- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Alibaba's Stock Soars 14%! $275 Million Buyback Still Ongoing: How Will the Buyback Impact Future Tr

Alibaba (BABA) has recently drawn the spotlight of investors and market analysts, with its stock price surging over 14%.

Last Friday, Alibaba’s filings revealed that the company repurchased $275 million worth of stock that week. This indicates that the buyback initiated in mid-September is progressing rapidly. The daily disclosure of these repurchases significantly aids in calculating one of the most critical metrics for this stock—shareholder yield.

Since being included in the Stock Connect program, Alibaba is now obligated to report its buyback activities daily, making it easier to assess the impacts of this strategy. Currently, Alibaba boasts an impressive 6.87% shareholder yield, and while its dividends are relatively modest, the buybacks appear to be driving significant capital appreciation.

Impressive Shareholder Yield

Alibaba’s daily buyback disclosures greatly assist in calculating one of the most critical metrics: shareholder yield. Thanks to ongoing buybacks and the recently announced dividends, Alibaba’s shareholder yield has reached 6.87%.

It’s important to clarify that the shareholder yield I refer to is not merely the “dividend yield,” which is the simple ratio of dividends to stock price. Rather, it encompasses the percentage of total returns to shareholders from buybacks, dividends, and net debt reduction relative to market capitalization.

This form of yield measures the total wealth returned to shareholders, for several reasons:

- Dividends are cash payments to shareholders;

- Buybacks increase ownership and sometimes raise stock prices;

- Reducing debt increases long-term equity value and decreases the compensation owed to bondholders during liquidation.

Theoretically, dividends, buybacks, and debt reduction all enhance shareholder equity. For a sustainably operating company, dividends and buybacks are the more significant contributors to shareholder yield since debt is not typically a major issue for a thriving company.

One might argue that a more meaningful shareholder yield for Alibaba is 9.23%, as the company is robust enough that its debt is relatively inexpensive, and existing debt should not pose a problem. Nevertheless, the technically correct figure of 6.87% is used in this article, as it aligns with industry standards for calculating shareholder yield.

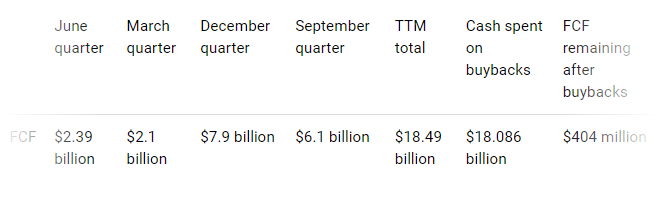

Consequently, the total wealth returned to shareholders amounts to $13.4 billion. Based on Alibaba’s recent market capitalization of $195 billion, this translates to a shareholder yield of 6.87%. Moreover, although Alibaba issued bonds to finance the buyback, the company’s free cash flow is sufficient to cover these repurchases. As shown in the chart below, the company’s TTM free cash flow significantly exceeds the $18 billion spent on buybacks.

Therefore, Alibaba’s buyback expenses are entirely covered by free cash flow. However, the total amount, including dividends, is not fully supported by cash flow, which might explain the issuance of bonds by Alibaba: cash flow did not entirely back the observed total shareholder yield over the past 12 months. On the other hand, the bonds carry a coupon rate of only 0.5% and were oversubscribed, meaning the effective yield could even be lower than the coupon rate. Thus, Alibaba did not overpay for the additional cash needed for buybacks.

Why the $275 Million Buyback Announcement Is a Game-Changer

The recent announcement of Alibaba’s weekly buybacks of $275 million has shifted the stock’s trajectory, as it provides figures we can use to estimate future shareholder yield.

What could be the expected shareholder yield for Alibaba? Here are the facts we know:

- Alibaba repurchased $275 million worth of stock last week.

- This averages out to $55 million per day.

- The amount has been relatively stable over the week.

- There are 252 trading days in a year.

- BABA pays a dividend of $1 per share.

- There have been no recent announcements about further borrowing to fund additional buybacks.

- BABA’s balance sheet shows $61 billion in cash and equivalents.

Based on these facts, I make the following assumptions:

- The buyback scale will remain at about $55 million per day over the next year.

- $2.5 billion will be allocated for dividends.

- Stock-Based Compensation (SBC) remains stable at $2.5 billion.

- No new debt will be issued.

Given these assumptions, as dividends and SBC offset each other, Alibaba’s expected shareholder yield will effectively drop to the buyback amount divided by market capitalization. Over 252 days, repurchasing $55 million daily amounts to $13.86 billion. With Alibaba’s current market cap at $195 billion, our expected shareholder yield rises to 7.1%, higher than the previously calculated yield.

