- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Google's recent stock performance has been weak, overshadowed by antitrust concerns. How can investo

In early August this year, Google was ruled by a US court that its search business violated the US Anti-Trust Law. On September 9th, Google executives will appear in court for questioning by the US Department of Justice regarding advertising profits. Reports indicate that if the states and the Department of Justice win, it will lay the foundation for their request for US District Judge Leonie Brinkema to order the company to be split.

Google has risen more than 15% this year, but its stock price has not performed well recently and has failed to achieve new breakthroughs. The further escalation of regulatory pressure has also brought headwinds. However, investors should not overly consider the impact of the Anti-Trust investigation. As a major leader in the AI market, Google still has strong strength.

A new round of Anti-Trust lawsuits, a new round of stock price headwinds

Google’s first round of Anti-Trust lawsuits began in 2020, jointly sued by the US Department of Justice and attorneys general from 52 states and jurisdictions. On August 5th of this year, the US federal court ruled that Google had dominated the internet search field through unfair business strategies and violated the Anti-Trust law. Specifically, Google’s parent company Alphabet paid Apple $20 billion per year to make Google the default search engine for iPhone. In the second phase of the trial, the federal court will decide what punishment to impose on Google. Google may appeal.

Meanwhile, the well-known US merchant review website Yelp also used this opportunity to accuse Google of controlling the local search and related advertising market by using its monopoly position in the search engine. Subsequently, another Anti-Trust lawsuit, the “DoubleClick Trial”, is scheduled to begin on September 9, 2024. The judgment in this case is expected to be made as early as the end of 2024.

Analysts predict that Google’s stock price may be affected by short-term headwinds during this period. Brian Pitz, an analyst at BMO Capital Markets, believes that continued legal action may prompt Google to take remedial measures and even consider business spin-offs. On July 10th, Google’s stock price hit a new high of $191.75, but then fell back and, like most technology stocks, failed to maintain a new high. According to the latest trading data, Alphabet’s stock performance may be consolidating, with a decline in trading multiples.

Google spin-off is unlikely and may be beneficial to shareowners

Despite frequent discussions about Google’s possible split in the context of the Anti-Trust case, this situation currently seems unlikely to materialize. The current Anti-Trust lawsuit mainly focuses on Google’s search business, while the online advertising market is relatively fragmented, making the possibility of Google’s split relatively small.

If the court ultimately decides to forcibly split Google, this decision may also have unexpected positive effects on shareowners. The most direct impact of the split may be to separate Google’s different business units, such as splitting YouTube or Android from the search business. Historically, forced splits have led to the valuation of the split company in the market generally being higher than that of the original merged company. The split may allow each independent entity to focus more on its own business area, thereby improving Operational Efficiency and profitability.

For example, YouTube, as an independent entity, can focus more on the development and profit potential of its video platform business. Android, as an independent business, can also better adjust its strategy to adapt to market changes. The split company may find more flexible strategy execution and more effective resource allocation, thereby maximizing the value of shareowners.

Although the possibility of a spin-off is not high, the potential benefits of this process are worth paying attention to for investors. Although the government’s regulatory action against Google has increased uncertainty, it may also push the company to take measures to optimize its business structure and ultimately increase shareholder returns. Overall, even if the risk of a spin-off exists, it may bring unexpected growth opportunities to investors.

