- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Trump Media Stock Rally: Can the Launch of New Streaming App Truth+ Save the Decline?

Recently, the stock price of Trump’s Trump Media & Technology Group (DJT) has surged against the trend, increasing by 146% from its low, with a more than 6% increase in the night session yesterday, attracting widespread attention from investors and the market.

Previously, the company faced many challenges such as declining revenue and user loss, but this rebound is aggressive. Is it the launch of the new streaming app Truth+ TV that brings good news, or is it a final sprint before the election? Is it a short-term speculative sentiment or does it mean the company’s business is back on track?

New Challenges and Opportunities in the Streaming Battleground

The recent sudden increase in the stock price of Trump Media & Technology Group may be driven by several main reasons. First, the company’s new streaming app Truth+ TV has been launched, which is a good benefit for the company’s fundamentals and business development, and the stock price can also benefit. Truth+ TV provides video services such as news, entertainment, and faith-based content, which expands the company’s media business and also triggers investor expectations and optimism. Since the app was launched on October 10, 2024, DJT’s stock price has continued to rise, which to some extent indicates that the market is full of expectations for this new product.

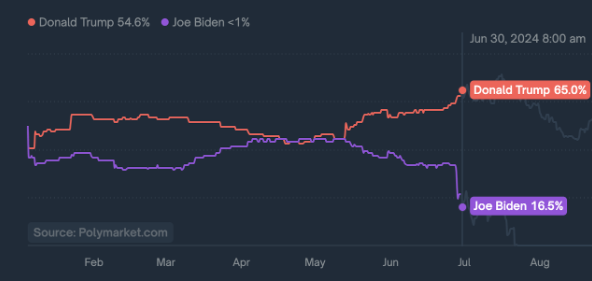

Of course, Truth+ TV may not be the only reason for the stock price increase. According to RealClearPolitics polls, as of October 14, Trump’s election rate has reached 54.1%, surpassing Harris’s 44.9%. Such political prospects also have a great impact on the company, enhancing investor confidence. In addition, Musk has also publicly supported Trump on several occasions and invested a huge amount of $47 million in his election campaign. In the final sprint stage before the official voting on November 5 in the upcoming U.S. presidential election, these political events have given DJT stock a lot of support.

Although the new app and political factors have driven up the stock price in the short term, the company still faces very fierce competition. In the streaming media market, giants like Netflix, Disney+, and Amazon Prime have already firmly occupied a dominant position. Truth+ TV hopes to find its own audience by attracting Trump supporters and some controversial content, but it is very uncertain whether such a strategy will be effective in the long term.

However, the launch of Truth+ TV has indeed brought new opportunities for the company, but in the competitive streaming media market, whether it can truly bring sustained revenue growth depends on whether users will stay in the long term.

In summary, although market sentiment brought by political factors has driven up the stock price in the short term, it remains to be observed whether it can be transformed into long-term financial benefits. Investors need to rationally evaluate and continue to focus on the company’s core business and market competitiveness.

Core Business in Trouble: Users Not Buying In?

Despite the recent attention gained by Trump Media & Technology Group through the launch of Truth+ TV and political influence, the company’s core business still faces huge challenges.

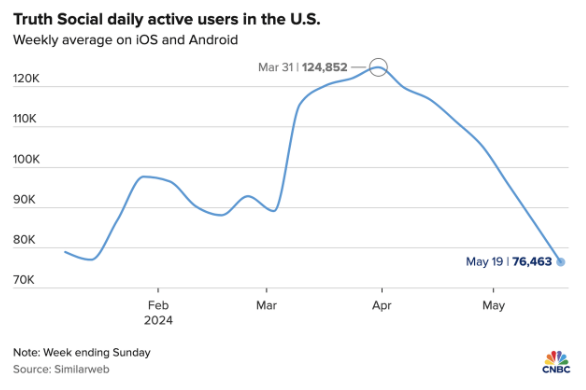

First, the user growth problem of the Truth Social platform remains very serious. According to the company’s latest data, the number of active users on the platform has not increased significantly with the heating up of political events, but has decreased in some periods.

