- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Fed Rate Cuts Fuel JD.com’s Stock Surge, $5 Billion Buyback Plan, and Soaring Profits: How Long Will

On September 19, 2024, JD.com’s stock price experienced a notable increase, jumping over 6% from about $25 per share to $26.75. The surge is widely attributed to the Federal Reserve’s recent announcement of an interest rate cut, leading to expectations of reduced financing costs—particularly beneficial for capital-reliant tech firms like JD.com.

This move not only spurred a short-term rebound in JD.com’s stock price but also led investors to reassess its future growth potential.

Beyond favorable macroeconomic policies, JD.com’s operational performance has also bolstered its stock price. For instance, the company reported a record 69% increase in net profit in its Q2 2024 earnings report. Announced in August, a $5 billion stock buyback plan, along with the recent strategic acquisition of Dada Group, has further solidified its market position in instant retail, clarifying the trajectory for future growth.

Federal Rate Cuts Benefit U.S. Stocks Broadly

Last night, the Federal Reserve finalized the rate cut, impacting global markets, especially the tech sector. Why? The reasoning is straightforward—reduced capital costs mean lower expenses for businesses to borrow and expand. This is particularly impactful for capital-intensive companies like JD.com.

Why are the Fed’s rate cuts so critical for companies like JD.com? Simply put, lower interest rates enable companies to finance at reduced costs, directly benefiting those needing capital expansion. Additionally, rate cuts typically lead to more money flowing into high-return risky assets, making a company like JD.com, with its long-term profit potential, a hot pick for investors.

Data shows that on September 19, JD.com’s stock price increased by more than 6% in just one day, from about $25 to $26.75 per share. By contrast, other Chinese concept stocks such as Alibaba (BABA) only rose 2.47% that day, while Tencent (OTC: TCEHY) saw a 1.45% increase. The performance of these stocks suggests that despite general market optimism, investors have higher expectations for JD.com’s future growth. JD.com’s long-term commitments to supply chain optimization and instant delivery, coupled with its recent $5 billion stock buyback plan, evidently make the market bullish about its developmental potential.

Not only JD.com, but the rate cut has also generally lifted market sentiment, boosting the entire tech sector. Apple (AAPL) saw its stock price increase by 1.5% on the same day, while Microsoft (MSFT) rose by 1.2%. Both companies also benefited from the improved financing environment, enhancing investor expectations for the future development of tech companies.

This stock performance indicates that the market is highly sensitive to future interest rate trends, and as a representative of growth-oriented businesses, JD.com is likely to continue enjoying market favor in this more advantageous financing environment.

Future Positive Factors for JD.com

Apart from the short-term stock price rise due to the Fed’s rate cuts, several long-term favorable factors position JD.com for sustained growth. These factors not only reflect the robustness of the company’s internal strategies but also demonstrate that JD.com’s business layout is gradually becoming effective.

Strong Financial Performance

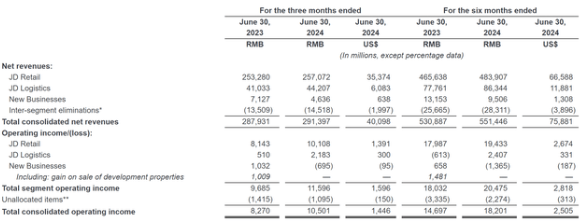

On August 15, JD.com published its June quarter results, showing a very stable performance: between April and June, JD.com generated about $39.9 billion in revenue, a 1.2% year-over-year increase. Generally, the revenue met expectations (with a slight decline), but the performance showed a slowdown compared to the 7% year-over-year growth in Q1 2024.

At the segment level, JD Retail’s revenue reached approximately $35.2 billion, a modest 1.5% increase year-over-year. In the retail sector, the electronics and home appliances segment was noticeably weak, with revenue decreasing by 5% year-over-year, while in Q1 2024, it had grown by 5.3%; however, the department store segment was healthier, growing 9% year-over-year, consistent with the previous quarter. Notably, JD Logistics was the standout segment of the second quarter, with its revenue growing nearly 8% year-over-year.

While revenue was flat/slightly up year-over-year, profit margins significantly improved due to massive efficiency gains and strong operational growth in the logistics department. According to Refinitiv data, JD.com’s non-GAAP operating profit for the second quarter increased by 41% year-over-year to about $1.62 billion (operating margin of 4.06%, up 114 basis points from Q2 2023), far exceeding market expectations by 21%.

Non-GAAP net profits reached about $1.99 billion, up 69% year-over-year, surpassing market expectations by 51%. This was due to a substantial increase in net profit margin, reported at 4.96%, up 199 basis points year-over-year.

