- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Super Micro Computer hit by Hindenburg, delays earnings release, stock plummets! How can the AI hot

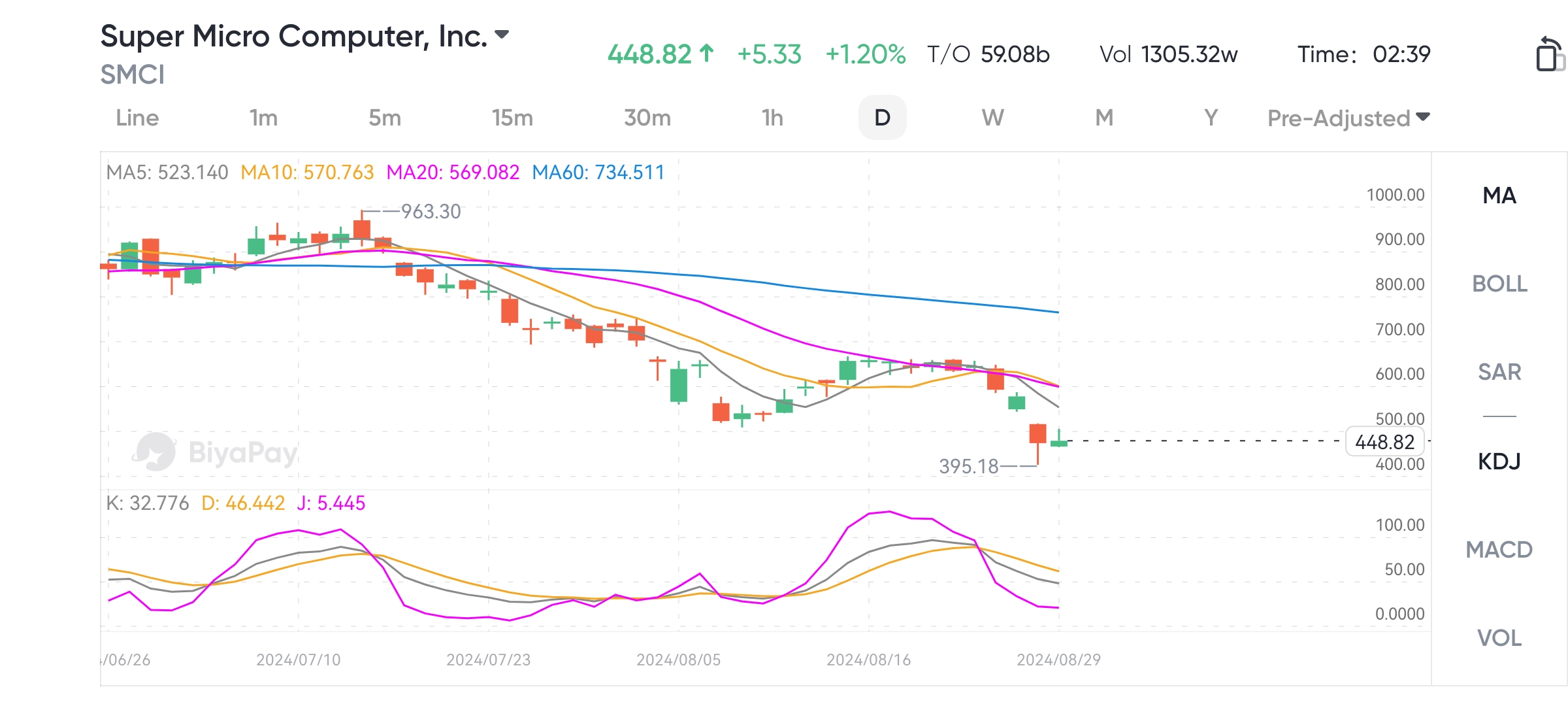

Supermicro Computer has risen more than 10 times since last year, making it one of the companies with the largest increase in this round of AI wave. Due to this amazing increase, it has been called a monster stock. However, since March this year, the company has been facing the problem of stock price correction. Recently, it has become the focus of the market due to financial disputes and stock market turmoil. After the stock price plummeted, it began to stabilize. Next, let’s take a look at what factors led to the recent tragic results and whether Supermicro Computer can break through and bring a new round of growth in the future.

Why has the stock price of Supermicro Computer plummeted recently?

Hindenburg Research Releases Short Selling Report, Alleging Financial Fraud

Recently, the well-known US short-selling institution Hindenburg Research released a new research report on its official website, targeting the US stock Listed Company Supermicro Computer, accusing it of accounting misconduct, undisclosed related party transactions, sanctions, and export control failures. It is currently unclear whether these two are related. Hindenburg Research publicly stated that they hold shares in Supermicro and have shorted the company in the market.

