- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

TSMC crushes its competitors again. The 2nm wafer factory is about to be completed. Morgan Stanley h

TSMC held a leading position in the global wafer foundry industry with a market share of 61.7% in the first quarter of this year. Samsung Electronics, ranked second, only had a market share of 13%, while Intel’s market share ranking lagged behind TSMC and Samsung Electronics. It is particularly noteworthy that TSMC’s market share in the advanced process field is as high as 92%, significantly benefiting from the rapid development of artificial intelligence.

According to the latest news, TSMC’s first 2nm wafer fab in Kaohsiung is about to be completed and will start mass production of its 2nm process in 2025. It has already adopted SMC’s water-cooled cooler for small-scale production on its 2nm chip pilot run.

Recently, TSMC’s stock price has risen significantly, and Morgan Stanley is also optimistic about its prospects, reiterating its overweight rating, raising its target price, and predicting that its capital expenditure will reach $38 billion to cope with the growing demand for AI semiconductors.

TSMC has a leading technological advantage

With its outstanding technological capabilities, TSMC continues to lead the development of the global semiconductor industry. Today, with the continuous evolution of semiconductor technology, TSMC’s 2nm process research and development is particularly important, which is not only related to its market competitiveness, but also to the future of the entire industry.

Progress and advantages of 2nm process

TSMC has always been at the forefront of technological innovation in the industry. In June 2022, TSMC launched the 2nm (N2) process technology. Compared with N3E, the speed of N2 at the same power is increased by 10% to 15%, while the power consumption is reduced by 25% to 30% at the same speed, and the chip density is increased by more than 15%. According to the management’s forecast, the sales volume of N2 in the first two years will exceed the total sales volume of 3nm and 5nm, and it is expected to achieve mass production in 2025.

In contrast, Samsung Electronics plans to achieve mass production of 2nm process in 2025 and launch 1.4nm process in 2027, while Intel is also striving to achieve preliminary production of its 20A (2nm) process. This indicates that all major competitors are moving towards 2nm technology, and TSMC’s technological advantages will further consolidate its market position.

A16 process

In addition, TSMC announced its new 1.6nm (A16) manufacturing process in April 2024. This process is particularly suitable for high-performance computing in complex signal routing and dense power supply networks, and is expected to be mass-produced in February 2026. Such technological advances will significantly improve computing power and chip density, greatly meeting the needs of artificial intelligence and large-scale Machine Learning tasks. The successful application of the A16 process also demonstrates TSMC’s continuous efforts in technological innovation, further consolidating its leadership position in the industry.

Other advanced technologies (e.g. HBM4, silicon photonics)

In addition to 2nm and A16 processes, TSMC has also made breakthroughs in other cutting-edge technology fields. For example, the HBM4 memory technology jointly developed with Samsung and SK Hynix will provide a faster storage solution for high-performance computing. Compared with traditional DRAM, this memory technology can complete data reading and writing in a shorter time, especially suitable for today’s application scenarios that require extremely high speed and efficiency.

In addition, the development of silicon photonics has opened up a new technological frontier for TSMC. By using optical signals instead of electrical signals, silicon photonics can not only achieve zero-delay data transmission, but also significantly reduce signal loss. This technology is expected to play a crucial role in future applications of data centers and artificial intelligence.

The strategic significance of an open innovation platform

TSMC’s success is also due to the construction of its open innovation platform. This platform enables the company to collaborate with various partners in the ecosystem for technology research and development, accelerating product market launch. Through close cooperation with leading Cloud Service companies, Electronic Design Automation (EDA) companies, and other technology companies, TSMC has not only improved its own research and development efficiency, but also strengthened its connection with customers, further consolidating its competitive advantage in the industry.

TSMC continues to expand

TSMC’s expansion plan is not only a strategy to respond to market demand, but also an important guarantee for its continued leadership in the industry. With the continuous growth of global demand for semiconductors, TSMC’s layout in new markets will lay a solid foundation for its future growth.

The strategic significance of European factories and UAE expansion

The construction of TSMC’s first European wafer factory in Germany marks another important milestone in its global layout. The focus of this factory will be on automotive and industrial chips, and production is expected to begin in 2027. This move can not only meet the local market’s demand for high-quality semiconductors, but also open up direct cooperation opportunities for TSMC with major car manufacturers. In addition, the construction of the Germany factory has received strong support from the German government and the European Union, which means dual guarantees in terms of funds and policies.

Meanwhile, TSMC’s expansion plan in the UAE is also noteworthy. The region is gradually becoming an important participant in the global semiconductor market. By establishing production facilities in the UAE, TSMC can better serve the Middle East and surrounding markets, further enhancing its market share and competitiveness.

