- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

The best high-dividend stock investment opportunities in 2024: Stable income and low risk

presidential debates, market sentiments and economic expectations have become particularly complex and variable. These events directly impact the policy environment and macroeconomic outlook, subsequently influencing investment decisions significantly.

In this context, dividend stocks, with their stability and reliability, offer investors a conservative yet intelligent asset allocation method. As 2024 approaches, understanding how to select and invest in quality dividend stocks becomes especially important in the face of potential policy changes and market volatility.

Below, the selection method based on the Free Cash Flow to Enterprise Value ratio (FCF PEG) will be used to recommend the top ten dividend stocks for 2024. These selected stocks, all chosen from the Dividend Aristocrats, each possess excellent financial health and the potential for sustained growth, enabling them to stand out in an ever-changing market.

What are Dividend Stocks?

Dividend stocks are those that regularly pay a certain percentage of profits to shareholders. These payments typically come from the company’s available cash flow, reflecting not only strong profitability but also robust financial health, capable of continuously returning profits to shareholders. Dividends are usually paid in cash, though sometimes they may be distributed in the form of additional shares.

For example, growth stocks like NVIDIA and Tesla, which are expected to grow faster than the average, typically do not pay dividends because all earnings are usually reinvested to support faster expansion. The main appeal of growth stocks lies in their potential for capital appreciation.

However, the major downside of growth stocks is their high volatility, particularly during economic slowdowns or market instability, where their share prices might experience significant fluctuations. For instance, in 2020, due to market panic triggered by the pandemic, Tesla’s share price plummeted over 60% from a high of $917 to around $361 in February.

In contrast, dividend stocks offer a stable cash flow, usually from companies that are mature and financially sound.

The attractiveness of these stocks lies in their ability to provide a continual income stream to investors, especially during periods of economic uncertainty or significant market volatility. For example, consumer goods companies and utilities, which can maintain stable dividend payments even during economic downturns.

Therefore, in a well-diversified investment portfolio, dividend stocks not only provide a stable income stream but also act as a buffer during market fluctuations, helping to reduce overall risk.

Why Choose Dividend Stocks

In the current global market fraught with high uncertainties, dividend stock investments provide a robust option, perfectly suited for those seeking stable cash flows without the constant worry of market volatility. The advantages of dividend stocks lie not only in their ability to generate continuous cash flows but also in the stability and safety they add to portfolios in tumultuous times.

For most people, the main appeal of dividend stocks lies in their provision of stable cash returns.

For retirees and long-term investors, this regular cash dividend income can provide essential cash flow during economic fluctuations and uncertain market periods. The stability of this income stems from these companies typically having mature business models and strong financial health, thus continuing to profit and maintain cash flow even during economic downturns.

Moreover, dividend stocks often exhibit lower price volatility during market downturns, acting as risk-averse assets in investment portfolios. During significant events like the U.S. elections, which can trigger policy and economic volatility, dividend stocks are often viewed as a “safe haven” in portfolios, helping investors protect capital while providing defense against market adjustments in other riskier assets.

Furthermore, dividend income enjoys tax advantages in some countries, making dividend stocks more attractive post-tax compared to other types of income, for example:

- Singapore: Residents enjoy a zero tax rate policy on dividend income received from local listed companies, greatly attracting individual investors to the stock market due to the significant increase in post-tax returns.

- Hong Kong: Similarly, a zero tax rate is applied to dividend income. Both local and international investors do not need to pay additional taxes on dividends received from Hong Kong companies.

- United Kingdom: The UK offers tax advantages on small dividend incomes. UK individual investors have a tax-free allowance, meaning they can earn a certain amount of income from dividends each year without paying taxes. This tax benefit further enhances the value of dividend stocks as long-term investment tools, especially for those seeking to optimize tax burdens while seeking returns.

How to Select Excellent Stable Dividend Stocks

Before deciding on dividend stock investments, it’s crucial first to analyze the current market environment, including the economic cycle, interest rate levels, political situations, and specific industry trends. For instance, a low-interest rate environment typically increases the attractiveness of stocks over bonds since dividend yields might surpass fixed-income investments; elections and policy changes generally affect the performance of specific industries, such as energy or healthcare; during economic recessions, defensive sectors like consumer goods, utilities, and healthcare may perform better; conversely, during economic expansions, financial, technology, and industrial stocks might offer greater growth potential and opportunities for dividend growth.

