- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

September non-farm payroll data surprisingly rose. Are there more and more signals that the Federal

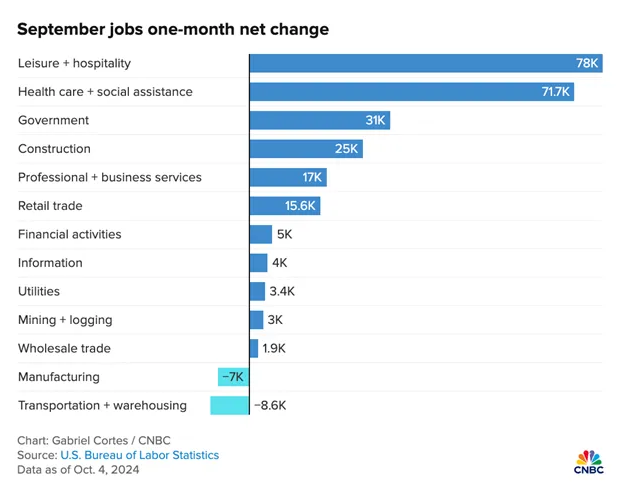

The non-farm payroll data for September exceeded market expectations, directly triggering discussions about whether the Federal Reserve will adjust its future interest rate cut plans.

The number of non-farm payrolls in the United States increased by 254,000 in September. The expected increase was 140,000. The previous value was revised from 142,000 to 159,000, marking the largest increase since March 2024. The unemployment rate in the United States in September was 4.1%, expected to be 4.2%, and the previous value was also 4.2%, which is higher than market expectations.

After the data was released, traders’ expectations for the Federal Reserve’s interest rate cuts in the next four meetings were less than 100 basis points. Does such strong employment data mean that inflation will rise again?

Does the non-farm data exceeding expectations disrupt the Federal Reserve’s interest rate cut rhythm?

The data shows that in September, the number of new non-farm jobs reached 254,000, far exceeding the market expectation of 140,000. This data indicates that the labor market is still very strong. The unemployment rate also dropped by 0.1 percentage point again to 4.1%, lower than the expected 4.2%. This has significantly changed the market’s expectations for the Federal Reserve’s interest rate cuts.

After the weak non-farm report in July, the market generally believed that the economy would either achieve a soft landing or fall into a recession. However, the non-farm data in September once again put the possibility of “no landing” on the table. If the economy really remains “unlanded”, the Federal Reserve may continue to maintain high interest rates and even not rule out the possibility of raising interest rates again. And currently, the market’s reaction to this expectation has not been fully reflected in prices.

The fund manager of Brandywine said that the hope of a 50 basis point interest rate cut in the future is basically dashed. Changes in certain aspects of the economy have increased the possibility of “no landing”, which includes the stimulation of some international factors that may push up global commodity prices and thus pose an inflation threat.

As high interest rates continue, the Federal Reserve’s interest rate cuts in November and December will be reduced. CME data shows that the probability of a 25 basis point interest rate cut in November is almost locked in, but there is also a more than 15% probability that the Federal Reserve may stand pat. For the whole year, the current market expectation for interest rate cuts has been adjusted from 100 basis points to 75 basis points, meaning that interest rate cuts are still possible to continue, but the magnitude will be significantly lower than previously expected.

Goldman Sachs believes that the non-farm data in September proves that the previous increase in the unemployment rate was mainly due to new immigrants entering the labor market.

As these immigrants gradually find jobs, the unemployment rate also falls back. And the tracking of wage data shows that although wage increases in the non-farm report have increased, the expected wage growth rate in the future is expected to fall back, so there is no need to worry too much about inflation.

In addition, investment banks such as Bank of America and JPMorgan Chase have also lowered their expectations for interest rate cuts in November. Bank of America lowered its expectation from 50 basis points to 25 basis points, showing that the market’s confidence in further monetary easing is weakening. These adjustments reflect the cautious views of investment banks on the current stubborn resilience of the economy.

Doubts about non-farm data: reasons behind the data divergence

In this September non-farm employment report, there is a particularly noteworthy phenomenon, that is, there is a significant divergence in the data of enterprise surveys and household surveys.

The enterprise survey is based on data from 650,000 enterprises and government agencies and is mainly used to measure the overall number of new jobs. However, the household survey is based on a sample of 60,000 households and measures employment status and unemployment rate.

The number of new jobs in enterprise surveys is often higher. Part of the reason is that the same person can hold multiple positions. In enterprise surveys, these multiple positions will be counted as new jobs, so it is easy to overestimate the total employment situation.

But in the September report, surprisingly, the data performance of household surveys is even stronger than that of enterprise surveys. According to household surveys, the number of new jobs in September reached 430,000, of which full-time jobs increased by 414,000 and part-time jobs decreased by 95,000. This is in sharp contrast to the results of enterprise surveys and has also raised questions about the accuracy of the data. So why is there such a difference?