Progress in US manufacturing facilities

In the US, TSMC’s factory in Arizona is expected to start mass production next year, and the trial production has achieved quite good results. By establishing production facilities in the US, TSMC can not only further reduce supply chain risks, but also establish closer cooperation with local technology companies. This will help TSMC respond to market demand more quickly and provide more convenient services to its customers.

In addition, TSMC plans to establish a second US wafer factory in 2028, focusing on the production of 3nm and 2nm chips. This diversified production layout will provide TSMC with greater flexibility and response capabilities in future market competition.

Market share is expected to further expand

Based on the above expansion plans and market dynamics, the market is generally optimistic about TSMC’s future market share. With the development of emerging technologies such as artificial intelligence, Internet of Things (IoT), and 5G, the demand for high-performance semiconductors will continue to rise. With its advantages in technology and capacity, TSMC is expected to occupy a larger market share in these fields.

Financial performance and valuation analysis

Financial performance is a key indicator for evaluating a company’s health and future growth potential. TSMC has shown strong growth momentum in past financial reports, and its profitability and cash flow situation are particularly noteworthy.

Latest financial report and revenue growth

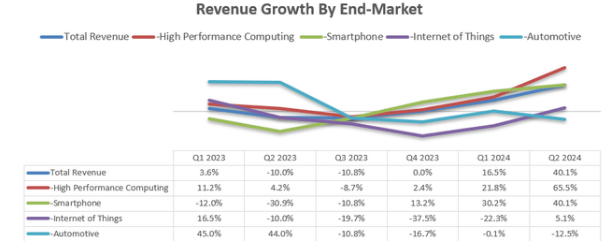

TSMC’s performance report for the second quarter of fiscal year 2024 shows that the total revenue achieved a growth of 40.1% driven by strong growth in high-performance computing (HPC) and the smartphone market.

During the financial report conference call, management predicted that with the increase in demand for process technology below 7nm, the overall capacity utilization rate in the second half of the 2024 fiscal year will improve. This improvement in utilization rate will provide momentum for the company’s short-term growth and also help improve its gross profit margin.

Despite the uncertainties facing the global economy, TSMC’s stable performance and strong market demand have enabled it to maintain its leading position in the semiconductor industry.

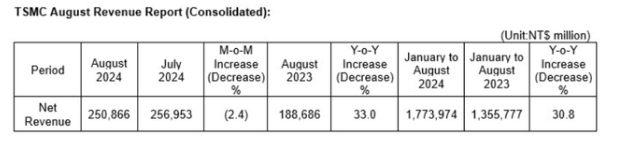

August Revenue Report

TSMC’s revenue in August fell slightly to NT $250 million, down from NT $256 million in July. However, compared to the same period last year, revenue still achieved a strong growth of 33%. From January to August 2024, overall revenue increased by 30% compared to the same period last year.

According to market analysis, TSMC will see a significant increase in order demand in the fields of high-performance computing, artificial intelligence, and electric vehicles in the coming period, which will inject new momentum into its revenue growth. In addition, TSMC’s stable cooperative relationships with major customers such as NVIDIA and Apple are also an important guarantee for its revenue growth.

Capital expenditures and free cash flow

TSMC’s capital expenditure (CAPEX) has been at a high level to support its technology research and development and capacity expansion. It is expected that TSMC’s capital expenditure will reach $30 billion in 2024, which will be used for the construction of new factories and the upgrading of existing capacity.

Meanwhile, TSMC’s free cash flow performance is also quite robust. In the past 12 months, the company generated $19 billion in free cash flow, further enhancing its financial flexibility and risk resistance. This enables TSMC to maintain a competitive advantage in future investments while creating higher returns for shareholders.

Valuation analysis

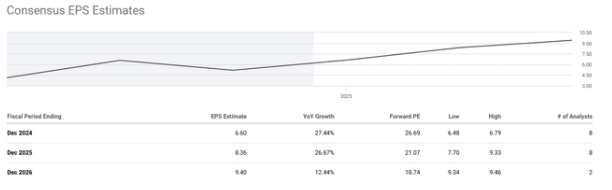

When using the Discounted Cash Flow (DCF) model to value TSMC, optimistic results can be obtained. Assuming the company maintains an average annual growth rate of 30% for the next five years and calculates free cash flow based on this, then based on a reasonable Universal Discount Rates (about 8%), the intrinsic value of TSMC can be obtained.

