- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Non-Farm Payroll Data Drastically Revised, Undermining Market Confidence! As the Pressure for the Fe

With the upcoming release of the August Consumer Price Index (CPI) report, market tensions are rapidly escalating. Investors are closely watching the Federal Reserve’s monetary policy moves, especially against the backdrop of ongoing inflationary pressures.

Recently, the U.S. stock market has experienced significant volatility, particularly following the release of the non-farm employment data, with noticeable declines in the S&P 500, Dow Jones, and NASDAQ indices. These fluctuations reflect the market’s uncertainty about the trajectory of inflation and future interest rate policies.

In this context, investment opportunities in the market have become particularly complex and variable. Fluctuations in oil prices, rising food costs, and the performance of energy stocks, insurance stocks, and the consumer goods sector all have significant impacts on investors’ strategies. This article will analyze the reasons for the current deterioration of market sentiment, discuss market reactions before the CPI report release, and provide an in-depth interpretation of the performance of different industries to help investors grasp potential opportunities in the market.

Market Sentiment Deteriorates Before CPI Data

As the August CPI data approaches, market sentiment has already begun to noticeably deteriorate. The CPI (Consumer Price Index) is a key indicator of inflation, and the Federal Reserve will adjust monetary policy based on this data. Investors are particularly sensitive to the Fed’s future rate cut expectations, so the release of CPI data often triggers significant market reactions.

Recent data shows that inflationary pressures still exist. Although the market generally believes that the Fed has somewhat controlled the rise in prices, investors remain concerned that inflation may accelerate again. This uncertainty makes the market more turbulent: major Wall Street indices fell last week, with the NASDAQ down about 5.6%, the S&P 500 down 4%, and the Dow Jones down about 2.84%.

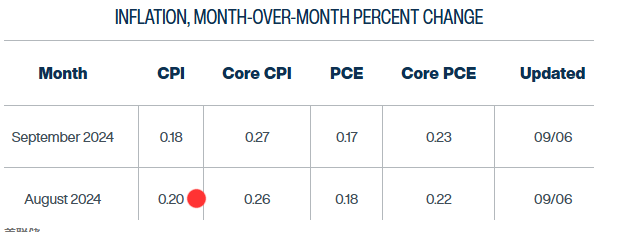

According to the Nowcast forecast of the Cleveland Federal Reserve, CPI growth in August will reach 0.2%, and inflation in September may drop to 0.18%. Although the data seems relatively moderate, investors are still very sensitive to inflation.

The market generally believes that although the Federal Reserve has slowed the pace of rate hikes, if the CPI data shows that inflationary pressures are still strong, the Fed may have to continue maintaining high interest rates and even further raise rates, which will put pressure on future economic growth and corporate earnings.

In the period before the CPI data release, the market is in a wait-and-see attitude towards the Federal Reserve’s monetary policy, and stocks and other risk assets have shown instability as a result. Investors tend to reduce risk exposure, leading to fluctuations in global stock, bond, and commodity markets to varying degrees.

This decline is particularly reflected in the outflow of funds from U.S. stock funds. As of September 4, U.S. stock funds experienced the largest single-week outflow in 12 weeks. According to LSEG data, investors net sold $11.37 billion worth of U.S. stock funds last week, which is the fourth consecutive week of outflows in five weeks.

This deterioration of sentiment not only reflects concerns about inflation but also questions about the future growth of the U.S. economy. This week’s inflation report may change the market’s view on monetary policy, especially after the disappointing employment report. It may also trigger unexpected reactions, such as damaging the yen carry trade and the technology sector in the stock market, especially technology stocks and semiconductor stocks.

In this context, the market has already made a preemptive reaction to a potential economic recession, with funds flowing into defensive assets such as bonds and gold, while risk assets such as stocks and commodities have been sold off. The release of the CPI data on Wednesday will be a crucial moment for the market to judge future economic trends and Federal Reserve policies.

