- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Elon Musk's last stand! Tesla's Robotaxi Day is approaching: a return to leadership or a fall back t

At 19:00 on Thursday, October 10 local time (10:00 am on October 11, Beijing time), Tesla is about to usher in another historic moment - Robotaxi Day. This day may determine the future direction of the company. For Tesla, Robotaxi Day is not just a showcase of autonomous driving technology, but also a crucial moment for Elon Musk to convey confidence to investors, the market, and the public.

This event is highly anticipated. Whether it will help Tesla return to the ranks of the seven major U.S. stock giants and even create new glories, or become an ordinary car manufacturer, Robotaxi Day will be a crucial watershed.

This is not only a subversion of business models but also an important node of a technological revolution. Tesla hopes to redefine the travel market through this project and continue to maintain its leading position in the industry. And Elon Musk also needs to convince investors through this event that Tesla is still a hotbed of innovation and still worthy of being regarded as a technology company like Apple (AAPL), Amazon (AMZN), or Alphabet (GOOGL).

Goldman Sachs analyst Mark Delaney believes that there are two major highlights of this presentation: one is the timetable for the commercialization of Tesla Robotaxi, covering technical maturity, operational and regulatory details; the second is that Tesla may simultaneously release the low-cost car model Model 2 priced at $25,000 at the presentation or announce more details.

Market expectations and analysis

In the upcoming Robotaxi Day event, the market and various analysts have very high expectations for Tesla. Robotaxi is regarded by Tesla as an important product to change the future travel mode, and this event will provide important information on the commercial prospects of Robotaxi.

Analysts from Deutsche Bank and Wedbush generally believe that Tesla will showcase the Robotaxi product named “Cybercab” at Robotaxi Day and discuss in detail commercial details such as its operating costs, production and usage locations. These specific commercial information are crucial for investors to understand the feasibility of Robotaxi and Tesla’s future business strategies.

In addition, Goldman Sachs analyst Mark Delaney expects that Tesla will announce the commercialization timetable of Robotaxi at this event, including technical maturity and plans to address regulatory obstacles. Especially in terms of how to meet the Federal Motor Vehicle Safety Standards (FMVSS) of the United States, Tesla will face huge challenges.

FMVSS requires vehicles to be equipped with basic control devices such as steering wheels and pedals, which conflicts with Musk’s promised design concept of “no steering wheel and pedals.” Therefore, these regulatory details directly determine whether Robotaxi can be commercialized as soon as possible and will also have an impact on investor confidence and stock prices.

At the same time, there is another common speculation in the market: Tesla may take this opportunity to release the low-cost car model Model 2 priced at $25,000!

As a more popular electric vehicle, Model 2 not only helps expand Tesla’s market share but may also become an important part of the future Robotaxi fleet. If Model 2 is released, it will bring a significant boost to Tesla’s overall sales growth and further consolidate its market position in the electric vehicle and autonomous driving fields.

Since Elon Musk announced in April 2024 that Robotaxi Day would be held, Tesla’s stock price has risen nearly 50%, showing the market’s high expectations and strong optimism for this event.

Analysts generally believe that if this event can send a signal that the Robotaxi project is close to commercialization, then Tesla’s stock price is expected to rise further, even reaching above $350. However, if the released content fails to meet market expectations, the stock price may be negatively affected and pressured below $200.

Therefore, this Robotaxi Day is not only an opportunity to showcase technology but also a key node for Elon Musk to convey confidence to the market. It has an important impact on the short-term and medium-term trends of Tesla’s stock price.

