- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

AMD goes all out! Unveiling the latest AI processors in Advancing AI 2024. Where is the next growth

With the explosive growth of the AI market, AMD is gradually becoming an important player, especially in the data center GPU and AI solution sectors. Recently, AMD announced that it will hold the “Advancing AI 2024” event. It is expected to showcase the next-generation AMD Instinct™ accelerator and the fifth-generation AMD EPYC™ server processor, providing the market and investors with an excellent opportunity to observe its AI roadmap and technological progress.

This event is not only a stage for AMD to showcase technological innovation but also a crucial step for it to regain market confidence in the fierce competition. The 2024 third-quarter earnings conference call that follows further increases market expectations for AMD, especially playing an important role in whether it can consolidate its position in the data center GPU field. These two events have a significant impact on AMD’s long-term success and short-term stock price increase.

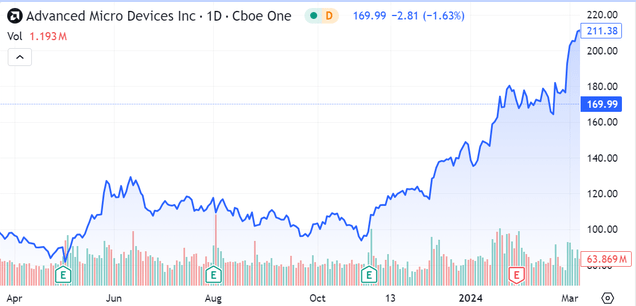

In the past six months, AMD’s stock price has mostly been in a sideways trend but with high volatility. In the past month, with the strong market focus on AI chip demand, AMD’s stock price has seen a significant increase.

Facing the “crazy demand” triggered by NVIDIA’s new generation of Blackwell series GPUs, AMD needs to prove its competitiveness and growth potential in the AI hardware field to the market through this event. Therefore, whether AMD can seize the opportunity at this critical moment in the coming months will become a key focus for investors.

Why is the Advancing AI 2024 event very important for AMD?

The “Advancing AI 2024” event to be held by AMD in San Francisco on October 10, 2024, is considered an important milestone on AMD’s path of AI development.

AMD has been committed to providing GPU accelerators that are more cost-effective than NVIDIA. This event is an opportunity for AMD to convey this message to the market.

One of the most important parts of this event is to showcase the latest AMD Instinct and EPYC product lines. The Instinct series AI accelerators and EPYC server processors are AMD’s core competitiveness in the AI and data center markets. Through this event, AMD will show the new features and improvements of MI300X and MI325X to the outside world, emphasizing its advantages in memory capacity, bandwidth, and computing performance, especially in the context of meeting the market’s demand for more efficient and high-performance AI computing.

The release of the MI300 series accelerator is regarded as AMD’s response to NVIDIA’s strong competition, especially in the field of AI computing accelerators. The competition between the two companies in terms of performance and price is becoming increasingly fierce. AMD hopes to attract enterprise users who cannot afford NVIDIA’s high prices by emphasizing the high cost-performance ratio of its products.

After AMD’s stock price has experienced a period of sideways movement, this “Advancing AI 2024” event is regarded as an opportunity to revive investor confidence. Investors and institutions will closely follow this event to understand whether AMD’s technological strength in the AI field can compete with NVIDIA or is approaching its opponent’s status.

Facing NVIDIA’s continuous leadership in the AI hardware field, AMD must show its product development progress to prove its competitiveness in data centers and AI solutions. This event is crucial for sending the signal that “AMD can gain a firm foothold in the AI battlefield” to the market and is likely to directly affect the market’s judgment on AMD’s long-term development prospects.

This event also has a certain leading influence on AMD’s short-term stock price performance. The latest analysis report from Goldman Sachs points out that the news about MI325X and MI350X in this “Advancing AI 2024” event may become an important factor driving stock price increases.

Morgan Stanley also mentioned in its investor briefing that investors should closely watch how AMD showcases the performance and price advantages of its new products to determine whether it can further narrow the gap with NVIDIA in the AI hardware market. If AMD can successfully showcase the technical advantages of its products and make investors confident in its market prospects, the stock price is expected to have significant upward room in the short term.

The 2024 third-quarter earnings conference call that follows will also provide investors with an opportunity to further understand AMD’s performance in the data center and AI markets and further influence its stock price trend. After a similar event in 2023, AMD’s stock price increased by 12% within a week after the conference, indicating that the market responded positively to the release of new products. Therefore, after this event, investors generally expect that if the showcase is successful, AMD’s stock price is expected to be further supported and increase in the short term.

Growth potential of data center GPUs: Can AMD catch up with NVIDIA?

In the field of data center GPUs, AMD is working hard to narrow the gap with NVIDIA, especially by continuously innovating and expanding its product line to increase market share. This conference is the first time AMD has introduced its products to the market. The biggest problems lie in product sales and functionality. Before the conference begins, investors already know that NVIDIA’s CEO, Jensen Huang, has emphasized the “crazy demand” for the upcoming Blackwell GPU.