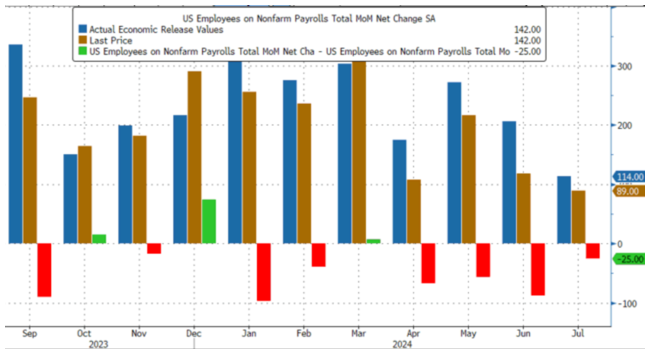

At the same time, recent employment data has also increased market uncertainty. Although the non-farm employment data for August appeared to show an increase of 142,000 people, the lower-than-expected employment growth and the drastic revision of data from previous months have made investors doubt the health of the U.S. economy.

Non-Farm Data Revision Intensifies U.S. Stock Market Turbulence

The recent market turmoil has significantly intensified, especially after the release of the U.S. non-farm employment data on Friday, when the stock market suffered a sharp decline.

The NASDAQ index plummeted by 2.5%, the S&P 500 index fell by 1.73%, and the Dow Jones index slid by 1.01%, with technology stocks leading the decline. For example, Tesla plummeted by more than 8%, NVIDIA, Google, TSMC all fell by more than 4%, and Broadcom fell by more than 10%. These significant declines not only reflect investors’ concerns about the future economic outlook but are also closely related to the doubts brought by the revision of employment data.

Although on the surface, the non-farm employment data for August added 142,000 people, and the unemployment rate also dropped from 4.3% to 4.2%; in terms of wages, the month-on-month increase was 0.4%, and the year-on-year increase was 3.8%, both higher than expected. The wage data released two signals: one is that it can support consumption and reduce the possibility of a recession, and the other is that it indicates that inflation still has a certain endogenous driving force, which seems to have shown signs of a steady economic recovery.

However, the problem lies in the significant downward revision of the data from previous months. The employment data for July was revised down from 114,000 to 89,000, and the data for June was significantly revised down from 179,000 to 118,000. This revision has raised widespread doubts in the market, especially the significant downward revision makes investors suspect that the actual situation of the U.S. economy is much worse than the initially reported data.

Analyst Sebastian Boyd said that the market believes that the non-farm data has cleared the way for a significant rate cut. However, after the release of the employment data, the two-year U.S. Treasury yield initially jumped, the 2y/10y curve slope flattened, and then immediately turned downward. After the non-farm employment increase was lower than expected, the two-year yield fell to the lowest point since August 5. The previous two months’ data was revised down by 86,000, which means that the labor market is much weaker than imagined.

More alarmingly, the market believes that the August data may also face a significant downward revision.

If the revision of the previous months is followed, the number of new jobs in August may be revised down to 90,000 to 110,000, which would be much lower than the market’s expectations. As early as August 20, the U.S. Bureau of Labor Statistics announced that it would adjust the employment data from April 2023 to March 2024, with a total downward revision of 818,000 people, meaning that the actual monthly employment growth in the past year was lower than the initial report.

This revision of employment data uncertainty has led investors to have strong concerns about the health and future direction of the U.S. economy, triggering a chain reaction in the global market. In addition to the fluctuations in the stock market, crude oil, copper, aluminum and other commodity futures have also declined, indicating that the market’s expectations for global economic growth have significantly deteriorated. The turmoil in the U.S. stock market, especially the sharp decline in technology stocks, shows that investors are gradually moving away from high-risk assets and turning to safer defensive investments.

The Federal Reserve’s Policy Outlook

The policy outlook of the Federal Reserve has also become an important source of market uncertainty.

