- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

With the first GOP debate over and shifts in U.S. markets, how will "Trump trades" and "Harris trade

With the approaching o f the 2024 US presidential election, the political atmosphere is becoming increasingly tense. On September 10th local time, Trump and Harris held their first debate as US presidential candidates in Pennsylvania, which was also their first head-to-head confrontation! As the election is less than two months away from the voting day, this debate is widely regarded as one of the key factors that may affect the election results. The direction of the election affects the trend of the US stock market, and there were obvious fluctuations in the US stock market after the debate.

What was the outcome of the debate?

Harris’ performance in the debate was considered quite successful, especially compared to Biden’s poor performance in the last debate, Harris significantly boosted morale within the Democratic Party. Post-debate polls showed that most voters who watched the debate believed Harris was the winner.

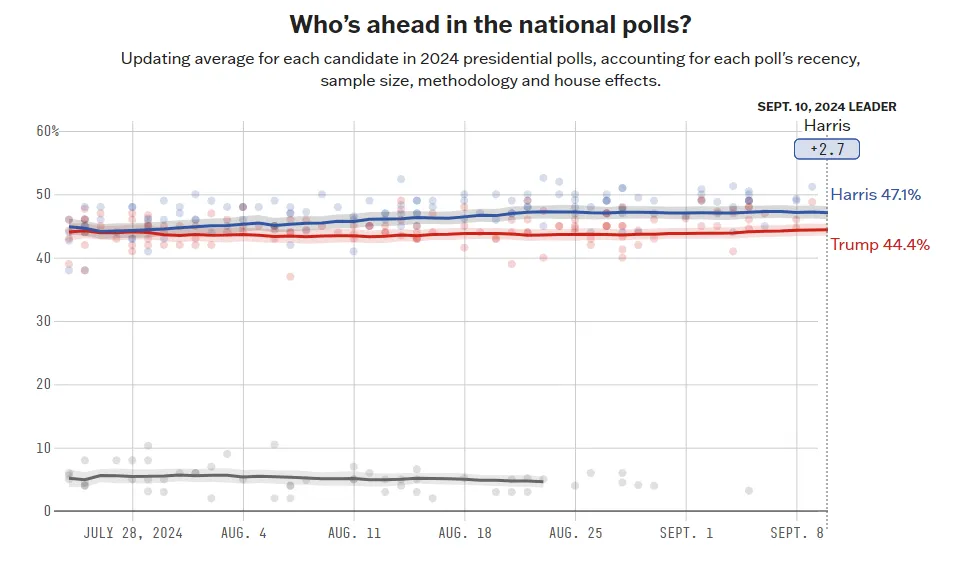

According to a survey by CNN/SSRS, 63% of viewers believe that Harris has won, which is significantly higher than the 37% who support Trump. However, it should be noted that this group does not fully represent the opinions of all voters. After the debate, Harris’ lead in national polls slightly increased. According to FiveThirtyEight data, Harris’ support rate reached 47.1%, leading Trump by 2.7 percentage points.

Although Harris’ performance in the first debate is widely regarded as better than Trump’s, the election is still complex. Although Harris may maintain her lead in the polls in the short term, the future debate and election development are still full of uncertainty.

How did the US stock market react?

Hart’s first debate saw significant fluctuations in the US stock market. This not only reflects the market’s direct reaction to the candidates’ performance, but also reflects the expected adjustment of the long-term impact of the economic policies behind the two candidates.

Trump deal "cools down

The “Trump trade” represented by Trump showed signs of cooling down after the debate, such as oil and gas, as well as industry stocks directly related to protectionist trade policies, which performed poorly after the debate. Relevant concept stocks fell generally, such as Trump Media Technology Group (DJT) and Phunware, Inc. (PHUN) both plummeted. The former even fell more than 18% at one point, closing down more than 10% today at $16.68, hitting a new low since its listing at the beginning of the year.

Harris deal "suddenly rises

The “Harris deal” showed a sudden rise after the debate. The market welcomed the new energy policies, healthcare reforms, and targeted economic stimulus measures that Harris tends to implement. These policies are believed to promote the rapid development of clean energy and high-tech industries, and the stocks of related industries showed an upward trend after the debate. Harris reiterated her support for clean energy, and the stock prices of clean energy-related ETFs, such as iShares (EEMA) Global Clean Energy ETF (ICLN), rose.

How does the US election result affect the trend of the US stock market?

In the short term, Harris may maintain his lead in the polls due to his excellent performance in this debate. However, there are still nearly two months until the election day, and there may still be two presidential debates and one vice presidential debate in between. The trend of the election is still uncertain, but the result of the US election will obviously affect the trend of US stocks, especially in specific industries and fields. Next, let’s see how the confrontation between the two sides will affect the trend of US stocks.