Although the Truth Social platform claims to have more than 2 million active users, this data is negligible compared to other social platforms. Facebook’s monthly active users have exceeded 2.9 billion, and Twitter (now X) also has more than 368 million active users. This huge gap indicates that Truth Social has not attracted enough users, especially the continuous growth of new users.

One of the main reasons for the weak user growth of Truth Social is the singularity of content and the suboptimal user experience. Most of the content on the platform focuses on politics and right-wing conservative views, which limits the platform’s ability to attract more users from different backgrounds. In contrast, other mainstream social media platforms offer more diverse content and interaction methods, which can better meet the needs of different audiences.

Therefore, despite the huge influence of Trump himself on the platform, it has not significantly increased user activity. Many users may register out of political interest but do not stay on the platform long-term, which is very unfavorable for the platform’s growth.

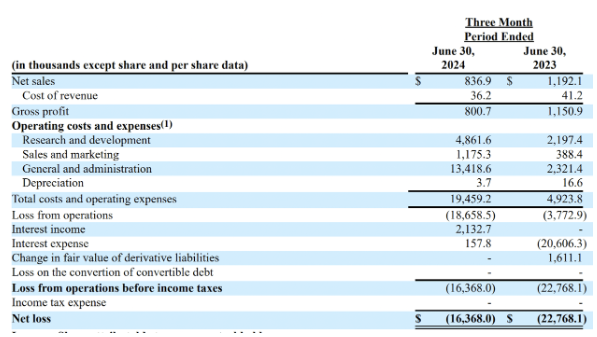

When it comes to advertising revenue, this part is also worrying. As of the end of August, Trump Media & Technology Group’s quarterly advertising revenue was only $8.369 million, a year-on-year decrease of 30%, and the company’s operating loss has expanded to $18.7 million. Advertisers want platforms with large traffic, and the activity and user base of Truth Social obviously cannot compare with those old-school social platforms. Therefore, advertisers will not rush to spend money on it, let alone the platform’s advertising fees are not cheap.

To cope with these difficulties, Truth Social is also trying to improve user retention by adding new features and expanding content types. For example, the recently launched Truth+ TV is an attempt to make the platform more interesting by adding more entertainment and video content. But the question is, it is still uncertain whether this strategy will really work.

Although political heat and new apps have brought a lot of attention to the company in the short term, if the company wants to achieve stable development and sustained stock price increases, it needs to make breakthroughs in its core business. Improving user experience, enriching content types, and attracting more advertisers are all issues that the company must solve in the future. Otherwise, this round of stock price increases may just be an ephemeral phenomenon.

Political Trump Card: How Far Can Trump’s Influence Go?

The increasing possibility of Trump’s re-election is a “political trump card” for Trump Media & Technology Group (DJT).

According to RealClearPolitics poll data, as of October 14, Trump’s election probability has risen to 54.1%, surpassing Harris’s 44.9%. This data indicates that the market’s expectation of Trump’s return to politics is gradually increasing, and investors are also taking a keen interest in businesses related to him. The stock has increased by 15.76% since July 10. The promotion of political factors has filled DJT’s stock with a significant “star effect.”

However, it needs to be emphasized that whether this growth, which relies on the political halo, can continue in the long term, there is still a lot of uncertainty. Although Truth+ TV and Trump Media & Technology Group can attract attention in the short term by leveraging Trump’s political power, whether they can convert this traffic into stable commercial value is still a big question mark.

If we compare Trump’s election probability with the platform’s user growth, we can see that as the possibility of Trump becoming the 47th president continues to increase, this political enthusiasm has not obviously transformed into user growth.

Data from CNBC shows that in the spring and early summer, despite the rise in Trump’s election chances, the platform traffic of Truth Social has shown a downward trend. It can be seen that Trump’s political charm seems to have not effectively transformed into a user base for the platform.

Many people who plan to support Trump do not actually use Truth Social. This exposes a big problem: many of Trump’s target users and most enthusiastic fans do not use his own social platform. For a company that hopes to achieve a high degree of product-market fit, this is undoubtedly a very serious challenge.

According to the company’s latest financial report, net sales in the third quarter decreased by 30% year-on-year, only $8.369 million, while operating losses expanded to $18.7 million. Even with the halo of the election, the company’s business fundamentals have not been significantly improved.

