- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Dell Makes a Strong Comeback to the S&P 500! AI Order Backlog Hits a New High, Server Revenue Soars

In today’s data-driven era, Artificial Intelligence (AI) has become a key driver for corporate innovation and growth. Global tech giant Dell Technologies (DELL), with its deep accumulation in the AI field and forward-looking strategy, continues to solidify its leadership position in the industry.

Recently, Dell Technologies’ stock was reincluded in the S&P 500 index. On September 9th, before the market opened, Dell’s stock surged by more than 6%. This event is not only an affirmation of the company’s performance and market influence but also a long-awaited opportunity for investors to reassess its long-term value.

Dell’s Historical Background of Returning to the S&P 500

Dell Technologies first joined the S&P 500 index in 1996 and exited the index in 2013 due to privatization. Since going public again in 2018, Dell Technologies has been striving to regain its leadership position in the public market.

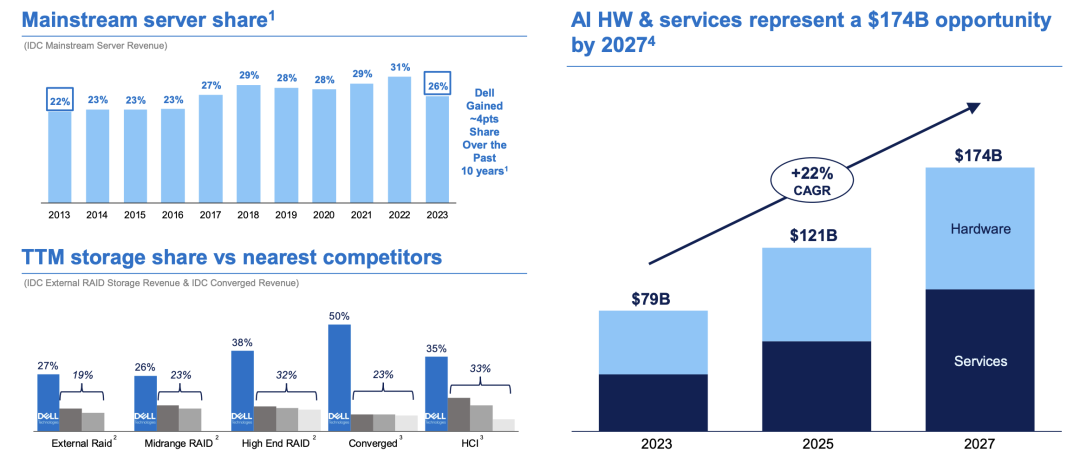

During the privatization period, Dell Technologies underwent a series of strategic adjustments and business reorganizations, which laid the foundation for its relisting and future growth. The company strengthened its competitiveness in key technology areas such as cloud computing, data storage, and AI servers through acquisitions and internal innovation. Especially in the AI server market, Dell Technologies has successfully seized the opportunity of the rapid development of AI technology with its high-performance products and solutions.

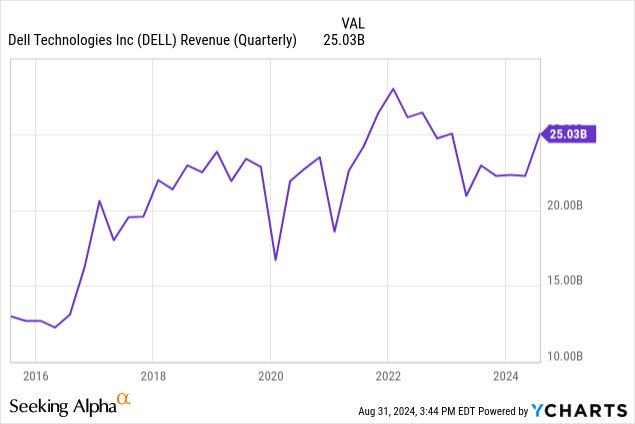

In 2024, Dell Technologies’ financial report showed its strong financial performance, with net revenue in the second quarter reaching $25.03 billion, exceeding market expectations and demonstrating the company’s leadership in the field of infrastructure solutions. In particular, the Infrastructure Solutions Group (ISG) achieved a revenue of $11.65 billion, a year-on-year increase of 37.6%, with a backlog of AI server business orders reaching $3.8 billion. This data fully demonstrates the market’s demand for Dell Technologies’ products and the company’s growth potential in the AI field.

These achievements have provided a solid support for Dell Technologies to return to the S&P 500 index. According to S&P Dow Jones Indices, Dell Technologies, Palantir, and Erie Indemnity will be included in the S&P 500 index, and this change will take effect before the U.S. stock market trading starts on September 23rd.