Impact of Buybacks on Valuation

Buybacks positively affect Alibaba’s per-share metrics, with the projected annual buyback amount set at $13.86 billion and the number of shares repurchased at 156.98 million, leading to a new equity figure of $23.3 billion.

The buyback will elevate standardized earnings per share to $4.93, increase free cash flow per share to $7.43, and raise book value per share to $61.57.

Using Friday’s closing price to calculate the forward multiples post-buyback, the price-to-earnings (P/E) ratio stands at 17.9, the price-to-free cash flow ratio at 11.88, and the price-to-book ratio at 1.43. Should the stock price remain unchanged due to the buyback, the P/E ratio will decrease.

This implies that buybacks offer potential upside for Alibaba’s stock; assuming the current valuation is accurate, the stock price is expected to rise in the future if the projected buybacks materialize.

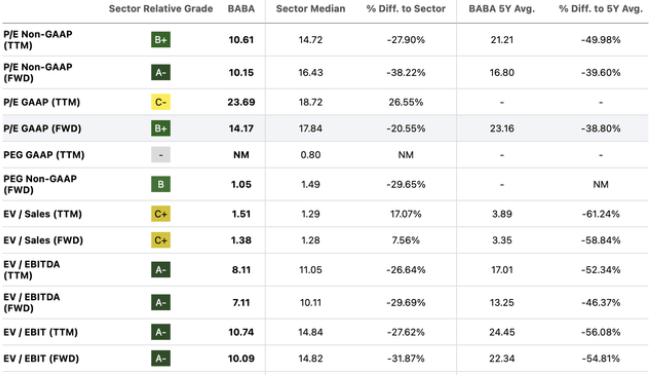

Compared to the entire industry, Alibaba’s valuation appears attractive, trading nearly 20% below the sector average and at a premium of about 39% to its historical valuation.

This assumes that Alibaba’s valuation is 14 times GAAP earnings or 10 times non-GAAP earnings, with the company expected to achieve a compound annual growth rate of approximately 10% in earnings and 8.8% in revenue by fiscal 2026.

Through ongoing buybacks, dividend payments, and ample free cash flow, Alibaba demonstrates its commitment to shareholder interests. The current shareholder yield is impressive and attractive compared to industry valuations, while a stable dividend policy helps mitigate the risk premium on the stock, thereby enhancing its valuation.

Moreover, as the company continues its buyback and dividend payments, Alibaba’s valuation is likely to increase further.

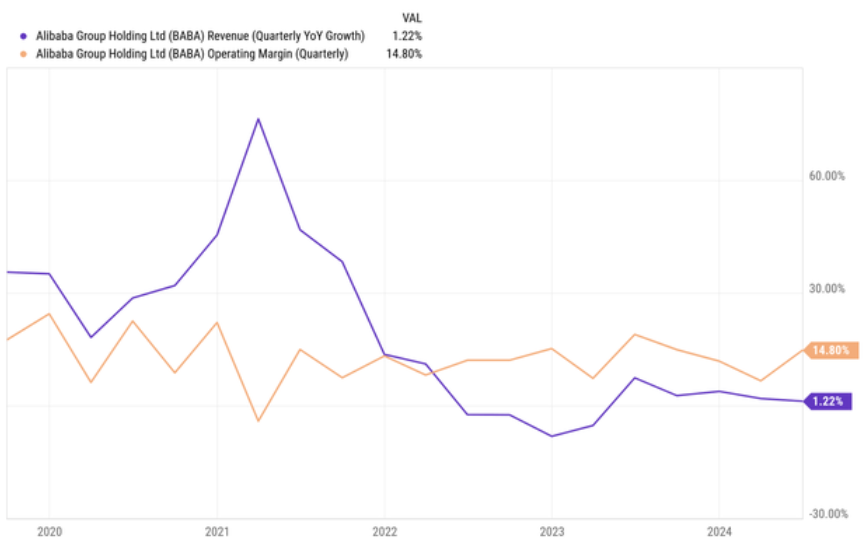

How is Alibaba’s Fundamental Position?

