- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Elon Musk's FSD Robotaxi May Turn into a Pipe Dream, $67 Billion Vanishes: What Did Tesla’s Launch E

Last Thursday, Tesla finally held its long-anticipated Robotaxi launch event. After a two-month delay, Musk introduced the latest autonomous taxis, CyberCab and Robovan, along with the flashy humanoid robot, Optimus. Initially, it was a futuristic mobility event brimming with tech innovations, with Musk ambitiously hoping the event would “go down in history.”

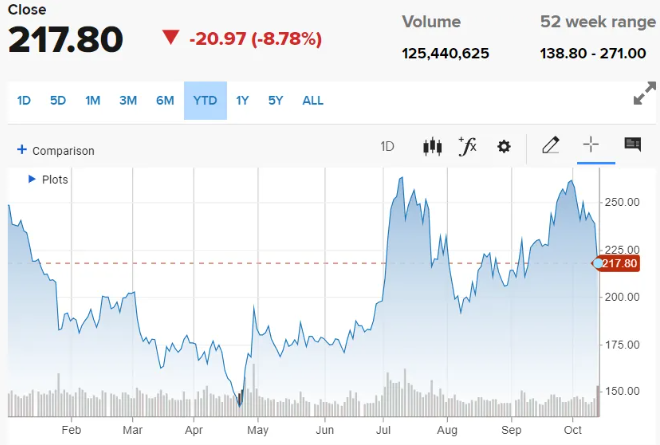

However, the stock market’s reaction was far from what anyone expected—Tesla’s stock plummeted 9% the next day, pouring cold water on what was supposed to be a groundbreaking event.

Today, we’ll walk you through the key takeaways from the launch, why Tesla’s stock faced a sharp decline, and highlight the “bright spots” that were overshadowed by market sentiment. Finally, from an investor’s perspective, we’ll discuss Tesla’s long-term vision and whether Musk can truly achieve his goal of transitioning from a “car company” to a “tech giant.”

Why the Market Paid So Much Attention to the Robotaxi Event

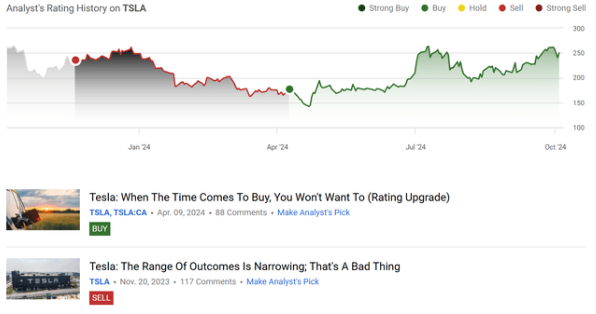

Before diving into the Robotaxi launch, we need to look at Tesla’s overall stock performance. Over the past six months, despite some volatility, Tesla’s stock has trended upward. With such strong stock performance, many might assume Tesla has been posting stellar financial results lately. However, that’s not the case—in fact, Tesla’s fundamentals are less than impressive.

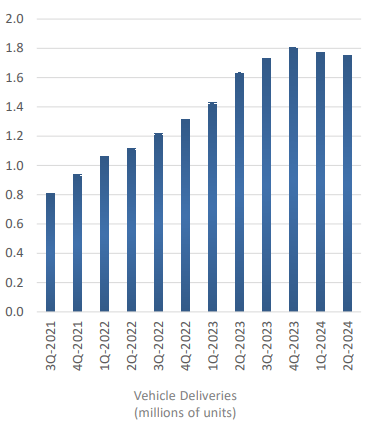

Tesla recorded poor sales results for two consecutive quarters. In Q1, vehicle sales revenue dropped 13% year-over-year, and in Q2, that figure declined another 10%. Even worse, the company’s gross margin, a key metric the market watches closely, fell to 14.6%, its lowest point since the pandemic. These two quarters represent Tesla’s worst performance in the past four years.

Yet, despite these underwhelming business results, the stock continued to rise. The driving force behind this phenomenon is the market’s high expectations for the Robotaxi launch.

So, why would a launch event have such a massive impact on a company’s stock price? It boils down to Tesla’s unique investment logic.

