- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Q3 financial report countdown! ASML's stock price turning point is approaching, may it rebound? How

In the global semiconductor equipment market, ASML stands out with its unique technological advantages and market position. However, since reaching its stock price peak in July 2024, ASML’s stock performance has consistently underperformed its semiconductor peers and has also performed poorly relative to the S & P 500 Index, which has somewhat disappointed investors.

Despite the challenges, ASML’s management is confident in achieving a revenue target of 30 billion to 40 billion euros by 2025. Additionally, ASML is about to release its latest financial report on October 16th, Eastern Time, which is expected to continue its growth momentum. Let’s see if it is worth investing in.

Leading technological advantages, large R & D investment

As a leader in the global semiconductor equipment market, ASML’s unique extreme ultraviolet (EUV) lithography technology has become the key to high-end chip production. Its EUV technology enables chip manufacturers to produce smaller, more complex, and higher-performance chips, which is crucial for meeting the needs of modern technologies such as artificial intelligence, big data processing, and high-performance computing.

The launch of EUV lithography technology marks the pinnacle of ASML technological innovation. This technology supports chip manufacturers to achieve finer pattern etching and is key to achieving chip manufacturing at 5 nanometers and below. Currently, only ASML can provide this advanced equipment globally, and its almost monopolistic market position provides the company with strong pricing power and market influence. In addition, due to the complexity and high threshold of EUV technology, it is expected that ASML will maintain this market monopoly in the foreseeable future. ASML’s continuous investment in research and development is one of its core strategies to maintain its market leadership position. The company invests a large amount of funds in research and development every year to ensure that its technology stays ahead of rapidly developing market demand. These research and development activities not only include optimizing existing EUV technology, but also developing new lithography technologies and improving the performance and efficiency of existing machines.

ASML has set a clear technological development roadmap, including further pushing the limits of EUV technology and developing next-generation lithography technology. The company is researching more efficient production processes and lower energy consumption equipment designs to meet increasingly stringent environmental standards and manufacturing efficiency requirements. In addition, with the rise of Quantum Computing and photonics, ASML is also exploring lithography applications in these emerging fields.

These technological advantages and continuous innovation efforts enable ASML not only to maintain its leadership position in the traditional semiconductor market, but also to seize the commanding heights of future technological development. Despite the increasingly fierce market competition, ASML’s technological accumulation and innovation capabilities will continue to be an important guarantee for its commercial success.

The growth potential of the AI field

Recently, OpenAI’s new model O1 and NVIDIA’s Blackwell chip have made breakthrough progress in improving computing efficiency. The optimization of the O1 model in complex task inference processing, especially in scientific research, programming, and mathematical problem solving, demonstrates a huge demand for high-performance processing capabilities. This demand directly drives the demand for ASML lithography machines, as only advanced manufacturing technology can produce chips that can support these complex applications.

NVIDIA’s Blackwell chip design, especially in improving the performance of AI model operation efficiency, indicates that the dependence on ASML technology will further deepen. The production of these chips requires ASML’s advanced EUV lithography technology, especially the support for major customers such as TSMC, which will continue to create huge revenue opportunities for ASML.

OpenAI CEO Sam Altman mentioned the global demand for more chip manufacturing facilities, as well as the news that TSMC and Samsung are collaborating to build new wafer fabs in the Middle East, further strengthening ASML’s important position in global semiconductor production facilities. With the increasing reliance on advanced manufacturing technology, ASML’s market potential is huge. It is expected that in the next few years, ASML’s EUV technology will play a core role in global emerging wafer fab projects, which will significantly drive the company’s long-term growth.

Combining these factors, ASML’s growth potential in the AI field is not only reflected in its current technological advantages, but also in its key role in future AI development. With the continuous progress and application expansion of AI technology, ASML is expected to continue to gain sustained growth momentum from its core technology areas.

The Q3 financial report is about to be released, and expectations are positive

As a leader in the semiconductor equipment industry, ASML’s financial performance is the focus of market attention. In the past few years, despite facing challenges from macroeconomic fluctuations and industry cyclical adjustments, it has still maintained strong revenue growth and profitability.

ASML’s quarterly financial report, which will be released on October 16th, has attracted much attention from the market. Analysts generally predict that ASML’s revenue in the new quarter will increase significantly, reaching 7.161 billion euros, an increase of about 7.2% compared to the same period last year. This growth is mainly due to the strong demand for its extreme ultraviolet (EUV) lithography technology in global wafer fabs.

Earnings per share are also expected to increase, with an expected earnings per share of 4.86 euros, slightly higher than the same period last year, an increase of 1.08%. This growth reflects the company’s achievements in optimizing Operational Efficiency and controlling costs. In a highly competitive market environment, ASML continues to consolidate its industry leadership position through technological innovation and market expansion.

The release of financial reports is not only a display of financial data, but also a window for ASML’s technological progress and market strategy updates. Investors and analysts will pay special attention to the sales dynamics of EUV equipment and the company’s latest progress in high numerical aperture EUV technology. These technologies are key to the company’s future growth potential and are crucial for maintaining its market advantage.

In addition to financial results, ASML’s management is expected to provide insights into future market trends and the company’s response strategies. This includes an assessment of current challenges in the global semiconductor industry, such as supply chain issues and their potential impact on ASML’s production and delivery capabilities. The management’s forward-looking statements will have an impact on investor confidence and the market’s assessment of ASML’s stock price.