When selecting dividend stocks, not only these factors must be considered, but also the following indicators for the company:

- Dividend Yield: This metric measures the ratio of dividend income to the stock price, where a high dividend yield might indicate that the stock offers a high return, but it could also signal potential fundamental issues with the company.

- Enterprise Value (EV): Enterprise value equals the company’s market cap plus its debt, minus cash and cash equivalents. This metric is considered the total price to purchase the company, providing a more comprehensive measure of company value than just market cap.

- Free Cash Flow (FCF): This is the cash flow available after necessary capital expenditures, which can be used for paying dividends, repurchasing shares, or reducing debt. A strong free cash flow indicates good profitability and cash management capabilities.

- Long-term Growth Rate: Analysts’ predicted annual growth rate for the company over the coming years. A stable long-term growth rate indicates potential future expansion and growth, meaning that the company’s future earnings and cash flows might increase, which is very favorable for dividend payments.

For those interested in dividend stocks, here’s a method recommended by Seeking Alpha analysts, the FCF PEG, a valuation method where the FCF PEG ratio is the ratio of enterprise value to free cash flow (i.e., FCF yield) divided by the long-term growth rate.

This ratio helps investors assess whether the stock price is reasonable considering the company’s growth potential. Ideally, a lower FCF PEG ratio (usually below 1) indicates that the company’s stock is undervalued relative to its free cash flow generation and expected growth, making it an attractive investment choice.

Through the FCF PEG method, you can find those dividend stocks not only with healthy cash flows but also reasonably priced with growth potential. This method provides a quantitative framework, helping investors scientifically filter potential investments that might offer excellent returns, especially those undervalued by the market but with strong financial performance and growth prospects.

The following ten are the top-ranked quality stable dividend stocks calculated, with an expected total return of 72% by 2026, an annualized return rate of 17.4%, compared to the S&P 500’s expected annualized return of 12%.

Average: 72% = Annual 17.4% compared to S&P 500 35% or annual 12%.

Based on the fundamentals, the expected reasonable upward potential within one year is 14%, while the S&P 500 index is expected to range between 9% to 27%.

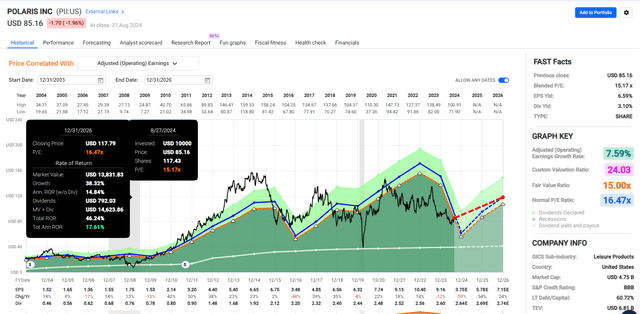

Polaris Industries Inc. (PII)

Polaris Industries Inc. is a well-known manufacturer of recreational vehicles, including motorcycles, snowmobiles, all-terrain vehicles (ATVs), and utility terrain vehicles (UTVs). Additionally, Polaris produces a range of related accessories and apparel, offering strong market diversity and a broad consumer base.

Financial and Dividend Performance: The company is known for its robust financial condition and consistent dividend payment history. It not only offers a competitive dividend yield but has also seen stable dividend growth in recent years, demonstrating effective financial management and profitability. Polaris’s leading market position in the recreational vehicle industry helps it maintain stable sales and profits through various economic cycles.

As a dividend stock investment, Polaris offers an appealing opportunity, especially for investors seeking to diversify their portfolios in the consumer leisure sector.

2026 Consensus Return Potential

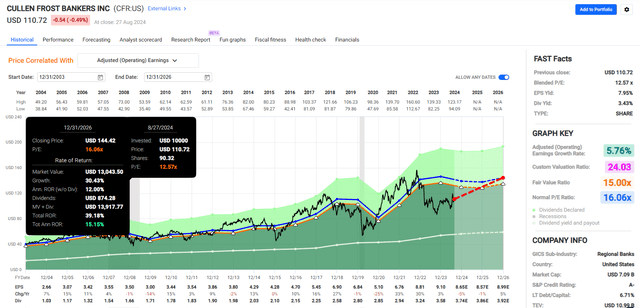

Cullen/Frost Bankers (CFR)

Cullen/Frost Bankers, headquartered in Texas, is a financial institution with a deep history, focusing on providing a full range of banking and financial services to individual and commercial customers. CFR stands out in the U.S. financial industry for its robust business model, exceptional customer service, and strong market position.

