- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

Broadcom has surged 60% this year, rising more than 6% in the first six trading days. How can it con

Broadcom (NASDAQ: AVGO), as a leading global semiconductor solutions provider, has performed particularly well compared to the S & P 500 Index, which has risen by 20% during the same period. It has risen nearly 60% this year and performed well. The stock has risen by more than 6% in the past six trading days. However, it fell on Friday and closed at $172.7.

This significant growth not only highlights Broadcom’s competitiveness in the technology-leading semiconductor industry, but also reflects its core technological advantages in the fields of artificial intelligence (AI) and high-performance computing. Broadcom’s performance has clearly surpassed industry peers such as Intel. This excellent market performance is not only attributed to its technological innovation in the communication hardware and AI chip market, but also to its continuous investment and development in the fields of data center and network solutions.

How much growth potential does Broadcom have in the future? Next, let’s take a look at what growth points are worth paying attention to.

Fundamental and financial analysis

Before exploring Broadcom’s future growth potential, it is crucial to understand its fundamentals and financial performance. The company’s economic foundation and Operational Efficiency directly affect its stock price performance and investor confidence. The following section will provide an in-depth analysis of Broadcom’s financial situation and its driving role in market performance.

Financial performance

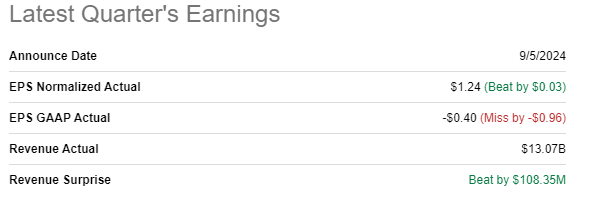

Broadcom announced performance that exceeded market expectations in its latest quarterly financial report, with an annual revenue growth rate of 47.27% and adjusted earnings per share increasing from $1.05 to $1.24. This significant growth is mainly due to the merger of VMware, which has been officially included in the financial statements since the second quarter. Even excluding the merger effect of VMware, the company’s organic growth still maintained a positive growth trend of 4%.

In the semiconductor solutions department, revenue achieved an annual growth of nearly 6%, while in the infrastructure software field, revenue achieved nearly threefold growth. As an important driving force for revenue growth, the artificial intelligence business achieved several-fold growth in sales, reaching about $3.20 billion. In the recent earnings call, management raised its expectations for artificial intelligence-related revenue for the 2024 fiscal year from the original $11 billion to about $12 billion. In addition, the year-on-year growth in network revenue also made a significant contribution to the company’s overall growth, reaching 43%.

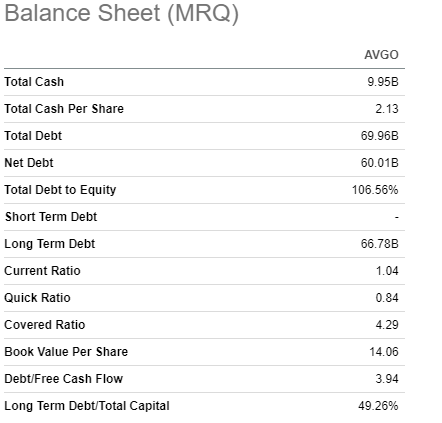

Thanks to the strong performance of these businesses, Broadcom generated $5.30 billion of adjusted free cash flow in the quarter, an increase of about 14% year-over-year, effectively supporting the company’s Balance Sheet health, with cash reserves of nearly $10 billion. In addition, the company’s net debt position also improved significantly, decreasing by $4 billion compared to the previous quarter.

Seasonal market performance

It is worth noting that according to Broadcom’s historical seasonal pattern, September is usually the worst month for its stock price performance. However, although the performance in October has always been mixed, according to historical data, November and December are usually extremely favorable months for Broadcom investors. This pattern provides important reference for when to enter the market, especially for investors seeking to seize seasonal investment opportunities.

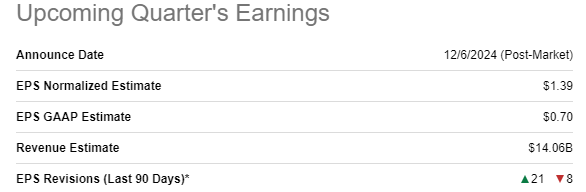

Wall Street analysts predict that Broadcom’s revenue growth will further accelerate for the upcoming quarterly financial report to be released on December 6th. The market generally predicts that the revenue for this quarter will reach $14.10 billion, with a year-on-year growth of 51.3%. Adjusted earnings per share are also expected to achieve year-on-year growth, from $1.11 to $1.39. In the past 90 days, analysts have raised their earnings per share forecasts 21 times, while the number of downgrades has only been 8 times, indicating a widely optimistic attitude towards Broadcom’s future performance.

