- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

US stocks plummet! September curse strikes? Why did the market fall in September? How should investo

At the beginning of September, the US stock market gave investors a “warning”! As of last Friday’s close, the US stock market began to plummet after the release of non-farm payrolls data in August; the Nasdaq index fell 2.55%, and the S & P 500 index fell 1.73%. In terms of Constituent Stocks, Broadcom fell more than 10%. Tesla fell more than 8%, and ASML and NVIDIA fell more than 4%.

From the current situation, the “September curse” that worries US stock traders the most seems to be coming true. The US stock market started with a sharp decline in September this year. Historically, the performance of the US stock market in September is often very poor.

Why does the September curse/September effect occur?

Whenever entering September, investors who have been observing the stock market for a long time may have heard about the seasonality of the stock market. The “September curse” is not groundless, but the result of Statistical Data on market performance over a long period of time. According to data from multiple investment research institutions, the performance of the US stock market in September was generally poor. This change may also trigger a reassessment of market risks, leading to changes in investors’ psychology and capital flows. Interestingly, the stock markets of multiple countries around the world also showed a relatively weak trend in September.

How did the stock market perform in September in history?

Since 1928, the Standard & Poor 500 index had the highest average decline of -1.2% in September , and positive returns only 44% of the time.

If the time is shortened a bit, the average decline of the S & P 500 index in September over the past 10 years is also -2.3% , which is even older The only month with negative returns in the past 100 years The Nasdaq index has been trading since 1971, and the average decline in September is also -0.6% Interestingly, September was also the worst month for cryptocurrency performance from 2013 to 2021, hence the name September Effect .

Although looking back at history, the September effect may be true, but it does not mean that the decline is inevitable It may only be the result of several market crashes in history. The worst month on record was 1931, when the Standard & Poor 500 index fell by -29.7% , in addition to the 2008 financial tsunami. Therefore, it may not be worth using as a basis for future trading strategies, because if extreme events are excluded, the frequency of large declines in September is not as frequent as before.

So why did the US stock market plummet in September this year?

Although the US stock market is mostly in a downward trend in September every year, the specific reasons vary from year to year. So what caused the sharp drop in the US stock market this year?

Non-farm data is not ideal

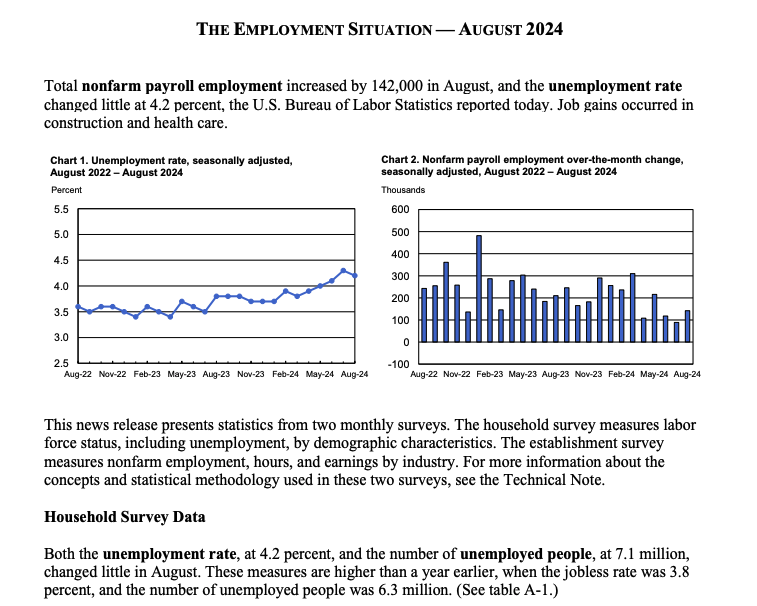

The US Department of Labor’s August non-farm payrolls report is a key indicator for determining whether the Fed will cut interest rates by 25 or 50 basis points in two weeks.

The latest data shows that the number of non-farm payrolls in August rebounded to 142,000 from the previous month, and the median expectation of analysts was 165,000. The unemployment rate fell to 4.2%, which is in line with expectations. It should be noted that these two data come from two different surveys. Employment comes from a sample survey of enterprises and government units, and the unemployment rate comes from a household survey.

Investors did not see the hopeful good news, but instead intensified people’s concerns about the slowdown of the labor market. Risk aversion continued to rise, and they began to sell assets with higher risks. The US chip and technology sectors led the decline.

NVIDIA leads the decline

NVIDIA, as the “leader” of US technology stocks, has been under downward pressure recently.

Previously, although Nvidia’s revenue and profit in the second quarter exceeded Wall Street’s expectations, Nvidia’s stock price plummeted by 8% due to not surprising the market and falling below the most optimistic expectations. Bloomberg reported, citing insiders, that the US Department of Justice issued subpoenas to Nvidia and some third-party companies seeking evidence of Nvidia’s violation of the Anti-Trust Act. After the news came out, Nvidia’s stock price fell under pressure.

