- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Finally, interest rates have dropped! What’s next for U.S. stock investments in this new era? Will i

In the vast ocean of financial investment, every major policy change is like a surging wave, impacting the pattern of global Capital Markets. Recently, the Federal Reserve announced its first interest rate cut in four years, with a reduction of 50 basis points. This radical move is like a boulder thrown into a calm lake, causing strong market fluctuations. So what is the deep meaning behind the Fed’s interest rate cut this time? How should US stock investors layout in this post-interest rate cut era? And what kind of foreshadowing has the Fed’s decision laid for the market?

The shock and market reaction of the Fed’s 50 basis point rate cut

The 50 basis point interest rate cut by the Federal Reserve shocked the entire Financial Marekt. From the market reaction, investors initially seemed to welcome this move. The day after the rate cut, the stock market saw a rare surge. However, they may not have realized that behind this seemingly positive rate cut, there are some risks that they once ignored. In fact, not all stocks are worth investing in during the period after the rate cut, and a large part of stocks are even facing unprecedented risks.

In order to make wise investment decisions in this complex and ever-changing market environment, we must first deeply understand the true meaning of this interest rate cut for investors. In this article, I will delve into how we should invest after the interest rate cut and what the 50 basis points cut by the Federal Reserve means.

Why is it 50 instead of 25? Analyzing the deep meaning behind the Federal Reserve

Many people have a vague understanding of the significance of the Fed’s interest rate cut, often thinking that the more it cuts, the better. However, the reality is far from being so simple. The Fed’s interest rate decision this time is likely to affect our investment theme for the whole year ahead. Therefore, it is necessary for us to first explore the profound connotation behind the Fed’s interest rate cut.

Before the decision to cut interest rates this time, the market generally expected that the rate cut would only be reduced by 25 basis points. In the past, the Federal Reserve would usually cut interest rates according to market expectations, after all, this has been a decision-making style for nearly three years. However, the situation is completely different this time. The Federal Reserve chose to actively intervene in market expectations. Before the meeting, they successively released information through The Wall Street Journal and The Washington Post, successfully adjusting market expectations from 25 basis points to 50 basis points.

In the past, we always thought that the Federal Reserve always followed the market, but this time, it is the first time in more than two years that the Federal Reserve has dominated the market. So why did the Federal Reserve not only aggressively start cutting interest rates, but also deliberately guide the trend?

At the press conference, journalist Nick, known as the “mouthpiece” of the Federal Reserve, raised a key question that may provide us with an answer. Nick asked, “Did you cut interest rates by 50 basis points because you felt you were behind?” Powell’s answer was thought-provoking. He first denied this, claiming that he did not feel he was behind. But then he said that if he had seen the follow-up data earlier, he might have started cutting interest rates earlier.

Powell’s statement, upon careful consideration, is essentially an apology to previous decisions. He cut interest rates by 50 basis points in September to avoid falling behind in the future, but in fact, he admitted that he had fallen behind before and now needs to cut more to make up for it. Powell also emphasized that the Fed is aware that non-farm employment data may have been artificially inflated and may continue to be revised downward in the future. He said that the Fed will not ignore this adjustment, and they will also consider possible adjustments when they see existing data. The implication is that they will not blindly follow the data, but will actively respond to the declining employment situation.

So, how to deal with it? The answer is obvious, which is to adopt a looser Monetary Policy, that is, to cut interest rates.

From Powell’s role and attitude this time, we can see some key information. For us investors, the biggest impact is not whether he cuts interest rates by 25 or 50 basis points. In fact, this has little impact on the US stock market. The most crucial point of this meeting is actually Powell’s change from the norm and beginning to show forward-looking policies.

Previously, Powell was most criticized by the market for only looking at the data to make decisions, in other words, solving problems after seeing them. However, we all know that interest rate policies have a lag, and often by the time problems are seen, the situation is already very serious. And this time, Powell could have cut interest rates by 25 basis points according to market expectations, but he forcibly intervened in the market and led a 50 basis point rate cut, which is a typical preventive policy. And his statement to prevent falling behind, whether it is to admit mistakes or to make up for it, is a clear and forward-looking statement. Finally, he also addressed the issue of labor market data, further downplaying his previous emphasis on decision-making based on existing data. All of this suggests that the Fed’s decisions in the future will be more forward-looking.

The Fed’s forward-looking performance is crucial for Financial Marekt and may even change the trading logic of the US stock market for the whole year to come. So, what exactly is the Fed’s forward-looking? How will the Fed’s interest rate cut affect the market? Many investors now believe that after the interest rate cut cycle opens, there will be a scene of everything waiting to be rebuilt and everything recovering. But this is not the case.