Over the past few years, Tesla’s stock price has been heavily influenced by its vehicle sales. While the company has numerous exciting ventures—autonomous driving, Robotaxi, humanoid robots, etc.—the key factor determining Tesla’s stock price is one thing: how well the cars are selling.

When car sales are strong, the stock rises, and the grandiose stories that seem like pipe dreams to some can further fuel market sentiment and push the stock higher. Conversely, when car sales falter, no matter how thrilling the announcements may be, the stock struggles to gain traction.

Earlier this year, Tesla’s stock performance was quite lackluster, even becoming the worst performer in the S&P 500 index at one point. The reason was simple—poor car sales. This has always been Tesla’s investment logic, a truth well known to veteran shareholders.

The market had extremely high hopes for this event, viewing it as a pivotal moment in Tesla’s transformation.

For years, Tesla has been spinning the tale of autonomous driving and Robotaxi. The significant progress of FSD this year, coupled with the successful deployment of Waymo and Cruise’s robotaxis, filled the market with optimism. Add to that Musk’s high-profile promotions, and this event seemed like it could finally turn those distant dreams into reality.

The market was hoping to see a clear commercialization roadmap from Tesla. Even if Robotaxi couldn’t be rolled out immediately, a well-defined roadmap and timeline would allow investors to value it accordingly. The results of this event would directly influence Tesla’s future investment logic. If Tesla could successfully shift from being primarily a car company to a tech company focused on AI technology, its valuation and stock price outlook would look entirely different.

Now that the event has concluded, what changes did it bring to Tesla?

Stock Plunge: Tesla Faces Investor Disillusionment

At the event, Musk showcased two fully autonomous electric vehicles: CyberCab and Robovan, along with the humanoid robot Optimus.

CyberCab is a fully autonomous taxi with no steering wheel or pedals. Its interior is minimalist, featuring just a row of seats and a large screen, allowing passengers to relax or work during the ride without worrying about driving. Robovan, on the other hand, is an autonomous minibus that can carry up to 20 passengers, designed for group travel or flexible transport scenarios, offering a glimpse into the future of intelligent transportation.

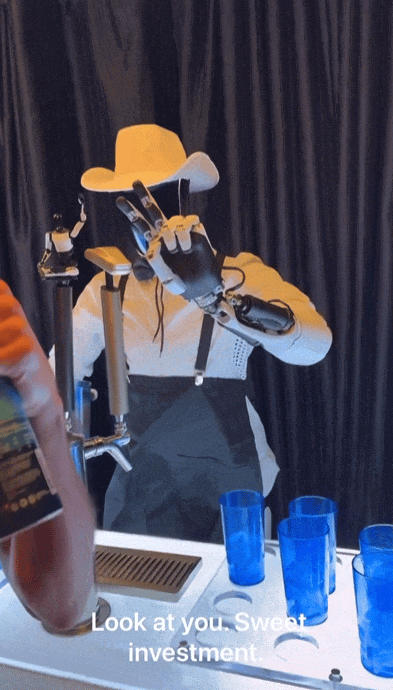

Besides these vehicles, Tesla also introduced the humanoid robot Optimus, which not only performed dance routines but also showcased skills like bartending and playing rock-paper-scissors, energizing the event. Optimus is designed for future multifunctional use, such as household assistants or factory workers, reflecting Tesla’s ambitions in AI and robotics.

Although these new products were packed with futuristic elements and entertainment, the market reaction was less than enthusiastic. So, why did this seemingly exciting event spark such intense disappointment from the market?

The Harsh Reality Behind Robotaxi Technology

During the event, Musk gave a grand introduction to CyberCab and Robovan—two vehicles filled with futuristic technology, even “cool” by some standards.

But the market wasn’t too excited about the hardware; investors were more interested in the underlying technology and whether it could truly be implemented. They were hoping for a clear Robotaxi commercialization roadmap and updates on FSD technology, but the event failed to deliver. Musk didn’t provide a concrete future plan or timeline, leading many investors to question Tesla’s future development direction.

Tesla’s competitors Waymo and Cruise have already commercialized robotaxis in several cities, while Tesla’s autonomous driving technology has made little progress, leaving the Robotaxi project without a clear launch plan. The market was understandably unimpressed by this lagging performance.