Although the employment data for August is not too bad, the downward revision of the data and the risk of future revisions have led the market to speculate more on the Fed’s decision-making. If the CPI data shows that inflationary pressures have not eased, the market may expect the Federal Reserve to continue maintaining high interest rate policies, and there is even a possibility of further rate hikes, which will continue to put pressure on the stock market, especially high-value technology stocks.

The global market’s expectations of an economic recession are rising, leading to capital flows into defensive assets such as bonds and gold, and the high volatility of the stock market indicates that the next few weeks may continue to face greater uncertainty and downward pressure.

Different sectors in the U.S. stock market have also been affected differently by the revision of non-farm data and inflation expectations. Technology stocks are the first to be hit, with significant declines due to expectations of high interest rates and declining profits, while energy stocks and the consumer goods sector also perform differently due to fluctuations in raw material prices and changes in consumer demand. The following will analyze the specific performance of these industries in the market turmoil, discussing potential investment opportunities and risks in each industry.

Industry Performance Analysis

Industry Performance Analysis: Oil Prices, Food Prices, Energy Stocks, Insurance Stocks, and Consumer Goods

As the overall turmoil in the U.S. stock market intensifies, the performance of different industries also shows differentiation, especially against the backdrop of oil price fluctuations, inflation expectations, and changes in consumer demand. Investors are gradually realizing that macroeconomic data and the uncertainty of Federal Reserve policies will have varying degrees of impact on each industry, with both market risks and opportunities coexisting.

Performance of Oil Prices and Energy Stocks

The energy sector

is one of the areas most affected by macroeconomic conditions. Recently, the fluctuation of crude oil prices has increased, especially the WTI crude oil price fell from $75 to $67.67, showing the market’s concern about the slowdown in global economic demand. Energy stocks have been impacted as a result, with large energy companies such as Exxon Mobil (XOM) and Devon Energy (DVN) showing significant fluctuations.

Although energy stocks are under pressure in the short term, some investors still see long-term potential, especially in companies with stable cash flows.

Petrobras (PBR) has attracted market attention due to strong financial performance and generous dividend returns. Morgan Stanley analysts have pointed out that PBR’s cash flow will remain strong in the coming years, making it attractive in an uncertain global economic environment. Investors in Petrobras will continue to receive dividends, and after announcing second-quarter earnings, Petrobras paid out $2.45 billion.

Although the future performance of energy stocks will still depend on the fluctuation of oil prices, long-term investors can continue to pay attention to resilient companies.

Food Price Increases and Opportunities in the Consumer Goods Industry

In the context of ongoing inflation, food prices, especially for basic necessities, continue to rise. In July, food prices rose by 0.2%, with a year-on-year increase of 2.9%, especially the prices of meat, poultry, fish, and eggs, which have driven the profit performance of related consumer goods industries.

Beverage prices also rose by 0.5%, benefiting from which, consumer goods giants like Coca-Cola (KO) and PepsiCo (PEP) continue to benefit. Despite market fluctuations, these two companies are still close to their historical highest stock prices.

However, not all consumer goods companies can digest the price increases brought by inflation. For example, Celsius (CELH) fell by 20.85% in the past month, showing that some consumer goods companies are under pressure to make a profit in a high inflation environment.

Therefore, investors need to carefully identify consumer goods companies and choose those that can successfully cope with rising costs and maintain market share.

The Insurance Industry: Inflation Pressure and Earnings Expectations

With motor vehicle insurance rates continuing to rise, the performance of the insurance industry is also showing differentiation.

In July, motor vehicle insurance prices rose by 1.2%, with a cumulative increase of 18.6% over the past year, which has brought income growth opportunities for some insurance companies. For example, Chubb (CB) stocks have recently performed strongly and set a historical high.

However, some insurance stocks that have been sold off are also worth paying attention to, such as Prudential (PRU) and MetLife (MET). Although they have been weak in the short term, they may provide buying opportunities as market sentiment corrects.