The market response was even more genuine; the stock soared over 15% in the two days following the earnings release as investors reassessed the e-commerce giant’s ability to not only generate cash flow but also distribute it to shareholders—with about $3.3 billion in buybacks executed in the first half of 2024, representing approximately 7% of the issued stock.

Even though profits reached historical highs, with a net profit margin of 5%, management believes there is still significant room for profit margin improvement in the long term.

Indeed, JD Group’s medium to long-term strategic goal is to achieve high single-digit profit margins, and management is confident in reaching this target. The main drivers for growth include the expansion of the platform ecosystem, strategic optimization of product categories, and continuous improvement in profit margins across various categories. If investors trust management’s high single-digit profit margin targets, they can anticipate JD.com generating about $10-11 billion in net income annually, with the company’s enterprise value around $36.2 billion.

Stock Buyback Is Not Over Yet!

With strong business momentum, JD.com’s management actively repurchased stocks during the second quarter, which should please shareholders. In the three months up to June, JD bought back $2.1 billion worth of stocks, bringing the total buyback amount in the first half of 2024 to $3.3 billion. As a reference, this represents about 7% of the issued stock. Notably, this buyback was on top of the $1.5 billion in dividends distributed in 2024, bringing the total shareholder yield to about 10% of the market value for the first half of the year.

Considering the initial scenario, the buyback might slow down in the third quarter, as only about $400 million was authorized for buybacks under the first half’s quota, and no new plans were announced for the second quarter.

However, from the fourth quarter of 2024 and early 2025, the market generally believes the buyback wave will continue, as JD.com still holds $15.9 billion in net cash positions, while the company can generate very healthy cash flow levels: According to Refinitiv data, JD.com’s free cash flow in 2024 is expected to exceed $5 billion.

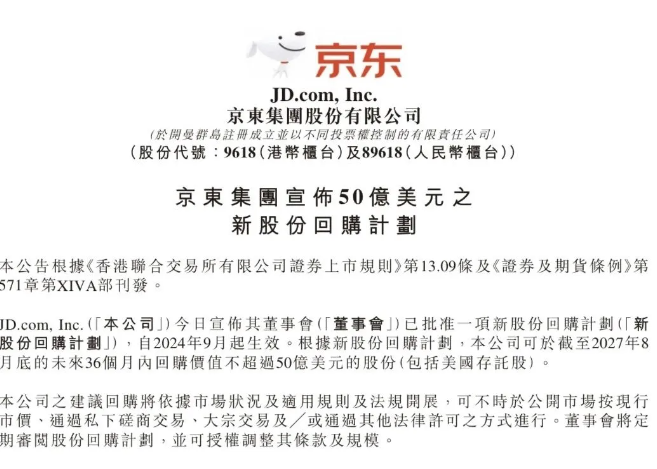

Thus, on August 27, 2024, JD.com announced a new $5 billion stock buyback plan.

This plan will take effect in September 2024 and continue until August 2027. This means JD.com will continue to reduce the number of shares in circulation over the next 36 months and enhance earnings per share. This new large-scale buyback plan, far exceeding the previous phase’s scale, reflects management’s confidence in the company’s long-term development.

Overall, these stock buyback plans not only enhance shareholder returns in the short term but also by reducing the number of shares on the market, strengthen market demand for JD.com’s stock, thereby supporting the stock price increase.

The continuous implementation of these two buyback plans enables JD.com to convey a stable return expectation to shareholders in the current capital market environment, also laying a solid foundation for future growth.

Expansion of Immediate Retail Business

In recent years, JD.com has been actively laying out the immediate retail market, having participated in financing for Ele.me as an investor back in 2015.

In 2024, JD.com designated immediate retail as one of its three strategic priorities and launched several initiatives to enhance user experience and service quality, including the introduction of the “Price Guarantee Refund” and “Slow Compensation” services in the Beijing area. These measures not only highlight JD.com’s pursuit of efficient delivery but also provide consumers with more convenient services.

