- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Cloud of Antitrust Case Hangs Over, Can Google's Stock Price Turn the Corner? Is There Room for Futu

Alphabet (NASDAQ : GOOGL) (NASDAQ: GOOG). Investors have had to endure a difficult third quarter as the stock of this search giant has underperformed the S&P 500 Index (SPX) (SPY) since reaching its peak in early July 2024. As a result, the market has begun to digest the uncertainty brought about by the recent loss of the monopoly case brought by the US Department of Justice.

The final remedy is not expected to be introduced until August 2025. The US Department of Justice is expected to announce its proposed remedies in the coming months.

Although regulatory risks still exist, Google has brought some exciting factors in recent quarters. First, the cloud division is expanding and reaching break-even. Second, the company-wide cost-cutting plan has reduced operating expenses and improved profitability. Finally, the latest developments in Waymo’s autonomous driving division are promising and may unlock the hidden value of the stock. My DCF model shows that there is still upside potential for this stock without considering particularly aggressive assumptions. I rate this stock as a buy.

Ongoing Review Risks

At present, Google is facing numerous challenges, which have caused its stock price to remain weak in recent months.

Google lost an antitrust lawsuit last month. In this lawsuit, the US Department of Justice accused Google of being an illegal monopoly enterprise and violating Section 2 of the Sherman Act because Google paid Apple (AAPL) $20 billion in 2022 to make its search engine the default search engine for Safari browsers.

The US Department of Justice may take extreme measures to split Google, which is likely to undermine Google’s business model and its dominant position in the search business. At the same time, Google is also facing another antitrust battle because the US Department of Justice also accused Google of illegally monopolizing the advertising technology market. The judge’s hearing is expected to last several weeks.

Considering that in the second quarter, Google’s search business generated $48.5 billion in revenue, accounting for 47% of total revenue. Due to the potential damage to its business model caused by regulatory actions, growth opportunities may be weakened. If the US Department of Justice successfully splits the company (the possibility is very low), then considering that nearly half of Google’s total revenue in the second quarter comes from the United States, the consequences could be fatal.

Another risk is that in the worst-case scenario, Google may face lawsuits from advertisers for up to $100 billion, which accounts for almost all of its case reserves at the end of the second quarter. If Google complies with EU regulations, then its search business will face the risk of disruption. If it does not comply with the regulations and a ruling is made by the end of this year, then Google may be forced to pay a fine of slightly more than $30 billion, which accounts for 10% of the company’s 2023 revenue. In addition to regulatory risks, competition is also intensifying.

Wall Street points out that the market has been trying to reflect the execution risk brought about by Google’s possible loss of exclusive distribution agreements with existing partners.

As a result, Google’s $20 billion exclusive agreement with Apple (AAFL) is in danger, creating an opportunity for Microsoft. After all, this company headquartered in Redmond has always wanted to break Google’s deeply entrenched dominance. And the OpenAI it supports has recently begun testing its artificial intelligence search platform, which is available to a selected group of users. Given the regulatory challenges Google faces, OpenAI may disrupt the search market in the future.

In addition, the second case brought by the US Department of Justice against Google’s advertising technology business has brought more challenges to CEO Sundar Pichai and his team. Jeff Green, CEO of The Trade Desk (TTD), made it clear that Google has not competed fairly in the digital advertising market for some time.

It is reported that even Meta (META) finds it difficult to break Google’s dominant position in the advertising technology field, which undoubtedly adds fuel to the fire. Green emphasized that Google plays multiple roles of “prosecutor, defense attorney, judge, and jury” in its advertising technology business. As a result, Google has gained an “unfair” advantage when competing with smaller advertising technology peers.

During the trial, market pessimism is likely to stem from Google’s previous failure as it failed to successfully defend against search monopoly charges.

Remedies

Despite the severe adverse situation, Google still has some ways to avoid the worst-case scenario.

At the beginning of this month, Google won an appeal against the ruling of the European General Court in another case and was successful. The European Commission fined Google $1.67 billion five years ago.

Even if Google loses another appeal, it takes several years from the appeal to the court’s final judgment. Therefore, even if the European Commission requires Google to pay 10% of its global annual revenue, Google will appeal this decision, and it will take several years for the court to make a final ruling.

As far as the United States is concerned, in 2000, a federal judge ruled that Microsoft also violated the Sherman Act and abused its monopoly power, but Microsoft avoided being forcibly split after appealing.