As a NYSE-listed company, CFR is renowned for its stable and attractive dividend policy. The company has long been committed to creating sustained value for its shareholders through sound risk management and prudent capital allocation. This strategy has enabled CFR to consistently pay and gradually increase dividends across different economic cycles, attracting a large number of long-term investors seeking stable cash flows.

2026 Consensus Return Potential

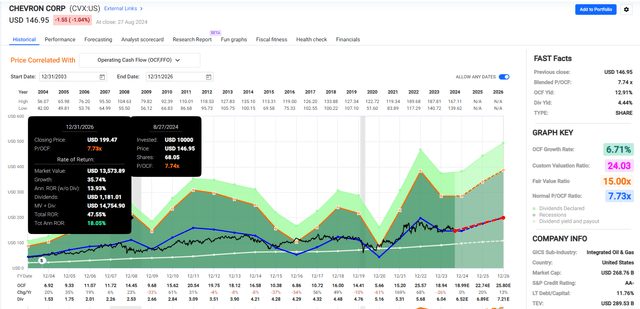

Chevron (CVX)

Chevron, a global leader in energy, is well-known for its extensive operations in oil and gas extraction and investments in renewable energy. As part of the S&P 500 index, Chevron is favored by investors for its robust financial health and excellent record of dividend payments.

Chevron attracts investors seeking stable returns with its higher-than-average industry dividend yield. Its continuous profitability and strategic investments in the renewable energy sector not only ensure the steady growth of its dividends but also indicate its potential for long-term value appreciation. Chevron offers a compelling choice for investors looking for reliable dividend income while anticipating the company’s adaptation to future energy trends.

2026 Consensus Return Potential

Automatic Data Processing (ADP)

ADP, a global leader in human resource management solutions and business outsourcing services, is known for its comprehensive services in payroll processing, human resources records management, and benefits administration. With steady dividend growth and a solid financial structure, ADP attracts numerous investors looking for stable income.

Though not the highest in its industry, ADP’s dividend yield is complemented by its continuous growth in dividends and long-term financial stability, making it a top choice for investors who prioritize both yield stability and corporate growth potential.

2026 Consensus Return Potential

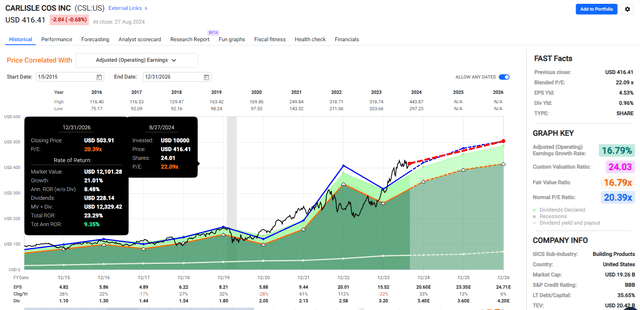

Carlisle Companies (CSL)

Carlisle Companies, a global leader in diversified manufacturing, specializes in producing and selling high-performance products for the building materials, aerospace, and industrial markets. Carlisle’s dividend policy reflects its commitment to continuous shareholder value growth.

With stable financial performance and strong cash flow generation capabilities, Carlisle represents an ideal option for long-term investors seeking solid returns. The company’s leadership position in its core markets, combined with investments in new technologies and market expansion strategies, points to potential future growth and dividend stability.

2026 Consensus Return Potential

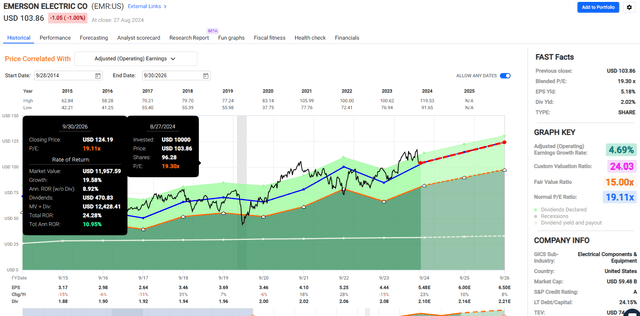

Emerson Electric (EMR)

Emerson Electric excels in process control systems, environmental optimization technologies, and energy management solutions, with its technology widely applied globally. Emerson’s financial health is robust, with annual revenues surpassing $18 billion in 2022 and maintaining a net profit margin above 15%, indicating sustained profitability and a firm commitment to shareholder returns.

