- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Microsoft's stock price has pulled back. The AI revenue target of 35 billion US dollars is within re

Microsoft is redefining the rules of the technology field with artificial intelligence! As cooperation with OpenAI continues to deepen, Microsoft has turned Azure and Microsoft 365 into the core drivers of the AI revolution, pushing the boundaries of technological progress. Azure’s market share continues to expand. Copilot integrates AI into daily office work. Microsoft is completely changing people’s work and lifestyle.

This growth is also reflected in the stock price - currently Microsoft’s stock price has pulled back to about 416 US dollars after reaching a recent high, triggering market discussions on its future valuation.

Azure and AI: The Furious Engine Driving Microsoft’s Growth

The rapid development of Azure and AI has become the core driving force for Microsoft’s growth.

Azure’s market share continues to expand. In 2024, the growth rate reached an astonishing 29%, far exceeding major competitors Amazon AWS and Google Cloud. According to Microsoft’s fourth-quarter fiscal year 2024 earnings report, the revenue of Azure and other cloud services reached 28.5 billion US dollars, a year-on-year increase of 19%. By expanding global data centers and adding AI services, Microsoft has further consolidated Azure’s competitiveness in the enterprise cloud computing field.

Microsoft’s cooperation with OpenAI is even more powerful. By deeply integrating OpenAI’s technology on the Azure platform, Microsoft not only enhances Azure’s market competitiveness in the AI field but also applies these AI technologies to Microsoft 365. The success of products such as GitHub Copilot and Microsoft 365 Copilot is the best manifestation of this integration. In 2024, the adoption rate of GitHub Copilot increased by 180% year-on-year, driving the overall revenue of GitHub and accounting for more than 40% of revenue growth. The application of Microsoft 365 Copilot also significantly improves enterprise office efficiency, making the automation of many daily tasks as simple and natural as using an “AI assistant”.

Azure’s strong performance is not only reflected in the growth of customer numbers but also in the degree of customer dependence on Microsoft’s AI tools.

For example, large enterprises such as Coca-Cola have signed multi-year cooperation agreements with Microsoft, reflecting these customers’ high trust in Azure and AI products. By the end of March 2024, the number of Azure Arc customers increased to 33,000. This snowballing demand for AI and cloud services indicates that Azure will continue to expand its influence in the enterprise cloud computing market in the coming years.

In the long term, Microsoft’s expected revenue from AI-related businesses is very considerable. According to the company’s estimate, by 2027, AI-related revenue is expected to exceed 35 billion US dollars.

This figure means that Microsoft is ensuring its leading position in the AI wave through forward-looking investment and deep technological integration.

In addition, Microsoft promotes the growth of its other core businesses through AI, especially in the AI integration of Microsoft 365 and Azure, significantly changing the way enterprise users work. The Copilot tool in Office 365 makes tasks such as data analysis and content creation more intelligent and efficient, as if providing each user with a personal AI consultant.

According to the company’s earnings report, the revenue growth driven by Azure and AI has become one of the main reasons for Microsoft’s excellent overall performance and will still be the core engine driving growth in the next few years.

Return Behind Huge Investments: How Does Microsoft Win the Future with AI?

To maintain a leading position in the fields of AI and cloud computing, Microsoft is making unprecedented huge investments, committed to expanding infrastructure and enhancing AI capabilities.

In recent years, Microsoft has invested a large amount of money globally for data center construction and GPU procurement:

Invested 2.9 billion US dollars in Japan; Invested 3.16 billion US dollars in the UK to enhance infrastructure; Invested 4.3 billion US dollars in France to expand data centers and plans to deploy up to 25,000 GPUs by the end of 2025; Invested 3.3 billion US dollars in Wisconsin, the United States, for AI and cloud computing infrastructure construction.

Not only that, Microsoft also cooperates with BlackRock and plans to raise up to 100 billion US dollars for the construction of AI data centers and energy infrastructure. These measures fully demonstrate Microsoft’s ambition in technology layout and aim to maintain its leading position in the fields of cloud computing and AI.