Given this optimistic expectation, everyone can go to BiyaPay to seize the opportunity and buy Broadcom. Of course, if you think the current stock price is high, you can also monitor the trend of the stock on the platform to find a more suitable time. In addition, BiyaPay can also be used as a professional tool for depositing and depositing US and Hong Kong stocks. You can exchange digital currency for US dollars or Hong Kong dollars, quickly withdraw to your bank account, and then transfer the funds to other brokerage accounts to buy stocks. The platform has a fast and unlimited arrival speed, which will not let you miss investment opportunities.

Drivers of future growth

Broadcom’s future growth potential depends on several key factors that will affect the company’s performance in the global semiconductor market and its technological development prospects.

Data center and artificial intelligence technology market demand

The surge in global data consumption has driven the widespread demand for data center infrastructure. With the increasing demand for data processing and storage capabilities from enterprises and individuals, the technological updates of data centers are also accelerating. Broadcom, as a major supplier of data center network solutions, has benefited significantly from this trend. The high-performance network hardware and server solutions provided by the company are key components in building modern data centers. In addition, the application expansion of artificial intelligence (AI) has brought the demand for specific hardware, especially high-performance computing (HPC) devices that can handle complex algorithms and big data analysis. Broadcom’s technological innovations in this area, especially in the development of AI chips and related hardware products, have begun to generate revenue, which is expected to be an important factor driving future revenue growth.

Deepening cooperation with major customers

Broadcom’s deep partnership with global tech giants is one of the key driving factors for its business growth. Especially in the field of artificial intelligence (AI), the company’s cooperation with industry leaders such as Google, Meta, and ByteDance has significantly expanded Broadcom’s market influence and technological prospects.

These companies are at the forefront of AI technology research and application, constantly seeking more efficient and powerful computing solutions to support their innovative projects. For example, cooperation with Google and Meta involves not only hardware supply, but also Broadcom’s technical cooperation in AI computing, network infrastructure, and data center technology.

These collaborations not only provide a stable source of income, but also promote Broadcom’s research and innovation in new technology fields. As these tech giants continue to seek to optimize the performance and efficiency of their Data centers, Broadcom’s customized hardware solutions will continue to be favored.

Macroeconomic and policy environment

Broadcom’s business development is significantly affected by the global macroeconomic environment and policy changes. Recently, the relaxation of Monetary Policy worldwide, especially the interest rate cut by the Federal Reserve, has had a positive impact on the technology industry. The low interest rate environment has reduced borrowing costs for enterprises, promoted investment in technology and infrastructure, especially in the fields of data centers and high-performance computing. In addition, the strengthening of data security and localization by governments around the world has also provided Broadcom with new opportunities in the network and data communication equipment market. Policy support and market demand have driven Broadcom’s expansion in the global market and the deepening application of technology.

Still face some risks

When looking at Broadcom’s growth potential, it is also important to take into account the risk factors the company faces that could impact its performance and market position.

Risks of acquisition integration

In Broadcom’s growth strategy, acquisitions and mergers play an important role. However, each acquisition brings integration challenges, including technology compatibility, corporate culture integration, and management integration. Although VMware’s acquisition has increased Broadcom’s product diversity and market coverage in the short term, successful integration requires careful planning and execution in the long run, and any mistakes may affect the entire company’s Operational Efficiency and market reputation.

In addition, Broadcom’s acquisition strategy may also be challenged by Anti-Trust regulations. As the company expands its market share and technology assets through mergers and acquisitions, regulatory agencies around the world may subject it to stricter scrutiny. This may not only delay or prevent some potential acquisition transactions, but also lead to high fines and legal fees, thereby affecting the company’s financial condition and stock price performance. The uncertainty of Anti-Trust review increases the complexity of the company’s operations and may limit its expansion speed in certain key markets.

Market competition and rapid technological iteration

With a strong technological foundation and financial strength, Broadcom continuously drives the market towards higher-performance products. In order to maintain its market leadership position, Broadcom must continue to launch innovative products and solutions, which not only involve improving chip performance, but also optimizing energy efficiency and cost efficiency.

The rapid changes in the technology field have put higher demands on Broadcom’s R & D strategy. The company needs to continuously make large-scale R & D investments, which is the key to ensuring that technology is synchronized with market demand and preventing technology from becoming outdated. In the semiconductor field, the iteration speed of technology is extremely fast, and a slight mistake may lead to being surpassed by competitors. Therefore, Broadcom’s R & D strategy not only pursues technological progress, but also anticipates technological trends to maintain the market competitiveness of its products and services.

Uncertainty in the economic environment

The volatility of the global economy is another important factor affecting Broadcom’s global business. Changes in trade policies, geopolitical tensions, and the slowdown of global economic growth may all have a direct or indirect impact on the company. As a global company, Broadcom’s supply chain, production, and sales network are spread all over the world, which makes its business affected by various international and regional economic factors.

