- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

TSM's Q3 expectations are positive, AI is accelerating its layout, and the growth potential is amazi

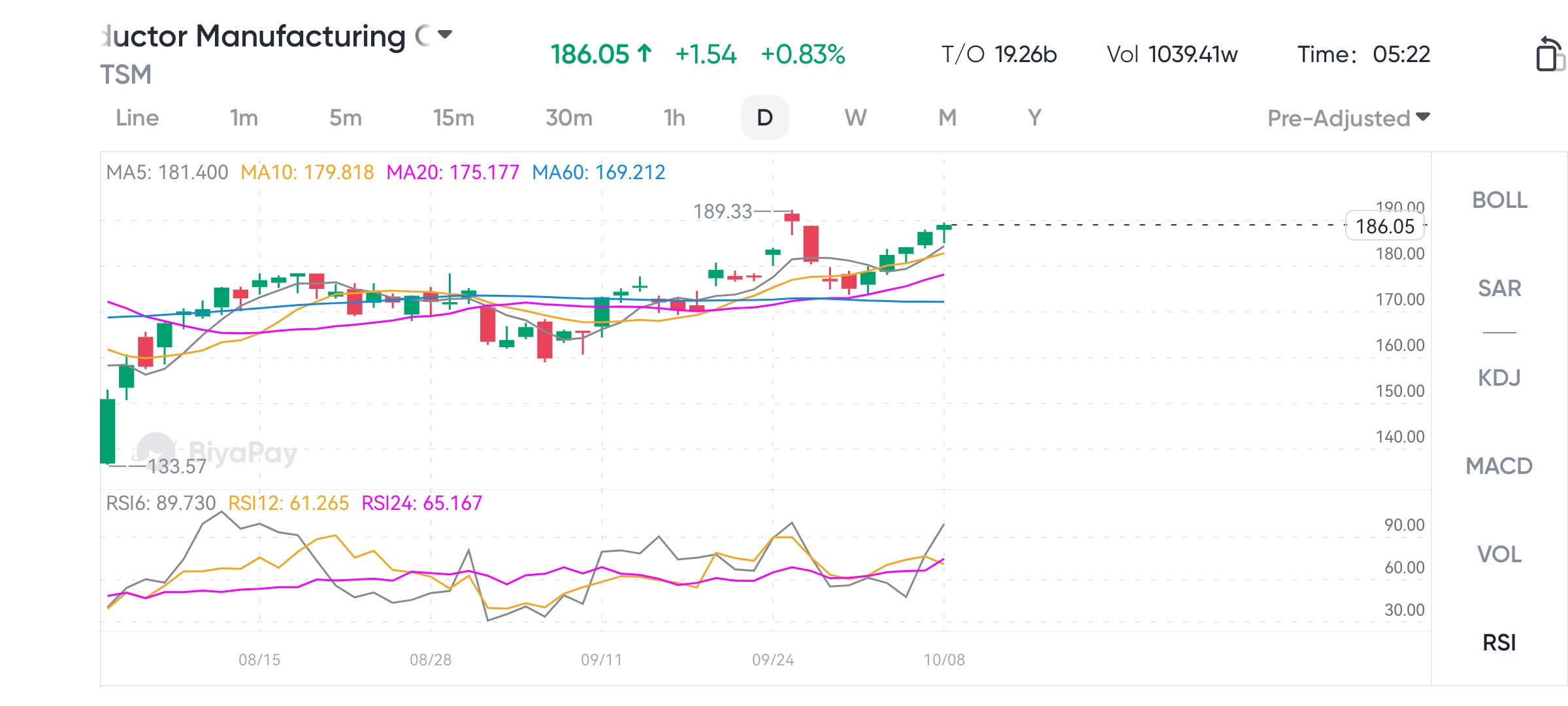

TSM, as a leading global wafer foundry, has always been a key force in the development of the semiconductor industry. Since its establishment, TSM has successfully occupied the high ground of the global market with its cutting-edge technology and efficient capacity. In 2024, facing the surge in demand for AI hardware, TSM’s performance is particularly outstanding, and its stock price has risen nearly 65% since this year. These also indicate that TSM not only maintains its technological leadership, but also its market strategy and investor confidence continue to strengthen.

The market generally expects TSM to demonstrate strong performance in its Q3 financial report released on October 17th, especially in the production and sales of AI chips. TSM has actively responded to the challenges of the chip industry in the past few years, especially by continuously investing in 3nm and 5nm process technologies, consolidating its market leadership. Next, we will focus on exploring TSM’s investment opportunities.