These huge investments are mainly concentrated in the fields of AI and cloud infrastructure. The core goal is to ensure that Azure has sufficient expansion capabilities in the face of fierce competition and improve the functions and performance of AI tools in Microsoft 365. In 2024, Microsoft invested about 16 billion US dollars in the expansion of generative AI in data centers, and it is expected that this investment will exceed 20 billion US dollars by 2027. With such large-scale capital expenditures, Microsoft is creating favorable conditions for revenue growth in the next few years and ensuring its leading position in the AI field.

According to research by Microsoft in cooperation with IDC, companies that invest in AI can obtain a return of 3.5 US dollars for every 1 US dollar invested on average, and some leading enterprises can even obtain a return of up to 8 US dollars for every 1 US dollar invested.

As Frank Gens, the chief researcher of IDC, said: “Microsoft’s investment in AI and cloud computing not only has a leading technological advantage but also creates significant added value for enterprise customers. The expected return on investment in the future will far exceed the industry average level.” In 2024, Microsoft achieved about 5.3 billion US dollars in revenue through generative AI, and by 2027, this figure is expected to grow to 35 billion US dollars or more.

One of Microsoft’s core strategies is to integrate AI functions into its flagship product Microsoft 365, including the launch of tools such as Copilot, which will create new value-added revenue sources for Microsoft.

The rapid growth of GitHub Copilot shows that AI tools have been widely recognized and adopted in the developer community. In 2024, its user number increased by 180% year-on-year and accounted for more than 40% of GitHub’s total revenue growth. Microsoft 365 Copilot also performs well in enterprise office scenarios, bringing significant efficiency improvements to users.

A report by PwC emphasizes the significant impact of Microsoft’s investment strategy on the AI and cloud infrastructure industries.

John Hawksworth, chief economist of PwC, said: “Microsoft’s large-scale investment globally, especially its cooperation with OpenAI, is redefining enterprises’ perception of cloud computing and AI. Microsoft’s infrastructure expansion and deep integration of AI technology may significantly promote the efficiency improvement of the entire industry and lay a solid foundation for future business growth.”

Although these large-scale investments have brought certain pressure to Microsoft’s financial situation in the short term, their long-term return potential is also significant.

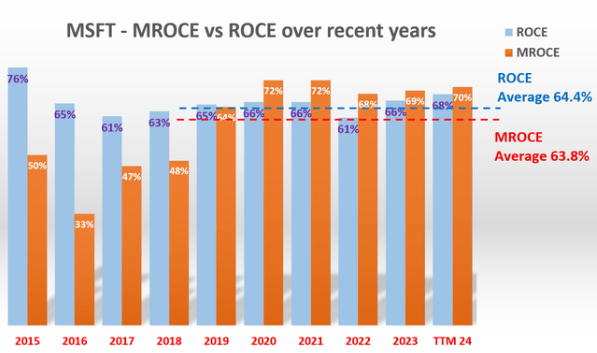

Microsoft’s return on capital employed (ROCE) and marginal return on capital employed (MROCE) have always remained at a high level, which also means that the company performs well in effectively using these funds and can obtain considerable returns from its investments.

In the medium and long term, these strategic investments will further enhance Microsoft’s technological strength in the AI field and consolidate its leading position in the market.

Through large-scale investment in infrastructure globally, Microsoft not only consolidates Azure and AI’s market leadership but also lays the foundation for its future growth. As more enterprise customers turn to Azure and Microsoft 365 to take advantage of the efficiency improvement brought by AI, Microsoft will continue to dominate this AI revolution.

The return behind huge capital expenditures is gradually becoming clear. Microsoft is winning the future through AI and opening up its own technological new era.

Challenges of High Valuation and Microsoft’s Growth Potential

During Microsoft’s strong growth in 2024, its stock price has also been rising. Currently, its stock price has pulled back to around 416 US dollars. Although Microsoft’s price-earnings ratio is as high as 36 times, which may seem overvalued to some investors, its underlying growth momentum and market potential cannot be ignored.

Although the strong performance of Azure and AI has brought extensive market trust to Microsoft, it also makes investors have different views on Microsoft’s future growth path.