Harris wins

The core of the “Harris deal” strategy is to bet on clean energy, healthcare reform, and targeted economic stimulus. If Harris wins, it will benefit a range of industries such as Renewable Energy, electric vehicle manufacturers, and even utility companies.

Specifically, the Democratic Party’s active stance on clean energy issues means.

If Harris wins, it will be good news for electric vehicle manufacturers such as Tesla, Rivian, and Lucid, electric vehicle charging network operators such as ChargePoint Holdings Inc., Beam Global, and Blink Charging Co., as well as suppliers and battery manufacturers.

Solar stocks, including First Solar Inc., Sunrun Inc. and Enphase Energy Inc., are also expected to perform better under Harris’s leadership.

Residential builders may also receive a boost. Harris proposed providing up to $25,000 in down payment support for first-time homebuyers and suggested tax incentives for builders building their first homes. She also called for the establishment of a $40 billion innovation fund to stimulate innovation in housing construction. Stocks such as DR Horton Inc., Lennar Corp., and KB Home may benefit.

The financial industry may not improve as the Harris administration is expected to continue strict regulation, imposing higher Capital Base requirements on banks such as US Bank, JPMorgan Chase, and Goldman Sachs, and credit card fee revenue will continue to be under pressure. Pharmaceutical companies may also face regulatory pressure as Harris proposes to set an annual cap of $2,000 on out-of-pocket costs for prescription drugs.

Trump won

The core of Trump’s economic policy is large-scale tax cuts and protectionist trade. If Trump wins, tariff policies may further tighten, and trade tensions will escalate. Some well-known companies, including chip manufacturers such as Nvidia, Broadcom, and Qualcomm, material companies such as Air Products and Chemicals Inc. and Celanese Corp., car companies such as Tesla and BorgWarner Inc., and industrial enterprises such as Otis Worldwide Corp., will be affected.

Trump announced the lifting of restrictions on domestic oil production, which will benefit oil, gas, and traditional energy companies. Notable stocks include Baker Hughes, ExxonMobil, ConocoPhillips, Occidental Petroleum, Williams, Halliburton, Devon Energy, Chevron, etc.

However, clean energy and electric vehicle companies that benefit from Biden’s Inflation Reduction Act are expected to face challenges during Trump’s administration, as he has stated that he will completely overturn Biden’s electric vehicle policy. Companies at risk if Trump cancels tax credits for buyers include Tesla, Rivian, and Lucid, as well as battery manufacturers and component suppliers.

Defense stocks may perform better in the event of a Republican victory, as people expect defense spending to be a clear priority for the Republican Party. Notable stocks include US aerospace manufacturer Lockheed Martin Corp., US multinational aerospace and defense-related science and technology company Northrop Grumman Corp., and Raytheon Technology Corporation.

Similarly, prison stocks such as GEO Group Inc. and CoreCivic Inc. may also rise, as strict immigration policies will benefit prison facility operators. Stocks of gun manufacturers such as Smith & Wesson Brands Inc. and Sturm Ruger & Co. Inc. also tend to rise due to Republican victories.

In addition, cryptocurrency stocks will also benefit significantly. It has recently been seen as a representative of the “Trump trade” because the former president’s attitude towards Bitcoin and other digital assets has undergone a major change since his election, even promising to make the US the “cryptocurrency capital” of the world. Notable stocks include Coinbase Global Inc., Marathon Digital Holdings Inc., Riot Platforms Inc., Cleanspark Inc., MicroStrategy Inc. and Cipher Mining Inc., as well as Bitwise Crypto Industry Innovator ETF.

US election in rate cut cycle intensifies US stock market volatility

The general impact of interest rate cuts on US stocks

During the interest rate cut cycle, the impact of the US election on Financial Marekt is particularly complex. The election results often directly affect investors’ expectations for the future direction of economic policies, causing market fluctuations. In the current interest rate cut environment, the different policy proposals of Trump and Harris may have a significant impact on the US stock market and the broader Financial Marekt.

Interest rate cuts usually lower borrowing costs for businesses, which is particularly beneficial for companies with low profit margins and high reliance on external financing. This makes it easier for investment projects to obtain funding support, which may stimulate business expansion and increase employment. At the same time, lower interest rates also usually boost the real estate and consumer markets, as individuals and families can finance their purchases or consumption at lower costs.

