- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Understanding U.S. Stock Financial Reports: A Guide from Beginner to Expert in 3 Minutes!

Investing in the U.S. stock market inevitably involves paying attention to the financial reports of publicly traded companies. Financial reports primarily consist of the income statement, balance sheet, and cash flow statement. Each reflects a company’s profitability, asset quality, and cash flow situation. When investors want to delve into the “heart” of a company, they need to look through the financial reports to gain insights into the company’s intrinsic value.

Many successful investors emphasize the importance of reading financial reports. For instance, Warren Buffett, the “Oracle of Omaha,” once said, “I just like to read financial statements.” He considers this one of the essential methods for stock selection.

So, what magic does the financial statement hold that fascinates Buffett so much?

Firstly, U.S. stock financial reports help investors understand a company’s financial health, including key indicators such as revenue, profit, assets, and liabilities. Secondly, these reports are vital tools for evaluating and comparing the performance of publicly listed companies and can serve as a basis for future projections.

Let’s break it down simply:

1.Understanding the Company’s Business

Financial statements allow you to grasp the basic information about a company, its products, the type of customers it serves, and the channels through which it reaches its customers. In essence, it answers the questions of what the company sells, to whom, and how. These are the foundations for studying a company’s business model.

2.Identifying Outstanding Public Companies

Many well-known companies, such as Apple, Amazon, Google, and Coca-Cola, are listed in the U.S. By examining the financial statements of these companies over the years, you can understand their past development. If you want to judge a company’s future prospects, financial statement analysis is also crucial. In addition to established public companies, if you want to discover more potential U.S. stocks, you need to delve into the financial statements of more companies.

3.Avoiding High-Risk Companies

U.S. history has seen many companies involved in financial fraud, causing significant losses for some U.S. stock investors. Such fraudulent activities might leave traces in the company’s financial statements. Moreover, many companies with bleak prospects also have poor financial data. Investing in these companies could lead to losses, which can be avoided through financial analysis.

How should investors analyze financial statements?

As mentioned earlier, financial reports mainly include the income statement, balance sheet, and cash flow statement, reflecting a company’s profitability, asset quality, and cash flow situation. Here’s a simple analysis based on these three points:

1.Income Statement

The income statement shows how a company makes money. It records the company’s revenue, cost of goods sold, operating expenses, and other expenses during a reporting period. It also shows the net profit or loss. From this, we can analyze the company’s profit margin, study the growth of revenue and profit, and the trend of profitability.

2.Balance Sheet

The balance sheet shows how much money a company has. It records the company’s assets, how they are composed, the amount of liabilities, and whether short-term liabilities are high. After subtracting liabilities from assets, it shows the net assets left for shareholders. Through the balance sheet, we can analyze the company’s asset indicators, the liquidity of various assets, and the company’s debt repayment ability. Combined with the income statement, we can further analyze the company’s operational capabilities and the return on investment for shareholders.

3.Cash Flow Statement

The cash flow statement shows the movement of a company’s funds. It records how much money the company received and spent during a reporting period from operations, how much was spent on investment projects, and how much was recovered, how much was borrowed from financing activities, and how much was distributed to shareholders or repaid to banks. Through the cash flow statement, we can assess the company’s “blood-making” ability in operating activities, the scale of “burning money” in investment activities, and the degree of dependence on external financing.

It’s important to note that the three financial statements are not independent; they are closely interconnected. We need to analyze them comprehensively to assess the company’s current financial condition and future prospects. Below, the editor will use the well-known Apple Inc. (AAPL) as an example to present in a table format and analyze key items (no need to interpret unfilled items separately).

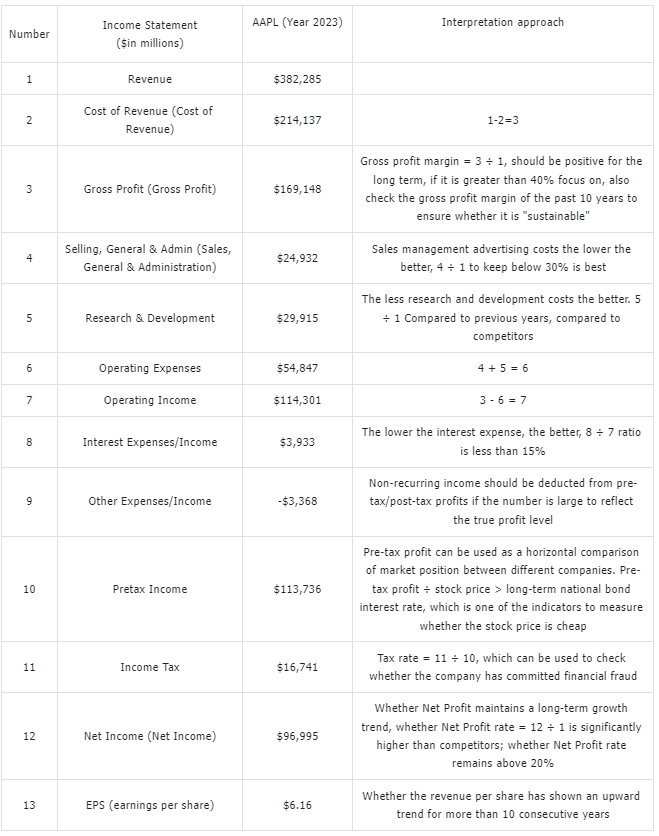

1.Income Statement (Profit and Loss Statement)

