- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Micron Plunges: Can Earnings Report Be a Catalyst to Reverse Market Sentiment? Buy Now or Wait?

As Micron Technology (MU) is about to release its fiscal fourth quarter 2024 earnings report, the market’s attention is once again focused on this global leading provider of memory and storage solutions.

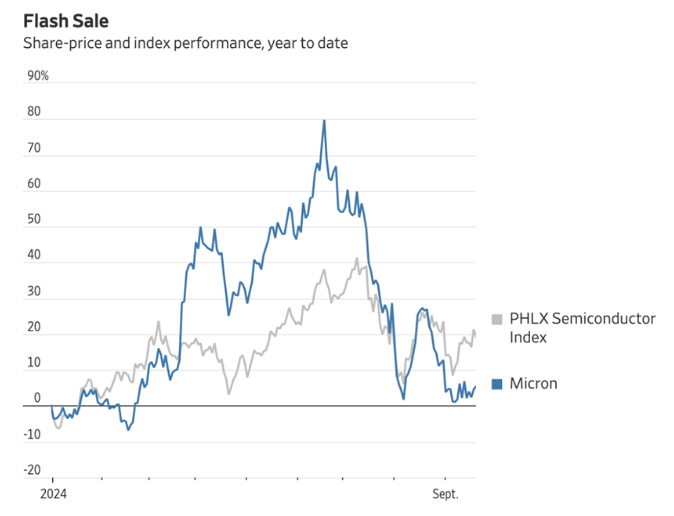

At the beginning of the year, with the booming of artificial intelligence and the chip industry, Micron’s stock price once climbed to a high point above $150. However, as the market’s enthusiasm for these sectors weakened, Micron’s stock price has fallen by about 40% from its year-to-date high. In the recent month, there has been continuous selling, and the stock price has fallen from a high of over $108 to around $93, a decline of more than 10%. Nevertheless, the current Micron stock price is still up about 10% compared to the beginning of the year, showing certain resilience.

After this round of decline, many investors believe that Micron’s valuation is relatively low, especially when the valuation of the S&P 500 index is generally high.

Although investors’ enthusiasm for artificial intelligence and the semiconductor industry has waned, Micron still holds an advantage in long-term growth potential. The market expects that the release of this earnings report is expected to become an important catalyst to push the stock price to rebound, especially against the background of a still strong industry fundamentals.

Micron’s Stock Price Volatility

For a long time, the stock market trend of Micron investors has been like a roller coaster. But this has been especially true in the past few months, which is enough to make people feel severe motion sickness.

Since hitting an all-time high three months ago, the stock price of this memory chip manufacturer has plunged 41%. This far exceeds the decline of most other chip stocks during the same period, as the market’s hype for artificial intelligence has begun to cool. Micron has made good use of this wave: According to data from S&P Global Market Intelligence, when the company announced its third fiscal quarter results at the end of June, its stock price had risen 118% in 12 months and was second only to Nvidia among stocks in the Philadelphia Semiconductor Index.

Why such a drastic shift? Although there is strong demand for artificial intelligence systems with dedicated and expensive memory, most of Micron’s business still comes from personal computers and smartphones. These are mature markets. Sales have rebounded slightly this year, but the growth rate is at most single digits. Personal computer and smartphone manufacturers also began to increase DRAM memory inventory in the first half of this year, and prices are expected to rise in the second half.

This volatile trend provides an important opportunity window for investors. Especially for those who are good at catching stock price pullbacks and patiently waiting for long-term rebounds, Micron’s current valuation appears quite attractive.

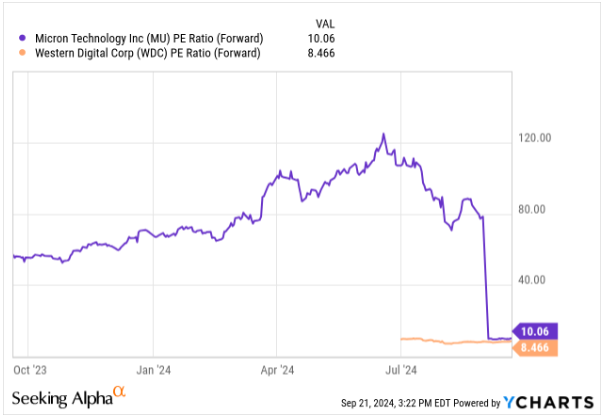

Compared with the generally high valuation of the S&P 500 index, Micron’s current forward price-earnings ratio is only about 10 times, which appears relatively cheap. This data is similar to Micron’s competitor Western Digital (WDC), which also faces challenges brought by industry volatility.