A senior economist from Group Economics explained this. He pointed out that there are significant differences in sample size and survey methods between enterprise surveys and household surveys. Enterprise surveys are affected by models of new and bankrupt enterprises and are used to infer national employment situations. Household surveys are more affected by population and immigration factors. Therefore, when the number of immigrants changes, the data of household surveys may reflect different employment situations.

In this report, the significant increase in the number of new jobs in household surveys is largely due to the underestimation of the impact of immigration. After immigrant populations enter the labor market and find full-time jobs, they drive the increase in employment data.

For the market and policymakers, this divergence means that more caution is needed when interpreting employment data. We cannot rely solely on one survey result but need to combine two sets of data to draw a more accurate judgment. In the September data, although the enterprise survey shows relatively extensive job growth, the significant increase in full-time employment in household surveys also shows the strong side of the labor market, especially the important role of immigrants in filling job vacancies.

These factors work together to let us see the resilience of the current job market and also explain why this employment data can provide more support for a “soft landing”.

Does the sell-off by corporate executives reflect distrust in interest rate cuts?

According to a report in The Wall Street Journal, the S&P 500 index has already risen by 20% this year. The performance in the first nine months has even set the best performance since 1997. But under such a strong increase, there are a group of people who choose to stand by. They can be said to be the people who know the company’s situation best. Many investors also take their strategies as reference benchmarks. These people are corporate executives.

Especially after the non-farm data in September exceeded expectations and the market generally lowered its expectations for a significant interest rate cut by the Federal Reserve, the attitudes of corporate executives have become more conservative.

Data from InsiderSentiment.com shows that in July, among all stock lists with executive transactions, 15.7% of stocks had net buying. In August, it rebounded to 25.7%, but in September it fell back to 21.9%, and these numbers are all lower than the 10-year average of 26.3%, indicating that executives are cautious about market performance.

Especially for technology companies, executives have carried out large-scale sell-offs. For example, Bezos sold $10.3 billion of Amazon stocks, Zuckerberg sold $2.1 billion of Meta stocks, and Huang Renxun also sold more than $700 million of Nvidia stocks. Some people on Wall Street believe that these executive sell-off behaviors are likely to reflect their concerns about future economic recessions.

But there is also an opinion that executive sell-off behaviors should not be overinterpreted as bearish on companies. The reason many executives sell stocks may just be to diversify investment risks and does not necessarily mean they are not optimistic about the company’s future. In addition, executive sell-off plans usually need to be announced several years in advance. These behaviors are often preset and may not be related to future market expectations.

A professor at the University of Michigan Business School pointed out that the sell-off behavior of a single executive may not have a significant impact, but the overall sell-off trend can indeed provide some guiding signals for future stock market performance. And currently, this behavior of lower-than-expected net buying may mean that future stock market returns will be lower than market expectations.

Some analysis articles on Seeking Alpha pointed out that the high valuations in the technology industry in recent years have also prompted executives to adopt a more cautious attitude.

Although this cautious attitude may make the market reserved about future stock market rises, in the long run, this behavior may be to avoid potential systemic risks. But in short, whether it is executive sell-offs or Buffett hoarding cash, an indisputable fact is that the current U.S. stocks are not cheap.

Strong dollar and rising Treasury yields: which sectors will bear the biggest impact?

With the strong performance of non-farm data, the market generally lowered its expectations for a significant interest rate cut by the Federal Reserve in November, leading to a strengthening of the dollar exchange rate and a decline in gold prices. And U.S. Treasury yields also rebounded significantly. The 10-year Treasury yield broke through 4%, which is the first breakthrough since August.

The rise in Treasury yields has weakened investors’ interest in stocks, especially utility stocks and real estate stocks.

The 10-year U.S. Treasury yield recently broke through 4%, which is the first breakthrough since August, putting huge pressure on these yield-dependent sectors. As of October 7, the S&P 500 utilities sector has fallen by about 7.1% in the past month, and the real estate sector has fallen by 5.4%. Stocks in this category that usually pay high dividends become less attractive when interest rates rise because investors are more inclined to seek risk-free high-yield Treasury bonds, resulting in poor performance of these sectors.

At the same time, energy stocks have become the only sector in the S&P 500 to rise due to rising oil prices. From late September to early October, oil prices rose to a high of $95 per barrel, driving the S&P 500 energy sector to rise by about 6.3% during the same period. The stock prices of energy giants ExxonMobil (NYSE: XOM) and Chevron (NYSE: CVX) also rose by 5.8% and 4.9% respectively. The climb in oil prices and the rise in the energy sector are significantly different from other sectors greatly affected by interest rates and have become one of the few bright spots in the market recently.

In addition, some analysis articles in Bloomberg pointed out that the strength of the dollar and the rise in oil prices are having a chain reaction on the global market.

The rise in oil prices has a positive impact on the energy industry but brings cost pressure to other industries, especially the consumer industry. This may also have a negative impact on corporate earnings growth in the next few quarters.

