- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Meta has hit new historical highs, rising 7% in a week. Meta Connect 2024 is coming soon. Can the st

Meta Platforms (NASDAQ stock code: META), as one of the world’s largest social media companies, has been closely watched for its business development since its establishment. Recently, Meta’s stock price has hit historic highs, rising 7% in a week. As of yesterday, the stock still closed up 0.55%, with a final quote of $564.41. This strong performance reflects the market’s confidence in Meta’s future growth potential, especially in the continuous innovation of artificial intelligence and virtual reality technology.

As Meta Connect 2024 approaches, investors are looking forward to the company’s new developments in virtual reality (VR), augmented reality (AR), and artificial intelligence (AI). The market’s expectations for new products have brought more upward momentum to Meta’s stock price.

So how much room does Meta have for future growth, and can its stock price reach new highs? This is undoubtedly a concern for many investors. In this article, we will focus on exploring this issue.

Meta Connect 2024 event is expected to help

Meta Connect 2024 (the annual developer conference) will be held from September 25th to 26th local time in the US. This highly anticipated annual event will become the focus of attention for investors and technology enthusiasts. This event will not only showcase Meta’s latest progress in virtual reality (VR) and augmented reality (AR) technology, but also profoundly affect the future trend of the stock price.

Firstly, CEO Mark Zuckerberg will deliver a keynote speech, expected to share Meta’s strategy and vision in the field of artificial intelligence. He may talk about how to use AI technology to enhance User Experience, improve platform interactivity, and integrate AI into the company’s core products. Analysts generally believe that Zuckerberg’s speech will directly affect investor sentiment, thereby driving stock price fluctuations.

Historically, Meta Connect events have often attracted analysts to upgrade the company’s rating, leading to a rise in stock prices. For example, in past events, the launch of new products and the outlook for future technology often made investors more optimistic about Meta’s prospects, resulting in an upward trend in stock prices in the weeks following the event.

In addition, it is expected that the new generation of Meta Quest 3S head-mounted devices will be launched at this event. This more affordable VR product is expected to attract a wider consumer group, especially considering Meta’s strategic goal of pushing VR technology to a larger market. If the functions and prices of the new devices can be recognized by consumers, Meta’s market share is expected to further expand, which will have a positive impact on the company’s revenue.

Another highly anticipated focus is the display of Ray-Ban Meta smart glasses. This glasses combines Meta’s AI technology and is expected to provide users with an augmented reality experience. If the new product can attract high market attention, it will further enhance Meta’s competitiveness in the AR market.

If Meta Connect 2024 is successfully held, especially with satisfactory product releases and innovative solutions, it may further enhance investors’ optimism and push up Meta’s stock price in the short term. As the event approaches, the market’s expectations for Meta are also increasing, and short-term fluctuations in stock prices will become a hot spot for investors.

Meta has other strong growth drivers

In the rapidly changing technology industry, Meta’s growth potential has attracted much attention, especially in cutting-edge fields such as artificial intelligence and virtual reality. The recently released Q2 financial report further confirms this, showing the company’s strong performance and development momentum in the market. With the continuous increase in global demand for digitization and intelligence, Meta’s layout in multiple fields provides strong support for its future growth.

Second Quarter Results Exceed Expectations, Company Financing Healthy

Meta’s Q2 financial report, which exceeded market expectations, has become the focus of investors’ attention since its release. The report shows that Meta’s revenue increased by 22% YoY, reaching over $32 billion, indicating strong market demand. At the same time, earnings per share increased by 73%, demonstrating a significant improvement in the company’s profitability. The positive response from investors to this financial report further pushed up Meta’s stock price, reflecting the market’s confidence in its future growth.

Meta has performed well in operating leverage and cost control. This quarter, costs only increased by 7%, while profit margins increased by 9 percentage points to 38%. This data not only proves Meta’s efforts in optimizing Operational Efficiency, but also shows its ability to maintain enhanced profitability in the face of constantly changing market environments.