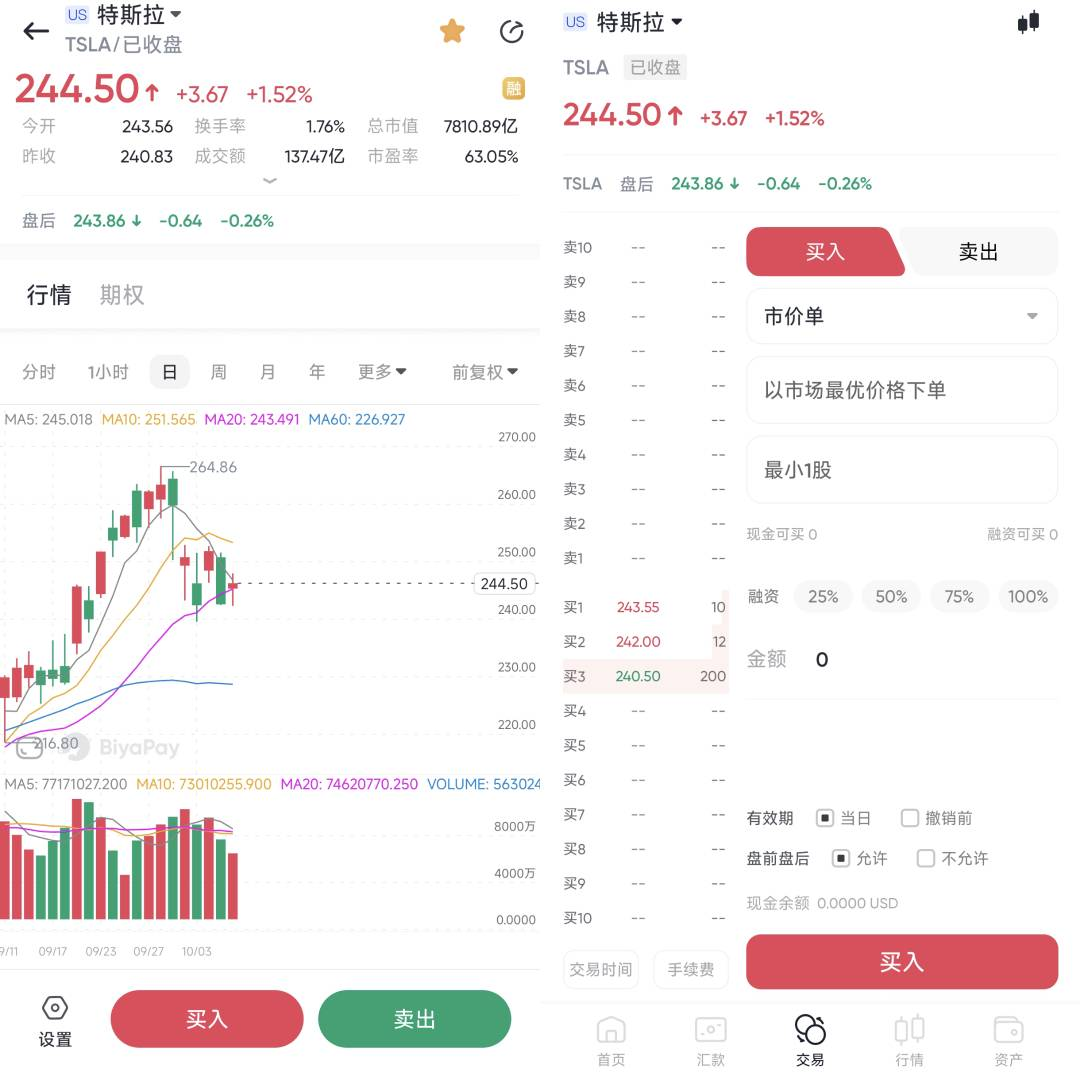

Investors can use the multi-asset wallet BiyaPay to regularly check Tesla’s market trends and choose trading opportunities. If there are problems with depositing and withdrawing funds, it can also be regarded as a professional tool for depositing and withdrawing funds for U.S. stocks. Recharge digital currency and exchange it for U.S. dollars or Hong Kong dollars, withdraw to a bank account, and then deposit funds into other brokers to buy stocks. The arrival speed is fast and there is no limit, so investment opportunities will not be missed.

Although the market is optimistic about the Robotaxi project, there are also some voices that remain skeptical about its practical applicability. The analyst of Canaccord pointed out that most people (including themselves) are skeptical about the practicability and commercial feasibility of Robotaxi, especially in terms of technology implementation and adaptability to existing regulatory rules.

Therefore, if the content released on Robotaxi Day exceeds market basic expectations and shows a clear commercialization path and technological breakthrough, then this event is expected to become an important catalyst for Tesla’s stock price.

Elon Musk’s last chance

This Robotaxi Day is widely regarded as a crucial moment for Elon Musk to prove that Tesla still has disruptive innovation capabilities.