Uncertainty in trade policies may lead to supply chain disruptions, increased costs, or Market Access barriers. In addition, global or regional economic crises may also affect its sales and profitability, as customers may reduce or postpone purchasing decisions, especially in capital-intensive industries such as data centers and communication networks.

How do investors layout?

It is crucial for investors to accurately understand Broadcom’s business model, market position, and the opportunities and challenges it faces. When investing in Broadcom’s stock, investors should consider multiple factors to ensure that their investments remain stable in the face of market fluctuations and technological advancements.

Investment timing and value assessment

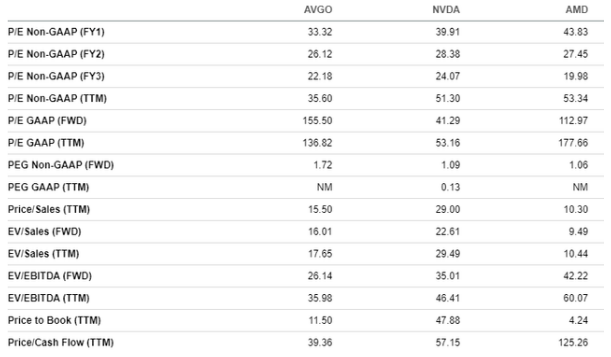

When choosing investment opportunities, investors should consider the company’s valuation level and market conditions comprehensively. Broadcom’s stock price has risen by 97% in the past 12 months and by 60% so far this year, significantly outperforming the market, which shows its strong performance in the market. Compared with the industry median, Broadcom’s valuation ratio has always been high, reflecting its position as a leader in the field of artificial intelligence. Compared with NVIDIA and AMD, Broadcom’s valuation is low, but considering its revenue and EBITDA growth, Broadcom appears more attractive for investment.

Using the Discounted Cash Flow (DCF) model, Broadcom’s intrinsic value is calculated using a weighted average cost of capital (WACC) of 9%. Forecasts indicate that Broadcom’s revenue compound annual growth rate over the next decade is 11%, consistent with the long-term growth expectations of the semiconductor industry. According to this model, Broadcom’s fair market value is estimated to be $865 billion, which is about 13% higher than its current market value, providing potential upside for investors.

Diversified investment and long-term holding

Broadcom’s business involves multiple high-growth areas such as AI, 5G, Data center, and Cloud Services. These areas are currently at the forefront of technological innovation and are expected to continue to develop rapidly in the coming years. Investors can indirectly participate in the benefits of these dynamic growth areas by holding Broadcom stocks. However, the technology industry is characterized by high volatility, which may cause significant fluctuations in stock prices in the short term. Therefore, it is recommended that investors adopt a diversified investment strategy, not only limited to Broadcom, but also pay attention to other technology stocks to balance potential risks. In addition, considering Broadcom’s strong market position and sustained growth potential, holding it as a long-term asset can help investors overcome short-term market fluctuations and achieve long-term capital appreciation.

Pay attention to industry trends and company performance

As a leading enterprise in the semiconductor industry, Broadcom’s performance is closely related to industry development trends. Investors should closely monitor the supply and demand situation, technological development trends, and economic environment of the global semiconductor market, all of which may directly affect Broadcom’s financial performance. By regularly reading the company’s financial reports and listening to management’s performance conference calls, investors can obtain the latest business progress, financial status, and future development plans of the company. In addition, Broadcom’s strategic layout in emerging technologies such as AI chip manufacturing and cloud infrastructure is also a key factor in judging its future growth potential. Understanding how the company uses its core technological advantages to enter and expand into new markets will help you better evaluate Broadcom’s long-term investment value.

Monitoring risk factors

Despite Broadcom’s strong growth potential and good market prospects, investors must also consider relevant risk factors when making investment decisions. Uncertainties in the global macro economy, such as economic recession and trade policy changes, may affect the performance of Broadcom and the entire semiconductor industry. In addition, the competition in the industry is becoming increasingly fierce, and technology is rapidly iterating, which requires Broadcom to continuously invest heavily in research and development to maintain its technological leadership. Changes in Anti-Trust regulations may also affect the company’s business expansion and merger and acquisition strategies. Therefore, investors should continuously monitor these risk factors through various information channels and adjust their investment portfolios in a timely manner according to changes in the market and company situation to protect investment security and seek the best returns.

Overall, Broadcom has become an attractive investment target due to its leadership position in multiple high-growth technology fields. Through in-depth understanding of the company and timely market analysis, investors can effectively layout Broadcom and achieve long-term capital appreciation. Despite facing certain market and technological challenges, Broadcom’s diversified business model and continuous technological innovation capabilities enable it to remain competitive in the future and bring sustained returns to investors.