- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

NVIDIA plummeted by 9%, wiping out nearly $300 billion in market value. Can it reverse course amidst

NVIDIA plummeted 9.5% on Tuesday, causing the total market value of the chipmaker to evaporate by nearly $300 billion, the largest drop in US stock history, and sending the company’s stock price to its lowest point in three weeks. In fact, NVIDIA’s previously released second-quarter results and outlook exceeded analysts’ expectations, but may not have met investors’ increasingly high expectations. Last Thursday, the day after the financial report was released, the company’s stock price fell by more than 6%. Since announcing the earnings, the company has fallen by 14% in the past three trading days.

This sharp drop is not only related to the recent financial report not meeting investors’ expectations and the tightening of Anti-Trust investigations, but also reflects investors’ deep-seated concerns about the AI market. Whether it can reverse and bring new breakthroughs in the future is also a focus of attention.

Concerns about the generative AI bubble are increasing, and investors are becoming more rigorous

NVIDIA once became the focus of market attention due to its rapid development of AI chip technology and became a key driving force behind the global stock market rebound. However, as its stock price plummeted in a short period of time, investors began to have a more cautious view of the economic benefits brought by AI technology.

Generative AI technology has become popular worldwide in a short period of time, driving a large influx of capital and technological research and development. However, as the market gradually returns from fanaticism to rationality, the business model and long-term prospects of generative AI are increasingly being questioned. The huge expectations of the market for AI prompted NVIDIA to announce its expectation of benefiting from the AI boom in May 2023, but just a few months later, market confidence began to shake.

One of the main reasons is that generative AI still faces many challenges in practical commercial applications. Although NVIDIA’s Hopper GPU is highly praised for its powerful AI processing capabilities, financial institutions such as Goldman Sachs are beginning to question whether AI has enough “killer applications” to support such high R & D and deployment costs. In addition to writing code and developing chatbots, other large-scale applications of generative AI are not yet clear, especially in the commercial and consumer fields, where their monetization capabilities are still unclear.

Another factor worth noting is the exponential growth in demand for computing power and energy with the development of AI. As AI models become increasingly complex, the computing power and energy consumption required to train these models are also increasing rapidly, which will directly affect their future cost structure and sustainability. Some analysts are concerned that the rapid development of AI technology may face the bottleneck of resource depletion, which will drag down its long-term profitability.

Anti-Trust investigations are becoming increasingly strict, increasing concerns

In addition to concerns about the AI bubble, Anti-Trust regulatory pressure has also become one of the key factors affecting NVIDIA’s future development. The US Department of Justice, as well as governments such as France and the European Union, have launched Anti-Trust investigations into NVIDIA’s dominant position in the AI chip market. The main concern of these regulatory agencies is that NVIDIA’s dominant GPU and CUDA platforms make it difficult for other competitors to enter the AI chip market and further exacerbate market monopoly behavior.

It is understood that NVIDIA’s market share in the AI training chip market is as high as 70% to 95%, making it a core supplier in major technology companies, Cloud as a Service providers, and the autonomous driving field. However, this market dominance also makes NVIDIA face more stringent Regulatory Scrutiny. If these Anti-Trust investigations progress unfavorably, NVIDIA may face huge fines or even adjustments in business structure, which will affect its market prospects.

On September 3rd, the US Department of Justice issued subpoenas to NVIDIA and other companies seeking evidence of NVIDIA’s violation of the Anti-Trust Law, reflecting the escalation of the investigation. Previously, the Department of Justice only distributed questionnaires to relevant companies, but now it has issued legally binding requests requiring recipients to provide information. As a result of this news, NVIDIA’s stock price further fell.

This series of Anti-Trust actions, especially investigations from France and the US, has led investors to re-evaluate NVIDIA’s future position in the global AI chip market. Despite NVIDIA’s repeated emphasis on its market advantage coming from product quality and performance, regulatory pressure and possible legal proceedings still bring uncertainty to the company’s long-term development.