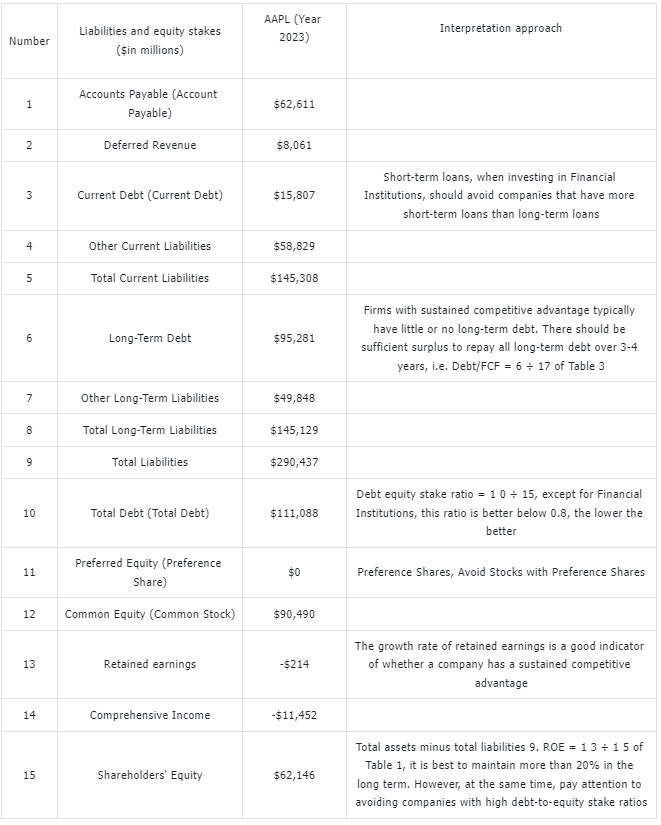

- Balance Sheet

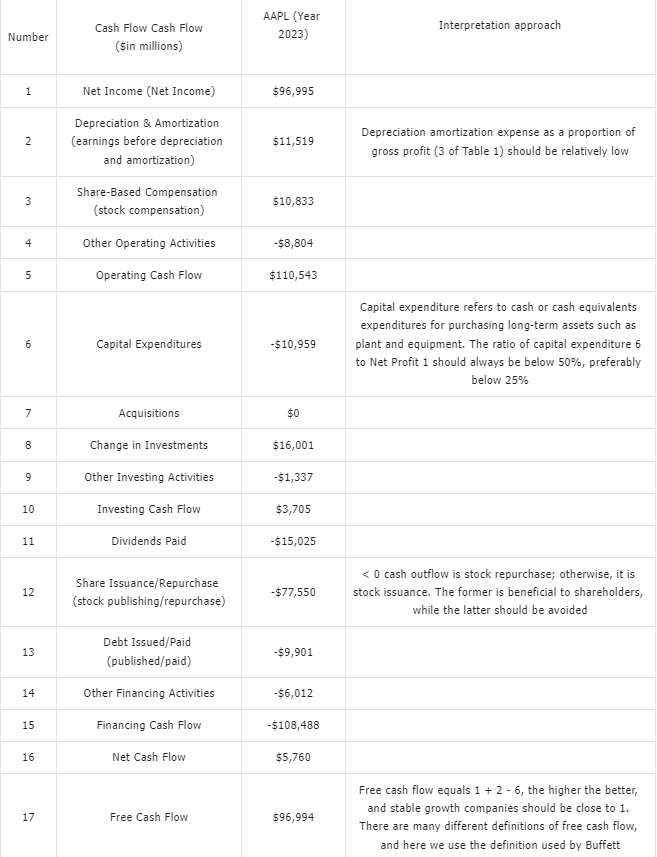

- Cash flow statement

In summary:

The core purpose of interpreting financial reports is to filter out companies with excellent performance and buy when the price is right. Such companies and the timing of purchase are key for ordinary investors to make stable profits from the stock market. However, financial reports alone cannot help investors determine whether they can profit from companies with unstable earnings.

Therefore, when we review the financial reports of specific companies, we can plug their data into these tables and analyze them one by one to form personal opinions and assessments of the company. It is recommended that everyone select a few companies of interest for practical operation exercises.

In financial report analysis, absolute values are usually not the most important indicators. Comparatively, ratios, growth rates, and relative values compared to other companies in the industry are more critical. In addition to focusing on high-quality profit margins, we also value the sustainability of profits, growth potential, debt levels, and asset utilization efficiency; these are all key points we need to pay attention to.

After analyzing the financial statements of U.S. stocks and selecting excellent companies, how should investors start?

The second quarter of the U.S. stock market’s financial report season in 2024 is drawing to a close, with pleasing results. According to data from FactSet, the average earnings growth of S&P 500 index companies this quarter was about 11%, the highest level since the fourth quarter of 2021 (31.4%). It is also worth noting that 79% of S&P 500 index companies’ earnings exceeded expectations, with an average excess of 3.5%. Especially in industries such as technology and utilities. Although some industries, such as materials and industry, are facing pressure, the overall market growth momentum remains robust. For investors, focusing on the potential opportunities in these growth-driven industries may be key to future investment strategies.

You can also use a multi-asset trading wallet like BiyaPay to inquire and follow up, and trade online in real-time at the right time; it also provides the function of recharging digital currency (USDT, BTC, etc.) to withdraw US dollars/Hong Kong dollars to bank accounts, and then deposit and withdraw funds to other brokerage platforms, so that you can use BiyaPay as a professional fund in and out tool. Investing in these stocks through such a multi-asset trading wallet not only allows investors to benefit from it but also facilitates investors to trade U.S. stocks, reasonably invest in a diversified range of asset categories, to cope with future market fluctuations, and push up the market value of U.S. stocks.

In conclusion, investing in U.S. stocks, financial statement analysis is an extremely important part, which can help you understand listed companies, discover investment opportunities, and avoid speculative mines. By comprehensively analyzing the three major statements of the income statement, balance sheet, and cash flow statement, it can help everyone make better investment decisions.