AMD faces the biggest problem of how its roadmap can keep up with the new Blackwell GPU. AMD provided the following general AI GPU roadmap before the conference:

MI300: On the market. MI325X: Q4’24 - The accelerator will have industry-leading memory capacity and bandwidth, which are 2 times and 1.3 times better than competitors respectively, and the computing performance is 1.3 times better than competitors. MI350X: 2025 - The new AMD CDNA™4 architecture is expected to be launched in 2025. Compared with the AMD Instinct MI300 series, the AI inference performance will be increased by 35 times. MI400: 2026 - AMD CDNA “next generation” architecture.

At the Computex conference, AMD released an updated AI GPU roadmap for the first time and made some significant statements. CEO Lisa Su predicted that the Instinct MI350 series will be better than the Blackwell Ultra version Blackwell 200 to be released in 2025.

The market will naturally focus a lot of attention on product updates and comparisons with competitors. But in the end, favorable comparisons need to bring stronger growth, or at least there is an opportunity for such growth.

The released MI325X and MI350X are regarded as AMD’s direct competitive products in response to NVIDIA’s new generation of Blackwell series. Compared with competitors, AMD’s MI325X has advantages in memory capacity, bandwidth, and computing performance. According to AMD, MI325X’s memory capacity is twice as high as NVIDIA’s similar products, the bandwidth is 1.3 times higher, and the computing performance is also increased by 1.3 times.

AMD continues to exert efforts on the MI series products. Its purpose is to gain more market share with reasonable price and performance advantages in the face of NVIDIA, especially for enterprise customers who cannot afford NVIDIA’s high GPU costs. By emphasizing the high cost-performance ratio of the MI series, AMD hopes to occupy a place in the AI market.

Although NVIDIA still holds a leading position in the AI chip field at present, AMD is gradually attracting customers who are sensitive to cost but need high-performance GPUs through its competitive prices and continuously optimized product roadmap. According to the report of HSBC analyst Frank Lee, if AMD can successfully release MI350X and maintain the cost-performance advantage of its products, its market share will reach 15% in 2025, an increase of 8 percentage points compared to 2024.

Impact of product layout on the market

The competition in the data center GPU field is an important factor in determining the future market status of both AMD and NVIDIA.

AMD has gradually increased its layout in the data center market in the past few years. The release of its MI series, especially the launch of MI325X and MI350X, will enhance its competitiveness in the data center field.

According to Goldman Sachs’ research report, AMD’s progress in the data center market is one of the main driving forces for its future stock price growth.

Goldman Sachs predicts that if AMD can successfully execute its product roadmap and launch the MI series GPU as planned, its stock price is expected to increase by 20% in 2025. Interested friends can use the multi-asset wallet BiyaPay to view AMD’s future market trends and choose trading opportunities.

Goldman Sachs believes that AMD will gradually expand its market share in the reasonably priced AI GPU market, especially with increasing attractiveness among small and medium-sized enterprise customers.

Where is the next catalyst?

Although AMD’s overall performance still has not reached NVIDIA’s level, the importance of the MI series products for the company’s revenue growth has been generally recognized by analysts. According to the latest market forecast, AMD’s AI revenue in 2024 is expected to reach 5.1 billion US dollars, achieving significant growth compared to 2023.

Since mid-2023, AMD’s revenue growth curve has been relatively stable. Although the growth momentum has not been interrupted, the market still lacks confidence in AMD’s stock, which has led to a downward trend in the stock price for most of this year. With the arrival of the fourth quarter, the market has high expectations for the MI325 series to be released on October 10.

This event may become an important turning point in AMD’s stock price trend. The latest research report from Citibank points out that AMD’s AI product release will support the short-term stock price, especially the long-awaited MI325 accelerator, which may help maintain the current rebound trend.

However, this event alone is not enough to boost investor sentiment in the long term. It can only help the stock price stabilize at the current level temporarily. The next real major catalyst will be the third-quarter earnings report on October 29.

Analysts from Credit Suisse emphasize that this earnings report will be an important opportunity for AMD to prove whether it can achieve continuous breakthroughs. Whether it is the stability of revenue growth or the market share of data center products, it will have a profound impact on AMD’s stock price trend.

From the data of the past few quarters, AMD’s data center GPU and CPU revenue has performed well but still has shortcomings. As can be seen from the 10-Q report for the second quarter of 2023, the MI300 accelerator was not mentioned at that time. By the third quarter of 2024, revenue began to show growth (quarter-on-quarter rather than year-on-year). The MI300 series was mentioned for the first time in the report, but it was mainly related to shipping supervision to China. In the fourth quarter of 2024, with the launch of the MI300X accelerator, AMD’s data center revenue reached 2.3 billion US dollars, an increase of 38% compared to the previous period.

This is also the period when AMD’s stock price performed the strongest. Although the quarterly results did not meet market expectations, AMD’s stock price still broke through 210 US dollars, setting a new historical high. However, this uptrend did not continue, and the stock price has been hovering below 180 US dollars.