Artificial intelligence brings opportunities and drives advertising

Meta’s investment and innovation in the field of artificial intelligence have provided new impetus for its growth. With the continuous development of artificial intelligence technology, Meta is deeply integrating its core products with AI through multiple strategic initiatives. Especially the launch of Llama’s large-scale language model demonstrates Meta’s leading position in AI research and development. This model not only enhances Meta’s ability in natural language processing, but also provides more accurate user positioning and personalized services for its advertising business.

The impact of AI on Meta’s advertising business cannot be ignored. According to internal research, advertisers who use Advantage + artificial intelligence advertising tools have increased their return on ad spend by 32%. This improvement enables advertisers to more effectively push products to the market, thereby driving Meta’s advertising revenue growth. With the change in population structure, advertising spending is gradually shifting from traditional media to digital platforms, creating rich opportunities for Meta’s advertising business.

Virtual reality and augmented reality have a promising future

In the field of virtual reality and augmented reality, Meta’s Reality Labs department carries its long-term strategic vision. Despite facing huge losses in the past few years, Meta still firmly promotes its layout in the construction of the metaverse. Currently, Reality Labs’ product line includes new generation Mixed Reality devices such as Meta Quest 3. Although sales have not yet met expectations, the future potential is still promising.

Meta’s strategic layout in the metaverse contrasts sharply with competitors such as Apple and Snap. Although Apple’s Vision Pro has attracted market attention, its high price poses a challenge. Snap competes for users through lower market prices and social elements, which undoubtedly provides a relatively relaxed market environment for Meta’s growth in this field.

Meta’s development still has risks that need attention

When investing in Meta, despite its promising growth potential and market performance, latent risks cannot be ignored. Especially in an environment of rapid technological development, Meta faces multiple challenges, which not only involve the company’s internal operational strategies, but also are closely related to external competition and market changes.

Potential threats from artificial intelligence

Despite Meta’s significant progress in the field of artificial intelligence, this technology also comes with risks. Firstly, the trend of commoditizing AI may lead to profit compression. As more and more companies invest in the development of AI models, similar products may appear in the market, leading to fierce competition and profit margins may be pushed down to marginal costs. In this case, Meta’s investment return may be seriously affected, and in the long run, profit growth may face challenges.

Secondly, artificial intelligence may have a disruptive impact on existing business models. Although Meta is increasing its investment in AI in the hope of obtaining high returns, such a strategy also carries risks. If Meta lags behind its competitors in the AI game, it may be forced to increase spending, although the return on investment is unclear. For investors, this risk requires special attention.

Reality Labs Financial Exposure

Reality Labs is another important risk point facing Meta. The continuous losses of this department have put pressure on the overall performance of the company. So far in 2024, the losses of this department have reached $8 billion. Despite the market’s expectations for Meta’s metaverse vision, Reality Labs currently only accounts for about 1% of the company’s total revenue. Obviously, the performance of this department has not supported the overall financial situation.

Investors’ concerns about Reality Labs’ high spending cannot be ignored. Although Meta has a first-mover advantage in virtual reality technology, if it cannot achieve profitability in the short term, it may lead to a decrease in investor confidence and affect stock price performance.

Market competition and technological change

Meta is also facing pressure from competitors. In the VR and AR fields, companies such as Apple and Snap are actively laying out and competing for market share. With the rapid iteration of technology, Meta must remain agile to adapt to changing market demands. If it cannot respond quickly to industry changes, Meta may be at a disadvantage in competition.

At the same time, changes in industry trends also pose challenges to Meta. The transformation of the digital advertising market and changes in user habits may affect Meta’s core business. Therefore, maintaining sensitivity to market dynamics and adjusting strategies in a timely manner will be the key to Meta’s success in future competition.

What is the future trend of the stock price?