Can NVIDIA break through in the future and what are the key growth points?

Despite Nvidia’s stock price crash, Anti-Trust investigation, and concerns about the generative AI bubble, the company still shows strong performance in its core business and is expected to break through and further grow in the future.

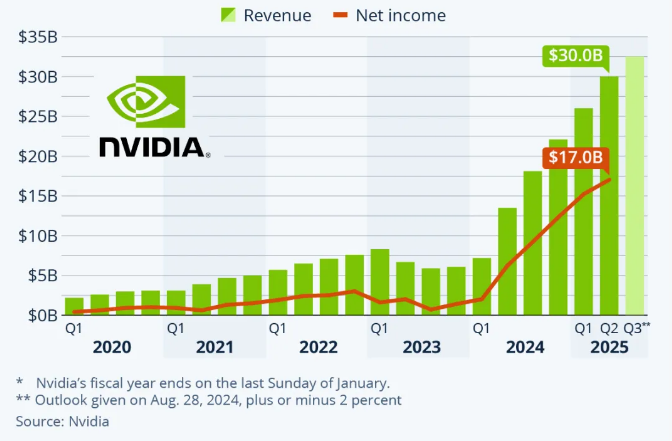

Its performance in the second quarter of fiscal year 2025 still exceeded market expectations, with revenue reaching $30.04 billion, a year-on-year increase of 122% and a quarter-on-quarter increase of 15%. This demonstrates NVIDIA’s dominant position in global AI demand growth, especially in the Data center business.

Overall growth slowed, but still exceeded expectations

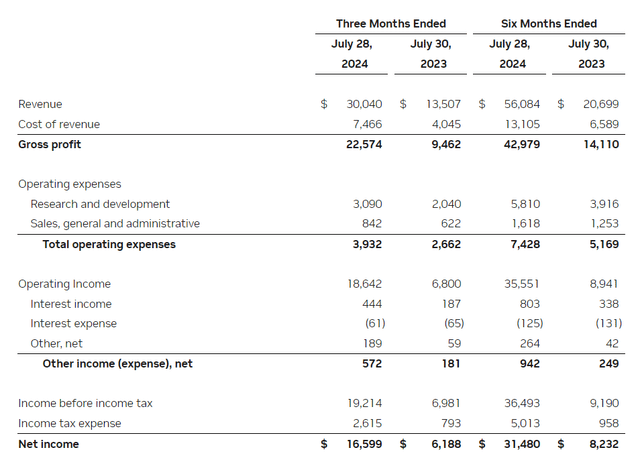

In the three months ended July 28, 2024, NVIDIA’s revenue grew 122% year-over-year to $30 billion, compared to the company’s own expectations of $28 billion and analysts’ expectations of $28.80 billion. NVIDIA’s data center business once again became the core of the company’s explosive quarter, as its revenue grew 154% compared to the same period last year and accounted for more than 87% of total sales. Net income for the previous quarter was $17 billion, almost three times the full-year profit for fiscal year 2023, as NVIDIA’s gross margin remained high at 75%.

Although NVIDIA’s growth rate slowed from over 200% in previous quarters to 122%, it is still higher than market expectations. The company’s management explained that the continued demand for Hopper GPU architecture is the main factor driving this growth. Although investors are concerned about the slowdown in growth, this growth rate still reflects NVIDIA’s irreplaceability in the AI chip market.

In addition, the company expects revenue to reach $32.50 billion in the next quarter, a year-on-year increase of 79.4%, which means that even in the case of a slight cooling of the AI market, Nvidia’s revenue still maintains steady growth.

To further demonstrate confidence, NVIDIA announced an authorization to repurchase $50 billion of stock in addition to the remaining $7.50 billion from its current share buyback program.