Micron’s long-term development potential, especially in the demand for storage chips driven by AI over the years, makes the market full of expectations for its future. Analysts generally believe that the fourth-quarter earnings report to be released on September 25 may become an important catalyst to push the stock price to rebound. If Micron can send positive signals through this earnings report, it will not only repair the recent stock price decline but also may start a new round of rallies.

Positive Factors Cannot Be Ignored

Among all the news we learned in this earnings season, there are two companies related to Micron that provide us with the best reference information for Micron’s upcoming earnings report.

Positive Signals from Western Digital and Best Buy

The first one is Western Digital, a direct competitor of Micron, which produces both HDD/ hard disk storage and NAND flash memory, and the latter is most relevant to Micron.

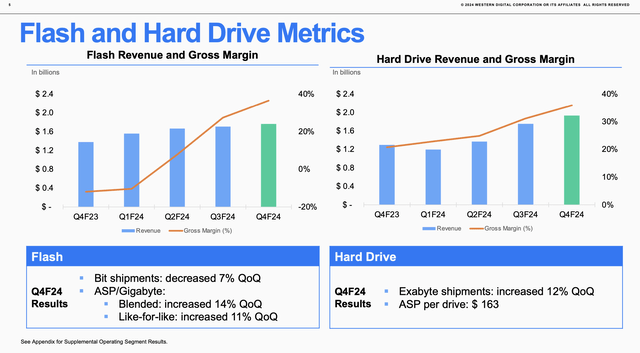

Western Digital announced its earnings report at the end of July. The first observation we can draw here is that the company continues to report healthy flash memory indicators, which directly translate into Micron’s performance in the same quarter. As shown in the figure below, the average selling price of Western Digital’s hybrid flash memory has increased by 14% quarter-on-quarter:

High flash memory pricing and the resulting high gross margin are one of the core reasons to be optimistic about Micron. After suffering losses in 2023, the massive demand for flash memory chips driven by artificial intelligence has brought huge profit growth to the company.

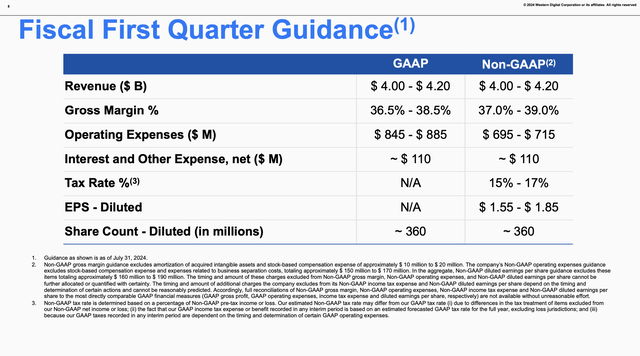

In addition: Although Western Digital did not announce specific flash memory pricing expectations for the first fiscal quarter (June), it expects a gross margin of 37-39%, and the midpoint is 170 basis points higher than 36.3% in the fourth quarter.

This indicates that entering the next quarter, the memory pricing environment is expected to remain healthy and may even improve.

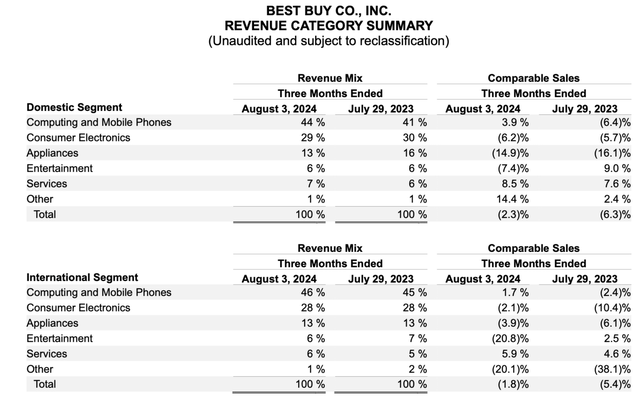

When it comes to the health of the end market, we can refer to Best Buy’s quarterly report for more information. Micron’s largest customers are equipment manufacturers such as HP, Dell, and Samsung: because storage chips power all personal computing devices from laptops to smartphones.

As we all know, the consumer market has entered a cold winter because consumers hold higher-quality devices for a longer time and cut budgets before the possible economic recession later this year. Best Buy has been a victim of an extended upgrade cycle and declining purchase intentions, but its recent quarter has brought a glimmer of hope.

The domestic sales of the company’s “computers and mobile phones” department increased by 3.9% year-on-year in comparable sales (excluding the impact of new store openings and closures), and international sales also increased by 1.7% year-on-year.