Since the concept of Robotaxi was first proposed in 2019, it has experienced many delays and doubts. Now, Tesla is facing fierce competition from other enterprises in the autonomous driving field, including Waymo under Alphabet, Zoox under Amazon, and companies like Baidu. Some of these enterprises have launched commercial operations of Robotaxi in multiple cities and made significant progress, making the market full of doubts about whether Tesla can keep up and maintain its leading position.

Therefore, this event is particularly important for Tesla. The success of the Robotaxi project will determine whether Tesla still maintains a leadership position in the global autonomous driving market. Waymo and Cruise have already carried out commercial operations of Robotaxi in some cities in the United States. Among them, Waymo has more than 100,000 paid rides per week. In contrast, Tesla has not yet launched a formal Robotaxi service, which puts Tesla under great pressure in the competition of autonomous driving commercialization.

This event will be Elon Musk’s last stand, proving to investors that Tesla is still an innovation leader in this field, not just an ordinary electric vehicle manufacturer.

According to market analysis, the potential market value of Tesla’s Robotaxi business is very difficult to quantify, but analysts estimate that 80% of its future product value may be related to Robotaxi. In short, a large proportion of the 80% part of Tesla’s current market value related to future value belongs to Robotaxi. Therefore, the result of Robotaxi Day is crucial to about 65% of Tesla’s market value. About $500 billion in shareholder value directly depends on whether the project can be commercialized and generate actual returns.

If Tesla performs well in this event, for example, announcing that it will launch an autonomous driving sharing service within three months and planning to charge a 25% commission on each ride, Tesla’s market position may rapidly improve. Considering the low-cost characteristics of autonomous driving sharing, such a service should be welcomed by cost-conscious consumers. In this case, the value of Tesla’s Robotaxi segment is expected to increase by 60%, which means about a 37% increase in stock price for shareholders, and the stock price may reach $345.

At the same time, Tesla also needs to prove that it has unique advantages different from its competitors. With its huge owner group, Tesla has a potentially huge Robotaxi fleet base, which is also one of the sources of its competitiveness. Elon Musk has said that owners can earn about $30,000 in additional income annually through Robotaxi. Such a business model is expected to encourage more Tesla owners to join the plan and further enhance Tesla’s market share.

In general, to a certain extent, this Robotaxi Day will determine whether Tesla regains its position as one of the seven major technology giants of U.S. stocks or falls behind competitors like Waymo in the competition of autonomous driving and becomes an ordinary car manufacturer. Tesla’s future fate largely depends on whether Elon Musk can successfully demonstrate the progress and potential of Robotaxi in this event.

Why did Tesla executives quietly resign before the debut of Robotaxi Day?

As Robotaxi Day is approaching, Nagesh Saldi, Tesla’s chief information officer, is about to leave.

Since joining Tesla in 2012, Saldi has promoted the development of autonomous driving and data centers, especially in terms of the company’s expansion of data centers in Texas and New York, improving computing power and research and development speed.

His departure has raised some concerns. Some investors believe that this may have a negative impact on Robotaxi and other projects and affect Tesla’s technology management.

On the other hand, there is also the view that Saldi’s departure is a positive signal. This is similar to the previous departures of other executives after reaching milestones, such as Andrej Karpathy and Zachary Kirkhorn. These departures may indicate that their historical missions have been completed and create opportunities for the addition of new leaders. As the Robotaxi project is launched, Tesla enters a new stage and needs new managers and perspectives to promote business development.

In general, Saldi’s departure may bring challenges in the short term, but it also provides an opportunity for Tesla to introduce new management thinking. At present, Tesla’s executive team only consists of three people: Chief Executive Officer Elon Musk, Chief Financial Officer Vaibhav Taneja, and Senior Vice President of Automotive Business Tom Zhu.

Investors should pay attention to Tesla’s progress in data centers and autonomous driving to evaluate the company’s position and potential in the future market. After experiencing multiple executive changes, Tesla still maintains technological progress and market competitiveness, showing its strong internal resilience.

What will happen to Tesla after Robotaxi Day? Can we enter the market?

Robotaxi Day is a crucial moment for Tesla. It not only showcases the latest technological breakthroughs in the field of autonomous driving but also is a major test for Elon Musk to fulfill his promises and maintain market trust.

