- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Unveiling BlackRock's Principal-Protected S&P 500 Buffer Fund MAXJ: Is It Truly a Win-Win?

The U.S. stock market is undoubtedly a fascinating area for study, with many intriguing ETFs to explore.

Recently, the world’s largest asset management company, BlackRock, launched a new hedged ETF—iShares Large Cap Max Buffer Jun ETF (MAXJ). This fund offers a 100% downside protection mechanism. Simply put, when the market declines, investors holding S&P 500 positions will not suffer any losses. It’s dubbed as a “sure-win” ETF!

But does such a “sure-win” ETF really exist? Grab a seat, and let’s explore this in depth.

In this article, I will unravel MAXJ from the following perspectives:

- What is MAXJ?

- How does MAXJ operate, and how does it achieve “guaranteed profits”?

- What are the risks associated with MAXJ?

- When and for whom is MAXJ a suitable investment?

What is MAXJ?

MAXJ, fully known as iShares Large Cap Max Buffer Jun ETF, tracks the returns of the S&P 500 ETF (IVV). By holding options and derivatives, it offers investors 10.6% capped returns while providing 100% downside protection against price drops in the underlying ETF over the next year.

Simply put, by purchasing this ETF, you gain returns as long as the core S&P 500 ETF rises. However, the returns are capped at 10.6%, meaning any gains beyond that will not benefit you. If the core S&P 500 ETF falls, you are shielded from losses thanks to 100% downside protection, meaning no matter how much the market falls, you won’t lose any money, except for the 0.5% fund management fee.

How Does MAXJ Operate?

MAXJ employs a Buffer strategy, which has gained popularity in the U.S. over the past two years. Buffer ETFs use a combination of options strategies to provide investors with a fixed level of loss protection over a set period, while also limiting their upside potential.

MAXJ’s Portfolio Composition

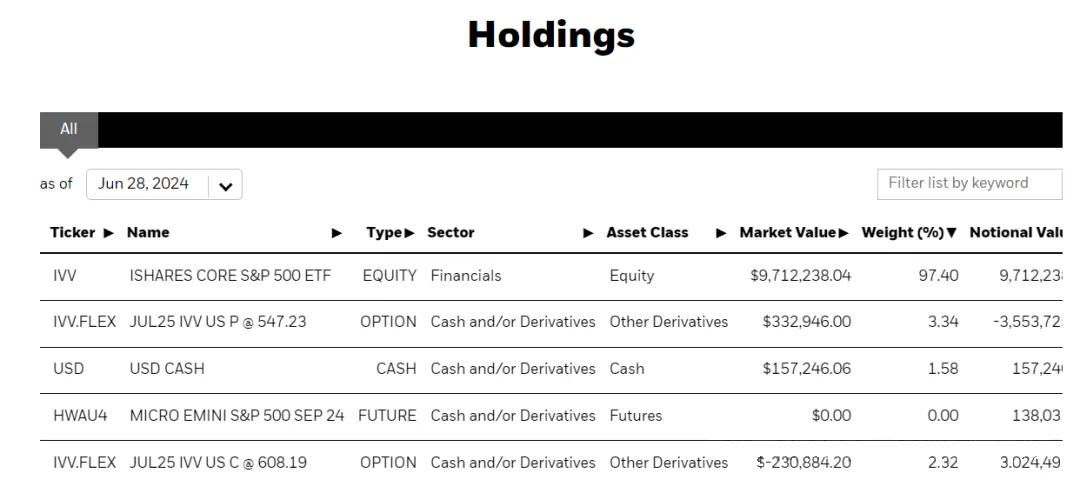

According to its official information, at inception, this ETF’s composition was as follows:

- 97.40% S&P 500 Index ETF

- 3.34% S&P 500 ETF put options with a strike price of $547.23, expiring on July 25 of the following year

- 1.58% in cash and cash derivatives

- 2.23% S&P 500 ETF call options with a strike price of $608.19, expiring on July 25 of the following year

How MAXJ Works:

Step 1: Capture the underlying asset’s returns MAXJ invests 97.40% of its funds into the S&P 500 Index ETF to obtain the underlying returns of the index. At inception, the S&P 500 ETF was priced at $547.23.

Step 2: Purchase put options for loss protection MAXJ buys put options representing 3.34% of the total portfolio, which provide protection if the market drops. When the underlying asset falls in price, the value of these put options increases, offsetting potential losses. Essentially, no matter how much the S&P 500 ETF falls, the portfolio is protected since the put options allow it to sell at the strike price of $547.23.