TSM’s Q3 financial report expectations

With the upcoming release of the third quarter financial report, the market expects TSM to show strong performance. Despite the recent weakening of enthusiasm for chip companies, TSM is expected to show outstanding performance in the financial report on October 17th. This quarter, TSM’s revenue is expected to grow significantly, mainly due to the sharp increase in global demand for AI hardware, especially high-performance computing and AI chips. In addition, TSM may see record demand for chip capacity in its third fiscal quarter, driven by hardware companies competing to ensure chip production orders.

TSM’s advanced process technology, especially its leading position in 3nm and 5nm processes, is expected to further drive its sales growth in the high-performance computing field. According to pre-released revenue data for August, the company showed strong order conditions and wafer fab utilization, indicating a continuous growth trend in its gross profit margin. These data indicate that TSM is in a very favorable earnings revision trend, adding more positive expectations to its third-quarter earnings report.

In terms of profitability, although rising raw material and production costs are putting pressure on gross profit margins, it is expected that TSM will be able to maintain or improve its gross profit margin and operating profit margin by improving production efficiency and optimizing cost management. In addition, the market will also closely monitor how TSM responds to challenges from competitors such as Intel and Samsung, especially in terms of strategic deployment in maintaining technological leadership.

TSM’s management remains optimistic about the company’s future performance and expects the company to continue to demonstrate outstanding performance in both revenue growth and profit margins in the coming quarters. This positive outlook not only reflects TSM’s strong market position, but also demonstrates its long-term growth potential in the global semiconductor industry.

Technology leadership and market advantage

TSM’s technological leadership in semiconductor manufacturing is the core of its market advantage and also the key to its continued attraction of top global customers. Especially in advanced process nodes, TSM has established an almost unshakable position, which is crucial for meeting the growing demand of the AI and high-performance computing markets.

TSM continues to research and optimize its 3nm and 5nm process technologies, enabling it to maintain its leading position in the global semiconductor industry. It is expected that with the monetization of 2nm and more advanced 1.6nm processes, TSM will further consolidate its market advantage. These technological advancements not only improve the performance of chips, but also significantly reduce energy consumption, meeting the market’s demand for more efficient computing solutions.

Despite competitors such as Intel and Samsung trying to narrow the gap with TSM by investing in new processes and expanding production capacity, TSM has effectively maintained its market leadership position through its deep accumulation in research and development and manufacturing. The technical challenges and production efficiency issues encountered by Intel and Samsung in achieving monetization of 3-nanometer and below processes enable TSM to maintain its technological advantage in the short to medium term.

With the rapid development of AI technology, especially in fields such as Deep Learning, Autonomous Cars, and Big Data Analysis, the demand for high-performance computing chips continues to rise. With its high-performance chip manufacturing capabilities, TSM has become the preferred chip supplier for many tech giants including Google, Apple, and Nvidia. This not only brings stable revenue streams to TSM, but also further enhances its competitiveness in the global semiconductor market.

Through continuous technological innovation and market expansion, TSM still has huge development potential and growth space in the future semiconductor industry. These technological and market advantages are the cornerstone of its sustained success and the key to maintaining a long-term leading position in the global semiconductor market.

Artificial intelligence brings investment opportunities

TSM is in a super cycle of artificial intelligence investment, driven by the rapid growth in demand for high-performance computing. With the widespread application of AI technology in various industries, the demand for advanced chips is growing exponentially, which brings unprecedented growth opportunities for TSM.

The increasing complexity of AI and Machine Learning requires more powerful computing power and more efficient energy management, which directly drives the demand for TSM’s advanced process node chips. These chips can provide the required high speed and efficiency when processing large amounts of data and executing complex algorithms, making TSM the preferred partner for solving high-performance computing solutions in multiple industries.

Meanwhile, the development of AI has also created a demand for new computing architectures, including chips specifically designed for AI training and inference. TSM’s technological accumulation and manufacturing capabilities in this field enable it to quickly respond to market changes and launch customized solutions that meet specific needs. This not only consolidates TSM’s market position, but also enhances its partnerships with major technology companies.

In addition, TSM’s global production layout enables it to effectively respond to regional market demand changes and supply chain challenges. With the increasing global dependence on AI technology, TSM’s international influence and cooperation network are also continuously expanding. These factors work together to enable TSM to seize growth opportunities in the AI investment super cycle and further enhance its competitive advantage in the global semiconductor market.

Increasing investment in AI hardware has also driven TSM’s up the ante in research and development and capital investment. With the continuous deepening of AI applications, from Cloud Service infrastructure to EdgeComputing devices, TSM’s products and services are playing an increasingly important role in helping customers achieve technological breakthroughs. This deep market penetration provides TSM with long-term growth momentum, ensuring its continued technological innovation and market leadership.

Through these strategies and advantages, TSM has not only solidified its core position in the semiconductor industry, but also laid a solid foundation for the company’s future growth and expansion. Against the backdrop of global economic transformation and technological upgrading, TSM’s prospects are promising and it is expected to continue to lead the development of the semiconductor market.