III. The lag of interest rate cuts and the downward trend of the economy (the impact of interest rate cuts)

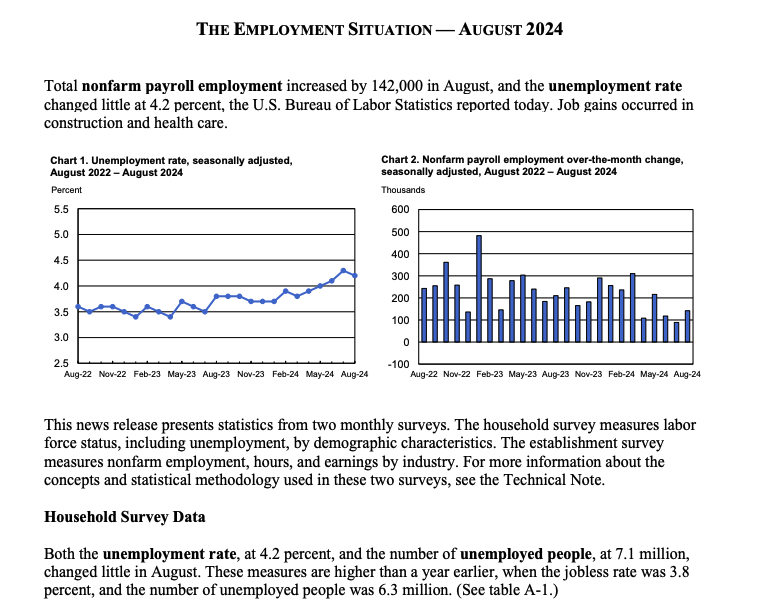

Here, let me show you two charts. The left chart shows the growth rate of US non-farm employment, and the right chart shows the hiring ratio and turnover ratio. It can be seen that both employment-related curves are continuously declining. According to the current statement of the Federal Reserve, employment is currently the area that the Federal Reserve is most concerned about. It is precisely because of this that the Federal Reserve has begun its aggressive interest rate cuts, trying to reverse this decline.

However, just as interest rate hikes have a lag, interest rate cuts also have a lag.

The downward trend of the economy will not be immediately reversed by the first few interest rate cuts. Moreover, the current interest rate level is still as high as 5% even after the rate cut. Compared with the neutral interest rate of 2% to 3%, this is still a very tight level. According to the latest data released by the Federal Reserve, even the most aggressive rate cut forecast will take at least a year to reach the neutral interest rate level.

This means that we still need to maintain tightening for at least another year. Therefore, even if the interest rate cut cycle is opened, and it is very aggressive, it is difficult to reverse the downward trend of the economy in the short term. In the future, we will still see worse and worse economic data until the effect of interest rate cuts is truly evident. Perhaps this does not require waiting for a year, but I believe that at least in the next six months, we may not see an improvement in the economy. The downward trend of the economy will not be easily reversed by one or two interest rate cuts.

So, what is the Fed looking forward to?

In fact, it is the continuously declining US economy, or more precisely, the continuously pressured labor market. Now the Federal Reserve has shifted its focus from inflation to employment, and has begun its policy foresight in a turning point. Therefore, facing the continuously declining job market, the Federal Reserve’s policy is likely to be more accommodative than imagined, which is a good thing. However, looking at it the other way around, we can also realize that the downward pressure on the economy is not smaller, but greater. Correspondingly, the risk of recession has further increased.

Regardless of whether the US economy will eventually decline or not, as long as the economy is still declining, the fear of recession itself is the biggest factor affecting the current US stock market, without exception. If you observe carefully, you will find that all the pullbacks in the US stock market so far this year have been caused by concerns about recession. The pullback in April, August, and September was the same. And I believe that this risk will still be the key factor determining the trend of the US stock market in the future, and it will definitely become the fuse for the decline of the US stock market again.

Why do you say that?