This inclusion is not only a recognition of Dell Technologies’ financial health and market position but also indicates that it will attract more investment from passive funds. These funds will buy Dell Technologies’ stocks according to the index weight, which may push up the stock price. In addition, being included in the S&P 500 index will also enhance Dell Technologies’ visibility and reputation among investors, strengthen its brand influence, and attract more investor attention and investment.

Furthermore, Dell Technologies’ management is optimistic about the company’s future growth. The company estimates that its revenue for the fiscal year 2025 will be between $95.5 billion and $98.5 billion, with ISG revenue expected to grow by about 30%. This forecast reflects the company’s confidence in its business and market prospects, and also indicates the market’s positive expectations for Dell Technologies as a component of the S&P 500 index.

Inclusion in the S&P 500

After being included in the index for many years, Dell lost its position in the S&P 500 index after going private, but now it has finally regained its place in the highly sought-after stock index.

Entering the S&P 500 index is very beneficial for Dell, as fund managers who require a stock to be in the S&P 500 will now invest in Dell. This dynamic should cause Dell’s price-to-earnings ratio and other multiples to expand, thereby increasing the stock price in the coming years.

In the second quarter of fiscal year 2025, Dell reported revenue of $25 billion, a year-on-year increase of 9%, and its diluted earnings per share (EPS) were $1.17, an 86% increase compared to the same period last year, while non-GAAP diluted EPS were $1.89, a 9% increase.

This was driven by strong growth in the Infrastructure Solutions Group, which achieved a record revenue of $11.6 billion, a 38% year-on-year increase, with server and network revenue surging by 80%. Revenue exceeded expectations by $903.32 million, and non-GAAP EPS exceeded expectations by $0.18. Among them, the backlog of AI server business orders reached as high as $3.8 billion, fully demonstrating the market’s demand for Dell’s products and the company’s growth potential in the AI field.

COO Jeff Clarke pointed out in the earnings call:

“We executed well in Q2, and I’m really proud of our team and our performance. Revenue was $25 billion, up 9%, with another record for our servers and networking business. Diluted EPS was $1.89, up 9%, and operating cash flow was $1.3 billion. Our AI momentum accelerated in Q2, and our results and outlook demonstrate that we are uniquely positioned to help customers leverage the benefits of artificial intelligence.”

The ISG department also achieved strong growth in the second quarter.

Sales reached $11.65 billion, a year-on-year increase of 37.6%. The server and storage business grew by 79.5% and decreased by 5.1%, respectively, and the AI server business performed well, with a backlog of AI server sales orders reaching $3.8 billion.

It is expected that the total addressable market (TAM) for AI hardware and services will grow at a compound annual growth rate of 22% in the next few years.

Chief Operating Officer Jeff Clarke emphasized the company’s competitiveness in the AI field and pointed out that the company has great opportunities in secondary CSPs, enterprises, and emerging sovereign customers. For the fiscal year 2025, Dell expects revenue to be between $95.5 billion and $98.5 billion, with ISG revenue expected to grow by about 30%.

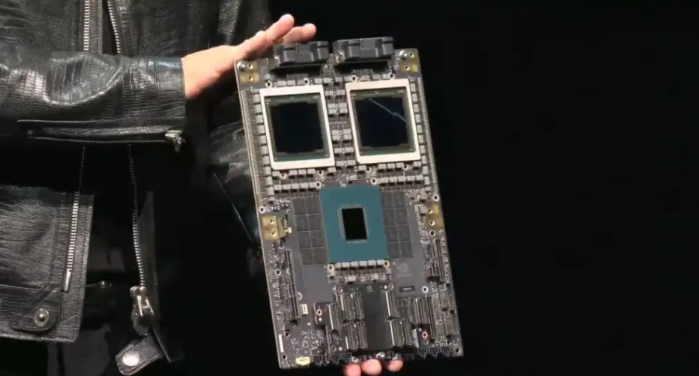

Dell’s AI server business is growing rapidly and has initially shown the potential to compete with VMware’s product line. Against the backdrop of a shortage of Nvidia GPU accelerators, Dell has still been able to achieve such growth, demonstrating its excellent capabilities in supply chain management and customer demand response.

Super Micro’s Troubles

Dell’s main competitor in the AI enterprise hardware field, Super Micro Computer SMCI, is facing problems.

A recent short report dented confidence in SMCI’s stock, which was exacerbated by the company’s statement that it will miss its 10K filing deadline. These events have put considerable pressure on SMCI’s stock and could have broader, longer-term implications.