Although data center revenue increased to 2.8 billion US dollars in the second quarter of 2024 and the sales of MI300 were booming, pushing data center revenue to increase by 115% year-on-year, the stock price failed to maintain its previous high, and there was significant price volatility in the market, eventually leading to the 25% rebound I mentioned earlier.

Therefore, the third quarter of 2024 becomes a critical moment for AMD’s success or failure. The event on October 10 is a crucial first step. This is not only a window for new product releases but also an opportunity to revive market confidence. The market performance of MI325 may become the beginning of AMD’s stock price breaking through the long-term dilemma. Any delay will dampen market sentiment and even affect the overall performance at the end of the year. At this stage, the only thing that can support investor confidence in AMD is this event and its subsequent conference call release.

Major risks and challenges

The rapid growth of the AI chip market provides AMD with huge opportunities, but there is still uncertainty about whether future demand growth can continue. The global AI market size is expected to reach 400 billion US dollars in 2027. However, if the demand does not explode as expected, AMD’s growth expectations will be impacted.

Analysts from UBS Group pointed out that if the future growth rate of AI market demand is lower than expected, AMD’s market share will face continuous pressure, which will weaken market confidence in its long-term growth.

Because compared to NVIDIA, AMD’s gap in market share makes it more vulnerable to demand changes.

Rise of emerging competitors

As the AI market expands, emerging companies such as Cerebras Systems are rapidly rising and posing a threat to traditional GPU manufacturers. Cerebras Systems focuses on high-performance AI computing, and its chips have shown unique advantages in AI training. In addition to Cerebras, there are other startups competing to develop AI hardware, which means that the competition will become increasingly fierce.

AMD needs to ensure its competitiveness in the face of these emerging rivals through continuous technological innovation and reasonable pricing. Unlike NVIDIA, AMD’s market position is not yet solid enough, and emerging competitors may pose a more direct threat to it.

In addition, the increase in foundry costs also creates pressure. As a fabless semiconductor company, AMD relies on foundries such as TSMC for chip manufacturing. However, as TSMC continuously increases foundry costs, AMD’s manufacturing expenses are also under pressure. According to reports, the cost of TSMC’s N2 wafers has reached 30,000 US dollars, which directly threatens AMD’s gross margin.

In this case, AMD must find ways to reduce production costs while maintaining product performance to maintain market competitiveness.

Is it a good time to invest in AMD?

With AMD’s continuous investment in the AI and data center fields, I still think it is a good time to invest in AMD.

In the short term, AMD’s stock price performance is being positively affected by the “Advancing AI 2024” event. This event has brought positive evaluations to the company’s product prospects. The latest analysis from Goldman Sachs believes that this conference has played a key role in maintaining AMD’s rebound in the past month. The upcoming MI325 series is regarded by the market as an important product that offers a cost-effective alternative to NVIDIA’s Blackwell, especially having great attractiveness in the construction of AI infrastructure for small and medium-sized enterprises.

Although the market is highly volatile, this optimistic sentiment about product launches is expected to continue to support stock prices in the coming months. The third-quarter earnings report will also be released on October 29. Analysts from Credit Suisse pointed out that this may be a key catalyst for AMD’s stock price to rise further. In the short term, positive market sentiment and technical factors make AMD have a good investment opportunity at present.

In the medium and long term, AMD’s growth potential remains strong, especially after MI325 and MI350 gradually enter the market. Although there is still a gap compared to NVIDIA, AMD is becoming one of its closest competitors. The launch of MI325 is a very attractive choice for enterprises that cannot afford NVIDIA’s high hardware costs.

In the long term, the reasonably priced AI GPU accelerator market is actually larger than the potential market for NVIDIA’s high-end hardware, which gives AMD an advantage in cost performance.

Considering the success of AMD’s cost-performance strategy in the AI market, its products are not only for large enterprise customers but more importantly for small and medium-sized enterprises. IDC’s spending guide also shows that AI spending in the financial services, software and information services, and retail industries will increase significantly in the next few years, providing a broad growth space for AMD’s product line. Especially for enterprises with relatively tight funds, under high debt costs, they may be more willing to choose AMD’s solutions to achieve AI transformation.

Although AMD’s stock price fluctuates greatly in the short term, I still maintain a bullish attitude towards its long-term growth prospects. AMD’s technological progress and continuous investment in the MI series indicate that it has the ability to expand its market share in the future AI market, especially in the field of cost-effective hardware. With the launch of MI325 and the gradual implementation of subsequent products, AMD is expected to continue to attract more cost-sensitive customers and gain a firm foothold in the fierce market competition.

Therefore, I think this is a good time to invest in AMD, especially for investors who are willing to bear short-term fluctuations and are optimistic about long-term growth potential. As the AI market expands, AMD is expected to become one of NVIDIA’s closest competitors and provide significant return potential for its investors.