At the same time, U.S. laws have strict regulations on the commercial behavior of political figures and their related businesses. If Trump is really re-elected, Trump Media & Technology Group may be subject to more policy constraints and public supervision. This means that the company may face more compliance pressures and business restrictions in the process of expanding its business.

Although the political trump card has indeed brought significant impetus to the company’s stock price in the short term, from a long-term perspective, the company still needs to improve the independence and stability of its own business.

It is difficult to maintain long-term healthy development by relying solely on political events and the influence of individual people. The company needs to build more diversified and sustainable sources of income. In the streaming media business, Truth+ TV needs to compete with market giants like Netflix and Disney+, and in terms of social platforms, Truth Social also needs to find a breakthrough to attract more non-political stance users.

Bubble and Risk Behind High Valuation

The launch of Truth+ TV indeed made the company shine in the short term, and the stock price also soared. The stock price rises quickly,and the valuation also rises with the tide, but the question is, is such a high valuation really reliable?

At present, DJT’s price-to-book ratio (P/B) is as high as 14.17, more than seven times the industry median of 1.93. This price-to-book ratio is like riding a rocket, relying more on investors’ “beautiful illusions” of Trump’s halo and Truth+ TV.

However, illusions are beautiful, but reality is a bit cruel. Looking at the company’s financial data, net sales in the third quarter decreased by 30% year-on-year, only $8.369 million, while operating losses further expanded to $18.7 million - it’s really a snowball effect. This means that despite the assistance of Truth+ TV, the company’s revenue situation has not been significantly improved and is still struggling to make a profit.

To be honest, such a high valuation seems a bit shaky. After all, in the streaming media market, giants like Netflix and Disney+ have already occupied a dominant position, and it’s not easy for Truth+ TV to snatch a share. Moreover, attracting users is one thing, but how to keep users is a bigger challenge. After all, people can see a large number of high-quality dramas on Netflix, so why choose Truth+ TV?

Looking at the valuation issue again, if DJT’s price-to-book ratio is reduced to a 25% premium over the industry median, then the stock price may have to go down significantly, and the correction may reach 82.97%. What does this mean? It means that investors who bought at a high price may be in for a roller coaster ride.

Moreover, the company’s current advertising revenue situation is not very good. The lack of user activity on the Truth Social platform naturally does not attract advertisers, resulting in heavy pressure on the company’s revenue and cash flow.

Truth+ TV indeed attracted a lot of attention to DJT in the short term, and the stock price was also pushed up. But the problem is that there is not enough solid financial support behind this high valuation. If market expectations cannot be realized, the stock price is likely to return to a level closer to the actual fundamentals. For investors, whether the current valuation is reasonable, it is necessary to calmly analyze the company’s financial performance, market competition pattern, and user growth and other actual situations, rather than making decisions solely based on the political halo and the launch of new apps.

High risk, high return, DJT may be an exciting choice, but be prepared for a “roller coaster” mentality.

Short-term Rebound or Long-term Opportunity?

Combining the stock price counterattack, the launch of new apps, and the challenges of core business, we can see that the increase in Trump Media & Technology Group’s stock price is more driven by market sentiment and political factors, rather than improvements in the company’s fundamentals. The launch of Truth+ TV and Trump’s personal political influence have indeed brought short-term benefits to the company, but to rely on these factors to achieve long-term stable growth still faces many tests.

At present, the company faces challenges such as weak user growth, insufficient advertising revenue, and the risks behind high valuation. In the increasingly competitive market of streaming media and social platforms, DJT needs to make breakthroughs in user experience, content richness, and commercialization capabilities to stand out, not just relying on the short-term attention brought by the political halo.

For investors, DJT represents an investment opportunity with both high risk and high return. If the company can make breakthroughs in its core business, improve user activity, and increase advertising revenue, its future growth potential remains considerable. However, if it fails to break through the current predicament, this round of stock price increases may just be an ephemeral phenomenon. Investors should carefully evaluate the company’s long-term growth capabilities and the current valuation level, remain rational in the highly volatile market, and avoid unnecessary losses due to blind speculation.