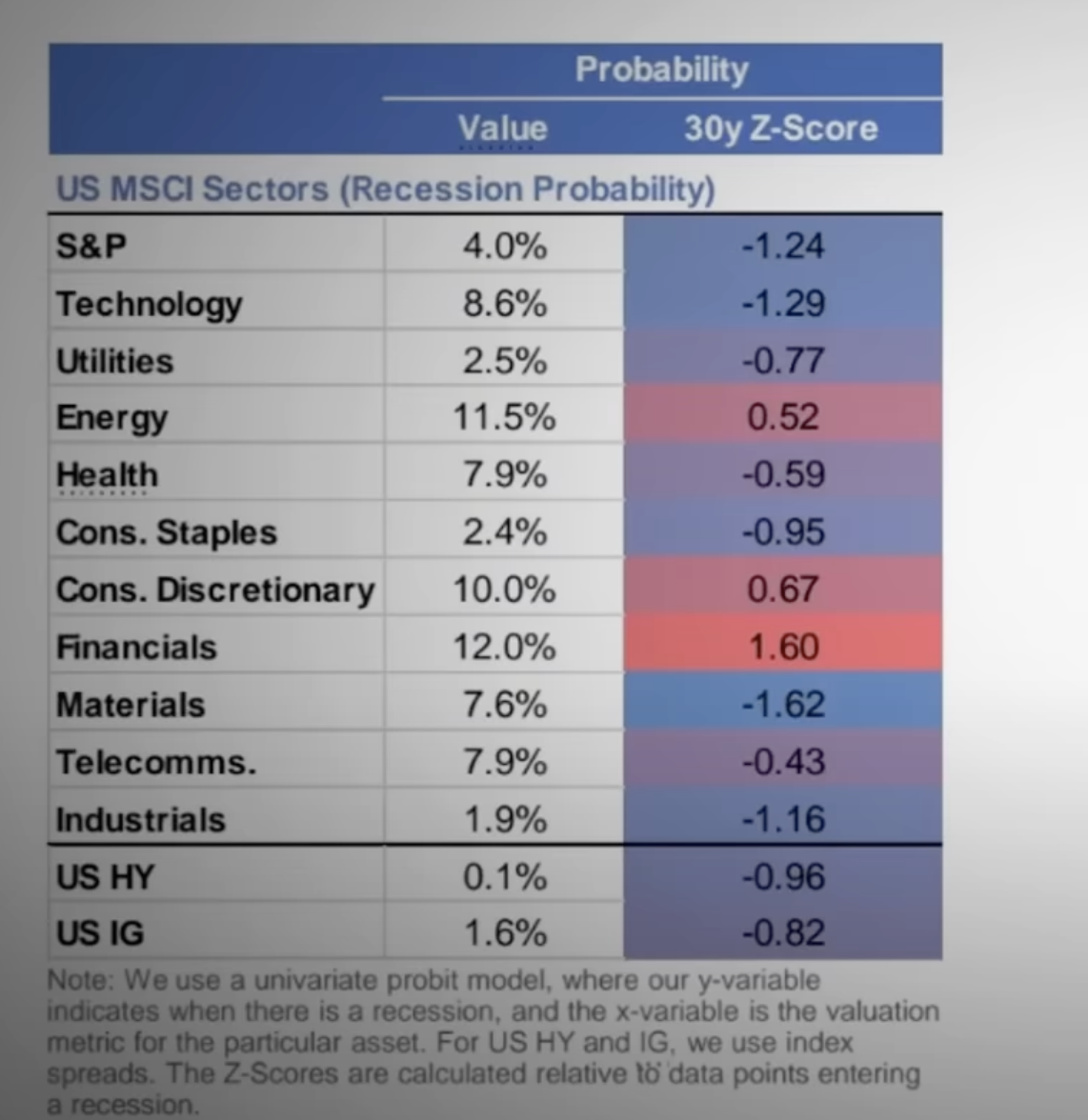

The following chart shows the pricing of recession in various sectors and credit spreads in the US stock market summarized by JPMorgan Chase. Credit spreads can be simply understood as a pricing of corporate debt default risk in the market, which is a very good data in the financial field to observe whether there are signs of recession in the market. The red in the chart represents a pricing recession in the market, while the blue represents no pricing recession in the market. It can be seen that almost all US stock sectors, except for the financial sector, have no pricing recession possibility.

This is actually a very dangerous signal. If all market participants do not expect a recession and there is no possibility of a recession in the price, then once the economic downturn intensifies, stock prices will become very fragile. Historically, regardless of the severity or duration of each economic recession, the US stock market will experience a significant decline. Since World War II, the lightest recession has had a nearly 13% correction, with an average decline of more than 20%. Because there is no possibility of a recession in the US stock market, and the cost of recession is so high, coupled with the fact that the objective trend of economic downturn is indeed intensifying, it means that the market will definitely experience significant fluctuations due to the risk of recession in the future. I believe this will be the most important risk for future US stock investment, without a doubt, and its impact is no less than the upcoming election.

IV. How investors respond: What is the core logic?

Now that we understand the deep meaning of the Federal Reserve’s policy and how the market will react, the more important question is, as investors, how will we react after knowing this? If we just passively adjust back and forth with the market, buy when interest rates are cut, and sell when we are worried about a recession, then we may become a green leek that is cut back and forth.

