates to a fair value of about $203 per share, indicating a potential upside of about 45%.

From the perspective of valuation and growth potential mentioned earlier, NVIDIA is a worthy investment choice. Interested investors can go to BiyaPay to buy NVIDIA. Of course, if you feel that the current stock price is too high, you can also monitor the trend of the stock on the platform and find a more suitable time to get on board.

In addition, BiyaPay can also be used as a professional tool for depositing and depositing US and Hong Kong stocks. You can exchange digital currency for US dollars or Hong Kong dollars by recharging, quickly withdraw to your bank account, and then transfer the funds to other brokerage accounts to buy stocks. The platform has a fast arrival speed and no limit, so you won’t miss investment opportunities.

Risks faced

When evaluating investment opportunities in NVIDIA, investors must also consider the latent risks associated with it. Despite the company’s outstanding performance in the AI market, there are several key risk factors that may affect its long-term success and stock price performance.

NVIDIA’s leading position in the data center GPU market is facing increasingly fierce competition. Rivals such as AMD are actively launching competing products, such as the Instinct MI325X AI accelerator, directly targeting NVIDIA’s main market. In addition, as other tech giants such as Google and Amazon increase their investment in their own AI chip development, market competition will become more intense. NVIDIA needs to continue to innovate and improve its product line to maintain its market advantage and respond to these competitive pressures.

Furthermore, in an industry where technology iterates rapidly, today’s technology stars may soon be replaced by emerging technologies. Although NVIDIA maintains its leadership in graphics processing and AI processors, any delay or failure in new technology development could quickly affect its market position. The company must continue to invest in research and development and ensure that its technology not only keeps up with the times, but also leads the industry.

Finally, NVIDIA’s current high valuation requires its performance to continue to be excellent to support it. The market’s expectations for its performance have been placed at a very high level, and any performance disclosure that does not meet expectations may cause sharp fluctuations in the stock price. If the global economy slows down or the market’s enthusiasm for technology stocks decreases, NVIDIA, as an overvalued company, may face significant Downside Risk.

Overall, NVIDIA’s leading position in the artificial intelligence hardware market and the launch of Blackwell GPU have laid a solid foundation for the company’s future growth, which is expected to bring sustained revenue and market value growth. However, potential market competition, technological iteration, global economic and policy uncertainty, and high valuation are risks that need to be carefully considered when investing in NVIDIA. For long-term investors, NVIDIA’s prospects are promising, but it is necessary to closely monitor the company’s performance and market changes to make wise investment decisions.