Therefore, Google may also have a chance to avoid the worst-case scenario. Google controls more than 90% of the search market. Before the court makes a final judgment, it may still have several years to obtain good returns in the search business. So, in the short term, the situation seems relatively stable.

The US economy also remains resilient, and gross domestic product continues to grow due to increased consumer spending. Since inflation seems to be under control, we may see an increase in advertising spending in the next few years, which may help Google grow at a good pace until the worst-case scenario begins to emerge.

Although the market is excited about Google’s possible split, I don’t think this will become a reality.

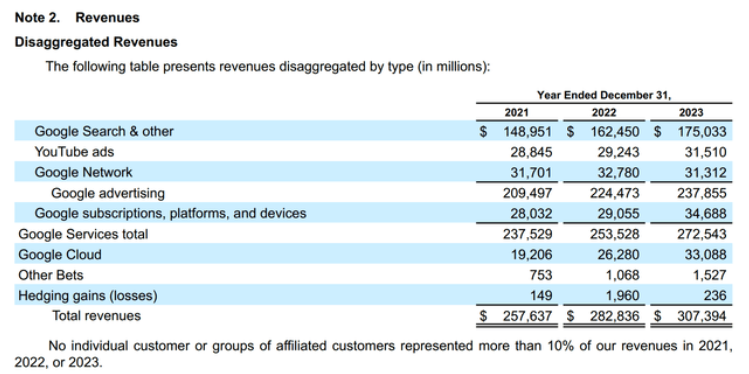

The challenge of splitting Google lies in the difficulty of proving that such a measure can weaken its dominant position in the search and search advertising fields. Search advertising is the revenue pillar of Google’s other businesses, as shown in Alphabet’s 10-K form for 2023.

At present, Android and key applications such as the Play Store are free for device manufacturers. In the future, can Android become self-sufficient through licensing fees? In addition, considering that Apple’s monopoly position in the US smartphone market is being sued, the government may be vigilant about the reduction in competition in the smartphone field.

Splitting the Chrome browser may be even more difficult to stop, but the question is what’s the point? This will not weaken the profitability of the search business. No matter how the search business changes, advertising revenue will follow closely and maintain its market position. The only benefit of splitting Chrome may be to eliminate the default setting of Google Search in Chrome, but this can be achieved through other behavioral remedies.

I think the court will be more inclined to behavioral remedies, such as abolishing search service agreements (RSAs), rather than splits that may harm consumers. Limits may be imposed on auction pricing because this is an obvious example of abuse. Google may be required not to give priority to its own services in search results.

Financially, the most influential remedy may be the abolition of RSAs. In 2023, Alphabet’s traffic acquisition cost (TAC) was $50.866 billion, accounting for 29% of search advertising revenue. Abolishing RSAs can save Google about $50 billion in costs annually. Users will need to make a choice in the initial settings of their devices or browsers instead of relying on default settings. This may cause Google to lose some search share, but it is unlikely to reach 30%.

In the short term, Google may not be financially damaged due to the lack of RSAs. It can make up for the lost search revenue by recovering TAC costs.

Worst-Case Scenario

Even if Google may give market share to Microsoft, so what?

Investors have to think about whether the worst-case scenario of losing the exclusive search distribution agreement will be a disaster. Although Google may give a lot of search market share to its peers, analysts at Evercore pointed out that the impact on its earnings per share may be in the single-digit percentage range.

Investors should remember that Google does not need to pay the huge sum of up to $20 billion to Apple. This may mitigate the impact of the decline in market share due to the loss of search revenue on earnings.

Although Google has been working hard to reduce its reliance on search advertising and advertising technology and achieve diversification. Although YouTube’s growth rate has slowed down, it has fully utilized its own advantages and expanded in scale to become one of the most important and leading streaming media platforms. As connected TVs are expected to continue to drive growth, YouTube’s dominance is expected to continue despite regulatory challenges in search and digital advertising.

In addition, Google Cloud has made significant progress in cloud services. As one of the leading hyperscale cloud service providers, Google Cloud is facing fierce competition from the resurgent Oracle. Oracle’s competitiveness in building large artificial intelligence clusters in cooperation with Nvidia is continuously improving, which may break Google’s emerging momentum in the hyperscale cloud service field.