Step 3: Sell call options to determine the return cap MAXJ sells call options representing 2.23% of its total portfolio, with a strike price of $608.19. This strategy generates income from selling the options but also limits the upside potential. If the S&P 500 rises above $608.19, the ETF must sell its holdings at the strike price, capping returns at 10.6%.

What Are the Risks of MAXJ?

1.The promised protection and capped returns only apply if the fund is held for the full cycle. If investors buy the ETF mid-cycle, the level of downside protection and return caps may vary:

If you buy MAXJ at a price below its initial offering, the downside protection is greater, and the cap on returns increases.

If you buy it above the initial price, you’ll need to endure some losses before the protection kicks in, and your return cap will be lower.

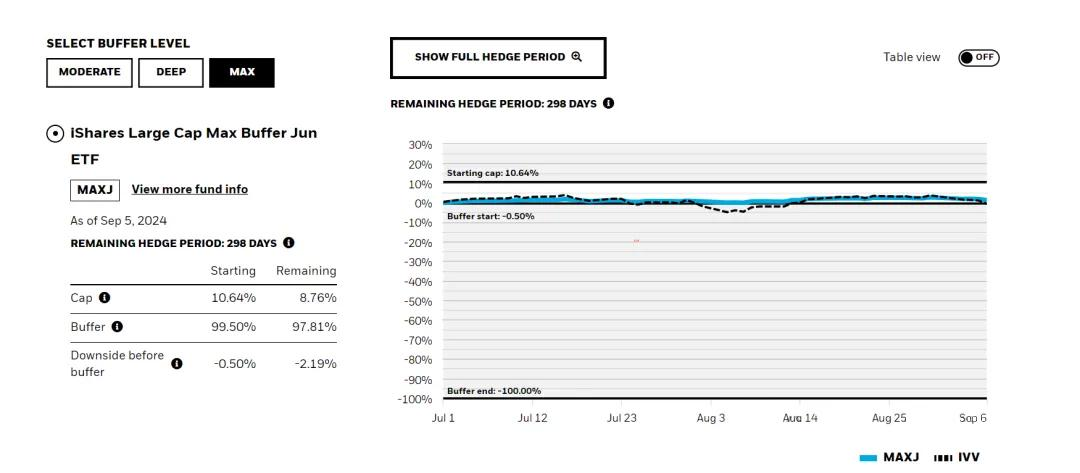

This image shows: The fund’s initial cap is 10.64%, and the initial downside protection is 99.50%. The maximum loss for holding the ETF until maturity is 0.50% (accounting for the 0.50% fund management fee). Based on the price as of September 5, 2024, the cap would be 8.76%, and the downside protection would be 97.81%, with a maximum loss of 2.19% if held until maturity.

2.Higher management fees compared to regular S&P 500 ETFs MAXJ charges a 0.50% management fee, whereas a typical S&P 500 ETF like IVV only charges 0.03%. While this fee might seem high in the U.S. market, it’s still considered quite reasonable compared to other global markets like A-shares.

3.The return cap isn’t as enticing as it appears MAXJ’s theoretical return cap is 10.6%, with an actual range of -0.50% to 10.6%. Given that there are many high-yield products available in today’s high-interest-rate environment, investors can find other securities that offer substantial, safe returns. For example, the yield on U.S. one-year Treasury bonds is around 5%, making MAXJ’s capped returns less appealing.

4.MAXJ may struggle to outperform the S&P 500 ETF over the long term Due to MAXJ’s return cap and higher fees, it’s likely to underperform the S&P 500 ETF over time. The S&P 500 has delivered an average annual return of around 10.5% over the past 30 years, roughly equivalent to MAXJ’s theoretical cap. Since its launch, MAXJ has generally failed to outperform the S&P 500 ETF except during significant market dips in late July and early September.

When and for Whom Is MAXJ Suitable?

Essentially, MAXJ is about sacrificing some upside potential in exchange for minimizing downside risks. This fund is ideal for investors who believe that the S&P 500 or the broader U.S. market may be overvalued but don’t want to miss out on potential gains.

By using options strategies, MAXJ allows investors to capture gains in the S&P 500 while fully hedging against downside risk. It’s also a useful tool for constructing a lower-volatility portfolio during periods of market turbulence. Given current market conditions, September may be a good time to consider this investment option.