Moreover, Emerson’s global operations and deep involvement in industrial automation and energy efficiency sectors enable it to maintain business stability and growth potential throughout economic fluctuations.

2026 Consensus Return Potential

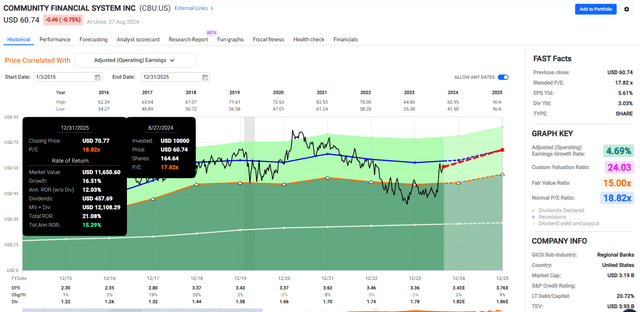

Community Financial System (CBU)

Community Financial System, a regional bank in the U.S., is known for its strong commitment to the community and robust support for small businesses. In the recent fiscal year, CBU demonstrated excellent financial performance, reflecting its operational efficiency and profitability. CBU’s current dividend yield remains competitive within the industry, and its record of steadily increasing dividends over the past five years underscores its commitment to continuous growth in shareholder value.

2026 Consensus Return Potential

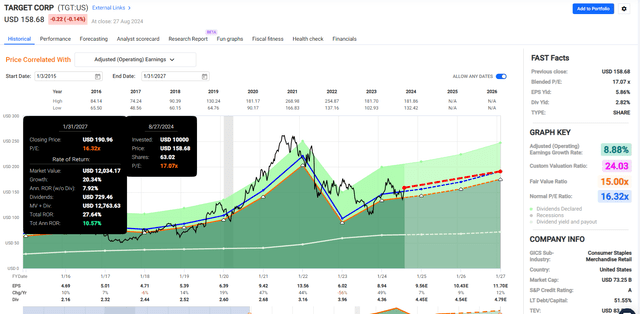

Target (TGT)

Target, one of the largest retailers in the U.S., is known for its extensive product range, high-quality customer service, and competitive pricing. The company’s consistently strong financial performance, with growing revenues and profit margins, underscores its solid market position and operational efficiency. Especially in recent years, Target has achieved significant growth in turnover and profits by enhancing its e-commerce channels, improving supply chain management, and expanding its private labels.

2026 Consensus Return Potential

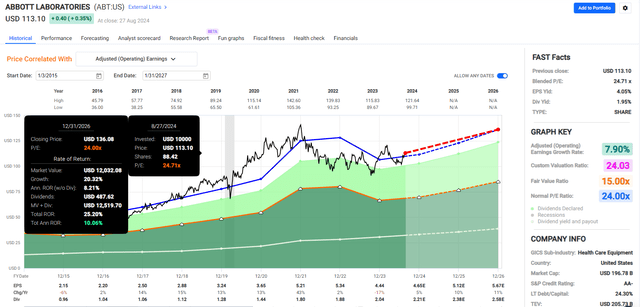

Abbott Laboratories (ABT)

Abbott Laboratories is a global healthcare company, highly regarded for its products in cardiology, diabetes, diagnostics, and neuroscience. The company’s annual revenue and profits continue to grow, reflecting its strong position in the global medical market and business expansion capabilities. Abbott’s dividend yield remains healthy, and as the company’s profitability increases, there is a steady trend of dividend growth, making it a highly attractive option for those seeking to invest in the health technology sector and expecting stable and potentially growing dividend income.