Analysts generally predict that TSMC’s earnings per share (EPS) in fiscal year 2026 will reach $9.40, with a target stock price of $282 calculated based on the current Price-To-Earnings Ratio of about 30 times. Compared to the current stock price of $172, the potential upside space exceeds 60%. This valuation reflects the market’s confidence in TSMC’s future growth, but also indicates that its stock price is to some extent undervalued.

In addition, considering the rapid development of artificial intelligence and high-performance computing, analysts believe that TSMC’s future earnings expectations may be further raised. Therefore, based on current market demand and technological progress, it is expected that TSMC’s Price-To-Earnings Ratio may be higher, further enhancing the attractiveness of its stock.

Risks faced

Although TSMC’s position and prospects in the semiconductor industry are bright, investors still need to pay attention to some potential risk factors, which may affect the company’s operations and stock price.

Market competition and technological risks

Although TSMC is in a leading position in technology, competitors such as Samsung and Intel are constantly catching up. Especially in advanced process technology, intensified competition may lead to a decline in market share. In addition, the rapid iteration of technology also means that TSMC must continue to invest in research and development to maintain its technological advantage.

The impact of capital expenditures

TSMC’s expansion plan requires huge capital expenditures, which may put pressure on the company’s cash flow. If future investments fail to generate expected returns, it may affect the company’s profitability and shareholder returns. Therefore, investors need to pay attention to the company’s capital expenditure plans and actual effects to judge their impact on financial health.

The semiconductor industry is cyclical

The cyclical nature of the semiconductor industry may lead to fluctuations in market demand. Factors such as economic recession and slowing market demand may cause semiconductor prices to fall, thereby affecting TSMC’s profit margin. Although the current market demand for semiconductors is still strong, investors need to monitor industry cyclical fluctuations to make timely investment decisions.

Is now a good time for bottom fishing?

With TSMC’s continuous breakthroughs in technological innovation, market expansion, and financial performance, many investors are beginning to pay attention to whether the current stock price constitutes a good buying opportunity.

Investment opportunities in current stock prices

Currently, TSMC’s stock price has shown some resilience in market fluctuations. Combined with multiple positive news such as the company’s construction of 2nm process and new manufacturing facilities, the market still has strong expectations for its future growth. According to the latest financial data and analysis, the current stock price is relatively cheap relative to its long-term growth potential, which allows investors to lay out at a low point and capture future profits.

Specifically, you can go to BiyaPay to monitor the market trend of TSMC and choose the appropriate time to buy. In addition, if you encounter difficulties in deposit and withdrawal, BiyaPay can also be used as a professional tool for depositing and withdrawing funds from US and Hong Kong stocks. You can exchange digital currency for US dollars or Hong Kong dollars, quickly withdraw to your bank account, and then transfer the funds to other brokerage accounts to buy stocks. The platform has a fast and unlimited deposit speed, which will not let you miss investment opportunities.

Technical Fundamental bullish

TSMC (TSM) has recently formed a bottom pattern and rebounded from the weekly support level when compared with the S & P 500 Index (SPY). This technical signal indicates that TSMC’s stock price is expected to further rise and may break through the weekly resistance level, thus achieving better performance than the market. This trend not only reflects the market’s confidence in TSMC, but also provides investors with a good buying opportunity.

How to evaluate the timing of buying

Evaluating the timing of buying not only requires analyzing the current stock price, but also considering changes in the market environment and company fundamentals. Investors can judge from the following aspects:

Pay attention to market news : Major news from TSMC, such as new product launches, cooperation agreements, or policy changes, may have an impact on the stock price. Therefore, closely monitoring this information can help seize the buying opportunity.

Technical analysis tools : The use of technical analysis tools, such as the identification of support and resistance levels, can help investors determine a reasonable entry time.

Fundamental analysis : Assessing a company’s financial health, including revenue growth, profit margins, and free cash flow, can support investment decisions.

Market sentiment : Understanding the overall market sentiment, especially the general view of the semiconductor industry, can also help you judge whether the current buying time is appropriate.

Make a long-term layout

In the long run, TSMC’s leadership position and continuous innovation ability in the global semiconductor industry will support its future revenue growth. Many analysts predict that with the increasing demand for high-performance chips worldwide, TSMC’s revenue and profits will steadily increase in the coming years. You can seize the opportunity of short-term stock price fluctuations and establish a long-term investment layout.

Overall, TSMC’s leadership position in the global semiconductor market has been further consolidated, especially its upcoming 2nm process, which will significantly enhance its competitiveness. Morgan Stanley’s target price increase reflects the market’s optimistic expectations for its future development. Investors should closely monitor TSMC’s strong performance in technology and finance, evaluate whether the current stock price constitutes a good buying opportunity, and make investment arrangements.