Global policy support and funding subsidies

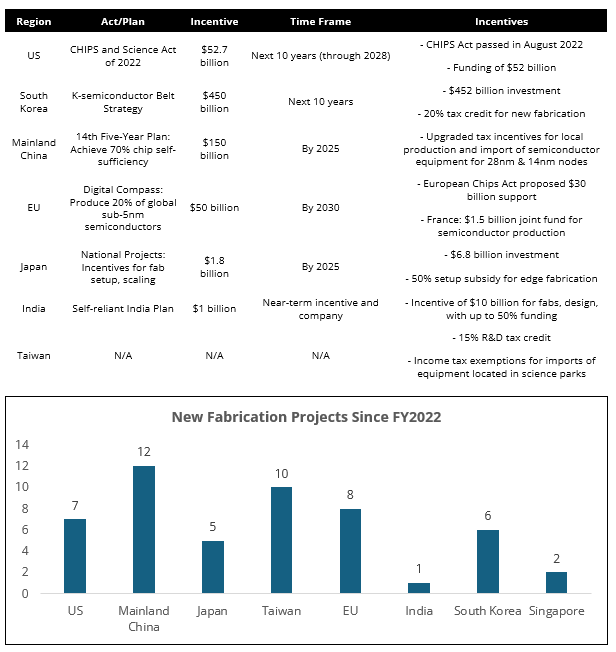

Globally, the semiconductor industry is becoming a core component of national strategies, especially in the context of increasing emphasis on technological autonomy and supply chain security. As an industry leader, TSM has benefited greatly from policy support and funding subsidies from governments around the world, which not only accelerates technological development but also optimizes its global production layout.

Major economies around the world have introduced policies aimed at strengthening their semiconductor manufacturing capabilities. For example, so far, major countries and regions such as the US, China, and the European Union have issued policies that provide incentives of more than $705.50 billion for Localization semiconductor manufacturing and ancillary projects, supporting semiconductor research and development and production to reduce dependence on external supply chains.

As an industry leader, TSM has benefited greatly from policy support and funding subsidies from governments around the world. These supports and subsidies not only accelerate technological development, but also optimize its global production layout. For example, in April 2024, TSM won a $6.60 billion state subsidy and a $5.50 billion loan in Arizona, US, to expand its chip manufacturing capabilities. In addition, in August 2024, the company partnered with Bosch, NXP, and Infineon in Dresden, Germany, and received over $5.40 billion in state aid to build a new semiconductor factory. In Asia, TSM revealed it has received a total of $1.90 billion in subsidies from China and Japan after receiving $1.46 billion in 2023 and $216 million in 2022.

These financial subsidies and policy support are important assistance for TSM to promote its technological progress and expand its global footprint. Through close cooperation with governments and local authorities around the world, TSM can ensure that its production activities are more in line with local economic and technological development needs, while also managing its supply chain risks more effectively globally.

More importantly, the funding injection brought by this policy support enables TSM to continue investing in research and development, especially in the development of next-generation semiconductor technologies such as 2nm and 1.6nm processes. The successful monetization of these technologies will further consolidate TSM’s leading position in the semiconductor industry and bring long-term market advantages to the company.

In addition, with the increasing global demand for high-performance computing and smart devices, TSM’s global strategic layout enables it to quickly respond to market changes and meet the needs of customers in different regions, largely due to the support and cooperation of governments around the world.

Therefore, the support of global policies and financial subsidies not only strengthens TSM’s market position, but also provides a solid foundation for its future sustainable development. In this process, TSM not only accelerates the pace of technological innovation, but also plays an increasingly critical role in the global semiconductor supply chain.

Valuation and investment opportunities

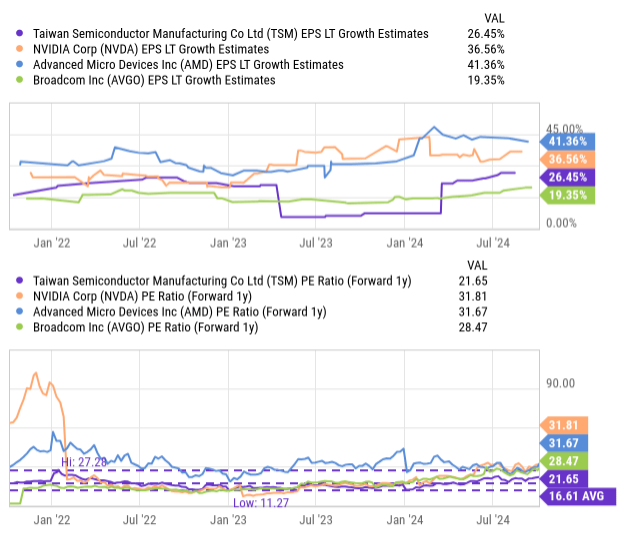

As a leading company in the global semiconductor industry, TSM has not only attracted the attention of global investors due to its technological innovation and market position, but also its valuation analysis is an important part of investment decisions. According to the latest market data, TSM’s current Price-To-Earnings Ratio is 21.7 times, based on expected returns for fiscal year 2025. This valuation level makes TSM an attractive choice for investors seeking to invest in the spending boom of artificial intelligence solutions.