Blackwell’s delay concerns have been eliminated and are expected to become a new catalyst

Previously, the market was concerned about the production delay of NVIDIA’s next generation Blackwell GPU. However, the company confirmed in its latest financial report that samples of the Blackwell architecture have been delivered to customers and are expected to begin mass production in the fourth quarter and continue until fiscal year 2026. This news dispelled market concerns, as Blackwell may drive sales acceleration and higher-priced GPUs will increase gross profit margin. NVIDIA’s profit in 2Q25 was $16.60 billion, a year-on-year increase of 168%. With Blackwell’s shipment, NVIDIA is expected to further drive profit growth.

The performance of Blackwell GPU will be more energy-efficient than the previous generation products, and the cost will be reduced by 25 times. According to reports, the price of each chip of this GPU may be as high as $70,000, and the price of fully customized high-end server racks can reach $3 million, which has a positive impact on Nvidia’s sales and gross profit. Compared with the current price of $30,000 for the H100 GPU, it can be predicted that with the large-scale shipment of Blackwell, Nvidia’s performance will bring new surprises to investors.

Management expects Blackwell’s shipments to contribute billions of dollars in revenue in the fourth quarter, further strengthening Nvidia’s leadership position in the AI market.

In addition, the company’s inventory and capacity purchase commitments increased by 48% quarter-over-quarter, indicating that NVIDIA is well-prepared for Blackwell’s mass production and plans to go all out to meet the market’s continued demand for AI computing power.

More than just AI, business diversification is expected to become a new growth engine

Although AI chips and data center businesses are the main sources of revenue for NVIDIA, other departments of the company are also steadily growing, especially the automotive department. In this quarter, NVIDIA’s automotive and robotics business revenue reached $346 million, a year-on-year increase of 37%, thanks to the surge in demand for its AI cockpit and autonomous driving platform. The company’s layout in the field of autonomous driving technology, especially its cooperation with automakers such as BYD, indicates that the revenue of this department will continue to steadily increase in the coming years.

NVIDIA’s latest autonomous driving platform, Thor, has been adopted by multiple automakers. The platform integrates the company’s latest Blackwell architecture, providing powerful computing support for the development of future autonomous cars. With the rapid expansion of the global autonomous driving market, NVIDIA’s automotive business is expected to become another important growth engine for the company in the coming years.

How should investors layout?

Under the recent stock price fluctuations of Nvidia and the market’s concerns about the AI bubble, investors face a difficult choice: whether to continue to wait and see or take advantage of this opportunity to enter and layout. In this regard, investors need to find a balance between short-term risks and long-term potential.

Despite the many uncertainties in the short term, NVIDIA’s long-term prospects in the AI field remain bright. The strong demand for data center business, the advancement of Blackwell architecture, and the company’s diversified layout in areas such as autonomous driving are all important support points for future growth. Especially with the increasing importance of AI in the global economy, NVIDIA occupies a core position in this market. In the long run, investors can still benefit from its technological leadership and market share.

The current stock price has experienced a significant decline, which may be a good investment opportunity. If you have investment intentions, you can consider buying in BiyaPay. Of course, you can also further monitor the market trend and wait for a more suitable time.

In addition, if you have difficulties with deposits and withdrawals, you can also use it as a professional tool for deposits and withdrawals of US and Hong Kong stocks. You can recharge digital currency and exchange it for US dollars or Hong Kong dollars, withdraw it to your bank account, and then deposit it into other securities firms to buy stocks. The deposit speed is fast and there is no limit, so you won’t miss investment opportunities.

However, NVIDIA’s current valuation is still relatively high. As of now, its expected Price-To-Earnings Ratio is 42 times. High valuation is accompanied by short-term market volatility, especially in the face of more doubts about AI technology and market cooling. As investors, we need to be cautious. Coupled with the uncertainty of the global supply chain, geopolitical risks, and challenges from competitors such as AMD and Intel, NVIDIA’s stock price may still face volatility in the short term. Everyone should make investment choices carefully and not blindly get on board.