US election intensifies uncertainty in rate cut cycle

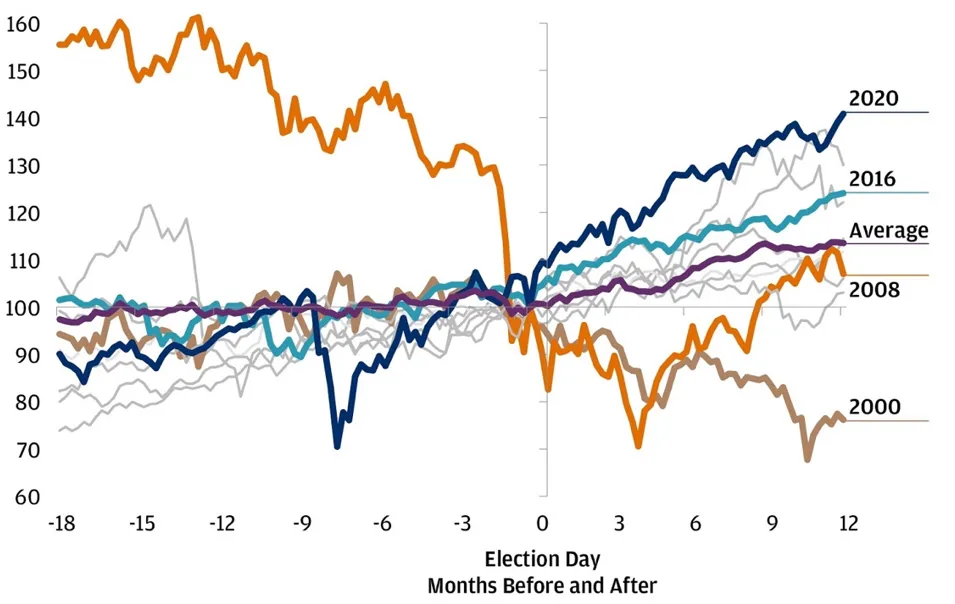

Data shows that market volatility in election years is significantly higher than in non-election years. Market volatility before and after the election has significantly increased, with more prominent gains and more significant declines.

Historical patterns show that the uncertainty of elections can significantly exacerbate market volatility. The significant policy differences between Trump and Harris have led investors to remain vigilant about two possible economic future paths. For example, Trump tends to further reduce taxes and relax regulations, which may stimulate the market in the short term but may also exacerbate long-term fiscal deficits. On the contrary, Harris tends to increase taxes and strengthen regulations, especially in the fields of environmental protection and technology, which may suppress market performance in the early stages but help sustainable growth in the long run.

The election results may also have an impact on the future direction of Monetary Policy. If the market expects the new government to take expansionary or contractionary fiscal measures, this may affect the Federal Reserve’s decision on future interest rate adjustments. Therefore, in an election year, investors usually need to pay extra attention to policy dynamics and prepare to adjust their investment portfolios to respond to potential market changes.

How do investors layout?

In an election year, the challenge for investors is how to find a sound investment strategy amidst policy uncertainty. Given possible policy changes, flexibility and diversification are key. Investors can consider diversifying their investments across industries and regions to reduce the impact of specific policy changes on their portfolios.

First, it is crucial to build a diversified investment portfolio.

This can not only help you resist the negative impact of single market or policy changes, but also effectively balance potential uncertainties by investing in assets in different industries and regions. For example, when predicting policy changes, investors can adjust their positions appropriately considering the policy tendencies of Harris and Trump. If Harris is predicted to win, increasing investment in clean energy and high-tech industries would be a wise choice, as these industries may benefit from their policies. Conversely, if Trump is expected to win, traditional energy and defense industries may be more suitable investment targets.

When facing the current complex uncertainties, you can use BiyaPay to monitor the trend of target stocks in real time. You can either buy directly or find a suitable buying opportunity. If you are troubled by deposits and withdrawals, you can also use it as a professional tool for depositing and depositing US and Hong Kong stocks. You can recharge digital currency and exchange it for US dollars or Hong Kong dollars, withdraw it to your bank account, and then deposit it to other securities firms to buy stocks. The arrival speed is fast, and there is no limit, so you will not miss investment opportunities.

Second, focus on Risk Diversification.

Considering the uncertainty and market volatility that the US election may bring, it is wise to maintain a certain proportion of cash holdings. This can not only provide a safety cushion when the market falls, but also act quickly when sudden investment opportunities arise. At the same time, using financial instruments such as options and futures as a hedge is also an effective strategy to protect investment portfolios from extreme market fluctuations.

Finally, focus on long-term investments rather than short-term fluctuations.

Although short-term markets may fluctuate due to election uncertainty, it is crucial to maintain a long-term investment perspective. This means that investors should focus on the fundamentals of companies and the long-term growth potential of industries, rather than just being affected by short-term policy changes. When considering long-term investments, choose companies and industries that have long-term growth potential regardless of changes in the political environment. These companies usually manage their finances well and have a good record of maintaining sustained growth.

Overall, as the US election day approaches, investors should pay attention to news and policy changes in a timely manner in order to better predict market dynamics. The policy showdown between Trump and Harris not only stirred up political waves, but also profoundly affected the volatility of the stock market. The transition from the “Trump trade” to the “Harris trade” reflects the market’s response to two completely different economic policies. During this critical period, investors should carefully consider various possible election results and prepare corresponding response strategies.