Due to the uncertainty surrounding SMCI, as customers move away from the volatile experience of SMCI to a more predictable and stable Dell atmosphere, Dell may gain customers. As more investors choose Dell for exposure in the lucrative AI enterprise hardware field, Dell’s stock may benefit.

Not only that, but Nvidia and Dell have also integrated well with Dell AI Factory and Project Helix, aiming to accelerate the adoption of AI technology. These powerful partners will enable Dell to quickly expand its market share.

Currently, Dell’s second-quarter performance is encouraging. Revenue increased by 9% year-on-year, and 13% quarter-on-quarter, with operating income and free cash flow also performing strongly, at $1.3 billion. As shown in the figure below.

Market Reaction After Inclusion in the S&P 500

After Dell’s re-inclusion in the S&P 500, there was a significant short-term increase in stock price. This phenomenon is not uncommon in the market, as stocks included in the S&P 500 usually receive widespread attention and investment. After the inclusion, Dell may still maintain an upward trend in stock prices:

Passive Allocation by Fund Managers

Companies included in the S&P 500 often become investment targets for passive index funds, which automatically buy new component stocks when passively tracking the index.

Dell’s re-inclusion makes it a target for these funds, thereby bringing a large amount of buying demand. This demand has driven a short-term increase in Dell’s stock price.

Positive Market Expectations

Investors usually have an optimistic attitude towards new components of the S&P 500, expecting this inclusion to bring more market attention and investor trust. This expectation will further drive up Dell’s stock price.

Increased Liquidity

As a component of the S&P 500, Dell’s trading volume has increased significantly, and the improvement in liquidity makes the stock easier to buy and sell, which also helps the price to rise.

Valuation Enhancement

Inclusion in the S&P 500 has also had a direct impact on Dell’s valuation:

Demand from Passive Investment Funds

The stocks of the S&P 500 are usually favored by various passive investment funds, which need to configure according to the weight of the index components. Therefore, Dell’s inclusion has triggered automatic purchases by fund managers, pushing up its stock price and P/E ratio.

Market Valuation Adjustment

Due to the high market recognition and investment stability of the S&P 500 component stocks, the market usually gives higher valuations to these companies. Dell’s inclusion means that the market is optimistic about its future performance, thereby driving up its P/E ratio.

However, Dell’s current P/E ratio is significantly lower than the industry median. Their forward non-GAAP P/E ratio is 13.89, a 39.77% discount compared to the industry median of 23.06.

I believe this presents a key opportunity for investors, especially considering Dell’s better position in the AI and server markets. Interestingly, Dell arguably has a much more robust growth profile and pipeline than the median stock in the Information Technology sector due to their exposure to AI servers (and the corresponding service contracts). Yet shares trade below the industry median. This looks like a classic mispricing.

On the same note, Dell’s forward P/E to growth (PEG) ratio is 1.12, also below the industry median of 1.82, in this case, at a notable 38.51% discount. Here, the market is implying that they are discounting Dell’s ability to earn over the next 12 months and believe that their actual EPS numbers will be lower than current expectations (expectations will be revised down).

However, strangely, market expectations are running counter to Wall Street analyst expectations, with a 3:1 ratio of upward EPS estimate revisions over the last three months.

That is to say, expectations are very conservative and undervalued, and Dell has a strong potential to capture market share, especially as they continue to expand their AI server and networking businesses.

I agree with Evercore that as they expand their comprehensive AI offering, they should be able to grab more key wins even as the market expands. Their EPS growth is already strong, with a year-on-year increase of 110.76% over the last 12 months, and the AI server trend is increasing.

Considering Dell’s strong growth potential and truly robust pipeline, their forward P/E ratio should trade at about the industry median. This would place their forward non-GAAP P/E at roughly 23.06. If we see the PC server giant converge on just an industry median valuation multiple, we could see shares move up about 66% from current levels, not including dividends.

Investor Advice

Dell’s return to the S&P 500 is not only a reflection of the company’s financial strength but also provides new opportunities and challenges for investors. Here are some investment suggestions based on Dell’s current market performance and financial situation.

Valuation and Investment Opportunities

Dell’s inclusion in the S&P 500 usually triggers a short-term increase in stock price, providing investors with an opportunity to buy low. Although Dell’s P/E ratio has risen after inclusion, compared with its main competitors such as NVIDIA and AMD, Dell’s valuation is still relatively reasonable. This indicates that despite the obvious increase in stock price, Dell’s stock may still have long-term investment appeal.

It is worth noting that Dell’s strong performance in the fields of data centers, storage solutions, and AI hardware demonstrates its potential for future growth. Although stock prices may be affected by market sentiment in the short term, in the long run, the company’s continuous innovation and market expansion in these key areas will be key to investment. Especially in the fields of AI and high-performance computing, Dell’s continued investment and the future expansion of the ISG group indicate growth opportunities.