Risk

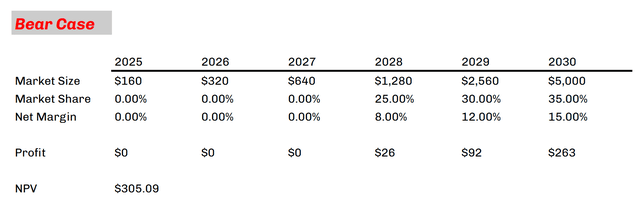

If the released content of Robotaxi Day is not convincing enough. For example, if Musk only announces a new stage of FSD without substantial commercialization information, this will make the market question Tesla’s innovation ability and may lead to a decline in stock price. In this case, here is what we think if the management needs to take another three years to launch Robotaxi and extract a 15% commission on each ride. How much might TSLA’s Robotaxi segment be worth?

This model assumes that TSLA builds a fleet in a “crowdsourcing” way and does not operate any vehicles in its own network. The market size is the most difficult to estimate, but we model the current size of the shared ride market ($160 billion) as 2025 and expect it to reach a $5 trillion addressable market by 2030. If a 4% discount rate is applied in the above model, the net present value (NPV) of Tesla’s Robotaxi business during this period is about $300 billion, 40% lower than the current valuation.

In this case, this will reduce Tesla’s $800 billion market value by about $200 billion, resulting in about a 25% downside risk for shareholders, and the stock price is about $185. As competitors such as Waymo and Cruise continue to make progress in the autonomous driving sharing market, if Tesla fails to smoothly promote the commercialization of Robotaxi, it may gradually lose its competitive advantage in this market.

Other situations

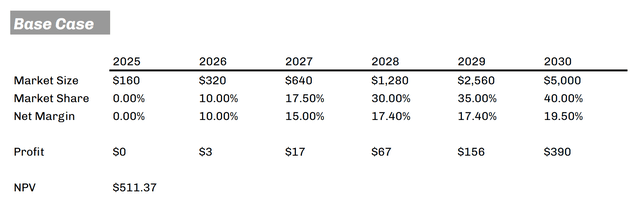

Normal performance situation: Tesla is expected to commercialize Robotaxi within two years. Musk will announce new applications and related functions, and owners can add their vehicles to the sharing network through the “Tesla Earnings” function.

In this case, market demand gradually increases. Tesla can quickly occupy 40% of the shared travel market and achieve stable profit margins. Under this scenario, the stock price is expected to remain between $250 and $300. This situation is basically what the market expects - valuing this segment at about $500 billion. After this, we may see some fluctuations in stocks, but it should not cause crazy fluctuations.

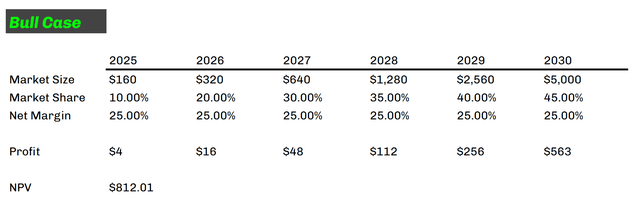

In a bull market scenario, if Musk announces that the autonomous driving sharing service will start within three months and charge a 25% fee for each ride as planned, Tesla’s business prospects will be very optimistic.

As users quickly join and the network scale continues to expand, this autonomous driving sharing service will be welcomed by consumers due to its lower cost.

In this case, we see that TSLA has higher revenue per ride and a larger supply and demand network under their control. This scenario will represent a 60% increase in the NPV (calculated at a 4% discount rate) of the Robotaxi segment, which means about a 37% increase in TSLA’s stock. This roughly means that the share price will reach $345, which will be a good thing for shareholders.

In general, the result of Robotaxi Day will have a direct impact on Tesla’s stock price and market expectations. For investors, maintaining cautious optimism is a more reasonable strategy. In the short term, if the performance of the Robotaxi project exceeds market expectations, the stock price may rise further, which is a positive signal for short-term investors. In the long run, Tesla’s investment in electric vehicle technology, brand influence, and autonomous driving research and development makes the company still have a strong competitive advantage in the market.