Nevertheless, Thomas Kurian, CEO of Google Cloud, emphasized the flexibility of its accelerated computing architecture. Kurian said that the platform provides customers with choices and can use internal tensor processing units or Nvidia’s artificial intelligence chips, with a focus on optimizing total cost of ownership and reliability.

If the US Department of Justice’s remedies against Google are successful and Microsoft is expected to seize some market share from Google in the search advertising field, then Google’s successful delivery in its cloud business becomes extremely critical.

Creating a Good Entry Point

Due to investors’ concerns about potential regulatory fines and government intervention, Google’s stock price has fallen since $191.75 on July 10. I think the closing price of $162.29 as of September 24 has reflected most of the risks.

In 2023, more than 75% of Google’s total revenue came from online advertising. Although advertisers, distributors of Google products and service providers, digital publishers, and content providers can terminate their contracts with Google at any time, it is unlikely to do so in the short term.

Google creates higher value (such as increasing users or customers, increasing sales leads, improving brand awareness, or making more efficient profits) than other similar companies. Advertisers still value Google’s expertise in search algorithms and AI learning, as well as Google’s access to and accumulation of data.

In terms of technical analysis, on September 24, GOOGL’s stock price closed at $162.29. I added red Fibonacci lines and used GOOGL’s highest and lowest points in the past five years.

It is interesting to observe how the market pauses or rebounds from these Fibonacci lines, as they can serve as a clue to the stock price trend.

GOOGL is currently at the 78.6% Fibonacci retracement level, but it may go lower. However, I believe that GOOGL’s trading price will exceed $165.00 by March.

The average one-year target price given by 32 analysts is $201.00, indicating that if their predictions are correct, the stock may rise by 24% compared to the trading price of $162.00 on September 24. Their ratings are 23 buys, 9 holds, and 0 sells.

Of course, analysts are only one of my reference indicators. They are not completely correct, but their predictions usually match expectations or at least move in the right direction. To be on the safe side, the price may eventually be lower than their one-year target.

Judging from the target prices given by analysts, Google’s stock price has the potential to rise. However, it should be noted that analysts’ predictions are not 100% accurate. Factors such as market sentiment, company performance, and macroeconomic environment may all affect the actual performance of stock prices.

Selling Covered Call Options

Google closed at $162.29 on September 24, 2024. For the March $165.00 covered call option, the price is around $12.85. Buying a covered call option requires 100 shares of stock. If the trading price on March 21 exceeds $165.00, the stock will be redeemed. If the price is higher, it may be redeemed early, which is conducive to faster return of capital.

Investors can also earn $1,285 through call option premiums, earn $271 from the stock price increase, and have a dividend income of $20. The total investment is $16,229, and the expected total profit is $1,576 with a term of 177 days and an annualized return rate of 20%.

If the stock price on March 21 is lower than $165.00, investors can still make a profit until the net stock price drops to $149.44 (that is, $162.29 minus the $12.85 option premium). Selling covered call options helps reduce risk.

The investment thesis is that due to the continuous growth of almost all business segments, its stock price has upside potential. Even if the stock price does not fluctuate significantly, the premium of covered call options and dividends can bring considerable returns to investors.

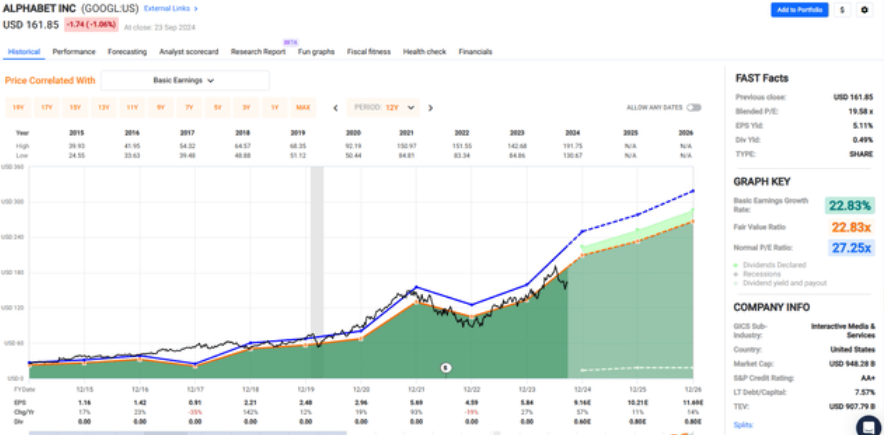

Earnings per Share and P/E Ratio Trends

The black line shows GOOGL’s stock price over the past ten years. By looking at the digital chart below the chart, we can understand GOOGL’s adjusted earnings: $5.61 in 2021, $4.55 in 2022, and $5.80 in 2023. Earnings for 2024 are expected to be $7.65, while forecast earnings for 2025 and 2026 are $8.37 and $9.96 respectively.