Whenever the market fluctuates, what investors should do is to step out and grasp the main contradiction.

So what is the main contradiction in the current market? Imagine if the market was bound to fall because of recession fears, what would make your investment different? If there is no recession in the end, then you should go bottom fishing every time it falls. And if there is a real recession in the end, going bottom fishing at this time is like catching a flying knife.

So, the main contradiction now is whether the US economy will eventually decline? The answer to this question will not affect whether the market will fall, but it will determine whether we can seize opportunities in the market downturn.

In fact, the macro economy of the US is still very strong, although under pressure, there is still a long way to go before a recession This gives us enough room for error to wait for a recovery. As for the micro-enterprises in the US, their profit growth has passed its worst moment, coupled with some positive factors that are about to appear, it is very likely to successfully drag the market when the economy encounters problems in the future. So overall, this macro and micro background gives me the confidence to say that the possibility of a US recession is actually not high.

I dare say that the future market will still experience a correction due to recession concerns, but this will actually be the best opportunity for us investors. In fact, I have also said the same thing in my market analysis videos in July and August. I believe that investors who seriously consider the market fluctuations in the past two months should be able to get through them with peace of mind. This is the core logic of the market.

In addition, besides studying the logic of the market, it is also important to choose a suitable investment platform. Here we need to choose a more credible securities firm for investment. For example, Jiaxin Wealth Management is a globally renowned investment securities firm. By opening an account with Jiaxin Wealth Management, you can get a bank account with the same name. You can deposit digital currency (USDT) into the multi-asset wallet BiyaPay, and then withdraw fiat currency to Jiaxin Securities for investment in US stocks. Of course, the user page can directly search for US stock codes on BiyaPay for purchase. At the same time, investors can monitor stock prices regularly according to their investment strategies and buy or sell stocks at the appropriate time.

Okay, now we understand the core logic and investment platform of the market. So, for us investors, how should we layout to best cope with such an environment? Besides passively waiting for the opportunity for a pullback, are there any opportunities to take the initiative? I think there are. In my opinion, the market will soon usher in a new round of sector rotation, which will become the theme of US stock trading for a long time to come.

Investment opportunities for investors in the post-interest rate cut era

In the past two years, although the overall performance of the market has been good, in fact, due to various risks such as high inflation and high interest rates, investors’ investment preferences are actually defensive. This is also why Big Tech is leading the way. Although they are not typical defensive stocks, they have stable profits, are not sensitive to interest rates, have strong competitive advantages, and are essentially the best defensive stocks in the current US stock market.

Due to the popularity of these stocks, their current valuations are also at a high level. However, I believe that this trend is likely to change soon. Investors’ focus will gradually shift from overvalued companies to reasonably valued companies, and from defensive stocks to cyclical stocks. When the fear of recession ferments to the extreme, it will be the layout for recovery. Although we mentioned earlier that real recovery will not come so quickly, the market reacts in advance. If we want to take the initiative, we must have enough foresight to layout future opportunities with real explosive power.

The second sector that I personally prefer is the financial sector. If interest rate cuts have a lag in other areas, then for companies in the financial sector, the impact is immediate. The main reason is that interest rate cuts will quickly reverse the trend of the interest rate curve. Near-term interest rates will quickly fall due to the Fed’s interest rate cuts, while far-term interest rates will remain high due to the expected increase in soft landing. This is a very favorable environment for banks. Because traditional banks earn money from interest rate spreads, the increase in interest rate spreads between long and short-term interest rates can naturally bring higher profits to banks.

Another cyclical industry worth paying attention to is real estate. In the environment of economic recovery and falling interest rates, the profits of real estate companies will increase significantly. Moreover, the demand suppressed by high interest rates has been accumulating for a long time. With the continuous decline of interest rates and the increasing affordability, those who locked in low interest rates during the epidemic and wanted to change houses now finally have the opportunity to do so. At some point, the suppressed demand will erupt. This will not happen immediately in the short term, but it can be expected in the future. In addition, the real estate industry is also benefiting from the policies of Democratic candidate Harris. Now Harris’s approval rating is not low, which may become a catalyst for future real estate sector investment.

Here, the investment layout in the post-interest rate cut era has been analyzed for everyone. With Powell’s forward-looking changes, I have also made a forward-looking analysis for everyone. If you simply want to find the answer to next week’s market fluctuations in my video, I’m afraid you will be disappointed. My analysis is not to predict the market next week or next month, but to help investors better understand the logic behind the market and make their investments more reassuring.