Google’s long-term growth potential remains significant

Solid core business performance

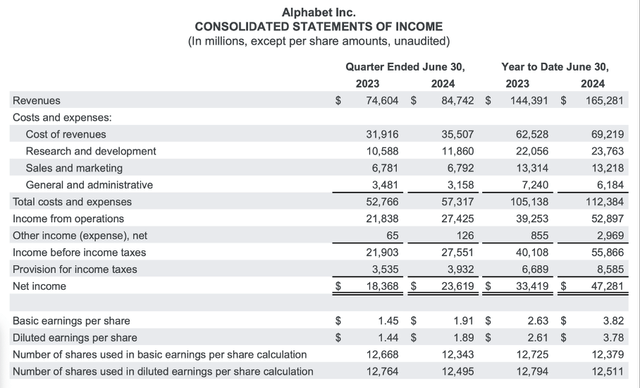

Google’s core businesses, especially search services and advertising, continue to show strong performance. According to recent financial data, Alphabet’s revenue and earnings per share in the second quarter of 2024 exceeded expectations, indicating that its business foundation remains solid. Revenue increased from $74.604 billion in the second quarter of 2023 to $84.742 billion, a year-on-year increase of 13.6%. Operating income also increased significantly, from $21.838 billion to $27.425 billion, an increase of 25.6%. Diluted earnings per share jumped from $1.44 to $1.89, a year-on-year increase of 31.3%.

Google services remain the main source of revenue and operating income. The total revenue of this department increased from $66.285 billion in the second quarter of 2023 to $73.928 billion, a year-on-year increase of 11.5%. Operating income increased from $23.454 billion to $29.674 billion, a growth rate of 26.5%. This shows that Google continues to maintain strong profitability in the advertising field while maintaining its dominant position in search engine.

Despite a significant increase in capital expenditures, resulting in a 38.2% YoY decrease in free cash flow from $21.778 billion to $13.454 billion, this reflects Google’s active investment in future growth areas such as artificial intelligence and Cloud Services. Although this investment temporarily affects cash flow, it helps the company’s long-term strategy and market position.

Continuously reshaping the cost base

Google continues to make efforts in optimizing its business structure and cost management to respond to Anti-Trust investigations and market challenges. Despite recent significant increases in capital expenditures, Google is still committed to improving overall financial performance through more efficient operations. Especially in the context of high capital expenditures, the company is actively reshaping its cost base to improve Operational Efficiency and financial health.

On one hand, Google is reducing operating costs through technological innovation and process optimization. The application of automation and artificial intelligence technology has helped the company achieve cost savings in data processing, advertising, and User Experience. These technologies not only improve work efficiency, but also reduce labor costs. On the other hand, Google is also streamlining its business departments and reducing inefficient investments to better allocate resources and improve profitability. This strategic adjustment helps the company control costs and enhance financial stability while maintaining business growth.

In addition, Google is gradually optimizing its asset structure, selling or divesting non-core assets to concentrate resources on core businesses and strategic growth areas. This asset optimization strategy not only helps improve the company’s financial situation, but also provides financial support for future business expansion and investment.

Google Cloud business accelerates development and focuses on AI.

Google Cloud has played a crucial role in the company’s overall growth strategy. In recent years, Google Cloud’s revenue has grown significantly and become an important source of revenue for the company. In the second quarter of 2024, Google Cloud’s revenue increased by 28.8% YoY to $10.347 billion, demonstrating its strong performance and growth potential in the market.

The success of Google Cloud is not only reflected in revenue growth, but also in the improvement of its business profitability. The operating income of this department increased from $395 million last year to $1.172 billion, and the operating profit margin increased from 4.9% to 11.3%. This significant improvement in profitability shows that Google Cloud is optimizing its business model and effectively improving Operational Efficiency.

In terms of AI, Google Cloud is actively integrating advanced AI technology to drive business development. Google’s AI technology is not only used to improve the performance of Cloud as a Service, but also to optimize data processing, enhance analytical capabilities, and provide personalized services. The application of these technologies enables Google Cloud to provide customers with more efficient and intelligent solutions, further consolidating its market position.

The application of AI also brings new business opportunities. Google Cloud uses AI technology to help enterprises achieve digital transformation, providing smarter Data Analysis and decision support services. This not only improves customer business efficiency, but also drives the growth of Google Cloud business.