Despite facing multiple challenges, Meta’s growth potential remains considerable. With the company’s continued investment in artificial intelligence, virtual reality, and augmented reality, the combination of its core business and emerging technologies will lay a solid foundation for future growth. From the Q2 financial report, it can be seen that Meta’s strong performance in revenue and profit, especially in artificial intelligence advertising and customer engagement, indicates that the company is successfully navigating this transformation process.

In addition, as the Meta Connect 2024 event approaches, market expectations for the company’s future products and strategies may further drive up the stock price. Investors need to closely monitor the upcoming new technologies and applications, as well as the market’s reaction to them, to evaluate Meta’s actual growth potential.

DCF model valuation analysis

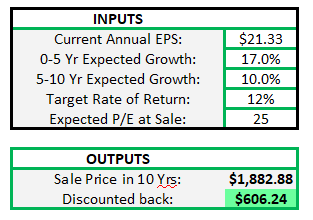

When evaluating Meta’s valuation, we considered its historical valuation, peer performance, and market trends. According to Refinitiv data, the expected Price-To-Earnings Ratio of the S & P 500 Index is 22.1 times, and it is expected that earnings per share will grow by about 11% in 2024. In contrast, Meta’s Price-To-Earnings Ratio is about 23 times, which is slightly higher than the index, but considering its expected earnings growth rate of 43% in 2024 and mid-term earnings per share growth rate of over 17%, this premium seems reasonable.

Using the discounted cash flow (DCF) model analysis, based on a target return rate of 12%, assuming that the mid-term earnings per share growth rate is consistent with analyst consensus and long-term earnings are expected to drop to around 10%, Meta’s intrinsic value is undervalued by about 8%, reflecting Meta’s profitability and future stock buyback potential.

Forecasts based on financial data and market trends

According to Meta’s recent financial performance and market trend analysis, the company is expected to achieve stable revenue growth in the coming quarters. With the gradual recovery of advertising spending and the company’s innovation in AI and VR/AR fields, Meta is expected to achieve a target of 43% growth in earnings per share in 2024. At the same time, as the market’s attention to Meta increases, analyst ratings and target prices may also be raised, further driving up the stock price.

How should investors layout?

Combining the stock price trend analyzed in the previous text, it can be found that Meta is an attractive investment opportunity in the current market environment. Investors can pay attention to the market in a timely manner and find the right time to buy. Specifically, you can go to BiyaPay to monitor the market trend of Meta and choose the appropriate time to buy.

In addition, if you encounter difficulties in depositing and withdrawing funds, BiyaPay can also serve as a professional tool for depositing and withdrawing funds from US and Hong Kong stocks. You can recharge digital currency to exchange for US dollars or Hong Kong dollars, quickly withdraw to your bank account, and then transfer the funds to other brokerage accounts to buy stocks. The platform has a fast and unlimited transfer speed, so you won’t miss investment opportunities.

Especially for long-term investors, considering Meta’s potential growth in AI and VR/AR fields, as well as its strong performance in advertising business, they can actively go to BiyaPay to increase their holdings of Meta stocks. Although there is some market volatility and uncertainty in the short term, in the long run, Meta’s technological advantages and market position will help it continue to grow.

However, investors should also remain cautious and pay attention to market trends and the company’s operational performance. Regarding Meta’s high expenses and Reality Labs’ continued losses, investors need to remain vigilant and implement corresponding risk management strategies to ensure reasonable returns in future investments.

Overall, Meta has shown strong growth potential in the rapidly changing technology field, especially in continuous investment in artificial intelligence and virtual reality. As Meta Connect 2024 approaches, the company will have the opportunity to showcase its technological innovation and future strategic direction. Despite the challenges of commoditizing artificial intelligence and losses in the Reality Labs department, Meta’s financial performance and market response still indicate its long-term value is solid. Meta not only occupies an important position in the current market, but also lays a solid foundation for future growth through continuous innovation and strategic layout, attracting the attention of many investors and making it a good investment choice.