Compared to other companies with strong performance in the AI field, such as NVIDIA, AMD, and Broadcom, TSM’s Price-To-Earnings Ratio is more attractive. Despite recent strong performance, TSM is slightly behind in valuation due to its historical cyclical gross profit margin. However, as the market’s understanding of the long-term demand for AI-related hardware spending deepens, TSM has strong upward revaluation potential.

In-depth analysis, given TSM’s long-term growth record and strong gross profit margin, its fair Price-To-Earnings Ratio should be 26 times. Chip manufacturers expect gross profit margins in the third quarter to be between 53.5% and 55.5%, which means that the midpoint-based gross profit margin may expand by 1.3 percentage points. In addition, TSM’s long-term earnings per share are expected to grow at an annual rate of 26%, mainly due to the continued strong demand for AI-optimized chips.

If calculated according to the Price-To-Earnings Ratio of 26 times, the fair value of TSM’s stock is estimated to be about $218 per share, an increase of $3 from the previous estimate. This adjustment reflects the rise in market consensus estimates. Compared to other chip manufacturers and hardware companies such as Nvidia, AMD, and Broadcom, if TSM’s stock price can be repriced to 26 times expected earnings, its stock will still be undervalued by the market.

Therefore, investment in TSM should not only consider its technology and market performance in the global market, but also comprehensively evaluate its financial health and future growth potential to ensure the rationality and profit potential of investment decisions. TSM’s complex global financial structure provides rich investment opportunities for various types of investors and is an investment target that cannot be ignored in the global semiconductor market.

Given the investment prospects, interested investors can go to BiyaPay to seize the opportunity and buy TSM. Of course, if you think the current stock price is high, you can also monitor the stock market trend on the platform to find a more suitable time. In addition, BiyaPay can also be used as a professional tool for depositing and depositing US and Hong Kong stocks. You can exchange digital currency for US dollars or Hong Kong dollars, quickly withdraw to your bank account, and then transfer the funds to other brokerage accounts to buy stocks. The platform has a fast and unlimited arrival speed, which will not let you miss investment opportunities.

Risks faced

When considering investing in TSM, although its prospects are broad, potential risk factors cannot be ignored. These risks may come from various aspects such as market competition, technological progress, geopolitical situation, and global economic fluctuations, all of which may have a significant impact on the company’s long-term performance and stock price trends.

Although TSM maintains a leading position in the global semiconductor manufacturing industry, it faces fierce competition from Intel, Samsung, and other emerging semiconductor companies. These competitors may achieve technological breakthroughs in specific technology fields such as next-generation storage technology or Quantum Computing chips, posing a direct challenge to TSM. In addition, semiconductor manufacturing highly relies on stable supply chains and key raw materials. Natural disasters or health crises may cause supply chain disruptions, affecting production efficiency and cost control. Price fluctuations of raw materials such as silicon wafers and rare metals may also affect the company’s gross profit margin.

The impact of global economic fluctuations on the semiconductor industry is particularly significant. Economic recession may lead to a decrease in demand in consumer electronics, automotive, and industrial markets, which in turn affects TSM’s orders and revenue. Exchange rate fluctuations can also affect the company’s reported earnings and profits.

Despite these risks, TSM has established certain risk mitigation mechanisms through diversified market strategies, continuous technological innovation, and active global expansion. By establishing production bases in the US and other regions to reduce dependence on a single region, the company helps maintain stable business growth and market competitiveness in an uncertain global environment. When evaluating TSM’s investment potential, investors should carefully consider how these variables may affect the company’s future performance and stock price performance.

As a leading enterprise in the global semiconductor industry, TSM has demonstrated strong market performance and expansion potential. With forward-looking technological innovation and strategic deployment, the company has continuously expanded its capacity in multiple key markets around the world, effectively responding to challenges such as fierce market competition and supply chain risks. With the continuous development of technologies such as artificial intelligence, the Internet of Things, and autonomous driving, TSM’s advanced process technology is expected to further consolidate its leadership position in the industry. The global government’s emphasis on semiconductor manufacturing and policy support will also provide impetus for the company’s future growth, making TSM the preferred investment target for investors seeking long-term stable returns.