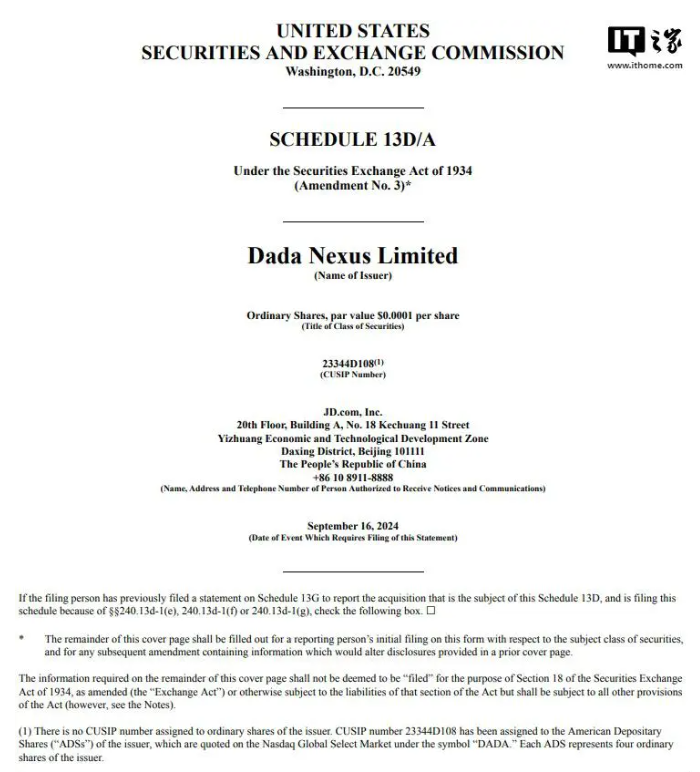

On August 17, Dada Group, listed on the US stock market, announced that JD.com had completed the purchase of 87.4813 million ordinary shares and 1.875 million American depositary shares held by Walmart’s subsidiary.

Thus, JD.com has acquired all the shares held by Walmart in Dada, increasing its shareholding to 63.2%.

Dada Group’s core businesses include JD Daojia and Dada Express, which provide same-city immediate delivery services for retailers. This integration allows JD.com to better serve a diverse range of needs, including fresh produce, department store goods, and more, especially through the “JD Hour Purchase” service, which can complete deliveries in just 9 minutes, covering over 2300 counties, cities, and districts, and cooperating with more than 500,000 retailers.

JD.com further enhances consumer experience through Dada’s logistical advantages, solidifying its brand position in the immediate delivery market.

In addition to its investment in Dada, JD.com is also actively expanding in local life services and omnichannel retail, aiming to utilize its

strong logistics network and supply chain advantages to enhance overall retail efficiency. This positions JD.com with a significant advantage in the fiercely competitive immediate retail market, particularly in competition with companies like Meituan and Pinduoduo. Unlike traditional platforms, JD.com’s deep cultivation in supply chain management and continuous investment in logistics enable it to handle orders more efficiently and deliver faster.

Overall, by acquiring shares in Dada Group, JD.com not only strengthens its competitiveness in the immediate retail market but also enhances the synergy of its platform ecosystem and logistical services. This strategic move will undoubtedly drive JD.com to achieve higher market shares and profit growth in the coming years.

Market Expectations and Technical Analysis

From a technical analysis perspective, JD.com’s stock price, which had been in a downtrend since early 2021, showed signs of bottoming out in 2024.

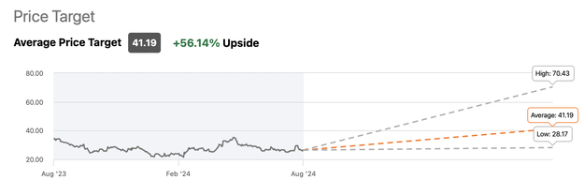

Technical charts indicate that JD.com’s stock price is forming a long-term reversal head and shoulders pattern, potentially challenging resistance levels between $35-40. Market analysts generally predict significant growth potential for JD.com’s stock in the coming years, with target prices even reaching up to $49, reflecting investors’ positive outlook on JD.com’s long-term performance.

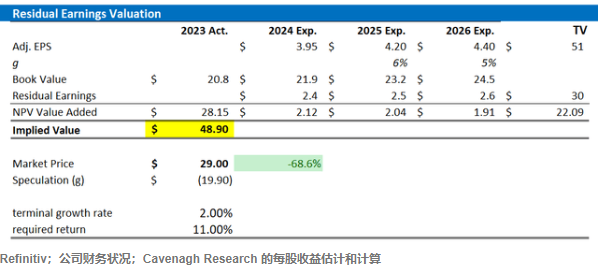

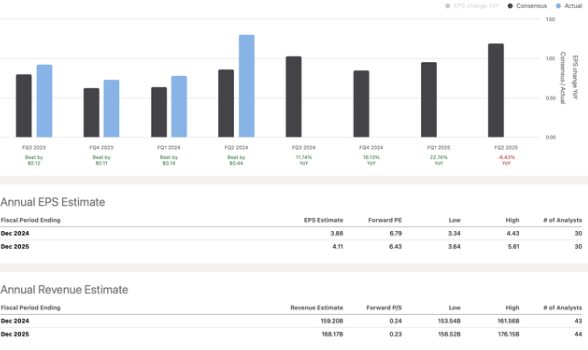

Based on JD.com’s Q2 2024 earnings report and management’s confidence in further enhancing profitability, analysts now estimate that JD.com’s earnings per share for 2024 will be around $3.95, for 2025 around $4.2, and for 2026 around $4.4. Also, assuming a cost of equity for JD.com at about 11%, and using a conservative terminal growth rate of 2% post-2026, these estimates calculate a fair implied stock price for JD.com of $49.