The AI industry is facing short-term obstacles

The popularity of the AI industry has also declined recently. Taking ChatGPT as an example, according to the latest data from Goldman Sachs, the monthly visit volume of the ChatGPT website has sharply decreased from spring to midsummer. The report states:

In terms of monthly users, the initial’excitement 'for ChatGPT is fading. Of course, this does not mean that the growth rate of related industries will not be strong, but it does indicate that the next wave of beneficiaries may come from new products and services that can be created based on these basic models.

The sharp drop in monthly traffic does not mean the end of OpenAI. Customers may be tired of GPT-4, and some users may find it unnecessary to integrate AI chatbots into their daily lives.

August ISM manufacturing index falls short of expectations

There are many reasons for the sharp drop in the US stock market. Although the lower-than-expected ISM manufacturing index is not the main reason, the market seems to be using this data as the culprit for investors to sell stocks. Overall, although the ISM manufacturing index rose slightly in August, the increase was not as expected and has been below 50 for five consecutive months. The survey shows that manufacturing demand has further contracted, which has also led to a decline in production, and the production index has hit its lowest level since the epidemic. In addition, the final value of the S & P Global manufacturing PMI was revised from 48.0 to 47.9, which is also lower than market expectations.

In fact, the ISM index has rebounded compared to July, but slightly worse than expected. The market seems to have magnified the decline in both the production index and new orders, as well as the increase in inventory, causing the new order/inventory ratio to fall to a recession level, which is seen as a warning sign of economic recession. At the same time, the price index has resumed its upward trend, conveying a signal of stagnant inflation, thus triggering market panic again.

Interest rate cuts are the biggest unknown

US bank economists expect the Federal Reserve to cut interest rates by only two 25 basis points this year. If the US economy rebounds strongly from the weak July employment report, it may push market sentiment and prove that investors are too confident in the Fed’s interest rate cut path, which may put downward pressure on US stocks.

It can be seen that the key economic data released recently may affect the magnitude of the Federal Reserve’s interest rate cut, which in turn will affect the sentiment of the US stock market. In the short term, before the “boots” of the Federal Reserve’s September Monetary Policy decision are lifted, the performance of the US stock market will continue to revolve around US economic data and the path of the Federal Reserve’s Monetary Policy.

How will the US stock market develop in the future? Can investors bottom fish?

In terms of the US economy, the manufacturing industry is weak, but the service industry is still resilient, and a soft landing is still a high probability event. The August ISM of the US was 47.2, slightly lower than expected; but the August ISM service industry index was 51.5, slightly higher than the expected 51.4. The growth of the US economy is mainly contributed by consumption and the service industry. Although the manufacturing industry is weak, the service industry still maintains a moderate expansion trend. Therefore, we believe that although the US economy is slowing down, the probability of a short-term deep recession is small, and we still use economic soft landing as a benchmark condition.

In terms of the fundamentals of the US stock market, Listed Company’s Q2 earnings performance is still good. Comparatively, the S & P 500’s Q2 EPS increased by 11% year-on-year, accelerating from 6% in the first quarter; the NASDAQ index’s EPS growth rate was 13%, although the growth rate has declined, technology stocks are still an important support for capital expenditure and stock buybacks in the current US stock market, and the market’s long-term growth prospects for AI are still positive.

How should investors respond?

The US stock market experienced a rapid rebound in August and is currently at a relatively torn position. The closer the interest rate cut is, the more sensitive the market will become. September is a traditional “eventful autumn” for the US stock market. The presidential election debate between Harris and Trump is about to begin, and the highly anticipated Apple product launch will also shine this week, which may increase the market’s volatility in the short term. However, we have not seen the fundamental factors that have caused the stock market to fall sharply. Historically, every round of deep correction may be a rare discount window period. Regular investment + low-position layout may be a good way to cope with the current volatility.

It is important to choose a suitable securities firm for investment at this time. We can choose a more credible securities firm for investment, such as Jiaxin Wealth Management, which is a globally renowned investment securities firm. By opening an account with Jiaxin Wealth Management, you can get a bank account with the same name. You can deposit digital currency (USDT) into the multi-asset wallet BiyaPay, and then withdraw fiat currency to Jiaxin Securities for investment in US stocks. You can also search for US stock codes on the platform for purchase. At the same time, investors can monitor stock prices regularly according to their investment strategies and buy or sell stocks at the appropriate time.

Summary

Overall, although the short-term market crash has posed a greater confidence test for investors, historically, every adjustment in the stock market may be a new opportunity for layout. Investors should always remain vigilant, control risks, and allocate assets reasonably to cope with unforeseen market fluctuations.