If ASML can meet or exceed these financial expectations, it may further enhance investors’ confidence in the company and drive up stock prices. However, any results that do not meet expectations may also put pressure on the stock price, testing the market’s belief in ASML’s future growth potential.

Valuation analysis

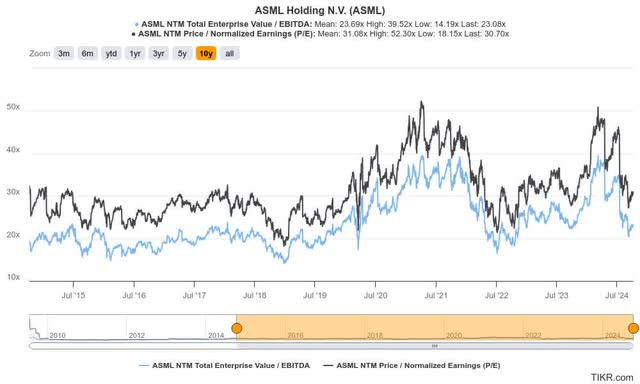

In the semiconductor equipment industry, ASML, as a technology leader, often receives close attention from investors for its market valuation. Current market data shows that ASML’s valuation has returned to its ten-year historical average level. According to the latest data, ASML’s forward-adjusted EBITDA multiple is stable at 23.1 times, which is very close to its ten-year average of 23.7 times. This indicates that the market’s valuation of ASML has taken into account industry standards and the company’s long-term profitability potential.

In addition, ASML’s forward-adjusted earnings multiple is currently 30.7 times, slightly higher than the median of its peers in the wafer equipment manufacturing field of 29 times. This slightly higher valuation reflects the market’s expectation for ASML to continue to play a key role in the advancement of semiconductor manufacturing technology. Although the market’s pessimism has a certain impact on the valuation, the company’s fundamentals and technological advantages maintain a high evaluation among its peers.

From a long-term investment perspective, ASML’s current valuation provides a reasonable level that reflects its technological leadership and market demand growth. With the continuous growth of global demand for advanced semiconductor equipment, especially in the fields of artificial intelligence and high-performance computing, ASML is expected to continue to generate stable returns from its core technology areas.

Given the current market environment and ASML’s strategic position, the company’s stock valuation may provide an attractive opportunity for investors seeking to invest in advanced manufacturing technology. Although short-term market fluctuations may affect stock price performance, in the long run, ASML’s technological innovation and market leadership position provide solid value support for its stock.

If you are optimistic about this long-term investment opportunity and the current low stock price may be a good opportunity, you can go to BiyaPay to buy ASML. Of course, you can also monitor the trend of the stock on the platform and find a more suitable time to get on board.

In addition, BiyaPay can also be used as a professional tool for depositing and depositing US and Hong Kong stocks. You can exchange digital currency for US dollars or Hong Kong dollars by recharging, quickly withdraw to your bank account, and then transfer the funds to other brokerage accounts to buy stocks. The platform has a fast arrival speed and no limit, so you won’t miss investment opportunities.

Risks faced

Although ASML is a leader in the semiconductor equipment industry, its operations and financial performance still face various latent risks. These risks may not only affect the company’s short-term performance, but also have an impact on its long-term Market Positioning.

ASML’s core business relies on its technological advantage in extreme ultraviolet (EUV) lithography technology. However, the speed of technological iteration is very fast, requiring the company to continue to invest heavily in research and development to maintain its leading position. Although there is currently no direct competitor in the market that can match ASML in EUV technology, rapid technological progress and potential new entrants may pose a threat in the future. In addition, technological failures or major defects may lead to loss of customer trust, affecting the company’s reputation and financial performance.

ASML’s sales are highly dependent on a few large chip manufacturers such as TSMC, Intel, and Samsung. Fluctuations in orders from these customers have a significant impact on ASML’s revenue. If the purchasing strategies of these major customers change or their market demand decreases, it may directly affect ASML’s sales performance.

The complexity of the global supply chain poses challenges to ASML’s production efficiency and cost control. Any interruption in the supply chain, such as raw material shortages, manufacturing delays, or transportation issues, may affect the company’s delivery capacity and profit margin. In addition, the efficiency of the supply chain directly affects production costs and the final price of products. Poor management may lead to cost increases, thereby eroding profit margins.

As a high-tech company, ASML needs to effectively protect its technical secrets and intellectual property rights. Any technology leakage may benefit competitors and threaten ASML’s market position. In addition, intellectual property disputes and related legal proceedings may result in significant financial and operational burdens.

Investment advice

Given ASML’s technological leadership and broad market prospects in the semiconductor equipment field, its stock provides investors with an attractive investment opportunity. The company’s continuous innovation and ability to explore new markets enable it to remain competitive in the face of industry challenges.

For investors considering adding positions or holding ASML stocks, it is important to observe market trends and company performance. You can continue to pay attention to relevant events in the future and do a good job of tracking and evaluation.

Although ASML offers significant growth potential, investors should also be aware of the risks involved in investment, including increased market competition, the speed of technological updates, and global economic fluctuations. Investors should carefully evaluate these factors based on their own risk tolerance and investment objectives.

ASML’s market position, technological advantages, and ability to face future challenges make it a focus of attention in the semiconductor industry. The company’s role in driving technological innovation and meeting global semiconductor demand indicates its long-term growth potential. For investors seeking to invest in high-tech and high-growth industries, ASML is a worthy investment target.