2026 Consensus Return Potential

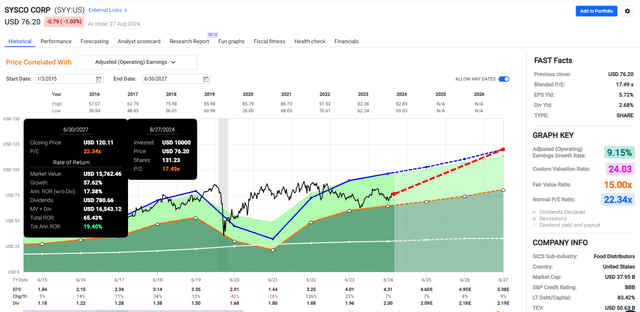

Sysco (SYY)

Sysco, a global leader in food service marketing and distribution, has a strong distribution network across North America and several international markets. Known for its exceptional service and efficient supply chain management, Sysco’s financial performance demonstrates the robustness and profitability of its business. The company’s annual revenue continues to grow, and with a broad product portfolio and optimized logistics operations, Sysco maintains a leading position in the competitive market. Additionally, Sysco is known for its stable dividend policy, with a dividend yield consistently above the industry average and a record of continuous dividend growth, providing an attractive return to investors.

2026 Consensus Return Potential

Investment Tools Recommendation

When investing in dividend stocks, it’s crucial to use the right tools and resources to evaluate a stock’s financial health, dividend sustainability, and overall market performance. Here are some useful tools and resources recommended to help investors better analyze and make decisions regarding dividend stocks:

-

Dividend Analysis Tools

Dividend.com: An online platform dedicated to dividend investors, offering comprehensive data on dividend history, yield, growth rates, and payout ratios.

Seeking Alpha: A popular investment research platform that provides detailed analysis articles, reviews, and community discussions about dividend stocks.

-

Financial Metrics Analysis

Morningstar: Provides extensive financial data, including a company’s free cash flow, enterprise value (EV), price-to-earnings ratio (P/E), and long-term growth forecasts.

Yahoo Finance: Offers comprehensive corporate financial data, historical stock prices, earnings reports, and dividend information, along with powerful stock screening tools.

-

Portfolio Management

Personal Capital: A tool that helps investors track dividend income, portfolio performance, and overall asset allocation in real time.

M1 Finance: An innovative investment platform that allows investors to create custom portfolios and automate dividend reinvestment.

-

Multi-Asset Wallet BiyaPay

BiyaPay provides investors with a convenient solution that supports trading in U.S. and Hong Kong stocks as well as investing in cryptocurrencies like Bitcoin. This means you can directly purchase top dividend stocks such as Polaris (PII), Chevron (CVX), and Target (TGT), and also support cash movements through cryptocurrencies, incurring only blockchain fees. Funds can be securely transacted within minutes without any limitations.

This functionality makes BiyaPay an ideal choice for investors looking to blend traditional investments with modern digital currency operations. Through BiyaPay, you can effortlessly trade in the Hong Kong and U.S. stock markets while enjoying efficient and secure financial management.

-

News and Market Data

CNBC and Bloomberg: Provide the latest market news, industry analysis, and expert commentary, crucial tools for understanding global economic trends and market dynamics.

Risk Reminder Dividend stocks, particularly those with high dividends, are usually very sensitive to changes in interest rates. When interest rates rise, the appeal of fixed-income products like bonds increases, potentially leading to a decline in dividend stock prices as investors seek higher risk-free returns. Rising interest rates can also increase a company’s borrowing costs, impacting its financial condition and ability to sustain or increase dividend payments.

Yield Chase and Stock Price Decline

Higher dividend yields can sometimes mask underlying problems within a company. While high yields may attract investors, if these high returns result from significant stock price declines, it could indicate market concerns about the company’s future profitability and the sustainability of its dividends. If a company’s dividend yield is significantly higher than the industry average, investors need to conduct a deep analysis to avoid falling into a “dividend trap.”

For instance, AT&T once attracted many investors with high dividend yields of 6%-7%, but underlying issues were masked. Its stock price plummeted, partly due to market concerns over the company’s enormous debt and frequent strategic shifts, such as the acquisition of Time Warner and the sale of DirecTV. These factors led investors to question the company’s ability to maintain high dividends, and ultimately in 2021, AT&T announced a dividend cut, exposing investors to not only reduced dividends but also losses from stock price declines.

As the global economic environment continues to evolve, choosing robust investment strategies is more important than ever. Dividend stocks, with their stable cash flow and relatively low market volatility, have become a preferred choice for many investors. While the stable returns from investing in dividend stocks are highly appealing, investors should also be vigilant of potential market risks and make prudent investment decisions.

Remember, the best investment decisions are based on comprehensive market analysis and personal investment goals. We encourage investors to keep up with market dynamics, regularly assess their portfolios, and ensure they align with long-term financial planning and risk tolerance. May you proceed steadily on your investment journey and achieve your financial goals.