Best Buy’s domestic sales declined by 610 basis points compared to the -2.2% decline in the first quarter, and international sales also increased, although the growth rate was only 100 basis points compared to the 0.7% increase in the first quarter.

In fact, Best Buy raised its expectations for this year and expects performance in the second half of 2024 to further improve compared to the first half. Corie Barry, CEO of Best Buy, said on Best Buy’s recent second-quarter earnings conference call:

Looking ahead to the second half of the year, we expect the industry to continue to show an increasingly stable momentum. Last quarter, we said that we may tend to the midpoint of our initial comparable sales expectations, which is flat to a 3% decline.

Today, we update our annual sales expectations to a decline of 1.5% to 3%. At the same time, we are raising the expected range of earnings per share because we largely reflect the better-than-expected performance in the first half of the year."

For Micron, of course, the interpretation of the ecosystem and industry players cannot be 100% reliable in indicating how Micron will perform after the earnings report is released. But from these early earnings reports, we can at least determine that the memory pricing fundamentals are healthy and the refresh rate of computers/mobile phones may be improving, which will help stimulate long-term demand for Micron’s products.

Micron Strives for Apple’s Orders

Apple is in discussions with Micron and Indian chip manufacturers such as Tata Group to purchase chips for locally produced iPhones.

Apple plans to shift 26% of its global iPhone production to India by 2026, which means the demand for local chips is expected to reach $12 billion. If Micron and Tata Group can provide products of the required grade, they will obtain large orders from Apple, the world’s largest company. The establishment of this cooperation relationship will significantly increase Micron’s revenue, especially against the background of Apple’s continuous expansion of its production base in India.

In addition, Apple’s chip spending in India may surpass that of any other company in the defense, aerospace, and automotive sectors. In fiscal year 2024, Apple’s iPhone production value in India reached $14 billion, accounting for nearly 14% of global iPhone production. This huge market demand not only provides growth opportunities for Micron but also shows its potential in high-end chip production.

Apple’s global chip consumption has increased significantly in the past decade, soaring from $18.8 billion in 2011 to about $72 billion currently, an increase of more than three times. With the continuous development of the smartphone market, Apple has implemented a smartphone production incentive plan in India through three Taiwanese suppliers, providing new opportunities for Micron’s supply chain. At the same time, India launched a $10 billion incentive plan in 2022 to stimulate domestic chip production, which further enhances Micron’s layout in this important market.

In general, the potential cooperation between Apple and Micron and the expansion of the Indian market have injected strong impetus into Micron’s future growth. These positive factors indicate that Micron’s upcoming earnings report may become an important catalyst for its stock price rebound.

Earnings Forecast

Micron Technology is one of the leading enterprises in the memory and storage industry. Its powerful cutting-edge memory products are regarded as the key to future artificial intelligence development. Micron has an impressive series of solutions, including DRAM, NAND flash memory, and the recently launched advanced HBM3E memory for AI high-performance computing applications, indicating that Micron’s technology will become the foundation of future AI development.

As Micron Technology (MU) plans to release its fourth fiscal quarter earnings report after the market closes on Wednesday, September 25, Wall Street analysts expect the company’s earnings per share to reach $1.11 and revenue to be approximately $7.64 billion, a year-on-year increase of 90.49%.

This earnings report is crucial for addressing the concerns I and other analysts raised after the third quarter release. At that time, the company’s operating cash flow decreased by 23.5% to only $2.48 billion, lower than the expected $3.24 billion.

The company has established a close cooperation relationship with leaders in the field of artificial intelligence such as Nvidia, which has brought great confidence to investors. Especially after Nvidia announced its initial production plan, they have sold all of their HBM3E supply for 2024.

Sumit Sadana, chief commercial officer, said in an interview in June: “We are very optimistic because after Nvidia, Micron may have a greater impact on AI growth than any other semiconductor company.”

Although the company’s revenue has increased driven by the growing demand for artificial intelligence and close cooperation with Nvidia, the improvement in cash flow has lagged due to a busy investment cycle. Last quarter, Micron’s gross margin was 28%, an increase of 8 percentage points from the previous quarter, mainly due to better pricing strategies and product mixes.

CEO Mehrotra pointed out at a recent conference:

Looking ahead to 2025, we expect HBM to account for about 6% of the total industry capacity. At that time, the total market value of the industry will exceed $25 billion. Therefore, this is an exciting market, and Micron is in a favorable position with its HBM products. Considering the 3:1 trade ratio of HBM, the tightening of the HBM supply market will have an impact and have a chain reaction on the pricing of the non-HBM market.

Therefore, we see a good supply and demand environment and an optimistic pricing environment in 2025, which allows us to predict that revenue in 2025 will set a considerable record and profitability will grow strongly.