Thus, the central issue of this Robotaxi launch lies in whether Tesla’s vision-only autonomous driving technology has made significant progress. Investors wanted to see updates on FSD iteration, the next-generation autonomous driving capabilities, and clear timelines for achieving L3 or L4 autonomous driving. Even if Tesla had provided just a detailed PPT with answers to these questions, investors would have responded positively.

A Flash in the Pan or the Same Old Promises?

During the event, Musk briefly mentioned a long-awaited highlight for investors—Tesla’s fully autonomous driving system, FSD—stating that it would eventually enable driverless operations in California and Texas.

These vague promises reminded many of Musk’s past unfulfilled visions. He neither provided specific explanations nor revealed a clear technological roadmap or data to support his claims. In fact, Musk has made such promises five years ago, three years ago, and even last year.

However, despite Musk’s limited mention of FSD during the event, it’s undeniable that FSD has made remarkable progress over the past year. Since the introduction of FSD v12, which incorporates a large AI model, Tesla’s autonomous driving technology has improved significantly. Though it’s still not on par with Waymo’s localized achievements, it’s enough to keep investors hopeful about its commercial prospects. So, could Musk seize this opportunity to present a viable commercialization plan for Robotaxi?

Before the event, Goldman Sachs had already predicted that Tesla was partially ready for commercialization and even suggested adopting a model similar to Waymo or China’s Baidu Apollo Go, with technicians remotely overseeing taxis and taking control when issues arise, gradually achieving full autonomy.

But Musk, being who he is, clearly doesn’t take the “gradual” path. The CyberCab he presented has no steering wheel, no pedals, and not even rearview mirrors. It seems like his way of telling us: Tesla is going all-in, with no compromises. As for the commercialization of Robotaxi, the only specific plan Musk mentioned was the production of CyberCab starting in 2027. Even then, he added a caveat, admitting that this timeline might be optimistic.

Many investors are growing weary of these “blank checks,” which has only fueled their concerns, damaging short-term confidence in Tesla.

The Overlooked Bright Spot Buried by Fearful Market Sentiment

After the event, while Robotaxi left the market feeling somewhat disappointed, there was one bright spot not to be overlooked: the humanoid robot Optimus. If the Robotaxi section left investors with mixed emotions, then Optimus was undeniably the highlight—perhaps even the saving grace—of the event.

In reality, Optimus showed significant progress during this event. Though some might dismiss it as just a “robot show,” industry insiders will understand the importance of what’s happening behind the scenes.

What we saw in Optimus—dancing, bartending, and interacting with people—may seem like simple entertainment, like a bar waiter mingling with guests. However, these actions were meant to demonstrate the robot’s flexibility and hardware capabilities, particularly its joint mobility and precise motion control. Don’t be fooled by the playful displays; this was Optimus showcasing its technical prowess, especially in hand movements—a particularly challenging area in robotics and a crucial indicator of its potential applications.