As the Federal Reserve may be more conservative in future policy actions and the current interest rate is difficult to fall rapidly, the market generally expects that the pace of interest rate cuts will slow down. This means that investors should pay more attention to corporate earnings growth rather than relying on valuation expansion because corporate earnings growth will become the key driving force for stock prices to continue to rise. Especially in a high-interest-rate environment, large-cap stocks and companies with stable earnings growth are more likely to be favored by capital because they can better cope with high borrowing costs.

The hawkish remarks of Summers, an advisor to former Federal Reserve Chairman Paul Volcker, and famous hedge fund manager Druckenmiller also warned investors that the magnitude and speed of the Federal Reserve’s future interest rate cuts may not be as rapid as before. Investors need to be more cautious about this policy change. Druckenmiller particularly emphasized that the Federal Reserve should not be trapped in a policy dilemma because of previous forward guidance. Monetary policy needs to be more flexible rather than being constrained by past remarks.

Key impact of subsequent October non-farm data

Before the Federal Reserve’s next meeting on November 7, the latest data on employment and inflation will become key factors in determining the Federal Reserve’s policy trajectory.

Ian Lyngen, head of U.S. interest rate strategy at BMO Capital Markets, pointed out that if the October non-farm employment report remains strong and inflation is proven to still be sticky, the Federal Reserve may temporarily suspend interest rate cuts. He wrote in a report to clients: “The latest employment data indicates that the Federal Reserve may be reconsidering its plan for an interest rate cut in November.”

The Federal Reserve’s concerns about the labor market are clearly exaggerated. Although it is a bit harsh to review the Federal Reserve’s 50 basis point interest rate cut in September and talk about prematurely declaring “victory”, the current data points to a 25 basis point interest rate cut in November rather than 50 basis points. When there is an inflection point in the economy, there is usually a situation where data appears solid but is then revised down. And this upward revision of employment data shows the resilience of the economy.

The Federal Reserve is still likely to implement two more 25 basis point interest rate cuts this year, partly to ease the burden on the public who are suffering from high borrowing costs. But there is also an opinion that the Federal Reserve will stick to interest rate cuts until 2025 because the current interest rate level is still relatively high compared to inflation and a longer period of interest rate cuts is needed to gradually bring interest rates down to an appropriate level to avoid hindering economic growth.

Data in the coming months will determine whether the Federal Reserve’s interest rate cut pace will slow down further. Especially when both inflation and employment data exceed expectations, the Federal Reserve may be inclined to adopt a more stable policy.

Future economic data will continue to provide guidance for the Federal Reserve’s decisions. In particular, the October non-farm data and inflation report will determine whether the Federal Reserve will suspend interest rate cuts in November. If the data shows higher inflation pressure or a continuously strong job market, the Federal Reserve may be more cautious about interest rate cuts rather than simply following previous forward guidance.

Investment strategy suggestions

Under the expectation of the Federal Reserve’s slower pace of interest rate cuts, investors should pay more attention to adjusting their investment portfolios. The current high-interest-rate environment means that the performance of interest rate-sensitive targets such as small-cap stocks and Treasury bonds may be suppressed, while large-cap stocks with strong profitability may be more attractive. Especially some economically sensitive stocks have high earnings growth expectations and can drive stock prices to rise when valuation expansion is limited.

In such a market environment, investors can use the multi-asset wallet BiyaPay to regularly check market trends and choose the right trading opportunities. If there are problems with depositing and withdrawing funds, BiyaPay can also be used as a professional tool for depositing and withdrawing funds for U.S. and Hong Kong stocks. Recharge digital currency and exchange it for U.S. dollars or Hong Kong dollars, withdraw to a bank account, and then deposit funds into other brokers to buy stocks. The arrival speed is fast and there is no limit, so you won’t miss investment opportunities.

According to some investment suggestions on Seeking Alpha, in a high-interest-rate environment, large-cap stocks and enterprises with stable earnings will be better choices. Especially in the current context of high market volatility, choosing companies with stable earnings and cash flows will help reduce the risk of investment portfolios. In addition, some technology giants and leading enterprises in the energy industry may also perform well in the next few quarters because they can better cope with macroeconomic uncertainties.

Overall, the strong performance of non-farm data in September has brought new uncertainties to the market regarding the Federal Reserve’s future interest rate cut plans. Although the possibility of interest rate cuts still exists in the future, the magnitude and speed of interest rate cuts may slow down significantly. The cautious attitude of corporate executives towards company stocks also reflects concerns about the future economy. The rise in Treasury yields and the climb in oil prices have further increased market uncertainties.

In such a market environment, investors should pay more attention to the earnings growth ability of large-cap stocks and make careful layouts in a high-interest-rate environment to deal with possible fluctuations and challenges in the future.

At the same time, closely following the upcoming October non-farm data and other macroeconomic data is crucial. These data will provide further guidance for the Federal Reserve’s policies. For investors, they will also be important signals for evaluating market trends. In this environment, flexibly responding to market changes and choosing enterprises with strong profitability will help maintain stable growth in future fluctuations.