Essentially, the relationship between Nvidia and Micron is the cornerstone of Micron’s future.

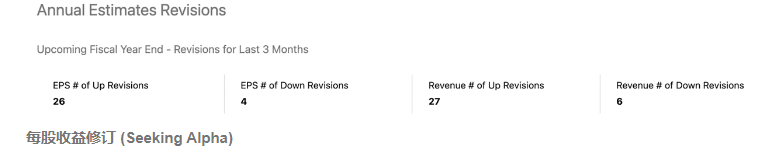

Frankly speaking, I think analysts’ expectations for this quarter may be a bit optimistic. In the past three months, EPS and revenue expectations have been revised upward 26 and 27 times respectively. This is indeed a positive signal. Even one of Micron’s major customers has indicated that it will postpone accepting orders for HBM memory chips.

In the upcoming quarter, we have seen 17 upward revisions of earnings per share and 15 upward revisions of revenue. These data indicate that the market still has full confidence in Micron’s future. Investors can use the multi-asset wallet BiyaPay to regularly check Micron’s market trends and evaluate Micron’s future to ensure that they do not make overly optimistic judgments about short-term market fluctuations.

If you are troubled by deposit and withdrawal, you can also use it as a professional deposit and withdrawal tool for US and Hong Kong stocks. You can recharge digital currency and exchange it for US dollars or Hong Kong dollars, withdraw it to a bank account, and then deposit it into other brokers to buy stocks. The arrival speed is fast and there is no limit, so you won’t miss the investment opportunity.

Stock Valuation

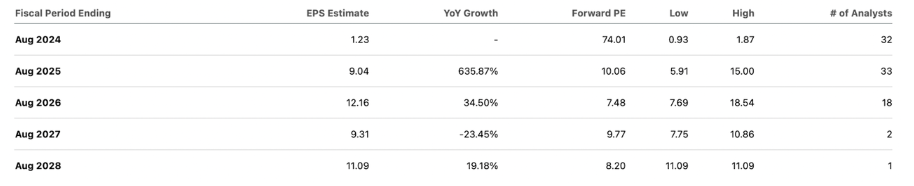

Micron Technology (MU) has experienced a plunge recently, making its current stock price even cheaper. According to market expectations, Micron’s expected price-earnings ratio is only 10 times, while Wall Street’s forecast for earnings per share in fiscal year 2025 is $9.15.

This low valuation is in sharp contrast to the approximately 20 times price-earnings ratio of other stocks in the S&P 500 index, making Micron more attractive in the current market environment.

Compared with Western Digital (WDC), Micron trades at a slightly higher price, but investors should note that Western Digital is about to spin off its flash memory department in October, which brings uncertainty to its future. In contrast, Micron’s growth rate is significantly faster. Historical data shows that Micron’s price-earnings ratio is usually in the middle single digits to a higher level during economic booms. The current low valuation provides a good buying opportunity for investors.

Betting on Micron is equivalent to betting that artificial intelligence will drive the investment cycle in the memory and hardware fields for many years in the future. As CEO Mehrotra pointed out, the HBM market is expected to account for about 6% of the total industry capacity in 2025, and the total market value of the industry will exceed $25 billion.

More importantly, analysts predict that Micron will achieve significant earnings growth in the next three to five years. Earnings per share is expected to jump from $1.23 in fiscal year 2024 to $12.16 in fiscal year 2026, mainly due to the strong demand for high-performance memory chips in artificial intelligence applications.

Revenue is also expected to grow, soaring from $25.37 billion in 2024 to $44.3 billion in 2026.

Although Micron has the ability to benefit from the expansion of the artificial intelligence market, it still needs to exceed market expectations in performance. The growth in demand for HBM products may reduce the severe fluctuations in the traditional cyclical memory industry, providing Micron with a new business model and helping to resist historical boom and bust cycles.

To sum up, although Micron faces certain uncertainties, its low valuation and close integration with artificial intelligence applications make it extremely attractive in the current market.

Before Micron Technology is about to release its earnings report, investors are faced with multiple key opportunities and potential risks. Judging from the current market trend, Micron’s stock price appears relatively attractive due to its low valuation, especially against the background of the rapid growth of artificial intelligence demand. Its future growth potential is worth looking forward to.

Although there may be fluctuations in the short term, considering Micron’s cooperation with industry leaders, in the face of the upcoming earnings report, it is recommended that investors consider a “buy on dips” strategy, especially in the stage after the current stock price adjustment, and seize this rare investment opportunity. At the same time, for long-term investors, holding Micron’s stock will be an expected choice, especially in the case where AI-driven memory demand may break through traditional cycle limitations.