- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

How to buy ETFs during the Fed's interest rate cut cycle? This article is enough!

With the expectation of the Federal Reserve’s interest rate cut in September increasing, there is more and more discussion in the market about investment opportunities in US Treasury bonds.

Not only individual investors, but also institutional investors are crazily grabbing US Treasury bonds. At the recent auction of US 2-year Treasury bonds, the auction was exceptionally hot and in short supply. Since the Fed’s interest rate cut is already a certain event, it’s just a matter of when and how much to cut. For US Treasury bonds, now is a good investment opportunity. Some people may not understand, Bond yields and bond prices are negatively correlated. The lower the bond yield, the higher the bond price.

Therefore, under the trend of the Federal Reserve’s interest rate cut, the price of US Treasury bonds will become higher and higher. So investing in US Treasury bonds at this stage is a long-term high-probability thing. As for how much the odds can be, it depends on the magnitude of the Federal Reserve’s interest rate cut.

The good news is that the federal base rate is currently between 5.25% and 5.5%. This is the highest level in the past 10 years, which means that the Fed has a lot of room to cut interest rates in the future.

If we want to invest in US Treasury bonds through our US stock account, we can focus on these few ETFs.

TLT 20 + year US Treasury ETF-iShares

This is an ETF fund that lays out government bonds with a maturity period of more than 20 years. The 20-year period here refers to the maturity period of the government bonds held. This maturity period is also known as the duration of the bond. The longer the bond duration, the more sensitive it is to interest rates. For example, this 20-year government bond ETF is very sensitive to interest rate hikes and cuts. It falls more when interest rates are raised and rises more when interest rates are lowered. Therefore, when buying this type of ETF, pay attention to volatility risk. If you want something more exciting, you can pay attention to it

TMF 3 times long 20-year and above government bonds ETF-Direxion

In addition to this 20-year long-term bond ETF, there are also two medium-term bond ETFs.

IEF US Treasury 7-10 Year ETF iShares and BIV US Medium Term Bond ETF Vanguard

The biggest difference between these two is that US Treasury 7-10 Year ETF-iShares 97.5% of holdings are in 7-10 year US Treasury bonds, while US Medium-Term Bond ETF-Vanguard not only holds 48.22% of 7-10 year Treasury bonds, but also holds 48.96% of 5-7 year Treasury bonds. Therefore, US Treasury 7-10 Year ETF-iShares is slightly more sensitive to interest rate changes than US Medium-Term Bond ETF-Vanguard .

So in the case of the recent interest rate cut expectations, the performance of the 7-10 year ETF will be slightly higher than the US medium-term bond ETF.

Finally, let me introduce two short-term bond ETFs with relatively low volatility

The first is the holding of bonds with a duration of 1-3 years VGSH short-term government bonds ETF-Vanguard,

These types of bonds with a duration of less than 5 years are called short-term bonds, but because the duration is not short enough, there is still some volatility in the market.

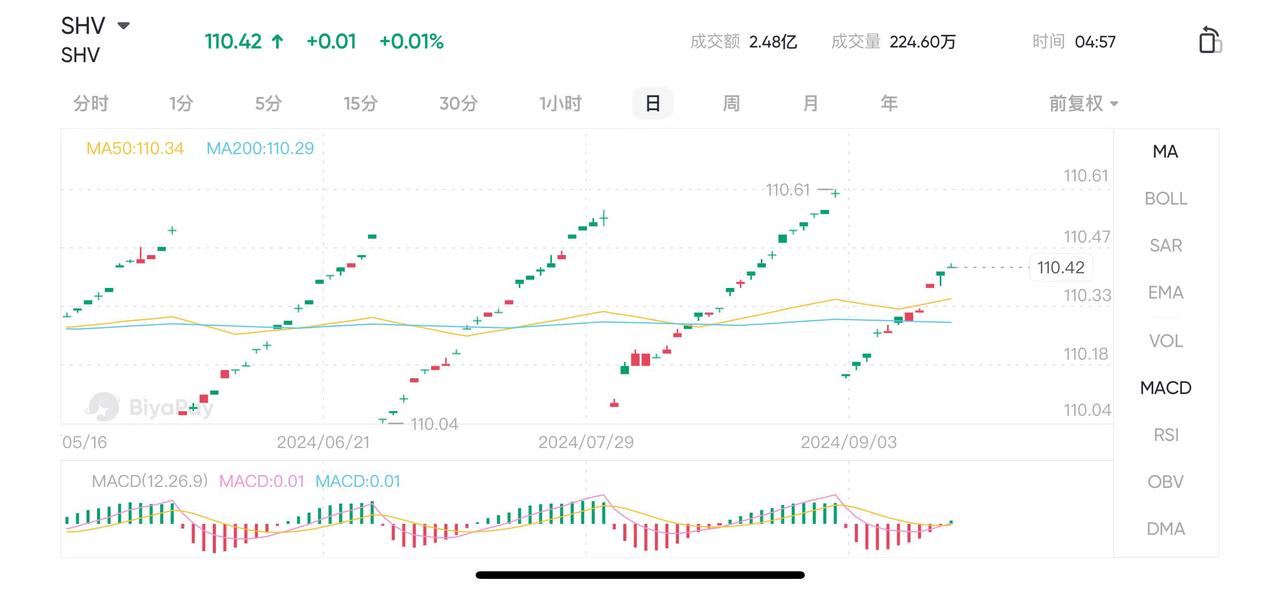

The SHV US short-term Treasury ETF-iShares is a bond with a duration of less than 1 year

Bond holdings with a duration of 3-6 months account for 75.88%.

Bond holdings with a duration of 6-12 months account for 24.12%.

Let’s compare the performance of these two short-term bonds

SHV US short-term government bonds ETF-iShares is mainly a stable, VGSH short-term government bonds ETF-Vanguard is also trending upward, but there will be some fluctuations.

The decline in US Treasury yields has three financial consequences.

- US Treasury Prices Rise

- Financial product yields have generally declined

- Universal Discount Rates Decline

Among them, the rise in US government bond prices will trigger a global bond price increase.

The general decline in financial product returns will trigger capital flow to the US overseas for profit, leading to prominent downward pressure on the US dollar. At this time, everyone can take a look at the US dollar bullish index, such as the UUP, which is short for Invesco DB US Dollar Bullish. It tracks the US dollar index at a single rate, and the underlying asset is the US dollar index futures contract, which follows the rise and fall of the US dollar index. When the US dollar rises, the UUP also rises.

To sum up, the longer the duration of the bond, the more sensitive it is to interest rate changes. In the context of interest rate cuts, if you want to pursue high returns, the yield of long-term bonds will definitely be higher. However, interest rate cuts are not smooth sailing. The magnitude of the rate cut may not be large enough, and it may also be suspended. This is the risk that long-term government bond ETFs need to bear Short-term government bond ETFs are the least sensitive to interest rate changes. So the yield is relatively low, but the advantage is stability.

After understanding the meaning of the above ETFs, everyone can check the market trends of each ETF on compliance US stock ETF platforms such as Interactive Brokers, Jiaxin Wealth Management, BiyaPay wallet, etc., and trade according to investment preferences.