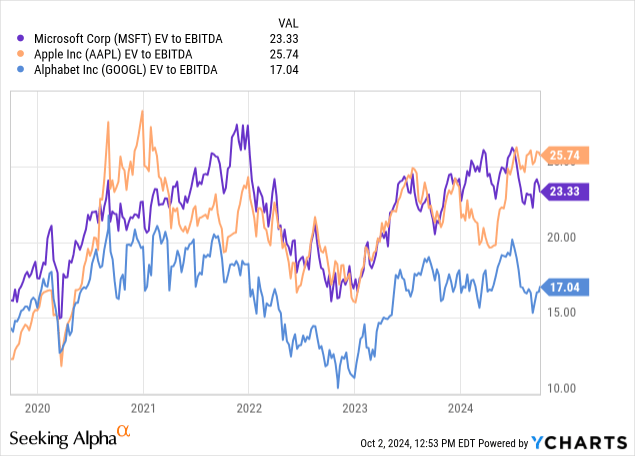

Before the release of first-quarter earnings, it is worth comparing Microsoft’s valuation with other members of the Big Three, namely Apple and Google:

Based on the above situation, Microsoft is temporarily less attractive in valuation than Google, and Apple’s current valuation is obviously too high. But I think there are sufficient reasons to hold Microsoft.

Microsoft has a reliable and strong free cash flow generation ability, and the free cash flow growth rate is expanding. The annual growth rate of cash flow has increased from an average of 12.7% in the past five years to 14.8%, while the same data for Google has dropped from 20.7% to 15.2%.

This difference shows that Microsoft’s performance in free cash flow growth is more stable and stronger than its main competitors.

Therefore, I think Microsoft’s current valuation is reasonable. Given Microsoft’s extremely powerful position in the field of artificial intelligence at present, I believe that once its moat is reliably established, its free cash flow generation ability will further enhance over time. Its SaaS (Software as a Service) business model has a strong scale economy effect and can achieve continuous revenue growth at a lower marginal cost in the long term.

The revenue of Microsoft 365 continues to grow, and businesses such as LinkedIn and GitHub also show strong profitability. In particular, the significant effectiveness of AI functions (such as Copilot) in Microsoft 365 in improving enterprise efficiency has greatly increased customer stickiness and further consolidated Microsoft’s dominant position in the office field.

Compared with other technology companies such as Google, Microsoft’s growth momentum does not only rely on advertising revenue but is based on a diversified product portfolio and strong AI technology.

Therefore, despite the high valuation, Microsoft, with its stable cash flow and diversified revenue sources, still has strong anti-risk ability in a volatile market environment.

Is Now a Good Time to Invest in Microsoft?

In the current macroeconomic environment, investors have different views on Microsoft’s high valuation, but we cannot ignore Microsoft’s significant advantages in the fields of cloud computing and AI. Now, Microsoft’s stock price is around 416 US dollars, which is in the stage of a pullback from a recent high. This provides investors with an opportunity to reconsider their investment layout.

According to a report evaluation by JPMorgan Chase, Microsoft can not only maintain market leadership in the short term but also has significant medium- and long-term growth potential, especially in the context of accelerated enterprise transformation and upgrading and automation processes.

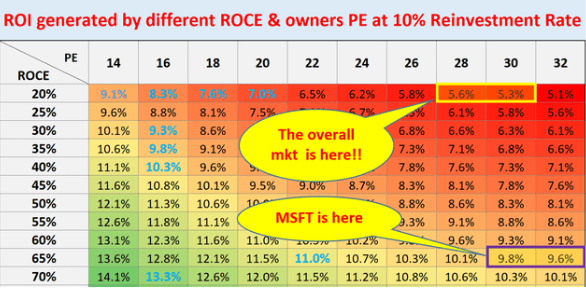

Microsoft’s expected price-earnings ratio is about 31 times, equivalent to an owner earnings yield (OEY) of about 3.2%. Combined with an average return on capital employed (ROCE) of 64.4%, assuming a reinvestment rate of 10%, its long-term growth rate is expected to be about 6.4%. This makes Microsoft’s total return on investment about 9% to 10%, far higher than the expected return rate of the S&P 500 index (about 5% to 6%).

From the chart, the marginal return on capital employed (MROCE) of the overall economy is far lower than Microsoft’s 63.8%, which reflects the significant scalability advantages of Microsoft’s SaaS model and annuity-style income streams.

Therefore, for long-term investors, behind the high valuation is not a bubble but the manifestation of Microsoft’s future technological leadership and revenue growth potential. The current stock price pullback provides an attractive entry point for investors who are willing to bear certain short-term fluctuations and is expected to bring considerable long-term returns.