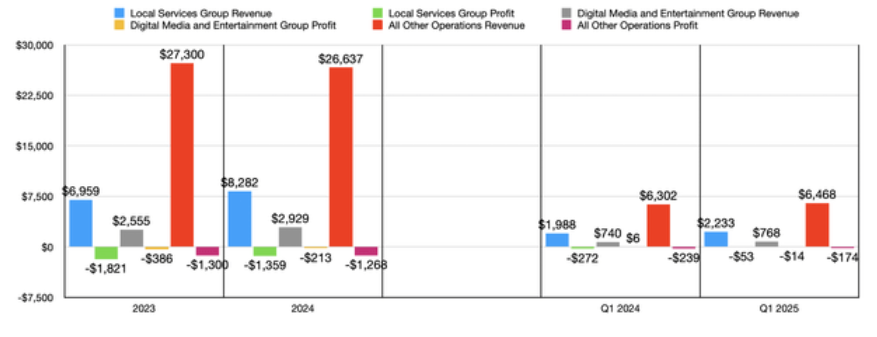

Now, let’s examine the fundamentals. Before understanding the entire company, it is essential to look at each of its major operating segments individually. The most important operational divisions are the Taobao and Tmall groups, which encompass the company’s consumer and business-to-business e-commerce operations.

While the company may hope for continued growth in this segment, we have recently observed some contraction. In the first quarter of fiscal 2025, revenue was $15.6 billion, down 1.4% from the $15.82 billion reported a year earlier. Although this is disappointing, management attributes the decline primarily to a drop in consumer electronics and home appliance sales. The company has decided to reduce certain direct sales, possibly due to low margins and anticipated weak demand.

This does not imply that all parts of the business are underperforming. The company offers certain value-added services to paid members, and its domestic wholesale business grew by 16% year-on-year. Customer management revenue increased by 1%.

The segment profit also experienced a similar decline, totaling approximately 1% lower. Profit decreased from $6.79 billion to $6.72 billion. Interestingly, management’s remarks about this decline were not related to revenue. In fact, they stated that the decline in segment profit was due to increased investments in user experience and technology infrastructure.

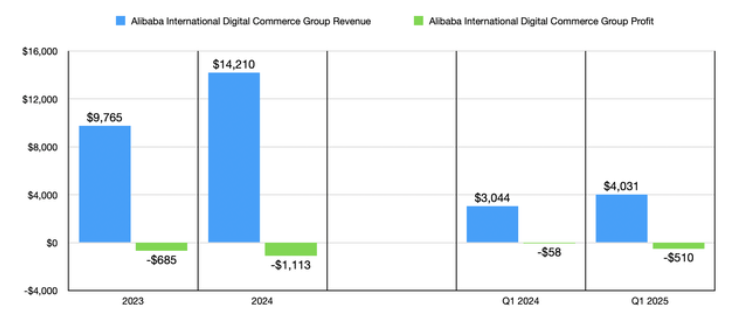

International Digital Commerce Group

At least in the first quarter, Alibaba’s International Digital Commerce Group was the company’s second-largest division. Through this segment, the company offers international retail and wholesale options. Notably, this includes its famous AliExpress business. From a revenue perspective, this has been a standout performer for shareholders. Revenue soared 32.4% from $3.04 billion to $4.03 billion. This growth was primarily due to a 38.2% increase in the company’s international retail business, attributed to improved monetization and growth in the AliExpress Choice service, which was launched in early 2023 and has since become the company’s largest growth driver.

While revenue increases should lead to profit growth, unfortunately, segment profit deteriorated. The company’s loss increased from $58 million to $510 million year-on-year. Despite significant improvements in monetization and operational efficiency, management’s decision to increase investment in AliExpress negatively impacted profits.

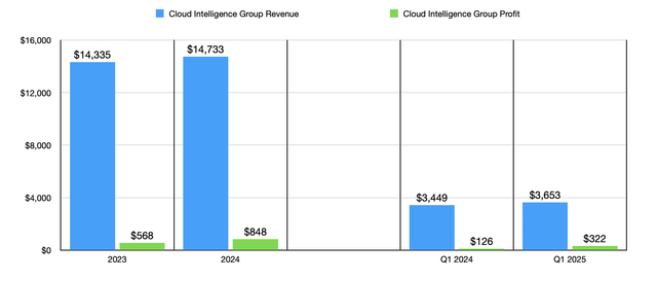

Cloud Intelligence Group

Alibaba’s most exciting division remains its Cloud Intelligence Group. In fact, it is the largest cloud computing group in the Asia-Pacific region. As the industry itself expands, revenue has indeed grown year-on-year, but the increase is only about 5.9%, rising from $3.45 billion to $3.65 billion. Management indicates that revenue from public cloud products is growing at a double-digit rate, largely thanks to AI-related offerings. However, as is the case in other areas of the company, some of the weakness is intentional.

Specifically, revenue from non-public cloud services has declined as the company decided to abandon project-based activities, which have historically contributed little to profits. This decision seems to be yielding results. In Q1 of FY2024, profits from this segment were $126 million, but surged to $322 million in Q1 of FY2025. This appears to be part of a broader trend in the cloud computing market.