In addition to the huge potential of the ISG group, Dell’s shareholders have other benefits. This year’s dividend yield has increased by 20% to reach 1.5%, and the management’s goal is to grow at least 10% annually by fiscal year 2028. No matter how much the stock price rises, this will bring at least a 2% cost of capital return to today’s investors.

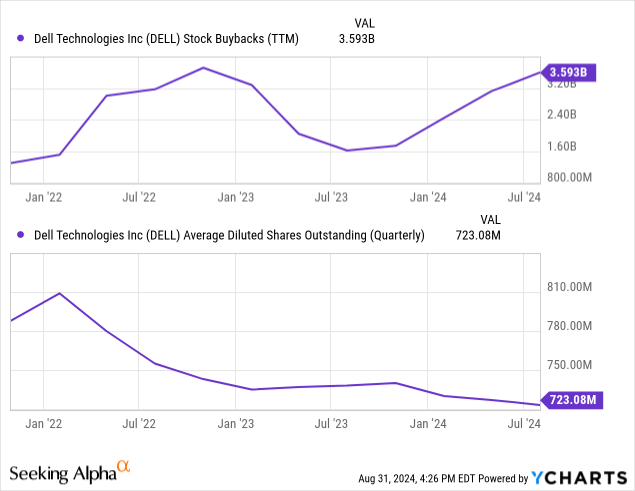

The company has been more aggressive in stock buybacks, repurchasing $700 million in the last quarter and $3.6 billion in the past 12 months, accounting for 4.5% of the current market value. As shown in the figure below, with the increase in buybacks, the number of circulating shares is rapidly decreasing.

The reason Dell can do this is that it has ample free cash flow, with a free cash flow of $24 billion in the past five years and $1.3 billion in the last quarter, that is, an operating rate of $5.2 billion.

However, Dell’s recent performance is even more eye-catching, and analysts are also optimistic about it. They give an average target price of slightly above $150 per share, which is 32% higher than the current stock price.

In addition, if Dell increases its market share due to problems with Super Micro, or if demand is higher than expected, then Dell’s earnings per share (EPS) may exceed analysts’ expectations. Many stocks have caught up with the AI hype, but Dell’s valuation is still reasonable, 36% lower than the recent high.

Risk Management

All stocks have risks, and Dell is no exception. The industry is highly competitive, and the cyclical personal computer market is its largest business.

Dell is also facing a decline in AI server build forecasts for the rest of 2024 due to shipment delays, especially related to NVIDIA’s Blackwell chip.

Morgan Stanley analysts said that although the original projection was to produce 48,000 units of the PowerEdge 9680/9680L AI servers, the estimate has been cut to 37,000-38,000 units. This is actually due to delays in the delivery of the Blackwell chips used in Dell’s AI server production. This does not indicate demand.

Although there are these problems, Dell is fully capable of managing these risks.

Although the delayed Blackwell chip will definitely pose challenges, it is good that Dell has the flexibility to mitigate this by integrating AMD (AMD) chips into their AI server builds if customers desire. They actually alluded to this on their earnings call.

Dell’s PowerEdge servers already use AMD EPYC processors to maintain performance and energy efficiency for demanding AI workloads. I believe this can support the company in managing delays in NVIDIA chip shipments by giving their customers key alternatives.

Considering the short-term increase in Dell’s stock price, phased investment may be an effective strategy. Investors can make initial investments when the stock price is relatively low and gradually increase their positions as the stock price rises. This approach helps to balance investment risks and returns.

At the same time, regularly paying attention to Dell’s quarterly financial reports and market dynamics will help obtain the latest company performance and market trend information. Combining financial data with market performance can make wiser investment decisions.

Due to NVIDIA’s strong pricing power, Dell’s AI server profit margin has been declining since June. However, the latest quarter at the end of last month showed that the company remains a strong beneficiary of AI infrastructure growth, with revenue from AI-optimized servers surging by 23% in the most recent quarter. Their strategy is comprehensive, as Evercore noted. I think Dell is poised to capture more market share in the coming quarters.

Although there are risks surrounding margin pressure and supply chain delays due to the Blackwell chip delay, I believe the company is prepared for them with their ability to offer AMD as an alternative. They can be nimble, which, I think, is key.

In my opinion, Dell remains a strong buy despite short-term risks and supply chain disruptions. The ongoing AI revolution presents an opportune moment for the company to expand and solidify its leadership in this key market. I really think they are getting a lot of the upside from the AI boom, with a much lower risk profile.