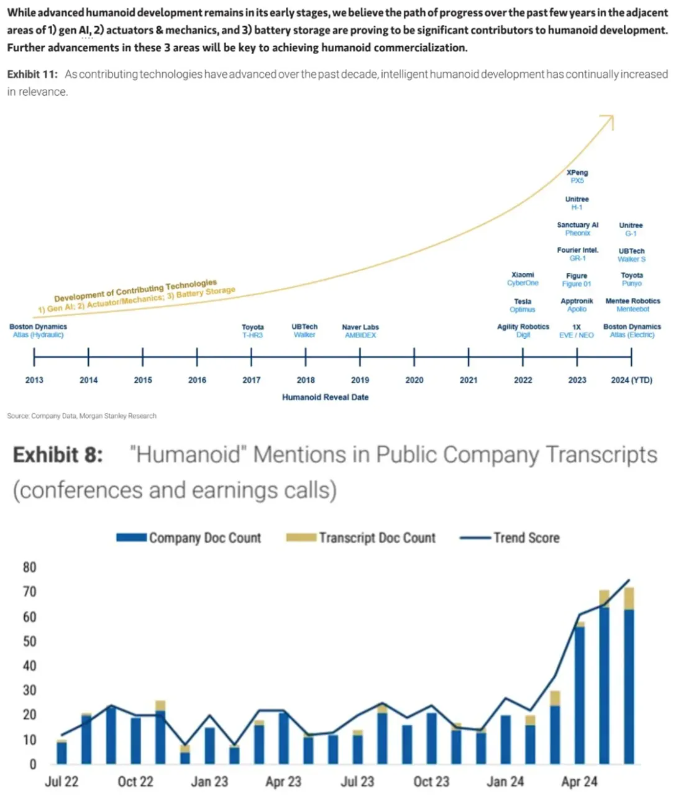

Because of its impressive hardware, Optimus opened up a wide range of future use cases, making investors take its commercial potential seriously. Additionally, it’s worth noting that humanoid robots have recently become a new trend in the capital markets, with many companies now incorporating robots into their “big vision” plans.

The data supports this observation. In the past two years, humanoid robot products have emerged in an “explosive” manner, and the mention of robots in company earnings reports has been steadily increasing, making robots one of the hottest topics in the capital markets.

In this race, Tesla remains the industry leader. Optimus has a massive edge, not just due to its robust hardware, but also because of Tesla’s strong software capabilities. At its core, Optimus is powered by a sophisticated AI model with two key features—vision recognition and end-to-end control. These happen to be the technologies Tesla has been developing for years in the autonomous driving field.

Therefore, autonomous driving is the perfect “testing ground” for Optimus, and Tesla’s accumulated expertise in these areas gives Optimus a substantial lead over competitors.

In the long run, Tesla is undeniably the company most likely to dominate this new trend. It is currently the only company capable of combining hardware and software to bring AI into the physical world and has the capacity for large-scale production. The launch of Optimus will undoubtedly provide a significant boost to Tesla’s investment value. While the Robotaxi section of the event may have fallen short of market expectations, Optimus gave investors confidence in Tesla’s continued potential at the cutting edge of technology.

Tesla’s Transformation: A Long Road Ahead

From an investor’s perspective, Tesla’s event felt more like a show—designed to capture public attention rather than satisfy investors, leaving many feeling underwhelmed.

The Robotaxi demonstration didn’t offer any groundbreaking innovations, no surprises, no new technological breakthroughs, and certainly no fresh, exciting narrative. It seemed like the event was merely fulfilling expectations, coming across as both unremarkable and lacking in substance, especially for those familiar with Tesla’s internal workings, making it particularly disappointing.

From an investment standpoint, this event didn’t add any real value to the Robotaxi business. The project remains at about the same stage as one or two years ago—still a far-off dream, with no immediate signs of commercial realization. However, don’t forget that, leading up to the event, Tesla’s stock surged 40% in just three months, driven largely by market expectations of Robotaxi’s success.

Now, the disappointing event has made that stock surge appear precarious. Once the bubble bursts, those inflated expectations could turn into a significant short-term downside risk for the stock. In such a market environment, how investors manage risk and maintain liquidity becomes crucial.

Some might say Wall Street’s reaction is exaggerated, but from an investor’s standpoint, these risks are hard to ignore.

The event clearly sent a message: FSD will not achieve a major breakthrough within the next year, and Robotaxi won’t be commercialized within the next two years. With no clear path to commercialization, Tesla’s current investment logic likely reverts to the old “car sales determine stock price” narrative—Tesla’s biggest short-term weakness.

Many investors had hoped this event would mark a turning point for Tesla’s transformation, helping it shift away from reliance on vehicle sales and gradually evolve into a tech company. However, the reality is, this event only reinforced the importance of the car sales business. This outcome significantly increases short-term risks—no clear commercialization plan, no substantial technological breakthroughs, and mounting performance pressures make Tesla less attractive to institutional investors. In the current “rate-cutting + soft landing” market environment, more attractive alternatives are easier to draw funds away, so it’s no surprise that institutions may start dumping Tesla stock in large numbers.

As such, now may not be the best time to bottom-fish Tesla. With risks on the rise, it’s unwise to increase exposure to risk. However, as retail investors, we have our own advantage—our risk tolerance is stronger than that of institutional investors when the stock price falls to a reasonable valuation range.

If you believe in Tesla’s long-term vision, the next six months could be an excellent time to enter. So for now, holding your position and waiting for the right moment may be the best strategy.