Challenges Faced by the Automotive and Parts Industry

The automotive and parts industry has also faced severe tests in recent months, especially the decline in used car prices has put great pressure on car manufacturers and parts suppliers. Although consumer demand for high-end and luxury models remains strong, the overall market demand has slowed down, dragging down the performance of some companies.

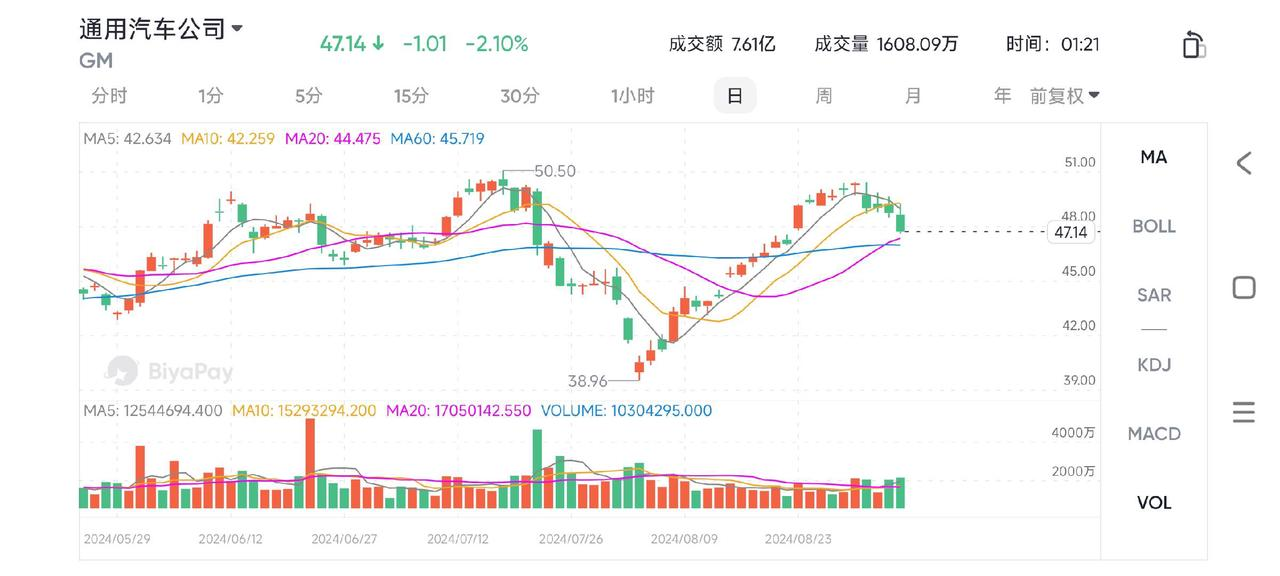

Traditional car manufacturers like Ford (F) and General Motors (GM) have seen their stock prices fluctuate in the face of rising costs and weak demand.

At the same time, parts suppliers such as Magna (MGA) and Aptiv (APTV) have seen their stock prices fall by 33.38% and 23.66% respectively this year, indicating that supply chain issues and cost pressures continue to affect the industry.

In the next few months, changes in inflation and consumer confidence will be extremely important, and the performance of the automotive and parts industry will still face uncertainty.

Defensive Consumer Goods and Investment Opportunities

In the context of increasing market volatility, the defensive consumer goods industry has attracted more attention from investors.

Procter & Gamble (PG) and Kimberly-Clark (KMB) are two consumer goods companies with stable cash flow and global influence. Their products cover daily necessities such as toilet paper, cleaning supplies, and personal care products, with stable demand and not easily affected by economic fluctuations.

In the current uncertain market environment, Procter & Gamble and Kimberly-Clark, with their global market penetration and brand influence, have become a safe choice for investors during economic downturns. Especially Procter & Gamble’s extensive layout in various sub-markets, and Kimberly-Clark’s market share in the sanitary products field, enable them to effectively resist the pressure of rising costs in an inflationary environment.