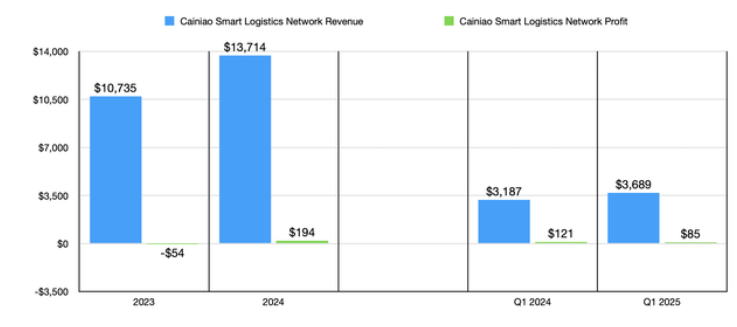

Cainiao Smart Logistics

The last operational segment introduced is Cainiao Smart Logistics. The company’s long-term goal is to ensure customers receive goods within 24 hours domestically. If customers reside abroad, the aim is to ensure their goods arrive within 72 hours or less. This division has actually achieved quite significant growth, with revenue increasing by 15.8% year-on-year, from $3.19 billion to $3.69 billion. This growth is primarily due to the rise in sales of cross-border fulfillment solutions. Honestly, I find this quite exciting as it suggests that the services of this division are robust enough to meet the needs of international customers.

Unfortunately, as seen in other segments of the company, profitability in this division has indeed declined. Profits dropped from $121 million to just $85 million. However, similar to other departments, this is attributed to increased investments by management, primarily focused on cross-border fulfillment solutions.

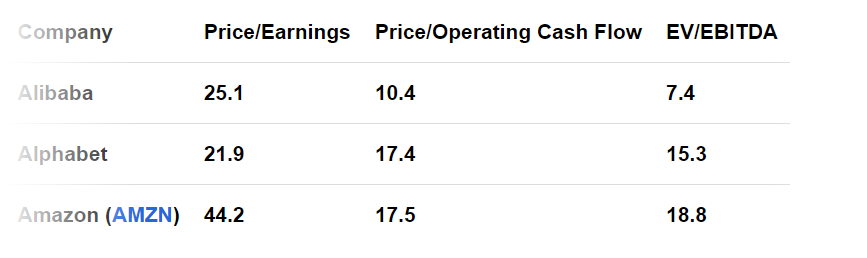

If we annualize the results so far this year, we obtain a net income of $7.81 billion, operating cash flow of $18.77 billion, and EBITDA of $26.09 billion. Using these estimates along with historical results from 2024, the stock does appear a bit pricey relative to earnings, at least from a long-term perspective. Yet, in terms of the other two profitability metrics, it seems reliable.

The table below compares Alibaba with two similar companies. Even using more conservative estimates for 2025, we find Alibaba’s price-to-earnings ratio is cheaper than both competitors, whether viewed in terms of price-to-operating cash flow or EV-to-EBITDA ratios. From a price-to-earnings perspective, its valuation falls between the two.

Investment Risks and Recommendations

Alibaba’s valuation is moderate, with very high shareholder returns. It has many advantages; however, investors must remain cautious about risks.

The competition in e-commerce today is far more intense than in the era when Alibaba reigned supreme. Competing against JD and Pinduoduo, Alibaba’s recent slowdown in growth may be tied to the rise of these rivals. Alibaba and JD Group have started to aggressively price their consumer products, competing with Pinduoduo to reclaim some market share from Alibaba’s peers. In the last earnings call, Alibaba’s management revealed that with the introduction of “attractive pricing tailored to different consumer shopping needs,” they noted “steady growth in GMV and order volume, with significant increases in purchase frequency.”

I anticipate that these measures by management will provide a moderate boost to Alibaba’s Tmall and Taobao groups, which handle most consumer-related e-commerce activities. The company typically spends about $250 million quarterly on repurchasing ADS, and this figure has sharply increased to about $5 billion over the past two quarters. Alibaba currently has approximately $26 billion in cash available for further ADS buybacks. It is likely that Alibaba will utilize the liquidity plans from recent monetary market measures to return more cash to shareholders, thus creating greater appeal for its stock.

In summary, Alibaba has demonstrated strong resilience and growth potential in the current market environment. Despite facing intense competition, the company creates substantial value for shareholders through continuous buybacks, dividend payments, and proactive positioning across its business segments. Moving forward, as the company further advances its buyback program and invests in technological innovation and business expansion, Alibaba is poised to continue enhancing its valuation and delivering substantial returns to investors.