Google Cloud’s continued investment and innovation in the AI field will further enhance its market competitiveness and promote its leadership position in the Cloud Service market. As more enterprises and organizations seek to use AI technology to enhance their business capabilities, Google Cloud is expected to continue to achieve strong growth and make important contributions to the company’s overall performance.

Future development also faces other risks

Although Google has shown strong growth potential in multiple areas, it still faces some significant risks that could affect the company’s future performance and investor returns.

Firstly, regulatory risk remains a major challenge for Google. In addition to the currently pending Anti-Trust case, Google may also face further regulatory pressure from different countries and regions. Regulatory agencies may impose stricter compliance requirements on Google or review its business practices. This may not only result in high fines, but also force the company to adjust its business model, thereby affecting its market competitiveness and profitability.

Secondly, the risks of technology and market competition cannot be ignored. Although Google maintains a leading position in the search and Cloud Service fields, the rapid development and innovation of competitors may pose a threat to its market share. For example, Microsoft’s Bing and other emerging AI search platforms may divert Google’s user traffic. In addition, competition from other Cloud as a Service providers may affect the growth of Google’s cloud business.

Investing in unprofitable businesses is also a risk worth paying attention to. Google’s investments in emerging fields such as autonomous driving and healthcare have not yet achieved profitability. Although these fields have huge potential, they also come with high risks. Waymo, as an important project among them, has not yet made a profit despite significant progress. Long-term investment and research and development expenditures may affect the company’s short-term financial performance.

Finally, economic and market fluctuations may have an impact on Google’s advertising revenue. The uncertainty of the global economy may lead to a reduction in advertising budgets, thereby affecting Google’s advertising revenue. Market turmoil may also cause fluctuations in the company’s stock price, bringing unstable returns to investors.

How should investors respond?

Faced with the challenges faced by Google in the Anti-Trust investigation, investors need to comprehensively consider the company’s current market performance and future growth potential. Although the Anti-Trust case and regulatory pressure may have a negative impact on the stock price in the short term, Google’s long-term investment value is still worth paying attention to.

As investors, we should closely monitor Google’s core business performance, especially the market share and profitability of its search and advertising businesses. Although the Anti-Trust investigation may cause short-term stock price fluctuations, Google’s dominant position in these areas and stable revenue sources provide a strong financial foundation for the company. The stable performance of the core business can support the company’s financial health in the future.

Meanwhile, Google’s rapid development in Cloud Services and artificial intelligence has provided important impetus for the company’s long-term growth. Investors should pay attention to how Google uses these technologies to enhance its business capabilities and market share. The continued growth of Cloud Services and the application of AI technology not only bring new sources of revenue to the company, but also consolidate its leadership position in the field of technological innovation.

In the uncertain market environment, it is particularly important to adjust investment strategies flexibly. For long-term investors, maintaining holdings of Google stocks may be a suitable choice. If you have not yet boarded the train, you can consider buying on BiyaPay. However, if you are a short-term investment enthusiast, you can consider further monitoring the market trend on BiyaPay to observe and find a more suitable opportunity to better evaluate risks.

In addition, if you have difficulties with deposits and withdrawals, you can also use BiyaPay as a professional tool for depositing and depositing US and Hong Kong stocks. You can recharge digital currency and exchange it for US dollars or Hong Kong dollars, withdraw it to your bank account, and then deposit it into other securities firms to buy stocks. The transfer speed is fast and there is no limit, so you won’t miss investment opportunities.

Finally, investors need to closely monitor Google’s response measures, including possible business adjustments and strategic transformations. As the case progresses, Google may take measures to respond to regulatory pressure, such as business spin-offs or other strategic adjustments. The effectiveness of these measures will have a significant impact on the company’s future development.

Overall, although Google’s current challenges and market pressures cannot be ignored, from a long-term investment perspective, the company’s sustained advantages in core business and emerging technology fields provide considerable growth potential. Investors should view Google’s stock from a comprehensive perspective, consider short-term risks and long-term opportunities, and develop a reasonable investment strategy.