For investors looking for safe investments in turbulent markets, holding these defensive consumer goods companies may be a stable choice. Their strong brand effect and continuous demand make them still have strong defensiveness when economic uncertainty intensifies.

Investor Advice: Positioning Strategy in Market Volatility

In the current context of increasing market turmoil, investors need to adopt more flexible strategies to cope with economic uncertainty and inflationary pressures. Whether it is significant fluctuations in the stock market or revisions of employment data and inflation expectations, the market’s response highlights the necessity for investors to adjust their portfolios in a timely manner. The following are several strategic suggestions that investors can refer to in the current environment:

Maintain Flexibility and Diversify Investments

In the face of market uncertainty, the primary task for investors is to ensure the flexibility and diversification of their investment portfolios. The market’s reaction to different asset classes varies, so diversifying assets across stocks, bonds, precious metals, real estate, and other areas can effectively reduce risk. At the same time, investors need to quickly adjust positions according to market changes to cope with sudden economic data or policy adjustments.

In terms of diversifying investments and maintaining flexibility, multi-asset wallets like BiyaPay can provide great convenience for investors. BiyaPay not only supports trading of U.S. stocks and Hong Kong stocks but also supports investment in digital currencies such as Bitcoin.

Through BiyaPay, investors can buy stocks of companies that have shown strong resilience in the current market turmoil, and can directly purchase stocks including Coca-Cola (KO), Procter & Gamble (PB), and Petrobras (PBR). These companies have good market performance and long-term growth potential in their respective fields, providing investors with stable returns.

In addition, BiyaPay also supports efficient fund management through digital currencies, achieving rapid cross-asset allocation, and helping investors flexibly cope with market fluctuations.

Focus on Defensive Assets

Against the backdrop of rising expectations of a global economic recession, defensive assets such as bonds and gold have become a haven for investors.

The stable income of bonds and the value preservation function of gold make them perform well during high inflation or economic recessions. In addition, defensive industries such as healthcare and essential consumer goods also provide investors with a stable source of income. Investors can consider holding these defensive assets to hedge the risks brought by significant stock market fluctuations.

Pay Attention to Industry Differentiation

Different industries perform differently in the environment of an economic recession and high inflation.

The energy industry, although greatly affected by oil price fluctuations, still has a certain resilience in the long term;

The consumer goods industry, especially the food and beverage sector, has the ability to pass on prices in an inflationary environment and can maintain stable profits;

In contrast, technology stocks and the automotive industry are more sensitive to high interest rates and rising costs, and may face greater pressure in the short term. Investors should make differentiated layouts according to the specific performance of each industry to avoid over-concentrating in industries with high volatility.

Focus on Global Market Opportunities

The global market no longer solely depends on the performance of the U.S. economy. Some areas of the European, Asian, and Latin American markets also provide good investment opportunities.

For example, Petrobras (PBR) has performed well in the global energy sector, especially in the context of significant oil price fluctuations, opportunities in the Latin American energy market should not be ignored. Investors should consider allocating a portion of global assets to diversify geographical risks.

The current market is in a state of intense turmoil, with the revision of non-farm employment data and the deterioration of market sentiment before the release of CPI, making investors face unprecedented uncertainty. The significant fluctuations in the U.S. stock market, as well as the ongoing concerns about economic slowdown and inflation globally, force investors to re-examine their investment strategies.

In such a market environment, it is crucial to respond flexibly to market changes and diversify investments reasonably. Diversifying assets across different types of investment products, such as stocks, bonds, and gold, can effectively reduce the risks of a single market. In terms of industry selection, industry leaders in the food and beverage, energy, and other fields, with their strong market position and business resilience, can provide investors with stable returns in the face of economic uncertainty.

In addition, short-term market fluctuations should not obscure long-term investment opportunities. Companies with strong fundamentals and long-term growth potential may be undervalued due to the impact of current market sentiment but are still worth investors’ attention. In such a market environment, investors should not only focus on short-term defensive strategies but also seize long-term investment opportunities to ensure better returns when the market recovers.