To facilitate understanding, the chart below’s “speculative” value represents the difference from the fair implied value. A positive value indicates a premium, suggesting that the market pricing has greater potential for appreciation than analysts estimate.

Improved Profitability, Attractively Priced

Despite a growth environment below expectations, JD.com has not fallen below its earnings per share estimates in at least the past 20 quarters (five years).

TTM earnings per share are generally estimated at $2.94, yet JD.com achieved $3.75, impressively beating the market by 28%. While JD.com forecasts EPS of around $4 for 2024 and 2025, over time, we may see considerable outperformance.

Applying a relatively modest 10% market beat to the 2024 EPS estimate, and a 15% forecast for 2025, yields an EPS of approximately $4.30 for 2024 and about $5 for 2025. This dynamic suggests that JD.com’s trading price is only about 5.2 times forward earnings estimates, which is extremely cheap for a company of JD.com’s stature.

JD.com’s price-to-earnings (PE) multiples are very low. Although the general estimate for 2025 is $4.11, the high-end estimates range between $5 and $5.50 or higher. JD.com’s earnings estimates may be undervalued, and it is highly likely to outperform the market! We can expect to see improvements in sales growth leading to higher than expected profitability growth, multiple expansions, and quite high stock prices.

At the end of August, analysts calculated JD.com’s average target price to be around $41, significantly above the then severely depressed levels by about 56%. However, even the lowest target price was around $28, with high-end estimates reaching up to $70, implying a potential rise of about 170% next year.

Regardless, JD.com’s current price is very low, and it is unlikely to remain depressed for long. For those interested, head over to the multi-asset wallet BiyaPay to regularly check JD.com’s stock price trends and find the right trading opportunities.

If you encounter any challenges with deposits and withdrawals, you can also use it as a professional US and Hong Kong stocks deposit and withdrawal tool. Recharge cryptocurrencies into US dollars or Hong Kong dollars, withdraw to bank accounts, then deposit into other brokerages, buy stocks, with fast transaction speeds and no limits, ensuring you don’t miss out on investment opportunities.

Through sustained sales growth and profitability enhancement, JD.com’s stock price is expected to continue rising steadily over the next few years. As the global economy gradually recovers, JD.com not only can continue to achieve profit growth but will also benefit from more relaxed monetary policies, further expanding its PE ratio.

Risks

In the long-term development of JD.com, aside from the uncertainty of the macroeconomic environment, several specific major risks arise from market competition, technological changes, and rapid shifts in consumer demands.

JD.com’s main competitors in the retail and logistics sectors, such as Alibaba, Pinduoduo, and Meituan, are intensifying their investments in supply chains, logistics networks, and local life services. The competition is particularly fierce in emerging areas such as immediate retail and community group buying.

Major platforms compete to improve delivery speeds and optimize service experiences, pressuring JD.com to maintain its market share.

Rapid technological advancements in the e-commerce industry, such as artificial intelligence, big data, and unmanned delivery, have become core competitive strengths for the future of e-commerce. Although JD.com invests heavily in technological research and development, it still needs to maintain a lead in innovation and efficiency improvements to adapt to industry changes and upgraded consumer expectations for logistics experiences and personalized recommendations. Failure to timely adapt to technological changes could impact JD.com’s market competitiveness.

On the macroeconomic risk front, global economic fluctuations and supply chain challenges could also affect JD.com’s business. While monetary policies like the Fed’s rate cut inject liquidity into the market, global economic slowdowns, inflation, and supply chain bottlenecks still pose uncertainties, affecting JD.com’s profit performance and business expansion.

Despite these risks posing challenges to JD.com’s long-term development, the company displays strong adaptability in addressing these challenges. By strengthening its technological research and development, deepening supply chain management, and actively expanding into new markets, JD.com is likely to maintain its competitive edge. Additionally, JD.com’s financial robustness, stock buyback plans, and continuous innovations in the logistics sector provide a solid foundation for future growth.

Overall, JD.com’s performance and potential in the current market are commendable. Whether it’s its robust logistics network or its strategies in immediate retail and omnichannel, JD.com is at the forefront of the industry. Despite fierce market competition and rapid technological changes, JD.com demonstrates strong resilience and innovation in adapting to these changes. By continuously optimizing its supply chain and expanding into new businesses, JD.com not only maintains its market position but also lays a solid foundation for future growth.

From a long-term perspective, JD.com’s stock price will inevitably fluctuate, but considering its strong business layout and anticipated future profit growth, it remains a highly attractive investment prospect. As the global economy gradually recovers, JD.com’s various advantages are expected to further manifest, helping it continue to lead in future competitions.

In summary, JD.com’s long-term prospects are not only stable but also filled with potential for growth.