Since the beginning of this year, the stock price of Supermicro has risen by more than 80%, and in Quarter 1, it rose by more than 300% to a high of $1299, becoming the largest small-cap stock in US history. Nevertheless, after Hindenburg released the report, the stock price of Supermicro fell more than 8% at one point, but then recovered most of the losses and closed down 2.64%.

Faced with the accusations, a Supermicro spokesperson said the company does not comment on rumors and speculation and has not responded positively, further exacerbating market concerns.

Supermicro announced a delay in financial report submission, further lowering the stock price

The day after Hindenburg directly pointed out the financial problems of Supermicro, the company suddenly announced that it does not expect to submit its annual report for the fiscal year ending June 30, 2024 to the US Securities and Exchange Commission (SEC) on time, and expects to submit a delayed submission notice regarding the annual report on August 30, citing the need for additional time for management to evaluate the internal control design and operational effectiveness of financial reporting. After the news came out, Supermicro’s stock price suffered another setback, with a nearly 20% drop at the opening on Wednesday.

This decision has further unsettled the market, and investors have more doubts about the transparency and accuracy of Company Finance’s reports. The company mentioned in a statement that they are conducting a detailed review to ensure the completeness and accuracy of the financial reports. However, regarding the specific allegations of Hindenburg Research, Supermicro chose to remain silent and did not release further comments to the public.

This financial dispute and stock price fluctuation is a major blow to the investors and market of Supermicro. After a period of strong growth, Supermicro’s stock price is facing a sharp decline due to financial problems, which is undoubtedly a warning signal for investors and shareowners in the market. The delay in the company’s financial report may affect its market reputation and investor confidence, and further negative impact on future stock price trends.

What factors are related to the future trend of Supermicro’s stock price?

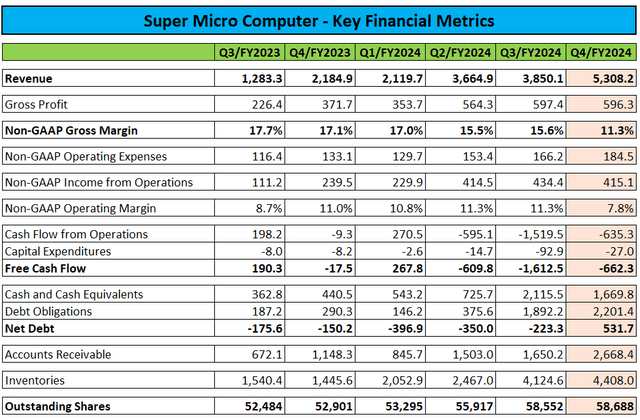

Cash flow and profit margins are facing challenges, but have been adjusting

Supermicro’s sales have surged in recent quarters, but the related Working Funds demand has led to a significant negative cash flow growth. In addition, the company has been facing profit margin issues recently, which are expected to continue in the short term.

In order to ensure sufficient liquidity, Supermicro entered Capital Markets multiple times between December 2023 and March 2024. Overall, the company raised over $4 billion in net income through stock and convertible bond publishing. This also indicates that the company has been actively adjusting in this regard, and this issue is expected to be alleviated and improved in the future.

Due to product relevance, it is expected to benefit from NVIDIA’s push-up stock price in the future

Supermicro’s main business is high-performance servers for data centers, and this business is booming with the expansion of AI demand, which helps to increase Supermicro’s revenue. The company’s customers include NVIDIA and others.

JPMorgan analysts said that NVIDIA’s recent financial report shows that its strength is still strong in the data center field. Most of its quarterly revenue comes from data centers, which is a “positive” signal for server manufacturers such as Supermicro. NVIDIA’s positive impact on it mainly includes the following aspects:

Firstly, NVIDIA’s financial report shows the growth of its Data Center business, indicating that the demand for high-performance computing resources is constantly increasing. This trend indicates the expansion of the Data Center market, providing greater market space for server manufacturers such as Ultra Microcomputer. With the increasing demand for advanced computing solutions in the market, Ultra Microcomputer has more opportunities to promote its products, especially in GPU-intensive computing and AI Application Areas.

Secondly, NVIDIA’s technological leadership not only enhances the processing capabilities of data centers, but also promotes technological innovation in the entire industry. Supermicro computers can take advantage of this technological advancement, integrate its GPU technology into their own server and storage solutions through cooperation with NVIDIA, improve product performance and energy efficiency, and better meet customer needs.

Finally, NVIDIA’s success can encourage it to establish a broader technology ecosystem, including partners and third-party developers. As a server manufacturer, Supermicro can use this ecosystem to jointly develop and optimize solutions with NVIDIA and its partners, enhancing the market competitiveness of its own products.