Currently, GOOGL’s price-to-earnings ratio is 18.7. If the market gives it the commonly seen price-to-earnings ratio of 22 in the past and assumes earnings of $8.67 in 2025, then the stock’s trading price may reach $190.74.

Due to the increase in internet usage and advertising revenue, Google’s stock price is expected to rise.

Even if by March 21, GOOGL’s stock price only rises slightly from $162.29 to $165.00, investors still have the potential to achieve an annualized return rate of 20%.

This return rate includes the premium of covered call options, a small increase in stock price, and dividend income.

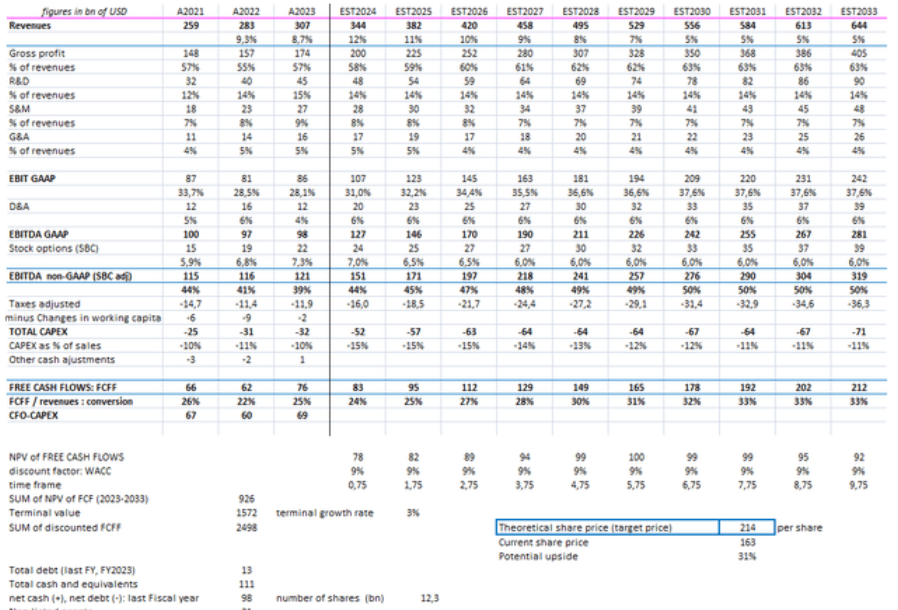

Possible Valuation

According to simulations, Google’s revenue stream is expected to grow at a compound annual growth rate of 11% over the next three years, which is in line with recent trends and is driven by the growth of YouTube and Google Cloud businesses. The improvement in profit margins is expected to be driven by two factors: one is the leverage of operating costs, and costs have been reduced after the recent slowdown in recruitment; the other is the enhanced profitability of the cloud computing department.

Driven by general investment, capital expenditures are expected to increase significantly this year, approaching $50 billion. In the second-quarter conference call, Google confirmed this, saying: “Looking ahead, we expect quarterly capital expenditures for the full year to be roughly equal to or higher than the $12 billion in the first quarter.”

Using a terminal growth rate of 3% and requiring a 9% discount for FCFF, a value of $214 per share is calculated, with an upside potential of nearly 30%.

Google’s balance sheet is in good shape, with $110 billion in cash and equivalents and total debt of $130 billion. In April this year, the company announced a new $70 billion stock buyback program and its first dividend payment. Since 2020, Google has repurchased $200 billion worth of its own shares.

In the future, as the scale of major business lines expands and strict cost management is gradually put in place, Alphabet’s profitability should continue to improve in the next few years. Although competition risks still exist, the company’s valuation metrics (a price-to-earnings ratio close to 20 times and with room for growth in my DCF) are very attractive and can provide sufficient safety margins. I rate this stock as a buy.