As technology companies bet on the latest AI technology, Supermicro has been a big winner in the AI boom. Since early 2023, the company’s valuation has been soaring, rising from a valuation of about $4.40 billion to a peak of $67 billion in March before starting to decline.

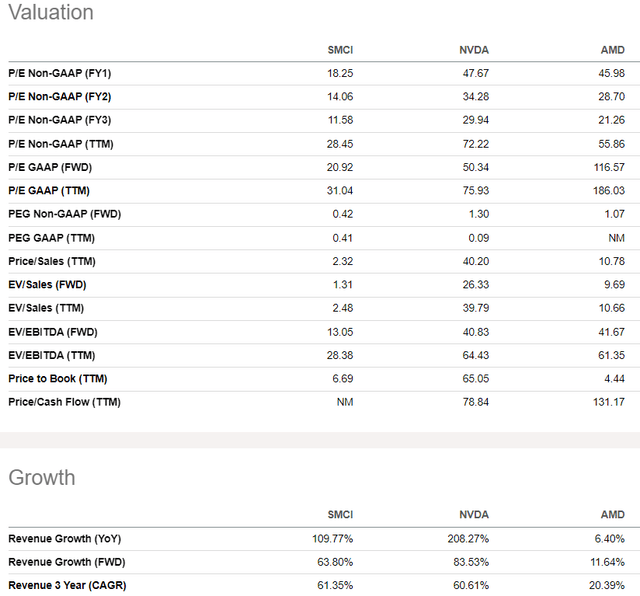

The valuation of ultracomputers still looks attractive

Supermicro, along with NVIDIA and AMD, has become one of the biggest winners in the AI-driven stock market frenzy. As we can see below, although Supermicro’s annual growth and expected future revenue growth are very significant, its valuation ratio is very moderate. Therefore, compared with the multiples of NVIDIA and AMD, Supermicro still looks very attractive.

My target price calculation for Supermicro will be based on the discounted cash flow method. The weighted average cost of capital used for DCF is 8.1%. This data is based on the consensus revenue estimate for the next five years. The consensus expects a compound annual growth rate of 15% in revenue over the next five years, which seems fair considering Supermicro’s strong positioning in the artificial intelligence trend.

Interest rate cuts are conducive to boosting the market, and Chaowei Computer is expected to benefit

In a recent public speech, US Federal Reserve Chairperson Jerome Powell made it clear that lowering interest rates will be the main direction of Monetary Policy in the coming period. Powell emphasized that although the current economic situation is complex, policymakers believe that appropriate policy adjustments can stabilize Financial Marekt and adapt to possible future economic slowdowns. By reducing borrowing costs, it can stimulate business investment and consumer spending, thereby supporting economic growth.

As soon as the news of this policy change was released, it immediately had a positive impact on Financial Marekt. Especially for technology stocks, such as Supermicro, its stock price is expected to benefit from the overall market sentiment. Interest rate cuts usually reduce the cost of capital for companies, making investment more attractive, and also help improve their profit expectations and market valuations. In addition, as a capital-intensive industry, the technology industry is highly sensitive to interest rates, so once interest rates are cut, Supermicro’s stock price will also benefit significantly.

How should investors layout?

For investors, recent emergencies have also highlighted the importance of financial transparency and corporate governance. Although Supermicro has great growth potential in the AI field, investors need to re-examine the company’s financial situation and future development prospects in the face of financial disputes and short selling pressure. Whether the company can solve financial problems in a timely manner and restore market confidence will become an important factor in future stock price trends.

With the delayed release of performance, investors need to prepare for the lengthy accounting review. Given the uncertainty and risks that may arise from the prolonged accounting review, they can consider going to BiyaPay to further monitor the market trend and consider whether to buy. In addition, if you have difficulties with deposits and withdrawals, you can also use it as a professional tool for deposits and withdrawals of US and Hong Kong stocks. You can recharge digital currency and exchange it for US dollars or Hong Kong dollars, withdraw it to your bank account, and then deposit it to other securities firms to buy stocks. The arrival speed is fast, and there is no limit, so you won’t miss investment opportunities.

Although the financial controversy and stock price fluctuations of Supermicro indicate an increase in uncertainty faced by investors, some analysts have pointed out that after carefully studying the Hindenburg short report, in addition to re-examining Supermicro’s accounting irregularities in 2020, the evidence for various allegations is not solid enough.

In addition, there are other positive factors that contribute to the rise of Supermicro computers. It is still expected to achieve new breakthroughs in the future. As for the specific follow-up, we can continue to observe the company’s response measures and development status.